Question

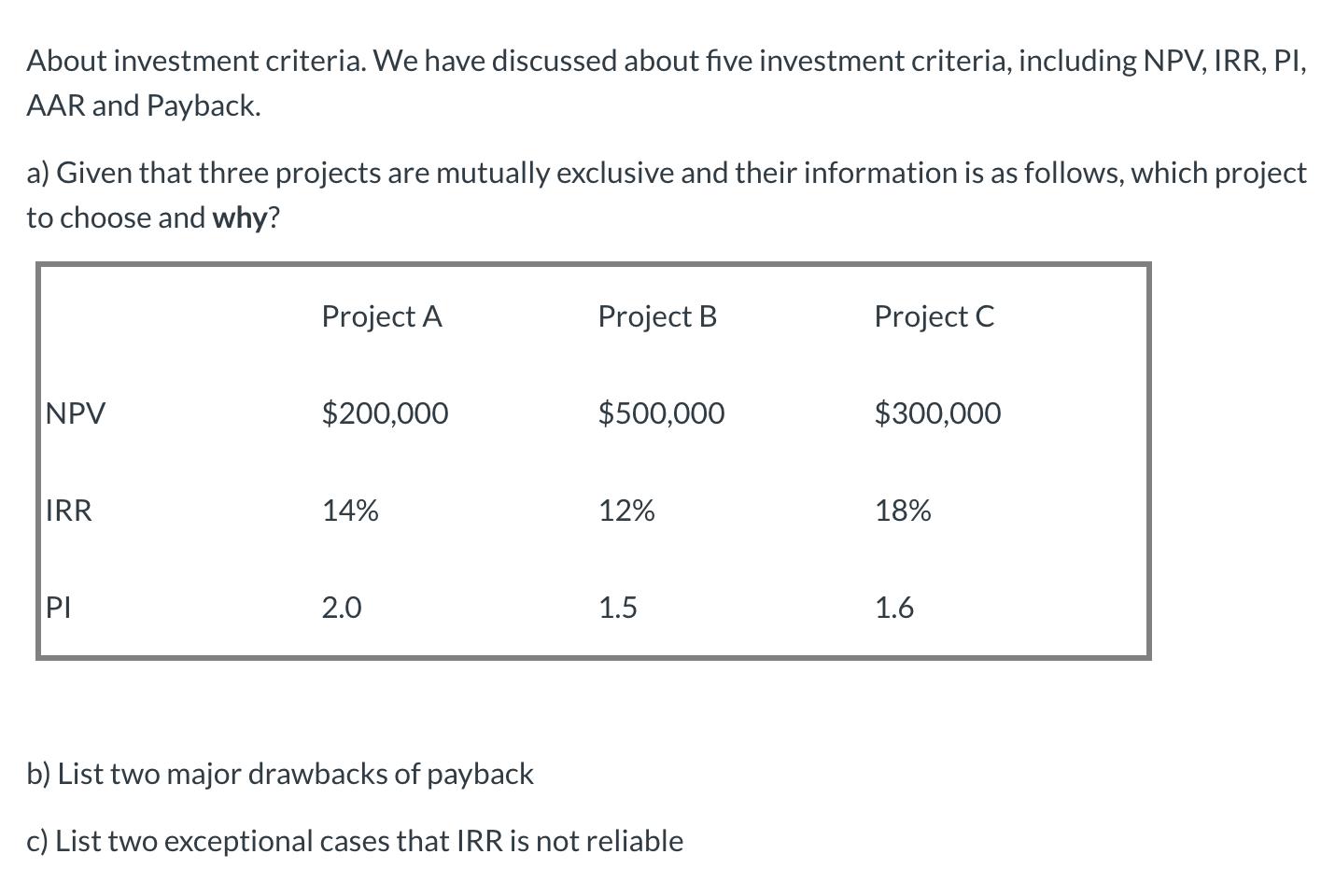

About investment criteria. We have discussed about five investment criteria, including NPV, IRR, PI, AAR and Payback. a) Given that three projects are mutually

About investment criteria. We have discussed about five investment criteria, including NPV, IRR, PI, AAR and Payback. a) Given that three projects are mutually exclusive and their information is as follows, which project to choose and why? NPV Project A Project B Project C $200,000 $500,000 $300,000 IRR 14% 12% 18% PI 2.0 1.5 1.6 b) List two major drawbacks of payback c) List two exceptional cases that IRR is not reliable

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here it is given that there are 3 projects which are mutually exclusive Since these projects are mut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

Concise 6th Edition

324664559, 978-0324664553

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App