Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aberwald Corporation expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed

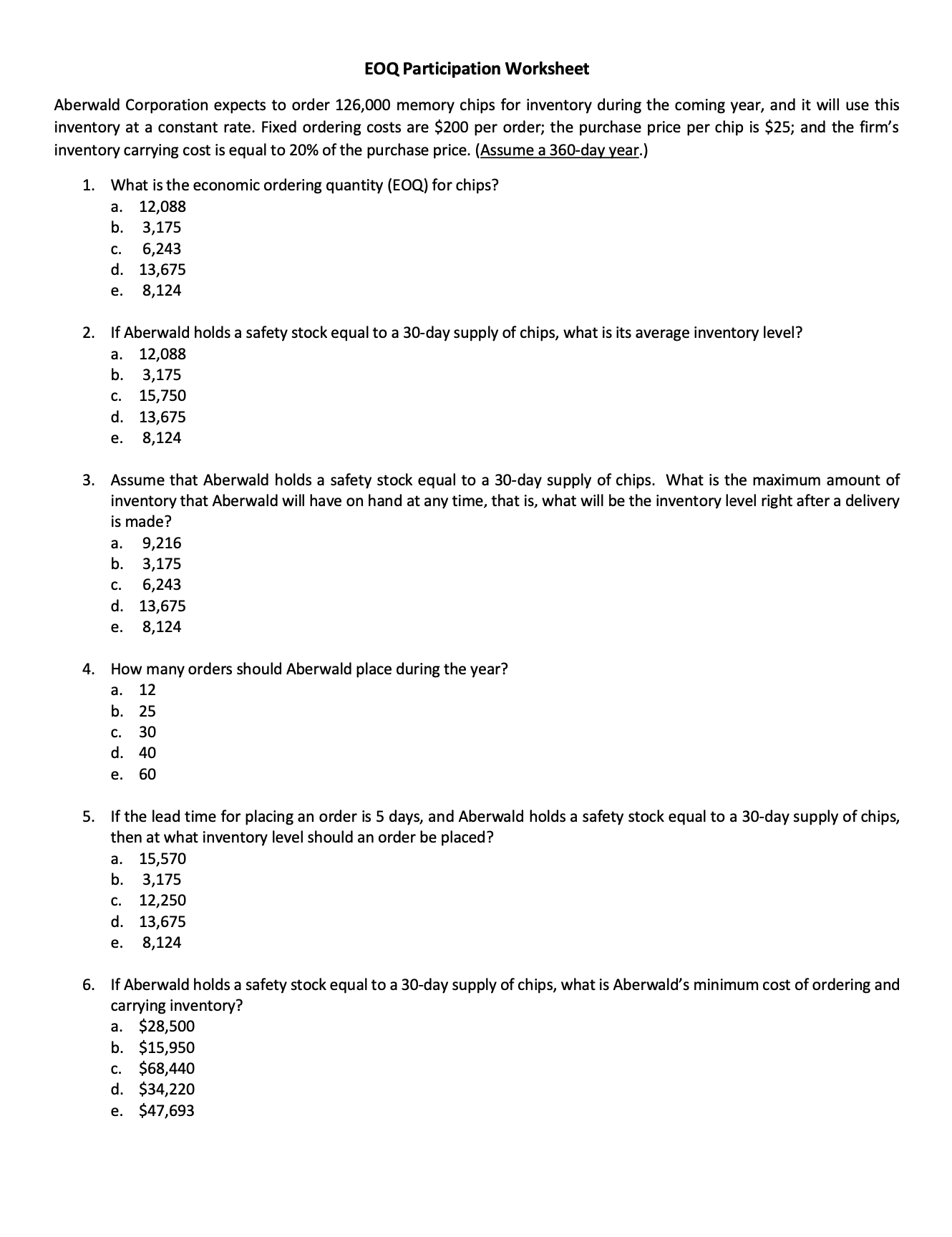

Aberwald Corporation expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying cost is equal to 20% of the purchase price. (Assume a 360 -day year.) 1. What is the economic ordering quantity (EOQ) for chips? a. 12,088 b. 3,175 c. 6,243 d. 13,675 e. 8,124 2. If Aberwald holds a safety stock equal to a 30-day supply of chips, what is its average inventory level? a. 12,088 b. 3,175 c. 15,750 d. 13,675 e. 8,124 3. Assume that Aberwald holds a safety stock equal to a 30-day supply of chips. What is the maximum amount of inventory that Aberwald will have on hand at any time, that is, what will be the inventory level right after a delivery is made? a. 9,216 b. 3,175 c. 6,243 d. 13,675 e. 8,124 4. How many orders should Aberwald place during the year? a. 12 b. 25 c. 30 d. 40 e. 60 5. If the lead time for placing an order is 5 days, and Aberwald holds a safety stock equal to a 30 -day supply of chips, then at what inventory level should an order be placed? a. 15,570 b. 3,175 c. 12,250 d. 13,675 e. 8,124 6. If Aberwald holds a safety stock equal to a 30-day supply of chips, what is Aberwald's minimum cost of ordering and carrying inventory? a. $28,500 b. $15,950 c. $68,440 d. $34,220 e. $47,693

Aberwald Corporation expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying cost is equal to 20% of the purchase price. (Assume a 360 -day year.) 1. What is the economic ordering quantity (EOQ) for chips? a. 12,088 b. 3,175 c. 6,243 d. 13,675 e. 8,124 2. If Aberwald holds a safety stock equal to a 30-day supply of chips, what is its average inventory level? a. 12,088 b. 3,175 c. 15,750 d. 13,675 e. 8,124 3. Assume that Aberwald holds a safety stock equal to a 30-day supply of chips. What is the maximum amount of inventory that Aberwald will have on hand at any time, that is, what will be the inventory level right after a delivery is made? a. 9,216 b. 3,175 c. 6,243 d. 13,675 e. 8,124 4. How many orders should Aberwald place during the year? a. 12 b. 25 c. 30 d. 40 e. 60 5. If the lead time for placing an order is 5 days, and Aberwald holds a safety stock equal to a 30 -day supply of chips, then at what inventory level should an order be placed? a. 15,570 b. 3,175 c. 12,250 d. 13,675 e. 8,124 6. If Aberwald holds a safety stock equal to a 30-day supply of chips, what is Aberwald's minimum cost of ordering and carrying inventory? a. $28,500 b. $15,950 c. $68,440 d. $34,220 e. $47,693

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started