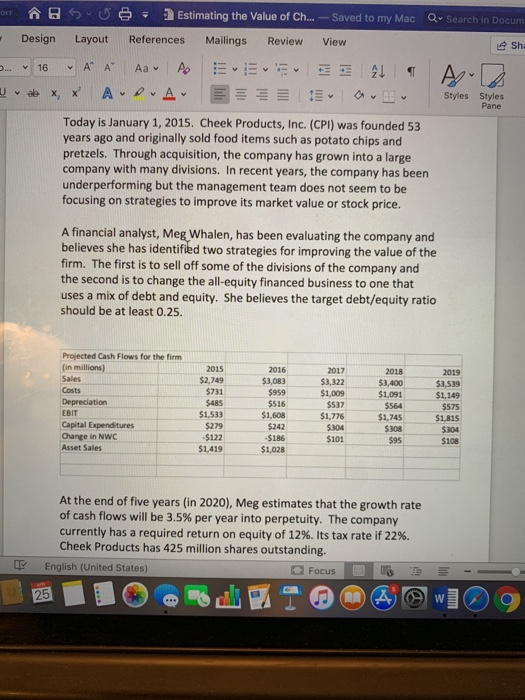

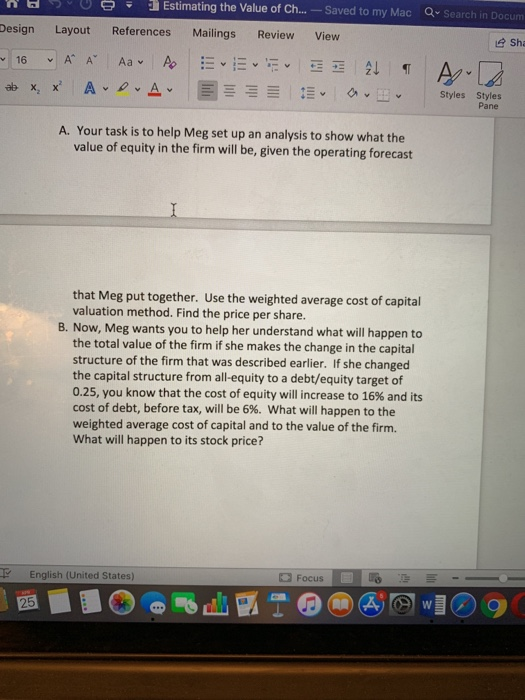

ABEstimating the Value of Ch... Saved to my Mac QS Design Layout References Mailings Review View :-., Gvmv | Styles Styles Pane Today is January 1, 2015. Cheek Products, Inc. (CPI) was founded 53 years ago and originally sold food items such as potato chips and pretzels. Through acquisition, the company has grown into a large company with many divisions. In recent years, the company has been underperforming but the management team does not seem to be focusing on strategies to improve its market value or stock price. A financial analyst, Meg Whalen, has been evaluating the company and believes she has identified two strategies for improving the value of the firm. The first is to sell off some of the divisions of the company and the second is to change the all-equity financed business to one that uses a mix of debt and equity. She believes the target debt/equity ratio should be at least 0.25 Projected Cash Flows for the firm (in millions) Sales 2015 2,749 $731 $485 $1,533 $279 $122 51,419 016 $3,083 $959 5516 $1,608 $242 186 1,028 2017 2018 53,400 1,091 2019 3,539 $1,009 537 $1,776 $304 $101 575 1,815 EBIT Capital Expenditures Change in NWC Asset Sales $1,745 $95 108 At the end of five years (in 2020), Meg estimates that the growth rate of cash flows will be 3.5% per year into perpetuity. The company currently has a required return on equity of 12%. Its tax rate if 22%. Cheek Products has 425 million shares outstanding. English (United States) Focus Estimating the Value of Ch...-Saved to my Mac . O ay Search in Docum a1 Design Layout References Mailings Review View Sha vev A. :-vJrv v Styles Styles Pane A. Your task is to help Meg set up an analysis to show what the value of equity in the firm ill be, given the operating forecast that Meg put together. Use the weighted average cost of capital valuation method. Find the price per share. B. Now, Meg wants you to help her understand what will happen to the total value of the firm if she makes the change in the capital structure of the firm that was described earlier. If she changed the capital structure from all-equity to a debt/equity target of 0.25, you know that the cost of equity will increase to 16% and its cost of debt, before tax, will be 6%. what will happen to the weighted average cost of capital and to the value of the firm. What will happen to its stock price? English (United States) ABEstimating the Value of Ch... Saved to my Mac QS Design Layout References Mailings Review View :-., Gvmv | Styles Styles Pane Today is January 1, 2015. Cheek Products, Inc. (CPI) was founded 53 years ago and originally sold food items such as potato chips and pretzels. Through acquisition, the company has grown into a large company with many divisions. In recent years, the company has been underperforming but the management team does not seem to be focusing on strategies to improve its market value or stock price. A financial analyst, Meg Whalen, has been evaluating the company and believes she has identified two strategies for improving the value of the firm. The first is to sell off some of the divisions of the company and the second is to change the all-equity financed business to one that uses a mix of debt and equity. She believes the target debt/equity ratio should be at least 0.25 Projected Cash Flows for the firm (in millions) Sales 2015 2,749 $731 $485 $1,533 $279 $122 51,419 016 $3,083 $959 5516 $1,608 $242 186 1,028 2017 2018 53,400 1,091 2019 3,539 $1,009 537 $1,776 $304 $101 575 1,815 EBIT Capital Expenditures Change in NWC Asset Sales $1,745 $95 108 At the end of five years (in 2020), Meg estimates that the growth rate of cash flows will be 3.5% per year into perpetuity. The company currently has a required return on equity of 12%. Its tax rate if 22%. Cheek Products has 425 million shares outstanding. English (United States) Focus Estimating the Value of Ch...-Saved to my Mac . O ay Search in Docum a1 Design Layout References Mailings Review View Sha vev A. :-vJrv v Styles Styles Pane A. Your task is to help Meg set up an analysis to show what the value of equity in the firm ill be, given the operating forecast that Meg put together. Use the weighted average cost of capital valuation method. Find the price per share. B. Now, Meg wants you to help her understand what will happen to the total value of the firm if she makes the change in the capital structure of the firm that was described earlier. If she changed the capital structure from all-equity to a debt/equity target of 0.25, you know that the cost of equity will increase to 16% and its cost of debt, before tax, will be 6%. what will happen to the weighted average cost of capital and to the value of the firm. What will happen to its stock price? English (United States)