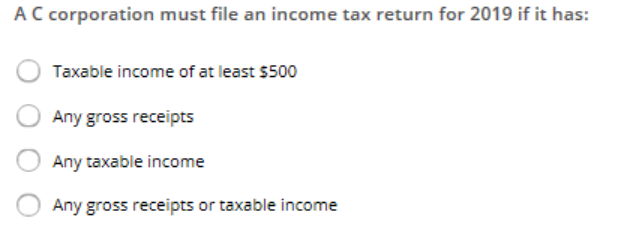

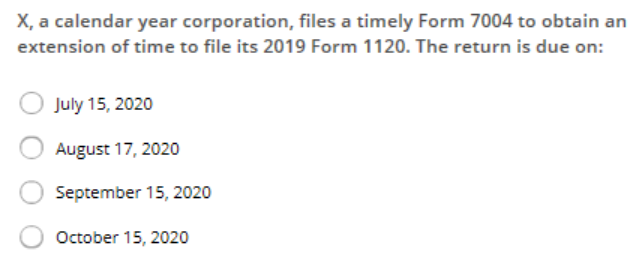

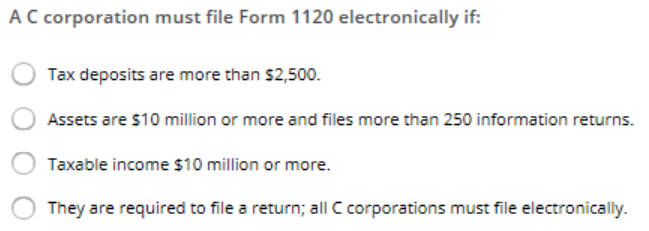

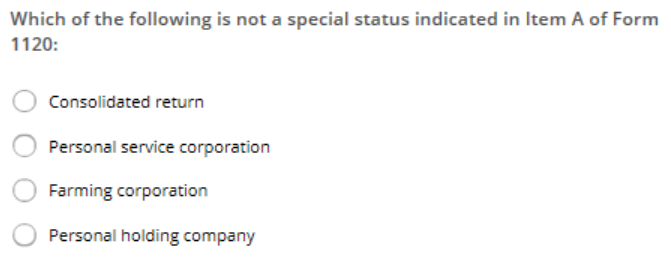

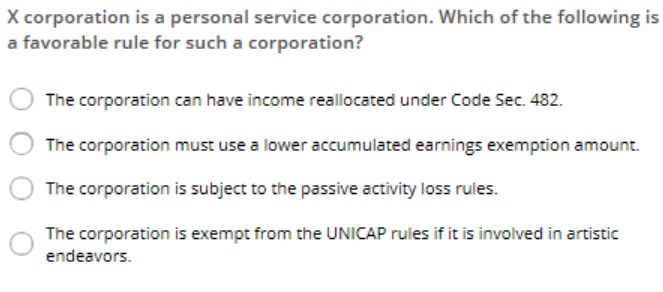

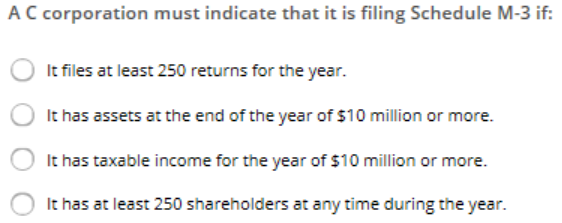

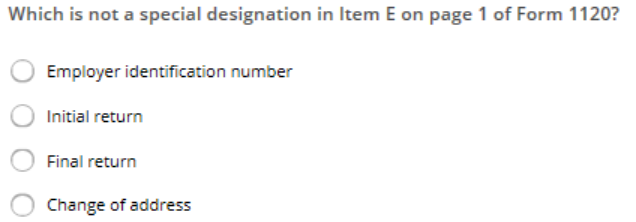

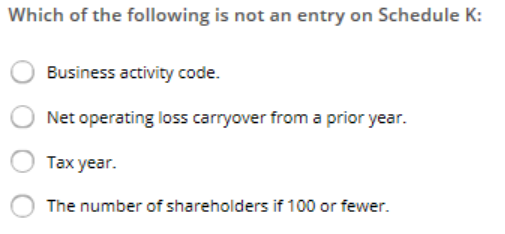

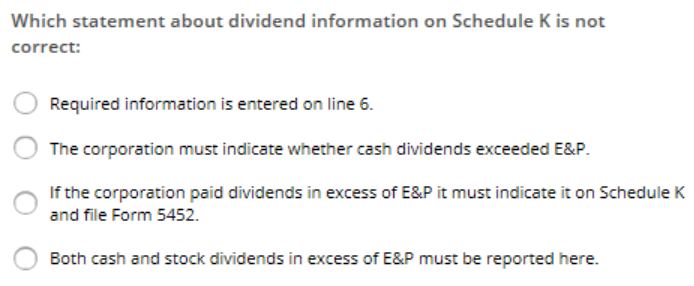

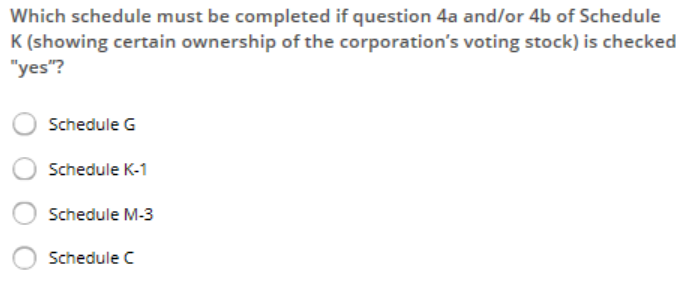

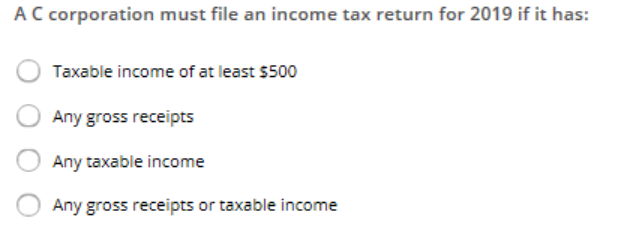

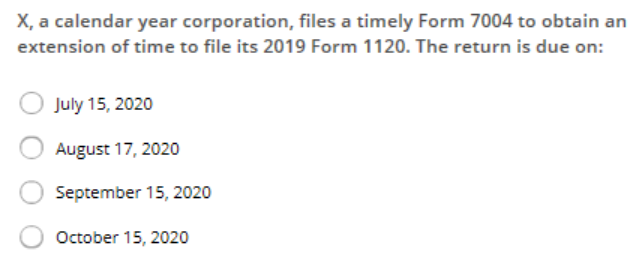

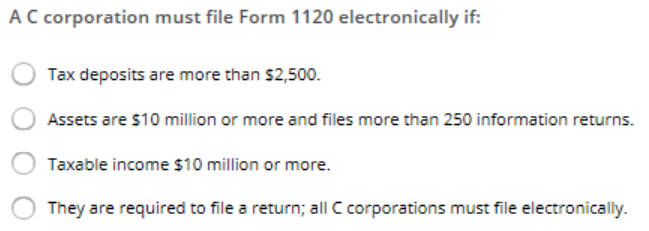

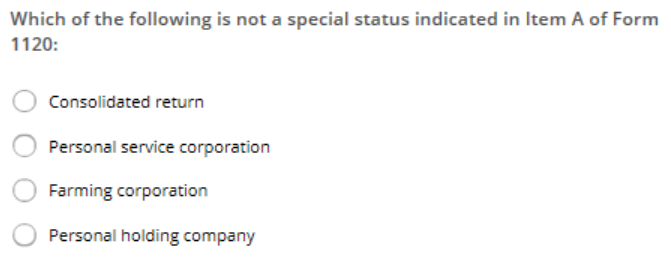

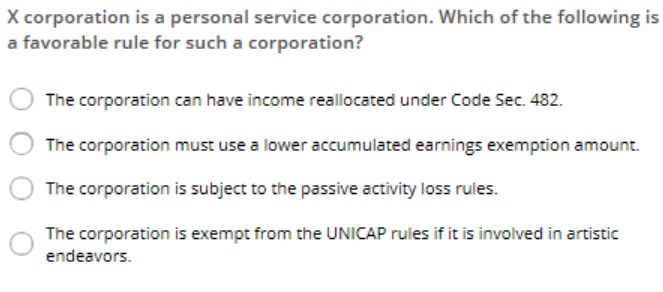

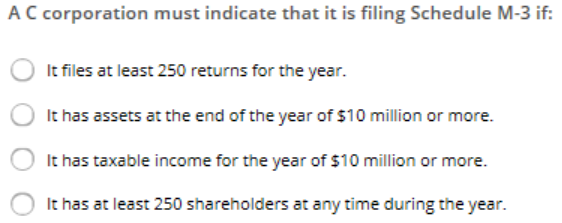

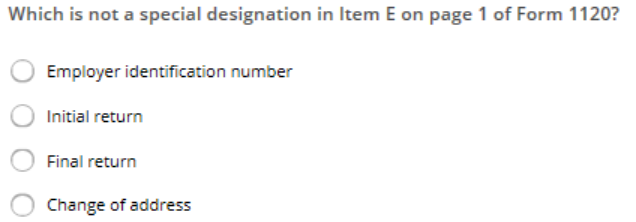

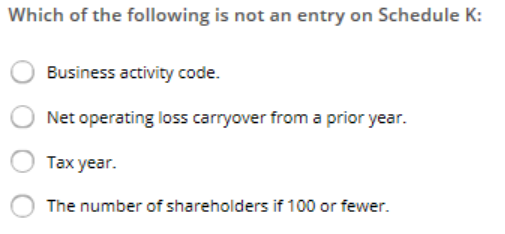

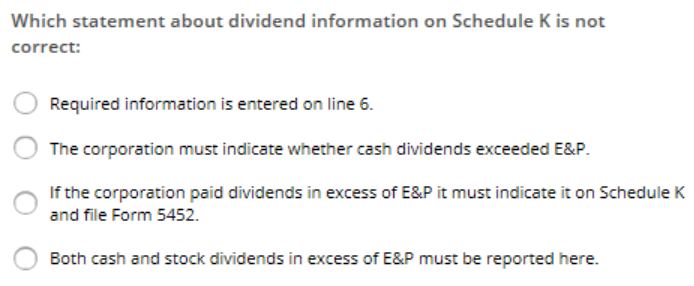

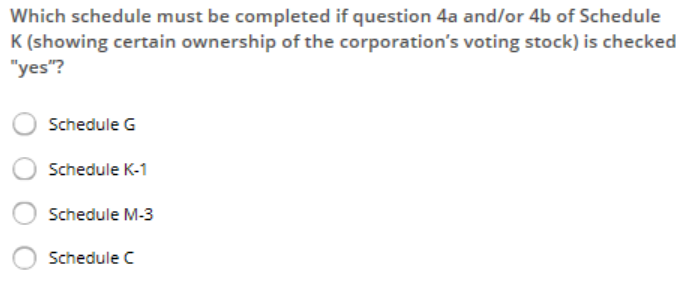

AC corporation must file an income tax return for 2019 if it has: Taxable income of at least 5500 Any gross receipts Any taxable income Any gross receipts or taxable income X, a calendar year corporation, files a timely Form 7004 to obtain an