Question

Abigail has requested that you review the client file so that any issues can be mapped out ahead of the scheduled meeting with the client

Abigail has requested that you review the client file so that any issues can be mapped out ahead of the scheduled meeting with the client early next week. The client files include notes taken from an initial phone conversation as well as some documents provided by the client.

Client Number: 99975

Client's Preferred Name: Maxine Robinson

Client Meeting: 12 August 2022

Item 1: Meeting notes prepared by Abigail (tax practitioner) and Maxine (client)

Maxine completed an animal behaviour degree at the end of 2020 and had been looking for work since. In August 2021, Maxine found employment as a consultant for a small sustainability firm in Warrnambool. The contract includes an annual salary, which $62,000 plus superannuation has been received in the 2022 income tax year. Maxine was required to purchase wet weather gear and other protective clothing at her own expense, totalling $660. Her employer reimbursed her for the total amount and also provided her with a hand-held radio transceiver (cost $270) and tablet computer (cost $1,599 plus case $210) for whilst she is on site visits.

Due to the closer proximity to her new employer, Maxine and Nathan decided to move into their investment property located in Warrnambool. Maxine and Nathan acquired the property in August 2020, which is made up of a modern brick home on a small suburban block. Maxine and Nathan moved into the property in September 2021. Maxine was against selling the Horsham property, so they decided to rent it out. Tenants moved in as soon as Maxine and Nathan moved out (also in September 2021).

