Answered step by step

Verified Expert Solution

Question

1 Approved Answer

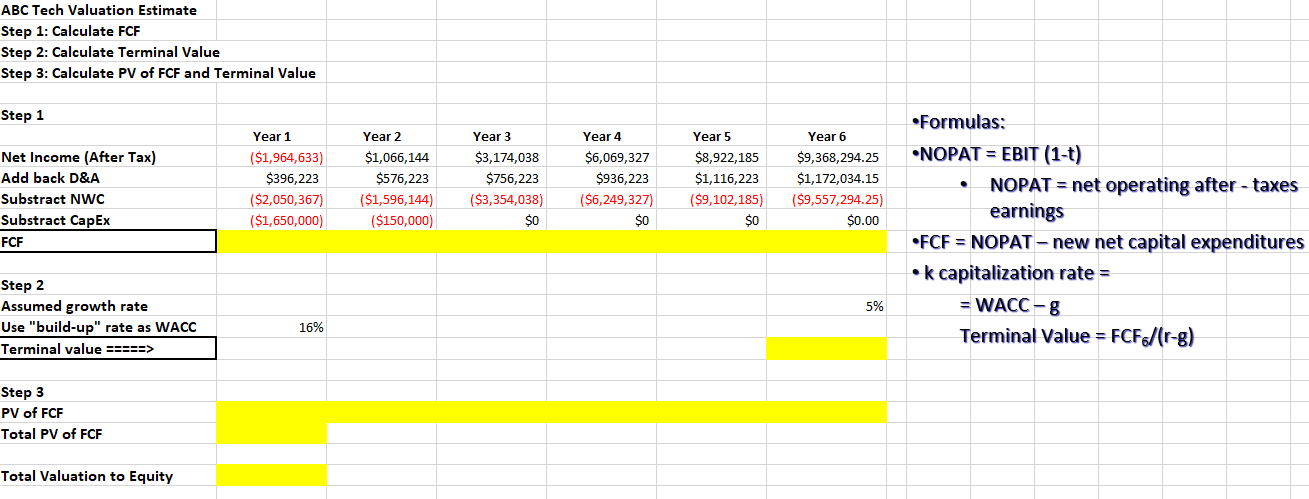

ABC Tech Valuation Estimate Step 1: Calculate FCF Step 2: Calculate Terminal Value Step 3: Calculate PV of FCF and Terminal Value Step 1

ABC Tech Valuation Estimate Step 1: Calculate FCF Step 2: Calculate Terminal Value Step 3: Calculate PV of FCF and Terminal Value Step 1 Year 1 Year 2 Year 3 Year 4 Year 5 Net Income (After Tax) Add back D&A ($1,964,633) $396,223 $1,066,144 $576,223 $3,174,038 $756,223 $6,069,327 $8,922,185 $936,223 $1,116,223 $1,172,034.15 Substract NWC ($2,050,367) ($1,596,144) Substract CapEx FCF ($1,650,000) ($150,000) ($3,354,038) $0 ($6,249,327) $0 ($9,102,185) $0 ($9,557,294.25) $0.00 Step 2 Assumed growth rate Use "build-up" rate as WACC Terminal value Step 3 PV of FCF Total PV of FCF ===> Total Valuation to Equity 16% Year 6 $9,368,294.25 5% Formulas: NOPATEBIT (1-t) NOPAT = net operating after-taxes earnings *FCF = NOPAT-new net capital expenditures k capitalization rate = = WACC-g Terminal Value FCF/(r-g)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started