Question

ABC XYZ Year 3 , Year 2 Year 3 , Year 2 Revenue 20.8% 9.5% 7.9% 6.4% Net Income 0.5% 24.6% 5.7% 2.4% 2. Calculate

ABC XYZ

Year 3 , Year 2 Year 3 , Year 2

Revenue 20.8% 9.5% 7.9% 6.4%

Net Income 0.5% 24.6% 5.7% 2.4%

2. Calculate and enter the ratios below

ABC XYZ

Year 3 , Year 2 Year 3 , Year 2

Current Ratio ____ _____ _____ ______

Days in A/R ____ _____ _____ ______

Days in inventory ____ _____ _____ ______

Debt Ratio ____ _____ _____ ______

Gross profit % ____ _____ _____ ______

Net income % ____ _____ _____ ______

ROI ____ _____ _____ ______

3. Based on your results in requirement 2, which company would you rather

a. sell inventory to, if sold an account? _____

b. make a long-term loan to? __________

c. invest in? _______________

4. If each company purchased $1500 of the equipment on account in year 3, how would that transaction impact each ratio below?

ABC XYZ

Current Ratio ______ _________

Debt Ratio ______ _________

ROI ______ _________

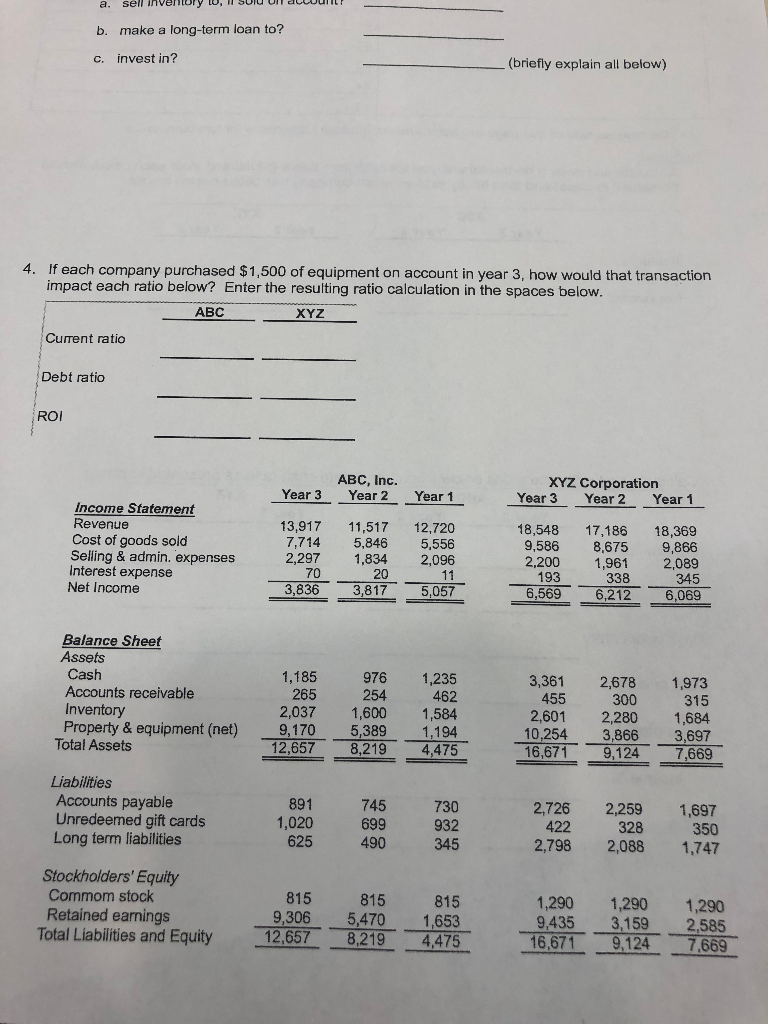

a. sell Inverury , QUI UFF B UTTU b. make a long-term loan to? c. invest in? (briefly explain all below) 4. If each company purchased $1,500 of equipment on account in year 3, how would that transaction impact each ratio below? Enter the resulting ratio calculation in the spaces below. ABC XYZ Current ratio Debt ratio ROI Year 3 ABC, Inc. Year 2 Year 1 13,917 7,714 Income Statement Revenue Cost of goods sold Selling & admin. expenses Interest expense Net Income 11,517 5,846 1,834 12,720 5.556 2,096 XYZ Corporation Year 3 Year 2 Year 1 18,548 17,186 18,369 9,586 8,675 9,866 2,200 1,961 2,089 193 338 345 6,569 6,212 6,069 3,830 3311 5,067 Balance Sheet Assets Cash Accounts receivable Inventory Property & equipment (net) Total Assets 1,185 265 2,037 9,170 12,657 976 254 1,600 5,389 8,219 1,235 462 1,584 1,194 4,475 3,361 455 2,601 10,254 16,671 2,678 300 2,280 3,866 9,124 1,973 315 1,684 3,697 7,669 Liabilities Accounts payable Unredeemed gift cards Long term liabilities 891 1,020 625 745 699 490 730 932 345 2,726 422 2,798 2,259 328 2,088 1,697 350 1,747 Stockholders' Equity Commom stock Retained earnings Total Liabilities and Equity 815 9,306 12,657 815 815 5,470 1,653 8,2194,475 1,290 9,435 16,671 1,290 3,159 9,124 1,290 2,585 7,669 a. sell Inverury , QUI UFF B UTTU b. make a long-term loan to? c. invest in? (briefly explain all below) 4. If each company purchased $1,500 of equipment on account in year 3, how would that transaction impact each ratio below? Enter the resulting ratio calculation in the spaces below. ABC XYZ Current ratio Debt ratio ROI Year 3 ABC, Inc. Year 2 Year 1 13,917 7,714 Income Statement Revenue Cost of goods sold Selling & admin. expenses Interest expense Net Income 11,517 5,846 1,834 12,720 5.556 2,096 XYZ Corporation Year 3 Year 2 Year 1 18,548 17,186 18,369 9,586 8,675 9,866 2,200 1,961 2,089 193 338 345 6,569 6,212 6,069 3,830 3311 5,067 Balance Sheet Assets Cash Accounts receivable Inventory Property & equipment (net) Total Assets 1,185 265 2,037 9,170 12,657 976 254 1,600 5,389 8,219 1,235 462 1,584 1,194 4,475 3,361 455 2,601 10,254 16,671 2,678 300 2,280 3,866 9,124 1,973 315 1,684 3,697 7,669 Liabilities Accounts payable Unredeemed gift cards Long term liabilities 891 1,020 625 745 699 490 730 932 345 2,726 422 2,798 2,259 328 2,088 1,697 350 1,747 Stockholders' Equity Commom stock Retained earnings Total Liabilities and Equity 815 9,306 12,657 815 815 5,470 1,653 8,2194,475 1,290 9,435 16,671 1,290 3,159 9,124 1,290 2,585 7,669Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started