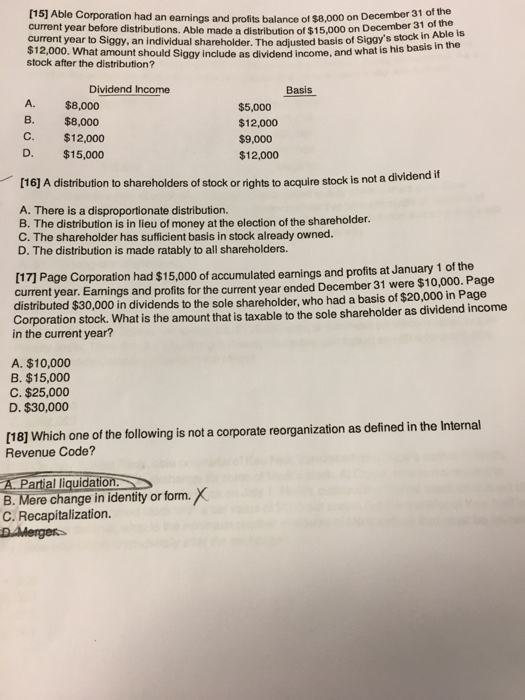

Able corporation had an earnings and profits balance of dollar8,000 on December 31 of the current year before distributions. Able made a distribution of dollar15,000 on December 31 of the current year to Siggy, an individual shareholder. The adjusted basis of Siggy's stock in able is dollar 12,000. What amount should Siggy include as dividend income, and what is his basis in the stock after the distribution? A distribution to shareholders of stock or rights to acquire stock is not a dividend if There is a disproportionate distribution. The distribution is in lieu of money at the election of the shareholder. The shareholder has sufficient basis in stock already owned. The distribution is made ratably to all shareholders. Page Corporation had dollar15,000 of accumulated earnings and profits at January 1 of the current year. Earnings and profits for the current year ended December 31 were dollar10,000. Page distributed dollar30,000 in dividends to the sole shareholder, who had a basis of dollar20,000 in Page Corporation stock. What is the amount that is taxable to the sole shareholder as dividend income in the current year? dollar10,000 dollar15,000 dollar25,000 dollar30,000 Which one of the following is not a corporate reorganization as defined in the Internal Revenue Code? Partial liquidation. Mere change in identity or form. Recapitalization. Merger Able corporation had an earnings and profits balance of dollar8,000 on December 31 of the current year before distributions. Able made a distribution of dollar15,000 on December 31 of the current year to Siggy, an individual shareholder. The adjusted basis of Siggy's stock in able is dollar 12,000. What amount should Siggy include as dividend income, and what is his basis in the stock after the distribution? A distribution to shareholders of stock or rights to acquire stock is not a dividend if There is a disproportionate distribution. The distribution is in lieu of money at the election of the shareholder. The shareholder has sufficient basis in stock already owned. The distribution is made ratably to all shareholders. Page Corporation had dollar15,000 of accumulated earnings and profits at January 1 of the current year. Earnings and profits for the current year ended December 31 were dollar10,000. Page distributed dollar30,000 in dividends to the sole shareholder, who had a basis of dollar20,000 in Page Corporation stock. What is the amount that is taxable to the sole shareholder as dividend income in the current year? dollar10,000 dollar15,000 dollar25,000 dollar30,000 Which one of the following is not a corporate reorganization as defined in the Internal Revenue Code? Partial liquidation. Mere change in identity or form. Recapitalization. Merger