Answered step by step

Verified Expert Solution

Question

1 Approved Answer

abe X2 X2 A T A D English (IS) AaBbCcDdEe Emphasis AaBbCCDC AaBbCcDdEe AaBbCcDdEe Heading 1 Strong Normal The following statement of financial position

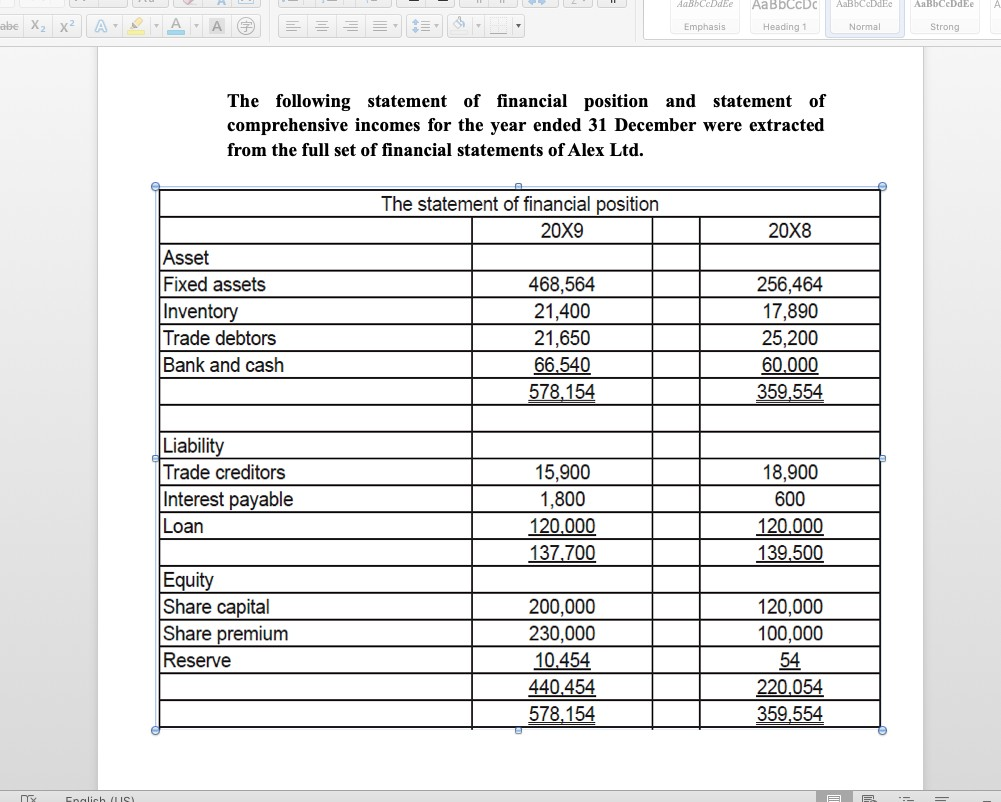

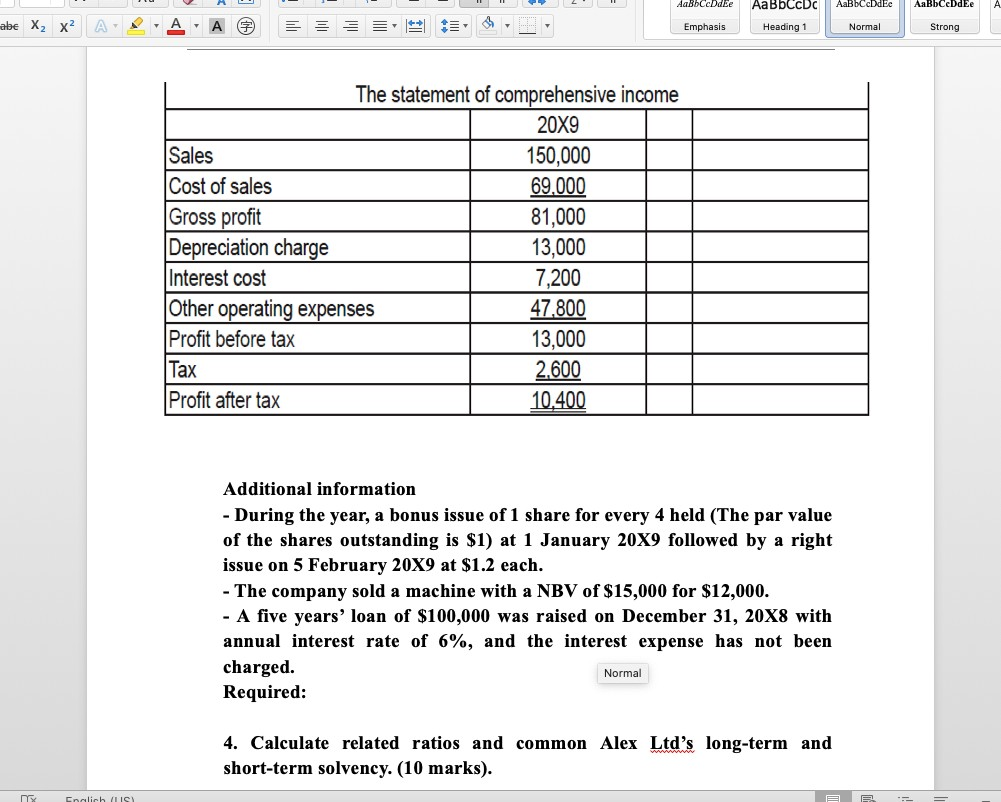

abe X2 X2 A T A D English (IS) AaBbCcDdEe Emphasis AaBbCCDC AaBbCcDdEe AaBbCcDdEe Heading 1 Strong Normal The following statement of financial position and statement of comprehensive incomes for the year ended 31 December were extracted from the full set of financial statements of Alex Ltd. The statement of financial position 20X9 20X8 Asset Fixed assets 468,564 256,464 Inventory 21,400 17,890 Trade debtors 21,650 25,200 Bank and cash 66.540 60,000 578,154 359,554 Liability Trade creditors 15,900 18,900 Interest payable 1,800 600 Loan 120,000 120,000 137,700 139,500 Equity Share capital 200,000 120,000 Share premium 230,000 100,000 Reserve 10.454 54 440.454 220,054 578,154 359,554 B == abe X2 X2 A English (IS The statement of comprehensive income 20X9 Sales 150,000 Cost of sales 69.000 Gross profit 81,000 Depreciation charge 13,000 Interest cost 7,200 Other operating expenses 47,800 Profit before tax 13,000 Tax 2,600 Profit after tax 10,400 AaBbCcDdEe Emphasis AaBbCcDc AaBbCcDdEc Heading 1 AaBbCcDdEe Normal Strong Additional information -During the year, a bonus issue of 1 share for every 4 held (The par value of the shares outstanding is $1) at 1 January 20X9 followed by a right issue on 5 February 20X9 at $1.2 each. -The company sold a machine with a NBV of $15,000 for $12,000. - A five years' loan of $100,000 was raised on December 31, 20X8 with annual interest rate of 6%, and the interest expense has not been charged. Required: Normal 4. Calculate related ratios and common Alex Ltd's long-term and short-term solvency. (10 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started