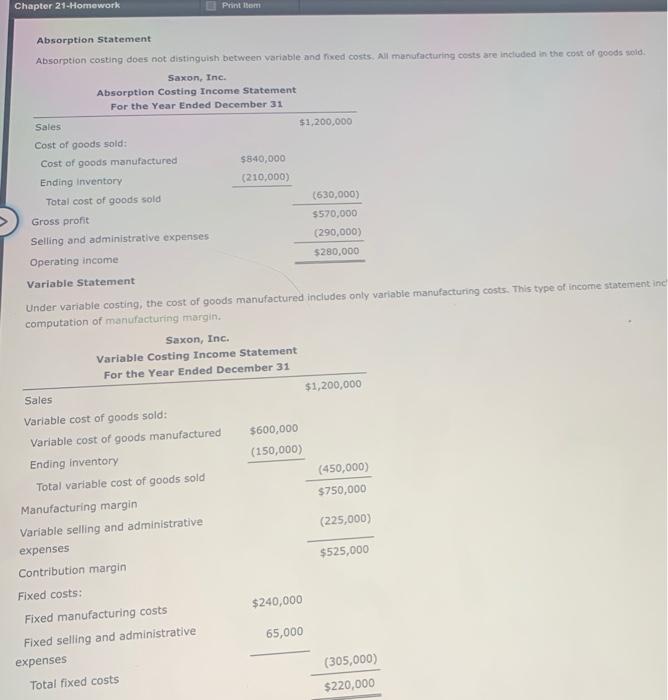

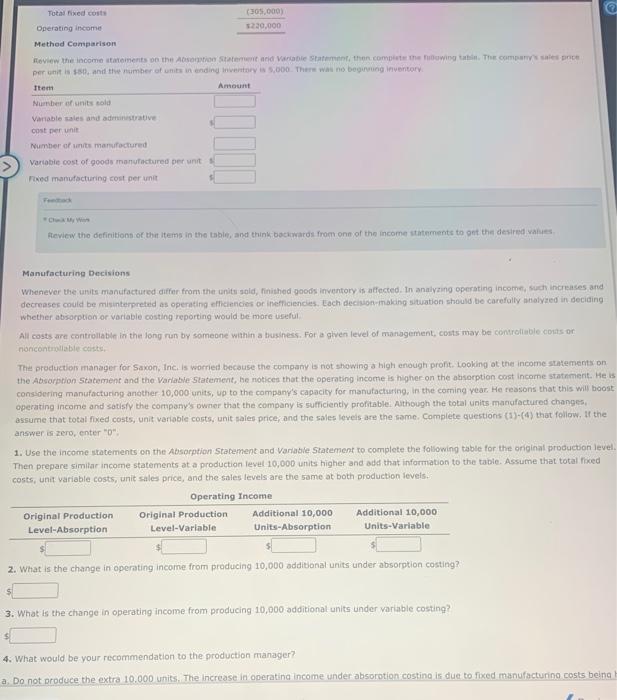

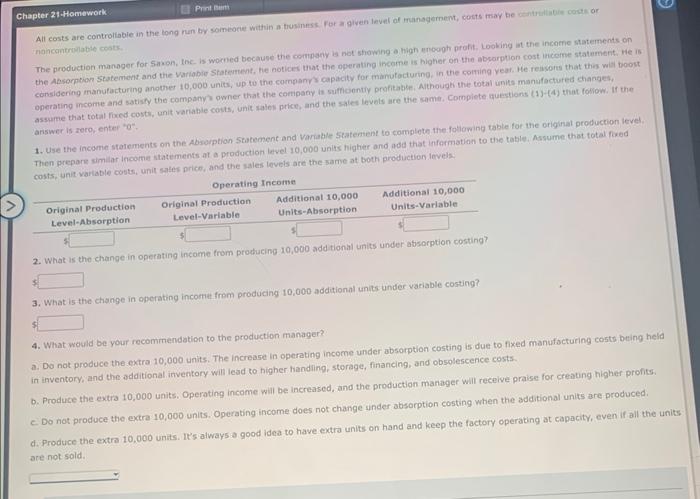

Absorption Statement Absorption costing does not distinguish between variable and fixed costs. Ali manufacturing ocsts are included in the colt af goods sald. Under variable costing, the cost of goods manufactured includes only variable manufacturing costs. This type of income statement in Fentask " Cluak Mi wiot Manufacturing Decisions decreases could be misinterpreted as operating effiencies or inefficiencies. Each deciugh-making sturation should be carefully attalyzed in deciding whether absorption or variable costing reporting would be more useful. All costs are cortroliabit in the long run by someone within a thasiness. Fof a given level of management, costs may be controliable coits of nonicontroliable caster, The production manager for Saxon, Inc, is worried because the company is not showing a high enough profit, Looking ot the income statements on the Absorption Statement and the Vanlable statemient, he notices that the operating income is higher on the atsorption cont income statnmerit. He is considering manufacturing andether 10,000 units, up to the company's capacicy for manufacturing, in the coming year, He reasons that this will boost operating income and sotisfy the company's owner that the company is sufficiently profitable. Authough the tokal units manufactured changes, assume that total fixed costs, unit variabie costs, unit saies price; and the sales leveis art the same. Complete questions (3)-(4) that folligw, If the answer is zero, enter " D ": 1. Use the income statements on the Absorption Statement and Variabie Statement to complete the faliowing table for the onginal production level. Then prepare simitar income statements at a production level 10,000 units higher and add that information to the table. Assume that total finced costs, unit variable costs, unit sales price, and the-saies levels are the 5ame at both production leveis, 2. What is the change in operating income from producing 10,000 addibonal units under absorption costing? 3. What is the change in operating income from producing 10,900 additional units under variable costing? 4. What-would be your recommendation to the production manager? 3. Do not produce the extro 10,000 units. The increase in operating income under absorotion costing is due to fixed manufacturing costs being the Absorption Spatement and the Variabie Statement, he notices that the operating inchime is higher on the abporption cost incelme statiment. He is cansidering manufacturing another to,000 units, up to the company's capacity for mamotacturing. in the colting year. He reissore that thes wial boost assume that total fixed costs, unit variable costs, unit sales price, and the sales levels are the same, Compiete aquestions (1)-(4) that foslow. If the answer is zeco, enter 02 1. Use the income statements on the Abreption Statement and Variable Statentent to complete. the foliowing table tot the original production ievel. Then prepare simiar income statements at a production level 10,000 units higher and add that infermation to the table. Assume that total fised 3. What is the change in operating incortet frem producing 10,000 additional units under variable costing? 4. What would be your recommendation to the production manager? a. Do not produce the extra 10,000 units. The increase in operating income under absorption costing is due to fixed manufocturing costs beting hela in inventory, and the odditional, itiventory will lead to higher handing, storage, financing, and obsolescence costs. b. Produce the extra 10,000 units. Operating income will be increased, and the production mariager will receive praise for creating higher profits. c. Do not produce the extra 10,000 units. Operating income does not change under absorption costing when the additional units are produced. d. Produce the extra 10,000 units. Its always a good idea to have extra units on hand and keep the factory operating at capacity, even if all the unity are not sold