Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Above is a question on income taxes and solution is provided. Can someone please help me with the numbers on PPE? How did they get

Above is a question on income taxes and solution is provided. Can someone please help me with the numbers on PPE? How did they get the GAAP and tax value?

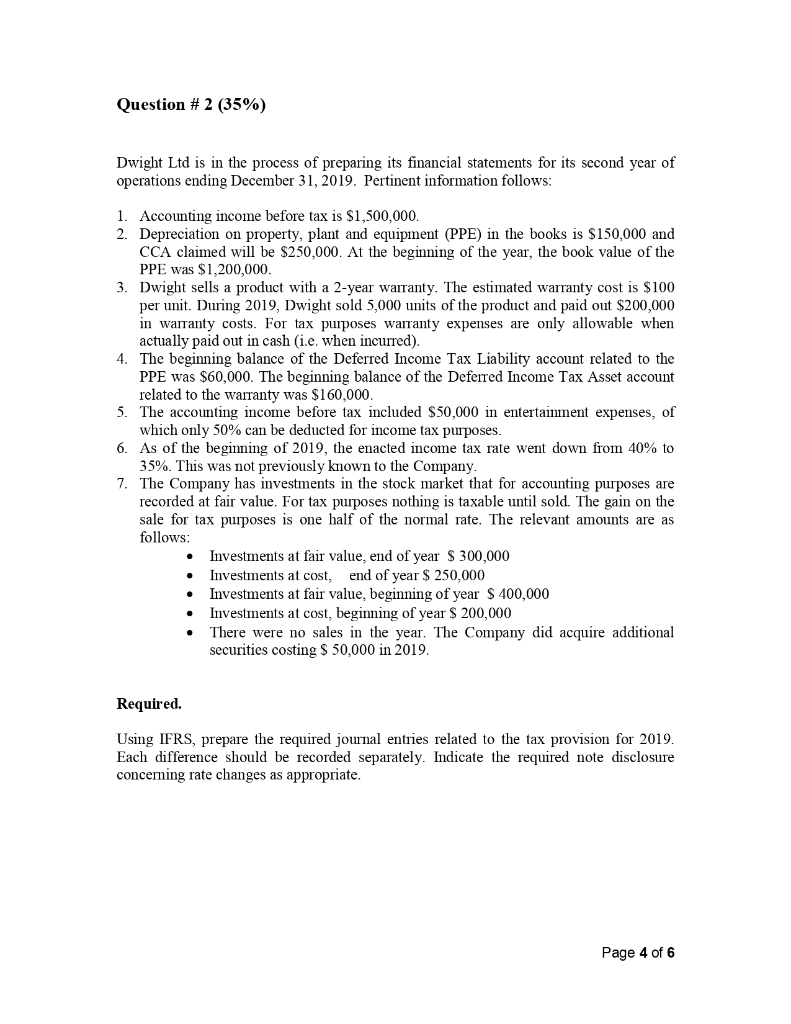

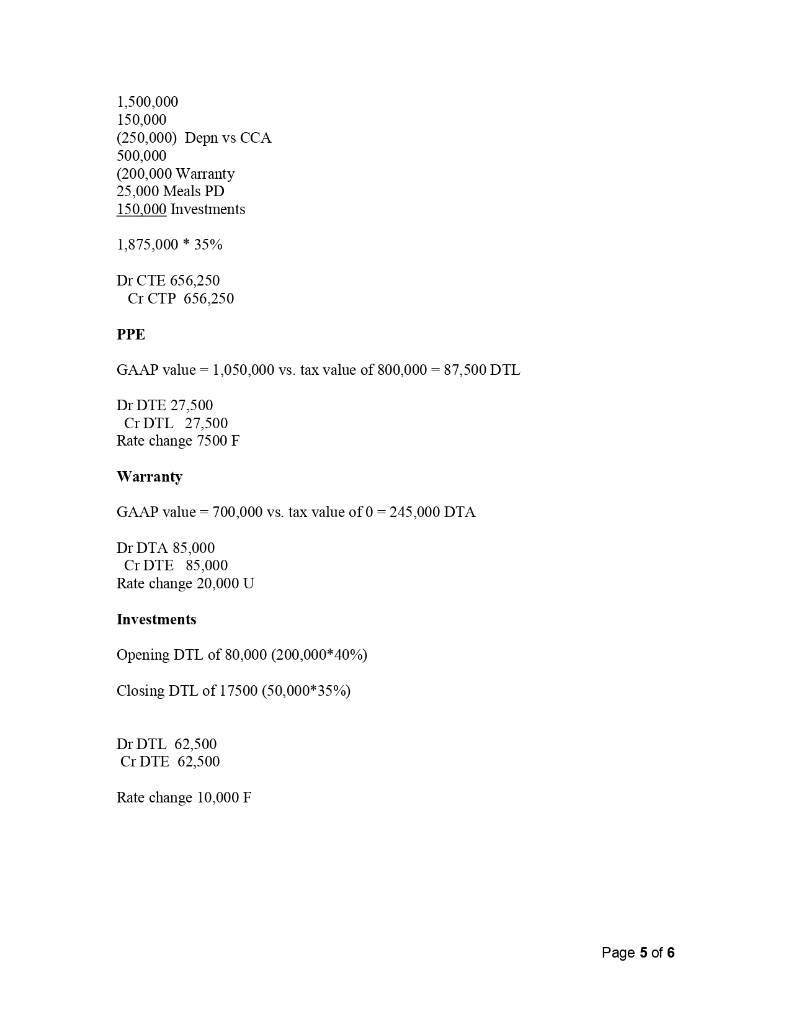

Question # 2 (35%) Dwight Ltd is in the process of preparing its financial statements for its second year of operations ending December 31, 2019. Pertinent information follows: 1. Accounting income before tax is $1,500,000. 2. Depreciation on property, plant and equipment (PPE) in the books is $150.000 and CCA claimed will be $250,000. At the beginning of the year, the book value of the PPE was $1,200,000. 3. Dwight sells a product with a 2-year warranty. The estimated warranty cost is $100 per unit. During 2019, Dwight sold 5,000 units of the product and paid out $200,000 in warranty costs. For tax purposes warranty expenses are only allowable when actually paid out in cash (i.e. when incurred). 4. The beginning balance of the Deferred Income Tax Liability account related to the PPE was $60,000. The beginning balance of the Deferred Income Tax Asset account related to the warranty was $160,000. 5. The accounting income before tax included $50,000 in entertainment expenses, of which only 50% can be deducted for income tax purposes. 