Question

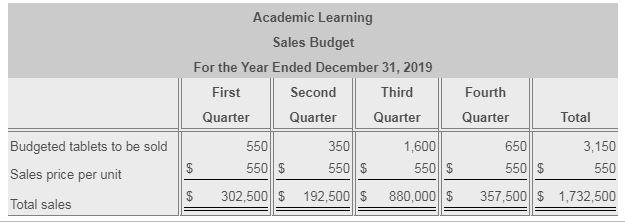

Academic Learning had prepared the following sales budget, schedule of budgeted cash receipts, and cash budget for 2019: Academic Learning Sales Budget For the Year

Academic Learning had prepared the following sales budget, schedule of budgeted cash receipts, and cash budget for 2019:

Academic Learning | |||||

Sales Budget | |||||

For the Year Ended December 31, 2019 | |||||

First | Second | Third | Fourth | ||

Quarter | Quarter | Quarter | Quarter | Total | |

Budgeted tablets to be sold | 550 | 350 | 1,600 | 500 | 3,000 |

Sales price per unit | $550 | $550 | $550 | $550 | $550 |

Total sales | $302,500 | $192,500 | $880,000 | $275,000 | $1,650,000 |

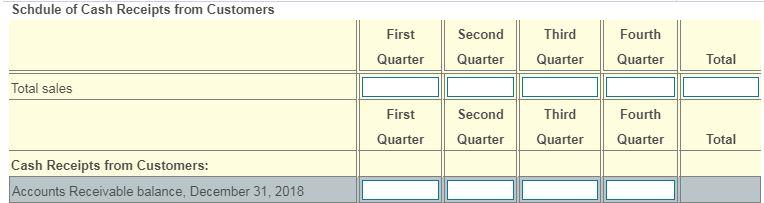

Schdule of Cash Receipts from Customers | ||||||

First | Second | Third | Fourth | |||

Quarter | Quarter | Quarter | Quarter | Total | ||

Total sales | $302,500 | $192,500 | $880,000 | $275,000 | $1,650,000 | |

First | Second | Third | Fourth | |||

Quarter | Quarter | Quarter | Quarter | Total | ||

Cash Receipts from Customers: | ||||||

Accounts Receivable balance, December 31, 2018 | $22,000 | |||||

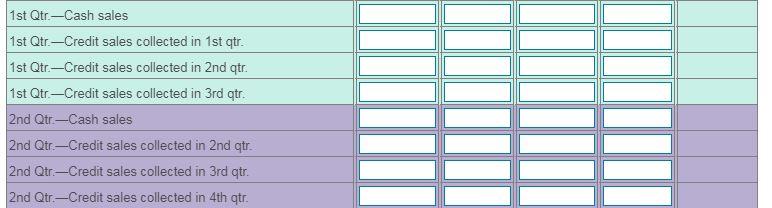

1st Qtr.—Cash sales (20%) | 60,500 | |||||

1st Qtr.—Credit sales (80%), 40% collected in 1st qtr. | 96,800 | |||||

1st Qtr.—Credit sales (80%), 60% collected in 2nd qtr. | $145,200 | |||||

2nd Qtr.—Cash sales (20%) | 38,500 | |||||

2nd Qtr.—Credit sales (80%), 40% collected in 2nd qtr. | 61,600 | |||||

2nd Qtr.—Credit sales (80%), 60% collected in 3rd qtr. | $92,400 | |||||

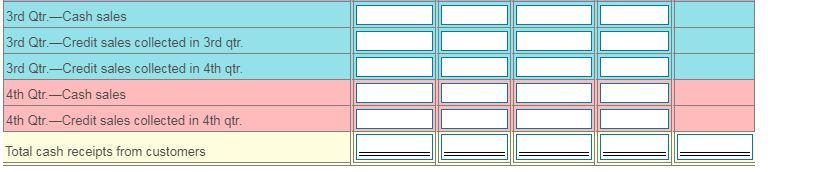

3rd Qtr.—Cash sales (20%) | 176,000 | |||||

3rd Qtr.—Credit sales (80%), 40% collected in 3rd qtr. | 281,600 | |||||

3rd Qtr.—Credit sales (80%), 60% collected in 4th qtr. | $422,400 | |||||

4th Qtr.—Cash sales (20%) | 55,000 | |||||

4th Qtr.—Credit sales (80%), 40% collected in 4th qtr. | 88,000 | |||||

Total cash receipts from customers | $179,300 | $245,300 | $550,000 | $565,400 | $1,540,000 | |

