Answered step by step

Verified Expert Solution

Question

1 Approved Answer

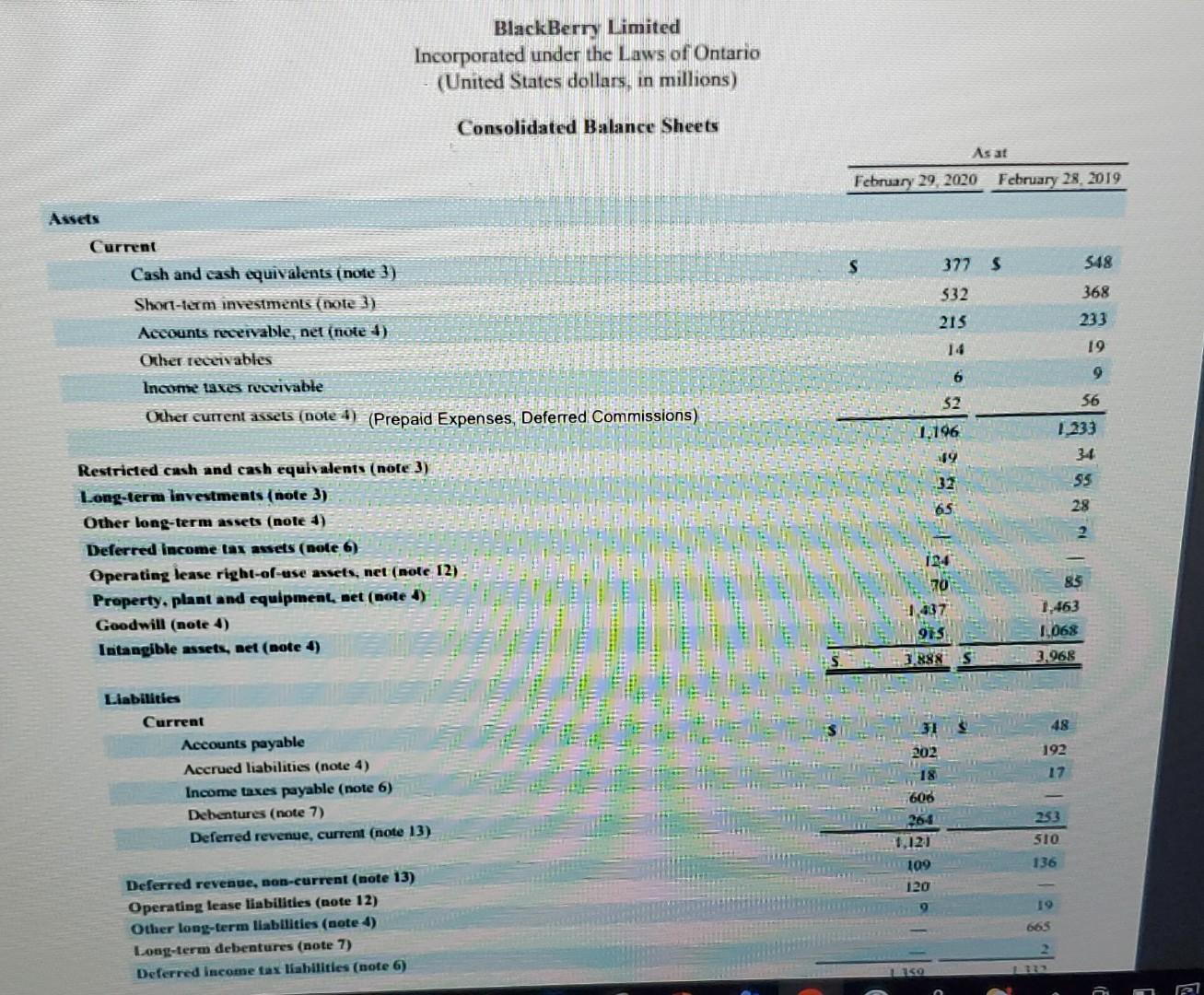

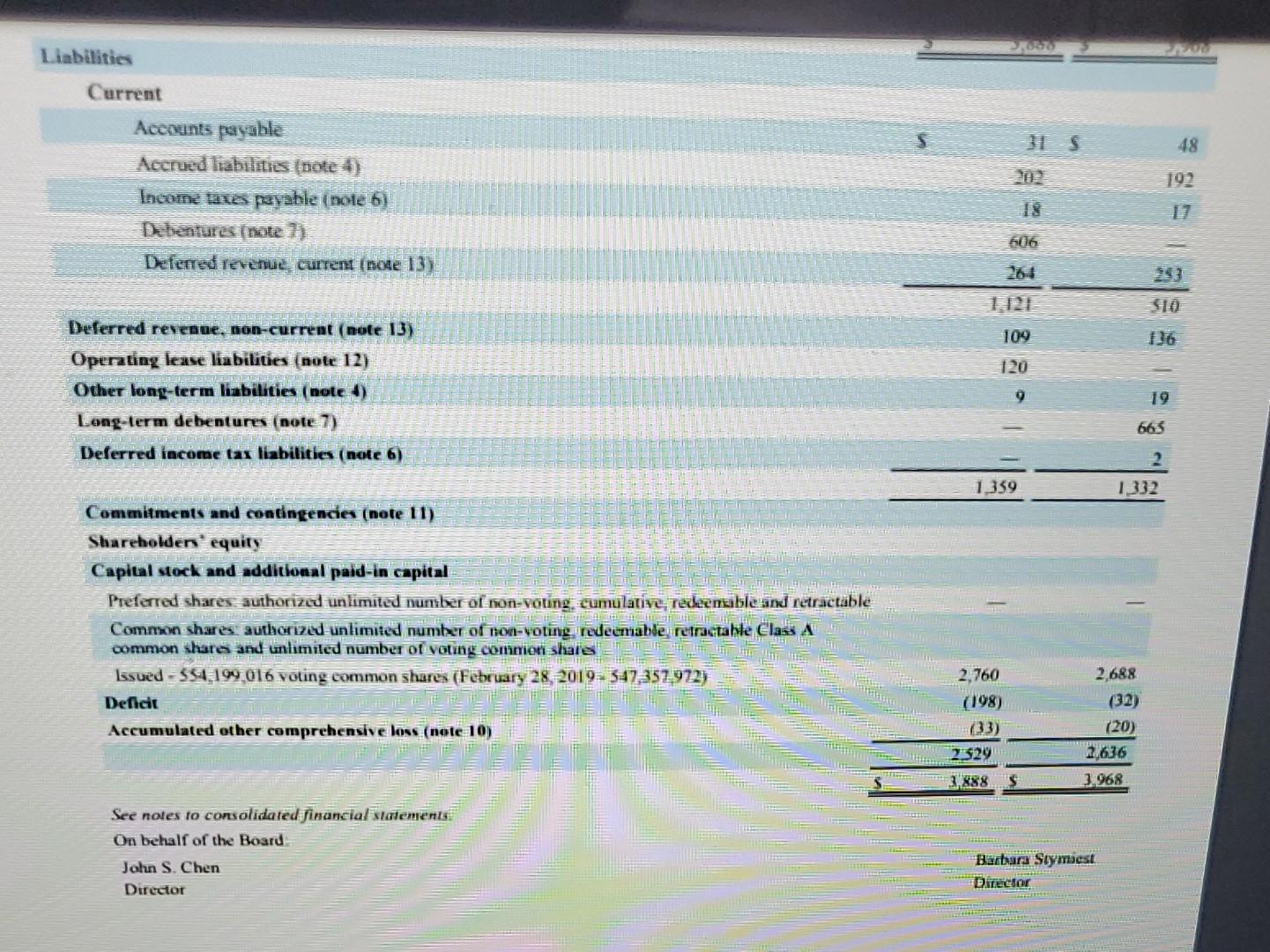

above is the balance sheet needed to answer the liquidity ratio questions BlackBerry Limited Incorporated under the Laws of Ontario (United States dollars, in millions)

