Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abdu has the following items in 2022. His AGI before any items below is $40k. Abdu partially owns a bar in downtown Austin, TX.

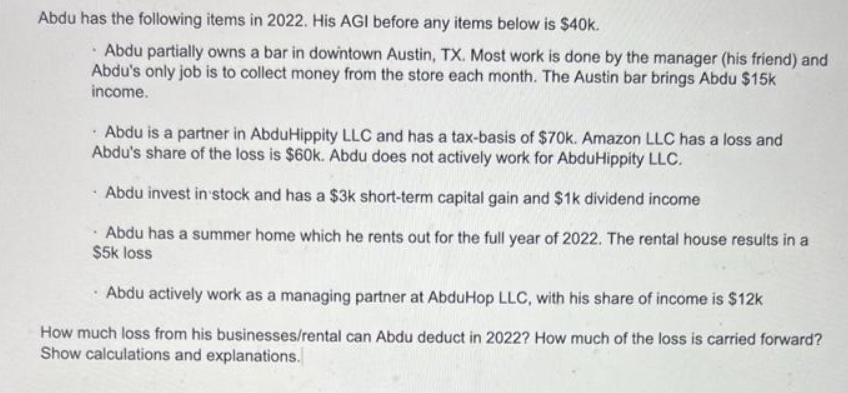

Abdu has the following items in 2022. His AGI before any items below is $40k. Abdu partially owns a bar in downtown Austin, TX. Most work is done by the manager (his friend) and Abdu's only job is to collect money from the store each month. The Austin bar brings Abdu $15k income. Abdu is a partner in AbduHippity LLC and has a tax-basis of $70k. Amazon LLC has a loss and Abdu's share of the loss is $60k. Abdu does not actively work for AbduHippity LLC. Abdu invest in stock and has a $3k short-term capital gain and $1k dividend income Abdu has a summer home which he rents out for the full year of 2022. The rental house results in a $5k loss . Abdu actively work as a managing partner at AbduHop LLC, with his share of income is $12k How much loss from his businesses/rental can Abdu deduct in 2022? How much of the loss is carried forward? Show calculations and explanations.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine how much loss Abdu can deduct in 2022 from his businesses and rental property we need t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started