6. As of the beginning of 2019, the enacted income tax rate went down from 40% to 35%. This was not previously known to the Company. 7. The Company has investments in the stock market that for accounting purposes are recorded at fair value. For tax purposes nothing is taxable until sold. The gain on the sale for tax purposes is one half of the normal rate. The relevant amounts are as follows: Investments at fair value, end of year $ 300,000 Investments at cost, end of year $ 250,000 Investments at fair value, beginning of year $ 400,000 Investments at cost, beginning of year $ 200,000 There were no sales in the year. The Company did acquire additional securities costing $ 50,000 in 2019. Required. Using IFRS, prepare the required journal entries related to the tax provision for 2019. Each difference should be recorded separately. Indicate the required note disclosure concerning rate changes as appropriate. Page 4 of 6 1,500,000 150,000 (250,000) Depn vs CCA 500,000 (200,000 Warranty 25,000 Meals PD 150,000 Investinents 1,875,000 * 35% Dr CTE 656,250 Cr CTP 656,250 PPE GAAP value - 1,050,000 vs. tax value of 800,000 - 87,500 DTL Dr DTE 27,500 Cr DTL 27,500 Rate change 7500 F Warranty GAAP value = 700,000 vs. tax value of 0= 245,000 DTA Dr DTA 85.000 Cr DTE 85,000 Rate change 20,000 U Investments Opening DTL of 80,000 (200,000*40%) Closing DTL of 17500 (50,000*35%) Dr DTL 62,500 Cr DTE 62,500 Rate change 10,000 F Page 5 of 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started