above is the balance sheet needed to answer the liquidity ratio questions

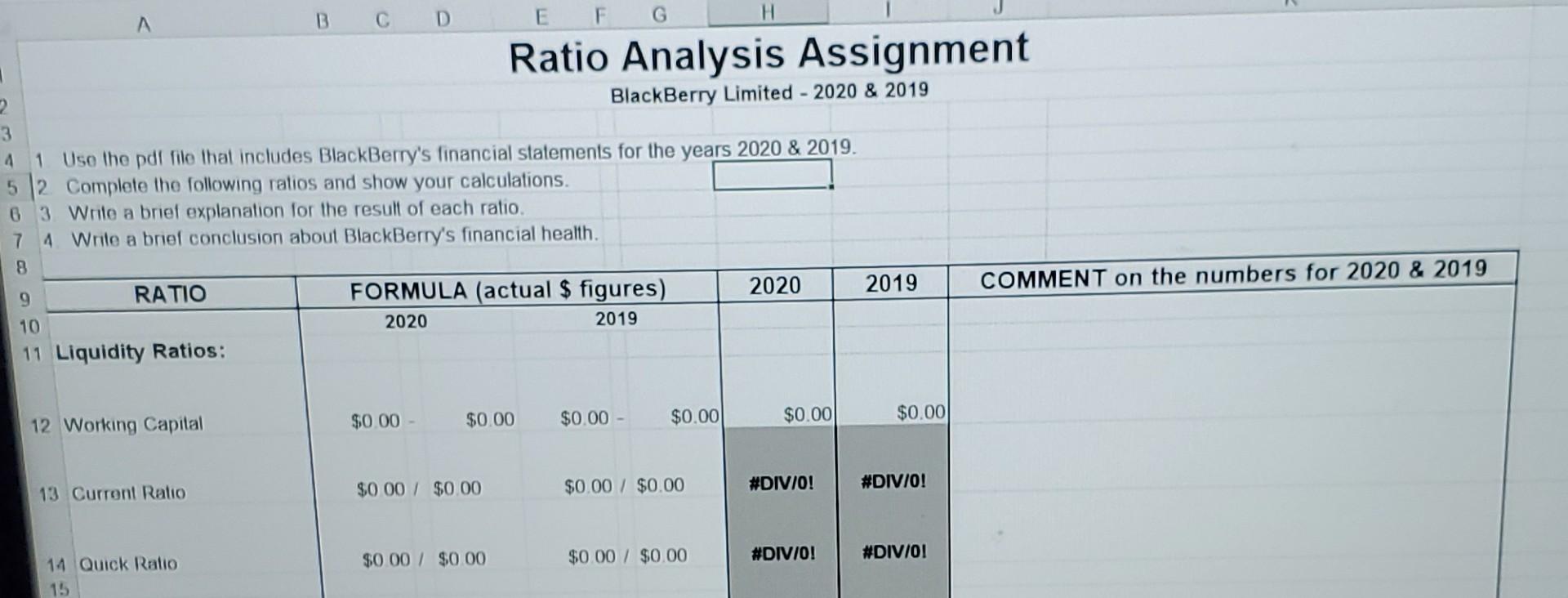

BlackBerry Limited Incorporated under the Laws of Ontario (United States dollars, in millions) Consolidated Balance Sheets As at February 29, 2020 February 28, 2019 Assets 377 S 548 532 368 213 Current Cash and cash equivalents (note 3) Shon-lerm investments (note) Accounts receivable, net (note 1) Other recevables Income taxes receivable Other current assets (note 4) (Prepaid Expenses, Deferred Commissions) 233 19 14 6 9 52 1.196 56 1233 34 55 19 32 65 28 2 Restricted cash and cash equivalents (note 3) Long-term investments (note 3) Other long-term assets (note 1) Deferred Income tax assets (note 6) Operating lease right-of-use assets, net (note 12) Property, plant and equipment, net (note 1) Goodwill (note 4) Intangible assets, net (note 4) 124 85 1,463 1068 3,968 48 202 Liabilities Current Accounts payable Accrued liabilities (note 4) Income taxes payable (note 6) Debentures (note 7) Deferred revenue, current (note 13) 192 17 606 26-8 1,12) 109 120 253 510 136 19 Deferred revenue, non-current (note 13) Operating lease liabilities (note 12) Other long-term liabilities (note 4) Long-term debentures (note 7) Deferred income tax liabilities (note 6) 665 159 315 48 Liabilities Current Accounts payable Accrued liabilities tnote 4) Income taxes payable (note 6) Debentures (note 1) Deferred revenue, current (node 13) 192 07 606 253 10 1121 109 120 Deferred revenue, non-current (note 13) Operating kase liabilities (note 12) Other long-term liabilities (note 4) Long-term debentures (note 7) Deferred income tax liabilities (note 6) 9 19 663 2 1.359 1,332 Commitments and contingencies (note 11) Shareholder' equity Capital stock and additional paid-in capital Preferred shares authorized unlimited number of non-voting, cumulative, redeemable and retractable Common shares authorized unlimited number of non-voting redeemable, retractable Class A common shares and unlimited number of voting comniori shaies Issued - 354,199,016 voting common shares (February 28, 2019 - 347.357.972) Deficit Accumulated other comprehensive loss (note 10) 2,760 (198) (3) 2324 2.688 (32) (20) 2,636 3.968 3,888 S See notes to consolidated financial statement On behalf of the Board John S. Chen Director Barbara Stymuest Director A D E F Ratio Analysis Assignment 2. BlackBerry Limited - 2020 & 2019 3 4 1 Use the pdf file that includes BlackBerry's financial statements for the years 2020 & 2019. 5 2. Complete the following ratios and show your calculations. 6 3 Write a brief explanation for the result of each ratio. 7 4. Write a brief conclusion about BlackBerry's financial health. 8 9 RATIO FORMULA (actual $ figures) 2020 2019 10 2020 2019 11 Liquidity Ratios: COMMENT on the numbers for 2020 & 2019 $0.00 $0.00 $0.00 $0.00 $0.00 12 Working Capital $0.00 $0.00 $0.00 #DIV/0! 13 Current Ratio $0.00 / $0.00 #DIV/0! $0 00 / $0.00 $0.00 / $0.00 #DIV/0! #DIV/01 14 Quick Ratio 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started