abigail grace has $900000 fully diversified portfolio . she subsequently inherits ABC company common stock

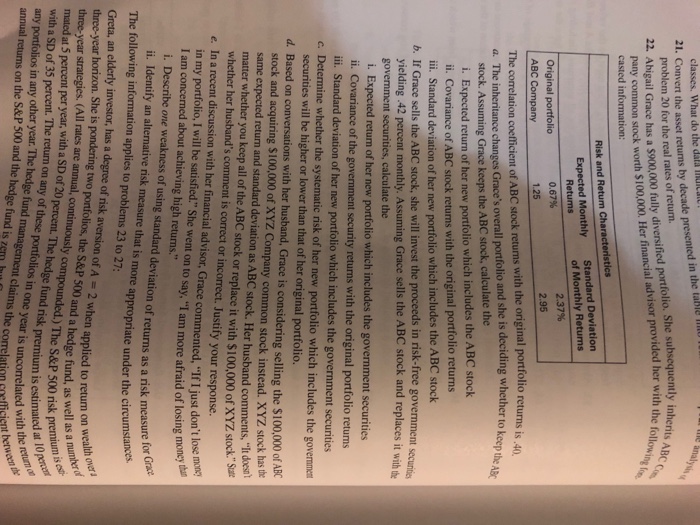

classes, What do the data Mlcaiu 21. Convert the asset returns by decade presented in the i problem 20 for the real rates of return. Abigail Grace has a $900,000 fully diversified portfolio. S pany common stock worth $100,000. Her financial advisor provided her withBC he subsequently inherits 22. casted information: Risk and Return Characteristics Standard Deviation Expected Monthly Original portfolio ABC Company Retuns 0.67% 1.25 2.95 The correlation coefficient of ABC stock returns with the original portfolio returns is a. The inheritance changes Grace's overall portfolio and she is deciding whether to k 40, keep the AB stoc k. Assuming Grace keeps the ABC stock, calculate the Expected return of her new portfolio which includes the ABC stock ii. Covariance of ABC stock returns with the original portfolio returns ii. Standard deviation of her new portfolio which includes the ABC stock b. If Grace sells the ABC stock, she will invest the proceeds in risk-free government secuidies yielding .42 percent monthly. Assuming Grace sells the ABC stock and replaces it with the govemment securities, calculate the i. Expected return of her new portfolio which includes the government securities ii. Covariance of the government security returns with the original portfolio returns ili. Standard deviation of her new portfolio which includes the government securities c. Determine whether the systematic risk of her new portfolio which includes the government securities will be higher or lower than that of her original portfolio. d. Based on conversations with her husband, Grace is considering selling the $100,000 of ABC stock and acquiring $100,000 of XYZ Company common stock instead. XYZ stock has the same expected return and standard deviation as ABC stock. Her husband comments, "It doesnt matter whether you keep all of the ABC stock or replace it with $100,000 of XYZ stock." Sar whether her husband's comment is correct or incorrect. Justify your response. e. In a recent discussion with her financial advisor, Grace commented, "If I just don't lose mn in my portfolio, I will be satisfied." She went on to say, "I am more afraid of losing m I am concerned about achieving high returns." i. Describe one weakness of using standard deviation of returns as a risk measure fo osing money thur i. Identify an altermative risk measure that is more appropriate under the circumstanc The following informatio Greta, an elderly investor, has a degree of risk aversion of A 2 when applied to return on weaumtd three-year horizon. She is pondering two ponfolios, the S&P 500 and a hedge fund, as ll as n applies to problems 23 to 27: three-year strategies. (All rates are annual, continuously compounded.) The S&P 500 riskeio three-year strategies.(All rates are annual, continuously comp percent. The hedge rauith a SD of 20 percemt. Tthe hedge fund risk premium is with a SD of 35 percent. The retun on any of these portfolios in any portfolios in any other year. The hedge fund mana annual returns on the S&P 500 and the hedge fund i premium is estimated at I0 e year is uncorrelated with the ret the correlation coefficient betw classes, What do the data Mlcaiu 21. Convert the asset returns by decade presented in the i problem 20 for the real rates of return. Abigail Grace has a $900,000 fully diversified portfolio. S pany common stock worth $100,000. Her financial advisor provided her withBC he subsequently inherits 22. casted information: Risk and Return Characteristics Standard Deviation Expected Monthly Original portfolio ABC Company Retuns 0.67% 1.25 2.95 The correlation coefficient of ABC stock returns with the original portfolio returns is a. The inheritance changes Grace's overall portfolio and she is deciding whether to k 40, keep the AB stoc k. Assuming Grace keeps the ABC stock, calculate the Expected return of her new portfolio which includes the ABC stock ii. Covariance of ABC stock returns with the original portfolio returns ii. Standard deviation of her new portfolio which includes the ABC stock b. If Grace sells the ABC stock, she will invest the proceeds in risk-free government secuidies yielding .42 percent monthly. Assuming Grace sells the ABC stock and replaces it with the govemment securities, calculate the i. Expected return of her new portfolio which includes the government securities ii. Covariance of the government security returns with the original portfolio returns ili. Standard deviation of her new portfolio which includes the government securities c. Determine whether the systematic risk of her new portfolio which includes the government securities will be higher or lower than that of her original portfolio. d. Based on conversations with her husband, Grace is considering selling the $100,000 of ABC stock and acquiring $100,000 of XYZ Company common stock instead. XYZ stock has the same expected return and standard deviation as ABC stock. Her husband comments, "It doesnt matter whether you keep all of the ABC stock or replace it with $100,000 of XYZ stock." Sar whether her husband's comment is correct or incorrect. Justify your response. e. In a recent discussion with her financial advisor, Grace commented, "If I just don't lose mn in my portfolio, I will be satisfied." She went on to say, "I am more afraid of losing m I am concerned about achieving high returns." i. Describe one weakness of using standard deviation of returns as a risk measure fo osing money thur i. Identify an altermative risk measure that is more appropriate under the circumstanc The following informatio Greta, an elderly investor, has a degree of risk aversion of A 2 when applied to return on weaumtd three-year horizon. She is pondering two ponfolios, the S&P 500 and a hedge fund, as ll as n applies to problems 23 to 27: three-year strategies. (All rates are annual, continuously compounded.) The S&P 500 riskeio three-year strategies.(All rates are annual, continuously comp percent. The hedge rauith a SD of 20 percemt. Tthe hedge fund risk premium is with a SD of 35 percent. The retun on any of these portfolios in any portfolios in any other year. The hedge fund mana annual returns on the S&P 500 and the hedge fund i premium is estimated at I0 e year is uncorrelated with the ret the correlation coefficient betw