Question

ABC steel plant industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component can be

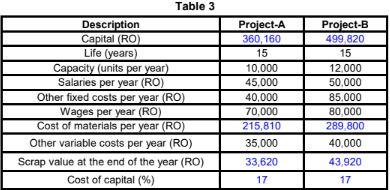

ABC steel plant industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component can be produced in the plant or bought in. An investment is required to start the production of the component for which two mutually exclusive projects A and B representing different production processes are available. The alternative option is to buy in from another company representing project C.

Using the information from table 3 and Discount Cash Flow criteria, calculate Pay Back Period (PBP), Account Rate of Return (ARR), Net Present Value (NPV) and Internal Rate Return (IRR) for project A & Project B if the industry plans to manufacture 6,000 units per year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started