ABC's maintenance service business grosses some $22M per year before discounts and its average days receivable is 30. If 15% of its clients opt to

ABC's maintenance service business grosses some $22M per year before discounts and its average days receivable is 30. If 15% of its clients opt to follow the new policy, what will be the change in receivables? If ABC's WACC is 7.0%, what are the projected savings of the new policy? If its gross margin is 22%, by how much will gross dollar revenues have to rise to offset the loss from discounts? In percent?

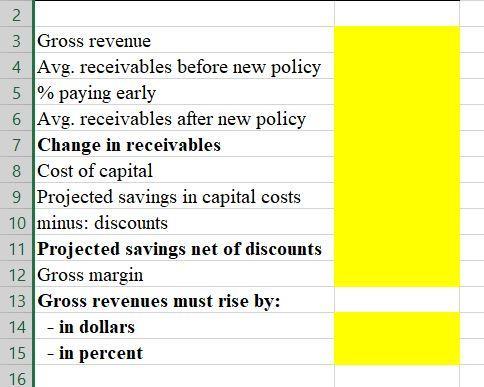

2 3 Gross revenue 4 Avg. receivables before new policy 5 % paying early 6 Avg. receivables after new policy 7 Change in receivables 8 Cost of capital 9 Projected savings in capital costs 10 minus: discounts 11 Projected savings net of discounts 12 Gross margin 13 Gross revenues must rise by: 14 - in dollars 15 - in percent 16

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Calculation Amount million Onetime client ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started