Question

ABC Pty Ltd produces turbines used in the production of hydro-electric generating equipment. The turbines are sold to various engineering companies that produce hydro- powered

ABC Pty Ltd produces turbines used in the production of hydro-electric generating equipment. The turbines are sold to various engineering companies that produce hydro- powered generators in Australia.

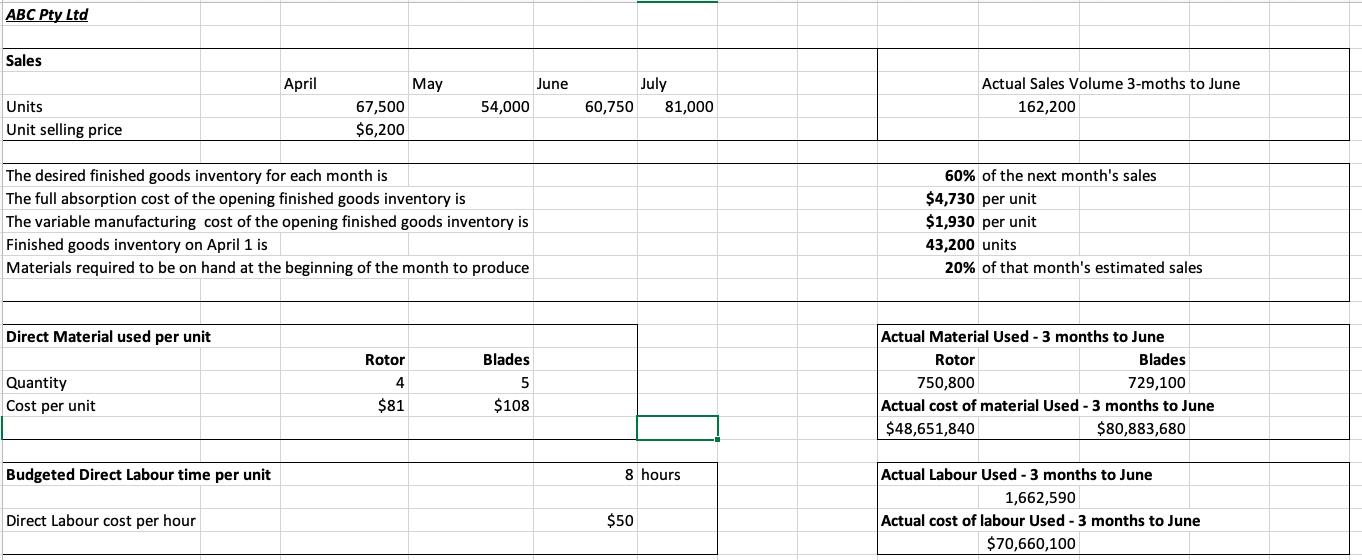

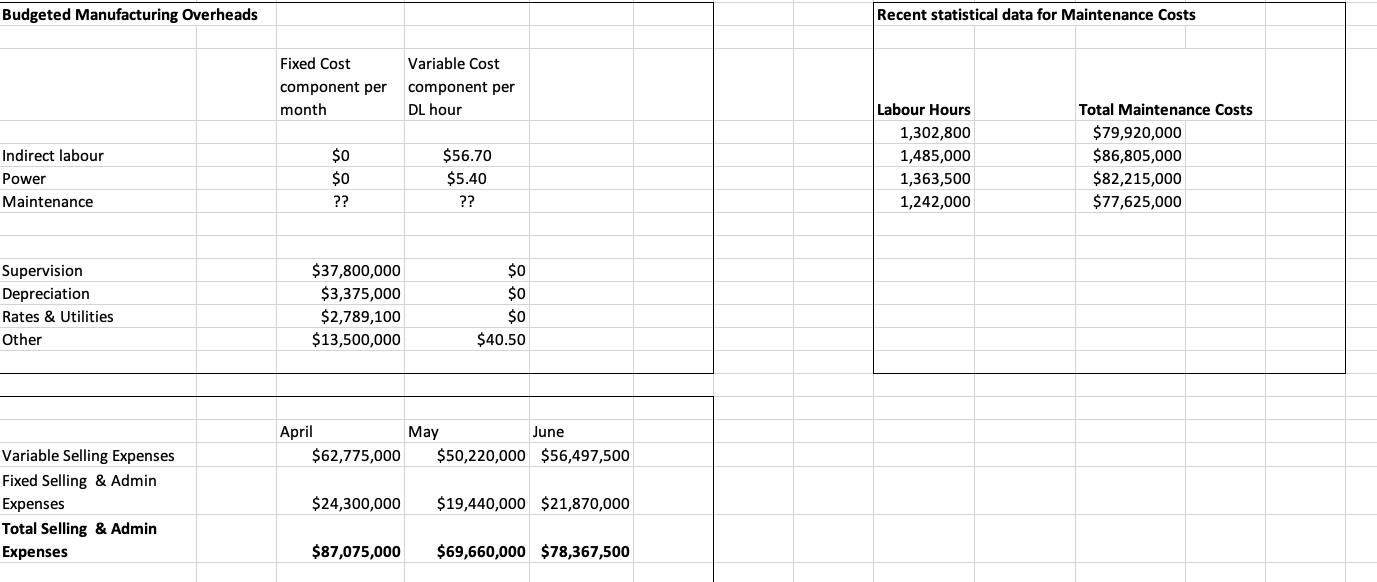

Details of the operations for the coming four months are provided in the attached excel spread sheet.

