Answered step by step

Verified Expert Solution

Question

1 Approved Answer

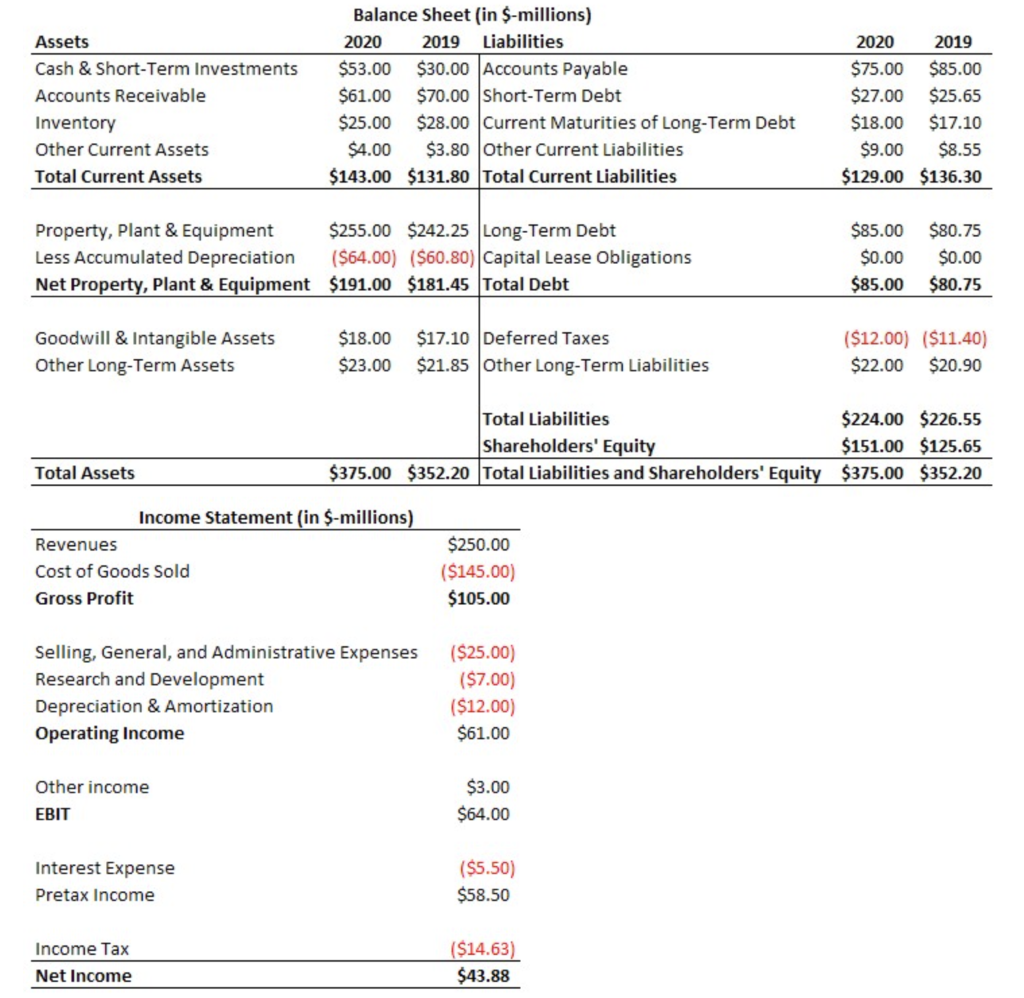

Above are financial statements for Fantastic Industries. Calculate the Cash Flow from Operations for 2020. Express your result in $-millions and round to two decimals.

Above are financial statements for Fantastic Industries. Calculate the Cash Flow from Operations for 2020. Express your result in $-millions and round to two decimals. (do not include the $-symbol in your answer)

Assets Cash & Short-Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet (in $-millions) 2020 2019 Liabilities $53.00 $30.00 Accounts Payable $61.00 $70.00 Short-Term Debt $25.00 $28.00 Current Maturities of Long-Term Debt $4.00 $3.80 Other Current Liabilities $143.00 $131.80 Total Current Liabilities 2020 2019 $75.00 $85.00 $27.00 $25.65 $18.00 $17.10 $9.00 $8.55 $129.00 $136.30 Property, Plant & Equipment $255.00 $242.25 Long-Term Debt Less Accumulated Depreciation ($64.00) ($60.80) Capital Lease Obligations Net Property, Plant & Equipment $191.00 $181.45 Total Debt $85.00 $0.00 $85.00 $80.75 $0.00 $80.75 Goodwill & Intangible Assets Other Long-Term Assets $18.00 $23.00 $17.10 Deferred Taxes $21.85 Other Long-Term Liabilities ($12.00) ($11.40) $22.00 $20.90 Total Liabilities $224.00 $226.55 Shareholders' Equity $151.00 $125.65 $375.00 $352.20 Total Liabilities and Shareholders' Equity $375.00 $352.20 Total Assets Income Statement (in $-millions) Revenues Cost of Goods Sold Gross Profit $250.00 ($145.00) $105.00 Selling, General, and Administrative Expenses Research and Development Depreciation & Amortization Operating Income ($25.00) ($7.00) ($12.00) $61.00 Other income EBIT $3.00 $64.00 Interest Expense Pretax Income ($5.50) $58.50 Income Tax ($14.63) $43.88 Net IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started