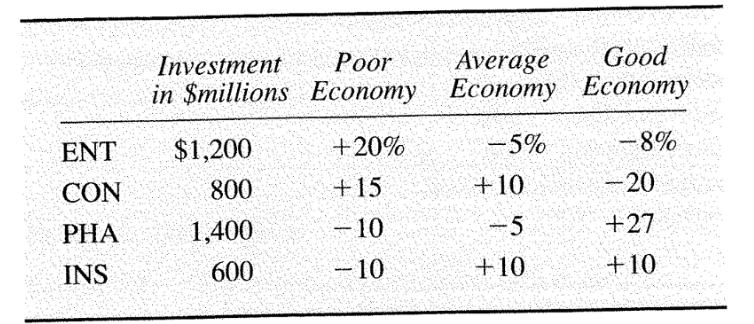

ABCO is a conglomerate that has $4 billion in common stock. Its capital is invested in four subsidiaries: entertainment (NET), consumer products (CON), pharmaceuticals (PHA),

ABCO is a conglomerate that has $4 billion in common stock. Its capital is invested in four subsidiaries: entertainment (NET), consumer products (CON), pharmaceuticals (PHA), and insurance (INS). The four subsidiaries are expected to perform differently depending on the economic environment.

Assuming that the three economic outcomes (1) have an equal likelihood of occurring and (2) that the good economy is twice as likely to take place as X the other two:

a. Calculate individual expected returns for each subsidiary.

b. Calculate implicit portfolio weights for each subsidiary and an expected return and variance for the equity in the ABCO conglomerate.

Average Good Investment or in $millions Economy Economy Economy ENT $1,200 +20% -5% -8% CON 800 +15 +10 -20 PHA 1,400 -10 -5 +27 INS 600 -10 +10 +10

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started