Accounts Receivable balance, December 31, 2019: | ||||||

4th Qtr.—Credit sales (80%), 60% collected in 1st qtr of 2020 | $132,000 | |||||

Academic Learning | ||||||

Cash Budget | ||||||

For the Year Ended December 31, 2019 | ||||||

First | Second | Third | Fourth | |||

Quarter | Quarter | Quarter | Quarter | Total | ||

Beginning cash balance | $38,000 | $35,575 | $35,680 | $35,525 | $38,000 | |

Cash receipts | 179,300 | 245,300 | 550,000 | 565,400 | 1,540,000 | |

Cash available | 217,300 | 280,875 | 585,680 | 600,925 | 1,578,000 | |

Cash payments: | ||||||

Capital expenditures | 40,000 | 40,000 | 40,000 | 40,000 | 160,000 | |

Purchases of direct materials | 33,280 | 146,880 | 172,440 | 139,320 | 491,920 | |

Direct labor | 14,080 | 38,400 | 88,320 | 33,280 | 174,080 | |

Manufacturing overhead | 97,640 | 100,300 | 105,760 | 99,740 | 403,440 | |

Selling and administrative expenses | 59,725 | 58,625 | 65,500 | 59,450 | 243,300 | |

Income taxes | 3,000 | 3,000 | 3,000 | 3,000 | 12,000 | |

Interest expense | 0 | 990 | 3,135 | 2,055 | 6,180 | |

Total cash payments | 247,725 | 388,195 | 478,155 | 376,845 | 1,490,920 | |

Ending cash balance before financing | (30,425) | (107,320) | 107,525 | 224,080 | 87,080 | |

Minimum cash balance desired | (35,000) | (35,000) | (35,000) | (35,000) | (35,000) | |

Projected cash excess (deciency) | (65,425) | (142,320) | 72,525 | 189,080 | 52,080 | |

Financing: | ||||||

Borrowing | 66,000 | 143,000 | 0 | 0 | 209,000 | |

Principal repayments | 0 | 0 | (72,000) | (137,000) | (209,000) | |

Total effects of financing | 66,000 | 143,000 | (72,000) | (137,000) | 0 | |

Ending cash balance | $35,575 | $35,680 | $35,525 | $87,080 | 87,080 | |

Academic Learning decided to revise its sales budget to show fourth quarter sales of 650 tablets due to the expectation of increased holiday sales.

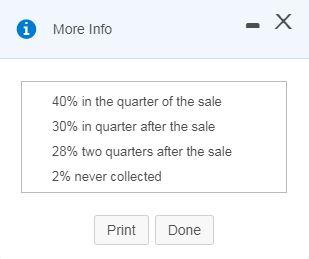

Suppose a change in the receipt of cash from sales on account is as follows:

Requirement 1. Revise the schedule of budgeted cash receipts to include the increase in fourth quarter sales and the change in the timing of customer receipts. (If a box is not used in the table, leave the box empty; do not enter a zero. Round your answers to the nearest dollar.)

Requirement 2. How will the changes in cash receipts affect the cash budget?

Academic Learning Sales Budget For the Year Ended December 31, 2019 First Second Third Fourth Quarter Quarter Quarter Quarter Total 650 550 550 S 1,600 550 S Budgeted tablets to be sold 350 3,150 Sales price per unit $ 550 S 550 S 550 302,500 S 192,500 S 880,000 S 357,500 $ 1,732,500 Total sales

Step by Step Solution

3.22 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Sales Budget First Second Third Fourth Quarter Quarter Quarter Quarter Budgeted tablets to be sold 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started