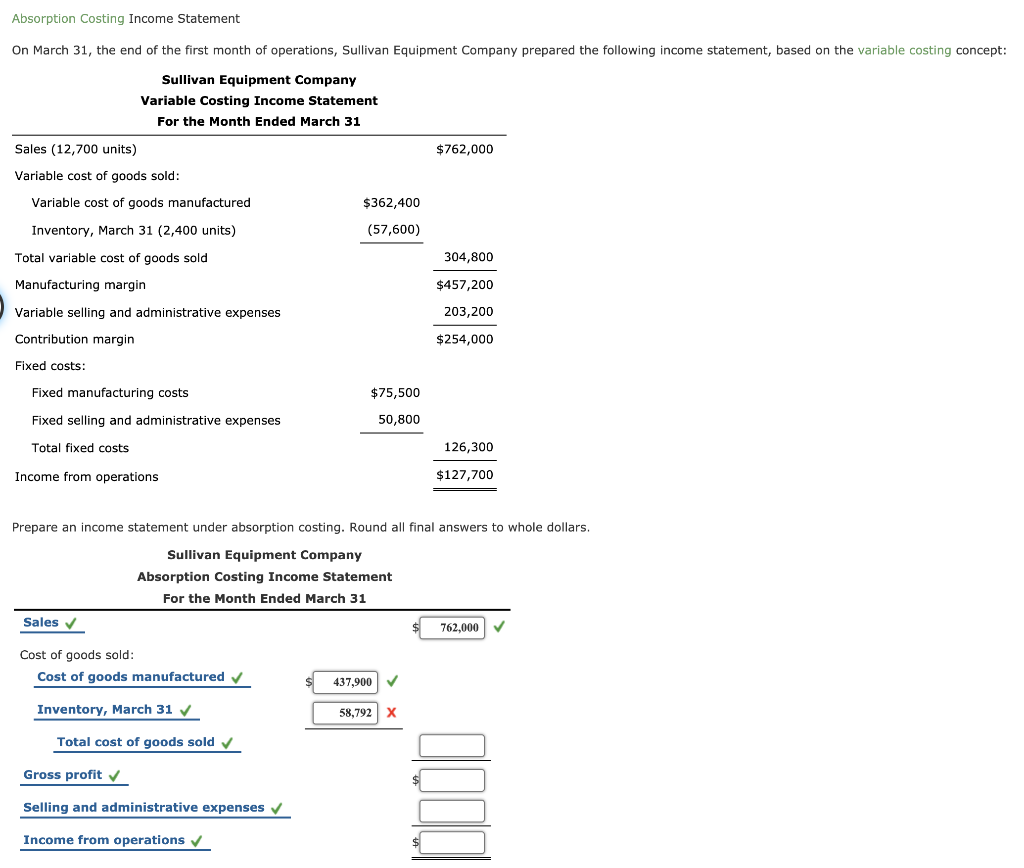

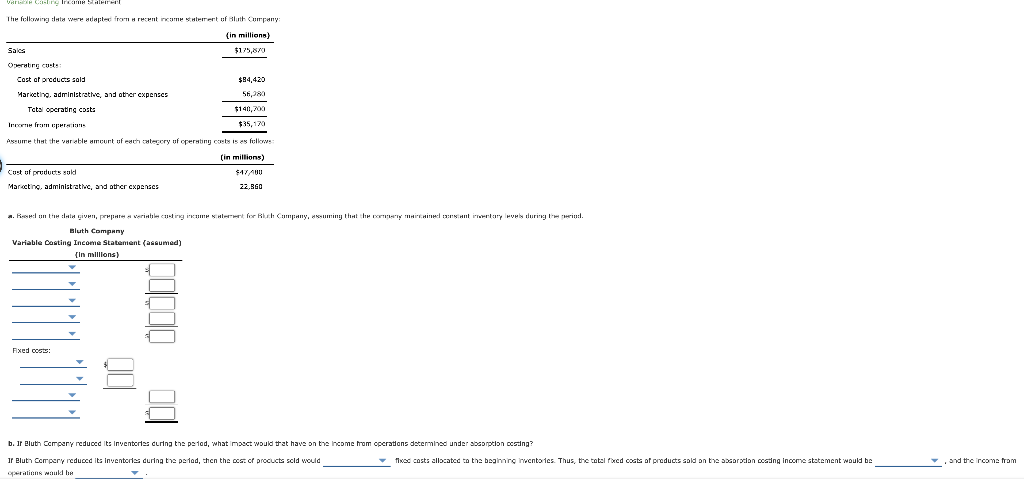

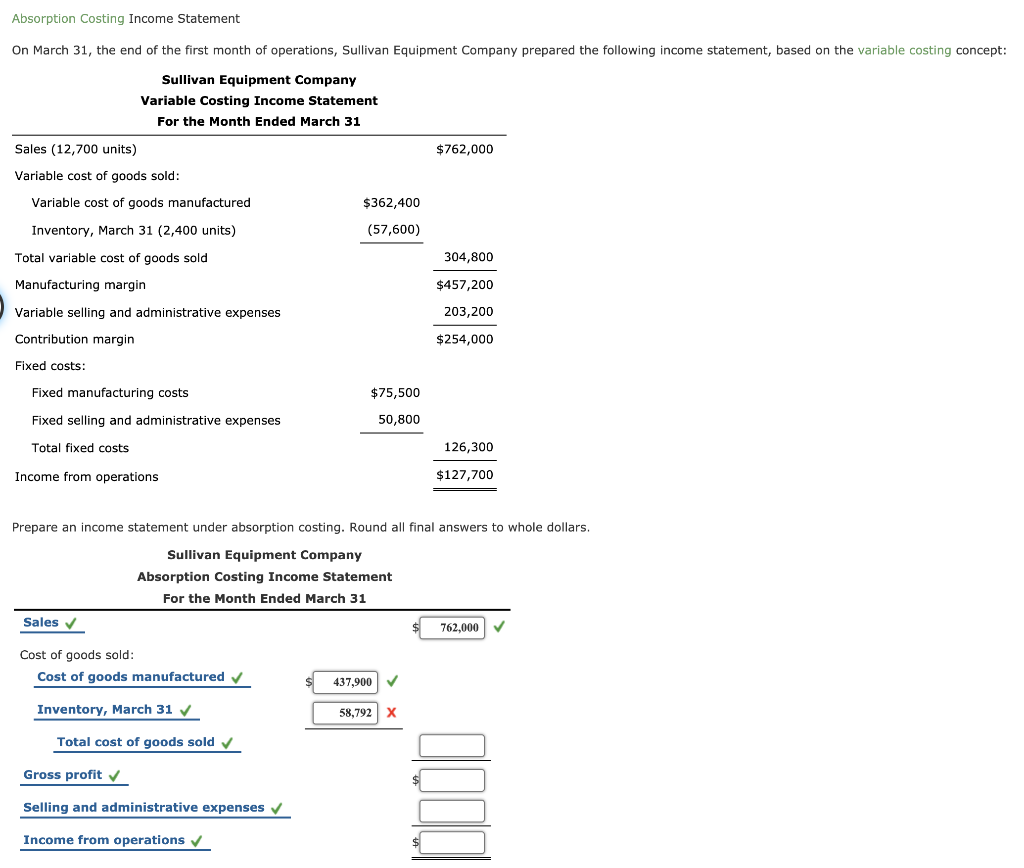

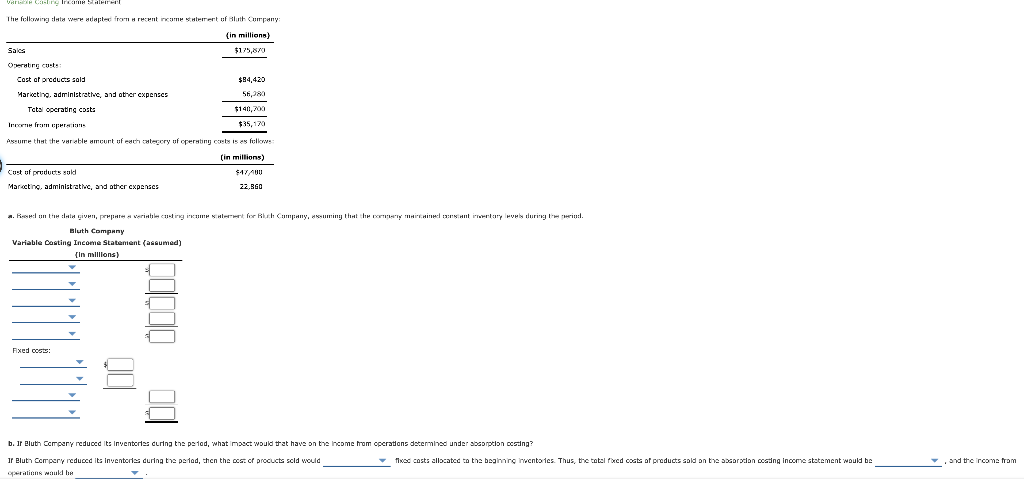

Absorption Costing Income Statement On March 31, the end of the first month of operations, Sullivan Equipment Company prepared the following income statement, based on the variable costing concept: Sullivan Equipment Company Variable Costing Income Statement For the Month Ended March 31 Sales (12,700 units) $ 762,000 Variable cost of goods sold: Variable cost of goods manufactured $362,400 Inventory, March 31 (2,400 units) (57,600) Total variable cost of goods sold 304,800 Manufacturing margin $457,200 Variable selling and administrative expenses 203,200 Contribution margin $254,000 Fixed costs: Fixed manufacturing costs $75,500 Fixed selling and administrative expenses 50,800 Total fixed costs 126,300 Income from operations $127,700 Prepare an income statement under absorption costing. Round all final answers to whole dollars. Sullivan Equipment Company Absorption Costing Income Statement For the Month Ended March 31 Sales 762,000 Cost of goods sold: Cost of goods manufactured 437,900 Inventory, March 31 58,792 Total cost of goods sold Gross profit DOOD Selling and administrative expenses Income from operations |-- - TIIN HIFIT - The following lata were duplex from recent income thrrent of Bath Company in millions) $175,870 Sales Operating costs Cost of products sold Marketing, administrative, and other expenses Tots operating costs $94,420 55,70 $140,700 Irene fruer $35, Axure that the varable meurt ui each weery of operating costs is as follow (in millions) Cet of products sold $47AULE Maracting, administrative, and other expenses 22.BGO 4. Rolul IV, po preverite culing Melor Company, suming that the air manitary Haly during wil Bluth Company Variable Casting Income Statement (assumed) in millions) Fixed costs: bo 1000 b. Ir Bluth Company reduced its Inventories during the pa tad, what in sct would tat have on the income hom opcrations determined under absorption cing? ir Bluth Company rcduocd its inventors during the period, then the ocs of products sold would fixec costs allocated to the beginning inventories. Thus, the total facd costs of products sold on the cordon ocasing income statement would be pealing wauld be and the income from