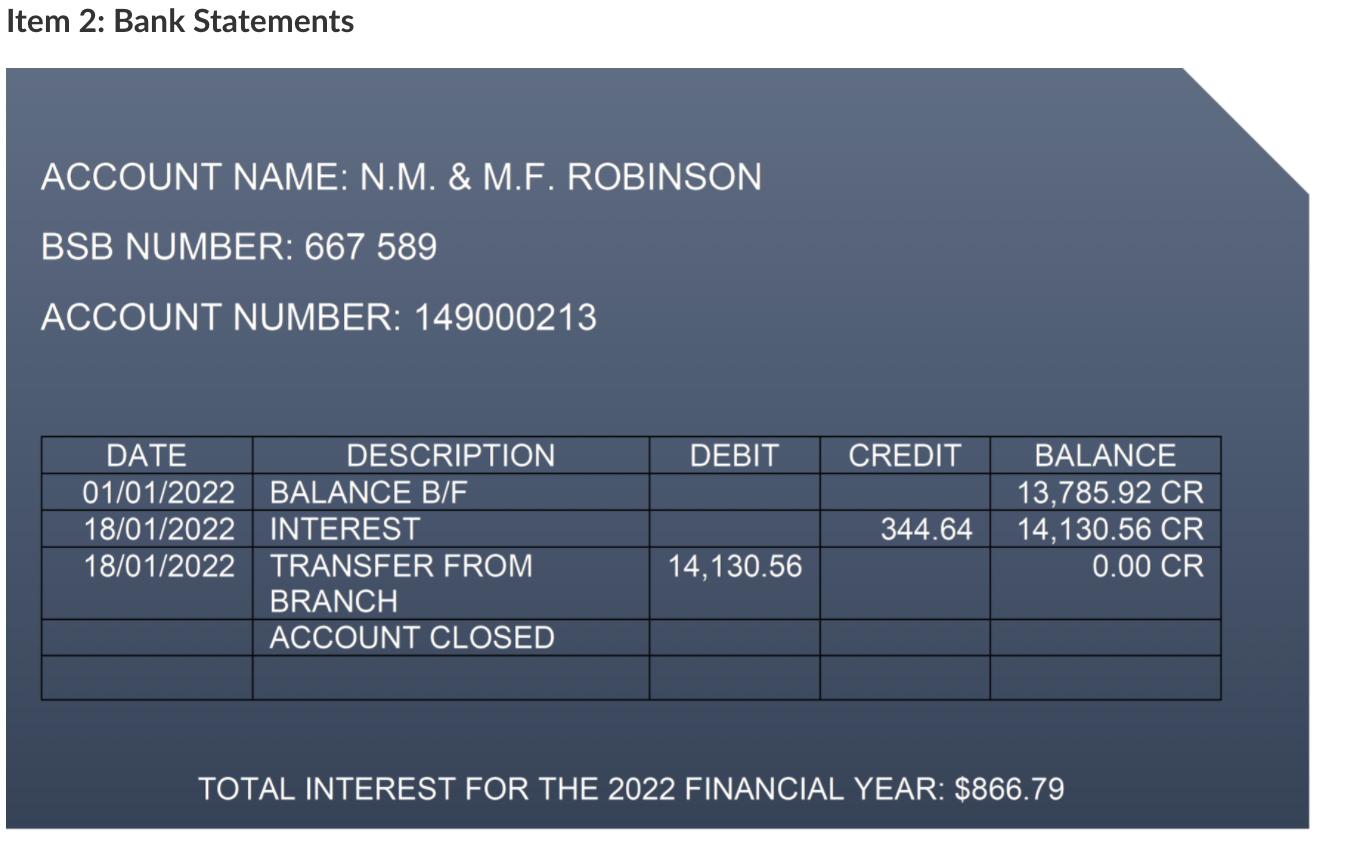

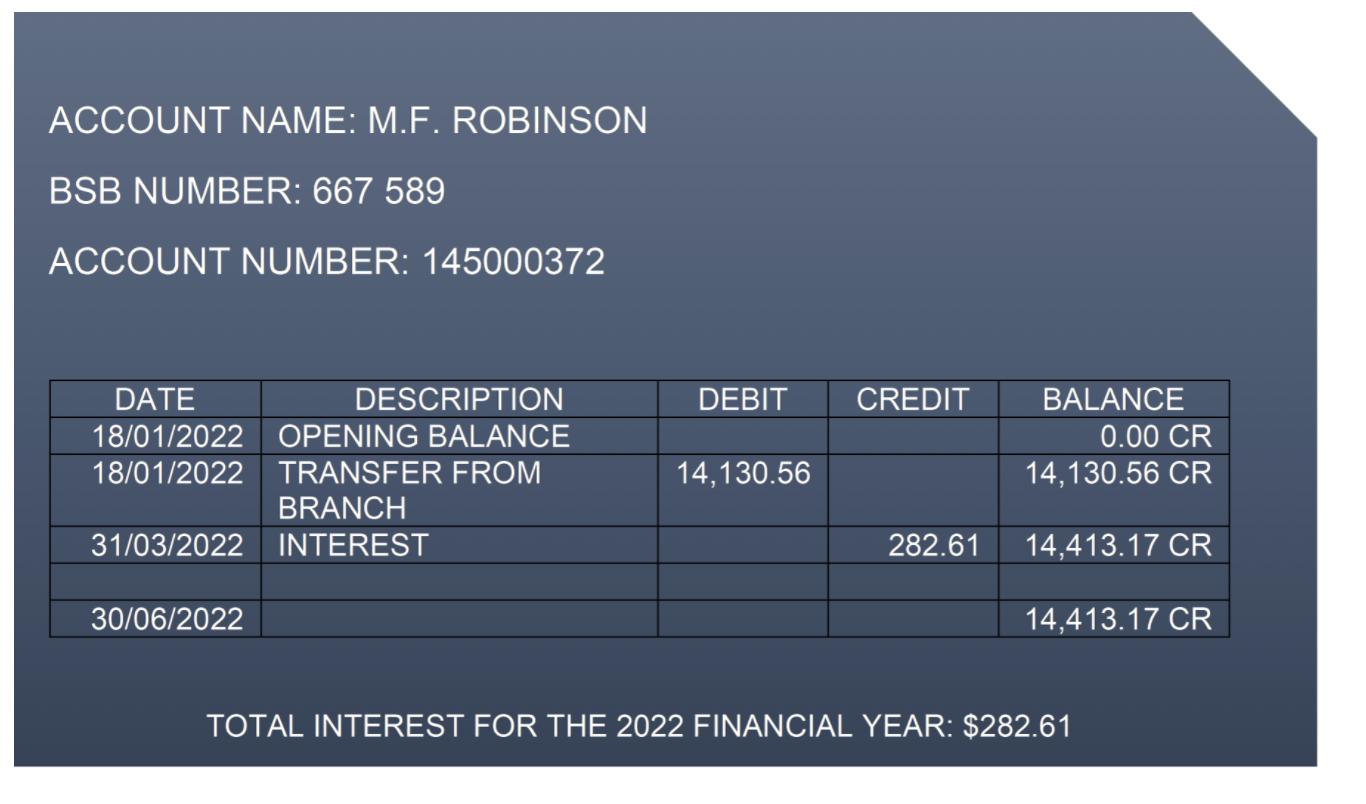

In January 2022, their joint interest-bearing account was closed, and Maxine transferred the remaining balance (including Nathan’s share at his request) into an interest-bearing account in her name only.

Available property information:

Investment property, Warrnambool:

01 August 2020 Purchased - $650,000

01 August 2020 Settlement/legal fees $6,732

Horsham Property:

30 November 2014 Purchased - $650,000

30 November 2014 Settlement/legal fees $6,350

Real estate agent valuation on Horsham property September 2021: $1,052,000

Over the course of the day, Abigail has asked you a few questions to ensure you are ready for the upcoming meeting and to pre-empt some of the questions that might come up.

REQUIRED:

Respond to Abigail’s enquiries by answering the following questions. Ensure you refer to appropriate legislation and case law and show all workings and explanations/ You must show a complete analysis to be awarded full marks.

1A) Assuming the Warrnambool property becomes Maxine’s main residence for the purposes of Subdivision 118 of ITAA97 in September 2021, discuss the implications to the main residence exemption for each property (5 marks).

Note: No calculation is required for this question

1B)

Create an asset register outlining the current cost base elements of each property pursuant to the income tax legislation (6 marks).

(Hint: create a table with the following four columns: (i) cost base element (ii) amount ($) (iii) date (iv) explanation).

1C)

Explain the income tax treatment of the interest accounts (4 marks).

1D)

Explain the income tax and FBT implications of the remuneration package she is receiving from her employer, from both the employee and employer’s perspective (10 marks).

1E)

With reference to the TASA Code of Professional Conduct, reflect upon the following aspects of this assessment task (3 marks):

i)The specialist tax knowledge required to give advice on the issues presented in this assessment task.

ii)The provision of, and reliance upon, information by the client.

iii)The potential for changing client circumstances over time.

1F)

Reflecting on the notions of academic integrity, provide a statement as to how you approached completing this task and a bibliography breaking down the resources you (i) viewed or examined, and (ii) those that you explicitly replied upon in completing this task (2 marks).

Maxine has been living in Horsham, Victoria since 2014, on a 4 acre property Maxine and Nathan (her partner) had purchased jointly at that time.

Step by Step Solution

3.39 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Introduction The events surrounding the killing of George Floyd in 2020 ignited widespread protests and discussions about systemic racism and discrimination particularly within law enforcement In resp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started