extension of time to file its 2019 Form 1120. The return is due on: July 15, 2020 August 17, 2020 September 15, 2020 October 15, 2020 AC corporation must file Form 1120 electronically if: Tax deposits are more than $2,500. Assets are $10 million or more and files more than 250 information returns. Taxable income $10 million or more. They are required to file a return; all C corporations must file electronically. Which of the following is not a special status indicated in Item A of Form 1120: Consolidated return Personal service corporation Farming corporation Personal holding company X corporation is a personal service corporation. Which of the following is a favorable rule for such a corporation? The corporation can have income reallocated under Code Sec. 482. The corporation must use a lower accumulated earnings exemption amount. The corporation is subject to the passive activity loss rules. The corporation is exempt from the UNICAP rules if it is involved in artistic endeavors. AC corporation must indicate that it is filing Schedule M-3 if: It files at least 250 returns for the year. It has assets at the end of the year of $10 million or more. It has taxable income for the year of $10 million or more. It has at least 250 shareholders at any time during the year. Which is not a special designation in Item E on page 1 of Form 1120? Employer identification number Initial return Final return Change of address Which of the following is not an entry on Schedule K: Business activity code. Net operating loss carryover from a prior year. Tax year. The number of shareholders if 100 or fewer. Which statement about dividend information on Schedule K is not correct: Required information is entered on line 6. The corporation must indicate whether cash dividends exceeded E&P. If the corporation paid dividends in excess of E&P it must indicate it on Schedule K and file Form 5452 Both cash and stock dividends in excess of E&P must be reported here. Which schedule must be completed if question 4a and/or 4b of Schedule K(showing certain ownership of the corporation's voting stock) is checked "yes"? Schedule G Schedule K-1 Schedule M-3 Schedule