Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abdullah manufacturing company has received a proposal for developing a new product. Abdullah estimated a 0.70 probability that the product will be successful. If the

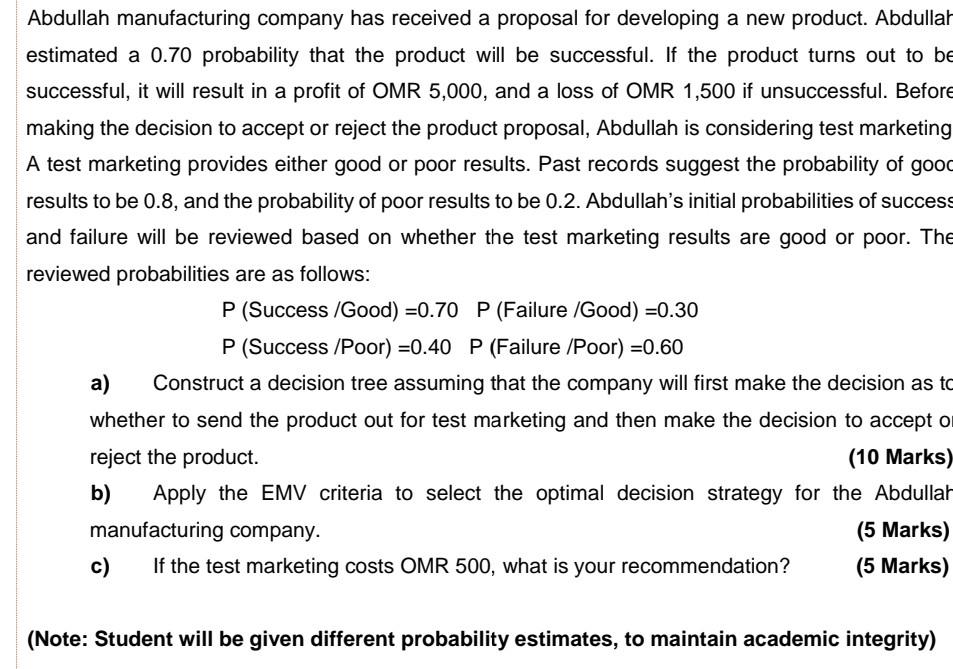

Abdullah manufacturing company has received a proposal for developing a new product. Abdullah estimated a 0.70 probability that the product will be successful. If the product turns out to be successful, it will result in a profit of OMR 5,000, and a loss of OMR 1,500 if unsuccessful. Before making the decision to accept or reject the product proposal, Abdullah is considering test marketing A test marketing provides either good or poor results. Past records suggest the probability of good results to be 0.8, and the probability of poor results to be 0.2. Abdullah's initial probabilities of success and failure will be reviewed based on whether the test marketing results are good or poor. The reviewed probabilities are as follows: P (Success /Good) =0.70 P (Failure /Good) =0.30 P (Success /Poor) =0.40 P (Failure /Poor) =0.60 a) Construct a decision tree assuming that the company will first make the decision as to whether to send the product out for test marketing and then make the decision to accept o reject the product. (10 Marks) b) Apply the EMV criteria to select the optimal decision strategy for the Abdullah manufacturing company. (5 Marks) c) If the test marketing costs OMR 500, what is your recommendation? (5 Marks) (Note: Student will be given different probability estimates, to maintain academic integrity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started