Other information:

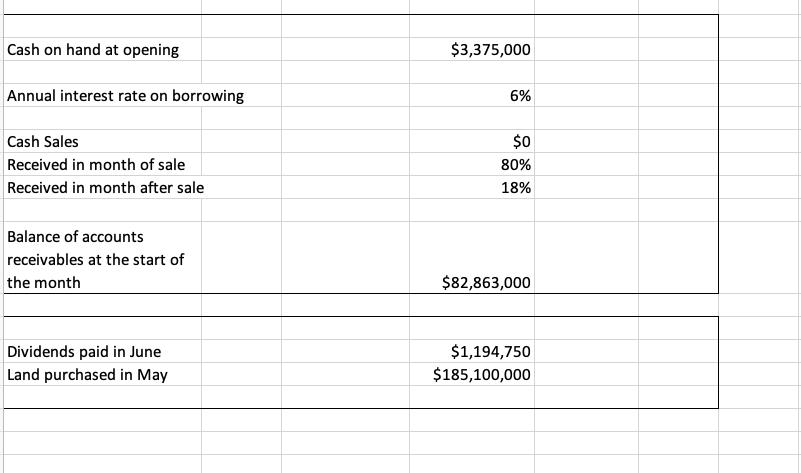

The company plans to purchase land for future expansion

Sales are on credit. Amounts not received in the month following the sale are

written off as bad debt immediately.

The payment for labour and purchases of materials and other costs are for cash

and paid for in the month of acquisition.

If the firm develops a cash shortage by the end of the month, sufficient cash is

borrowed to cover the shortage (including any interest payments due ). Any cash borrowed is repaid one month later, as is the interest due.

During the process of preparing the organisation’s budget, the Sales Manager is discussing the possible outcome of the forthcoming election with the Production Manager. She noted that if one of the major political parties wins the election and forms the government, there is a strong possibility that alternative sources of energy such as hydro-powered electricity may no longer be as actively supported by the new government as is the case under the current government.

The sales manager’s primary concern is that market for alternative power generation is already volatile and subject to significant uncertainty. The production manager is also concerned about his plans to build the new automated manufacturing facility on the land to be purchased in May. This new manufacturing facility will enable him to manufacture, in-house, the major two parts he is now purchasing and to significantly automate the assembly process that is currently somewhat labour intensive. His projection for the new facility indicates a reduction in direct material & direct labour costs of 33% but that his fixed manufacturing overheads are likely to increase by 65% due to the increased investment in production capacity.

Required:

Part A: Prepare Operating Budgets as follows: (75% of the marks)

1) Monthly Sales Budget for the quarter ending June

2) Monthly Production Budget for the quarter ending June

3) Monthly Direct Materials Budget for the quarter ending June

4) Monthly Direct Labour Budget for the quarter ending June

5) Monthly Manufacturing Overhead Budget for the quarter ending June

6) Monthly Selling & Administrative Expenses Budget for the quarter ending June 7) Ending Inventory Budget for the month of June

8) Cost of goods Sold Budget for the quarter

9) Budgeted Income Statement for the quarter

10) Monthly Cash budget for the quarter.

Part B (25% of the marks)

Write a brief report (approx. 500 words or less) addressing the Sales managers concerns, using some of the concepts covered in topic 1 to 6 AND the information provided on the cost structures identified in the budget prepared in Part A. Your report should also include a discussion on the impact of the production manager’s intended investment in new manufacturing capacity. Support your report with relevant calculations.

Notes: the excel file is in picture format. use the data in the file to work out the 10 budgets reports and a report in words based on the budget reports and the background information.

ABC Pty Ltd Sales April May June July Actual Sales Volume 3-moths to June Units 67,500 54,000 60,750 81,000 162,200 Unit selling price $6,200 The desired finished goods inventory for each month is 60% of the next month's sales The full absorption cost of the opening finished goods inventory is $4,730 per unit The variable manufacturing cost of the opening finished goods inventory is $1,930 per unit Finished goods inventory on April 1 is 43,200 units Materials required to be on hand at the beginning of the month to produce 20% of that month's estimated sales Direct Material used per unit Actual Material Used - 3 months to June Rotor Blades Rotor Blades Quantity 4 5 750,800 729,100 Cost per unit $81 $108 Actual cost of material Used - 3 months to June $48,651,840 $80,883,680 Budgeted Direct Labour time per unit 8 hours Actual Labour Used - 3 months to June 1,662,590 Actual cost of labour Used - 3 months to June Direct Labour cost per hour $50 $70,660,100

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer ABC Pty Ltd Sales Budget Quarter Ending June Budgeted Unit Sales Budgeted Unit Price Budgeted Sales Dollar April 67500 6200 418500000 May 54000 6200 334800000 June 60750 6200 376650000 Total fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started