Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abigail Adams, a calendar-year individual taxpayer, is a 10 percent owner in Acme Company. In Year 1, Abigail received a liquidating distribution from Acme Company.

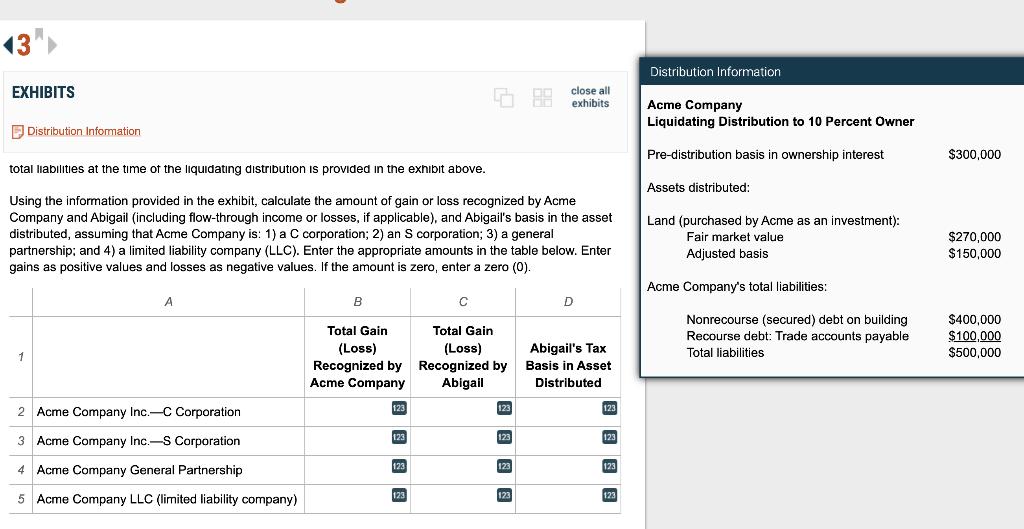

Abigail Adams, a calendar-year individual taxpayer, is a 10 percent owner in Acme Company. In Year 1, Abigail received a liquidating distribution from Acme Company. Information about the asset distributed to Abigail, Abigail's basis in her ownership interest immediately before the distribution, and Acme Company's total liabilities at the time of the liquidating distribution is provided in the exhibit above.

13 EXHIBITS Distribution Information 1 total liabilities at the time of the liquidating distribution is provided in the exhibit above. Using the information provided in the exhibit, calculate the amount of gain or loss recognized by Acme Company and Abigail (including flow-through income or losses, if applicable), and Abigail's basis in the asset distributed, assuming that Acme Company is: 1) a C corporation; 2) an S corporation; 3) a general partnership; and 4) a limited liability company (LLC). Enter the appropriate amounts in the table below. Enter gains as positive values and losses as negative values. If the amount is zero, enter a zero (0). A 2 Acme Company Inc.-C Corporation 3 Acme Company Inc.-S Corporation 4 Acme Company General Partnership 5 Acme Company LLC (limited liability company) B Total Gain (Loss) Recognized by Acme Company 123 123 123 15 8.8 C Total Gain (Loss) Recognized by Abigail 123 123 123 close all exhibits 123 D Abigail's Tax Basis in Asset Distributed 123 123 123 123 Distribution Information Acme Company Liquidating Distribution to 10 Percent Owner Pre-distribution basis in ownership interest Assets distributed: Land (purchased by Acme as an investment): Fair market value Adjusted basis Acme Company's total liabilities: Nonrecourse (secured) debt on building Recourse debt: Trade accounts payable Total liabilities $300,000 $270,000 $150,000 $400,000 $100,000 $500,000

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started