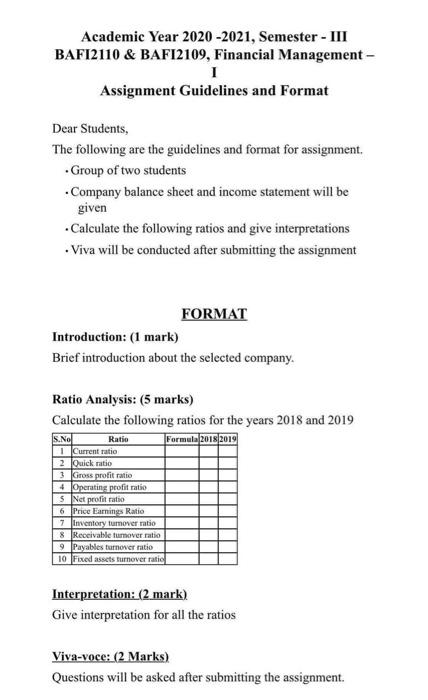

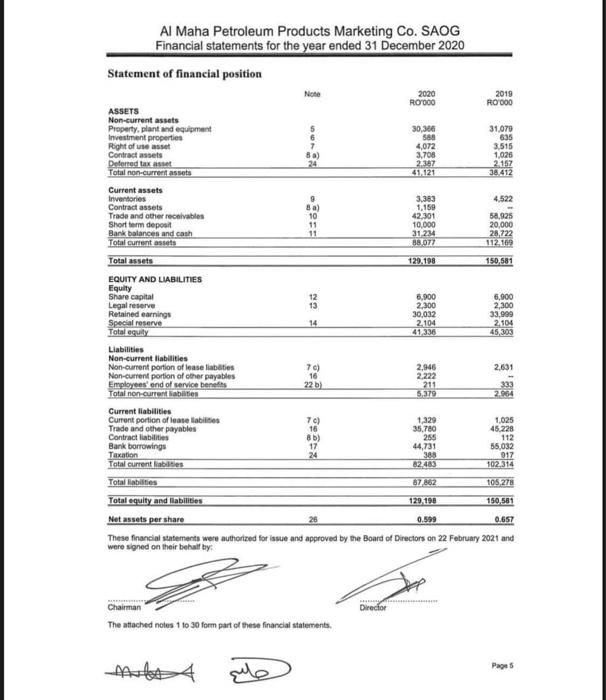

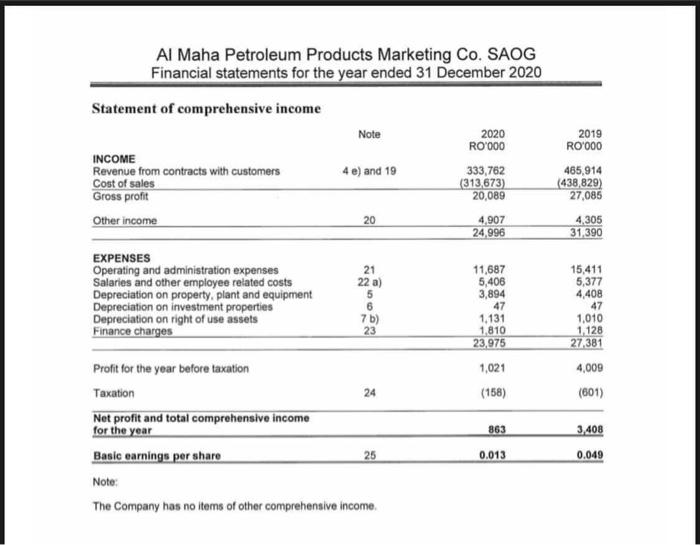

Academic Year 2020-2021, Semester - III BAFI2110 & BAFI2109, Financial Management - I Assignment Guidelines and Format Dear Students, The following are the guidelines and format for assignment. Group of two students Company balance sheet and income statement will be given Calculate the following ratios and give interpretations Viva will be conducted after submitting the assignment FORMAT Introduction: (1 mark) Brief introduction about the selected company. Ratio Analysis: (5 marks) Calculate the following ratios for the years 2018 and 2019 S.NO Ratio Formula 2018 2019 1 Current ratio 2 Quick ratio 3 Gross profit ratio 4 Operating profit ratio 5 Net profit ratio 6 Price Earnings Ratio 7 Inventory turnover ratio & Receivable turnover ratio 9 Payables turnover ratio 10 Fixed assets turnover ratio Interpretation: (2 mark) Give interpretation for all the ratios Viva-voce: (2 Marks) Questions will be asked after submitting the assignment. 2019 R t0 Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2020 Statement of financial position Note 2020 ROY000 ASSETS Non-current assets Property, plant and equipment 30,300 Investment properties 580 Right of use asset 7 4,072 Contract assets 8a) 3.700 Deferred tax asset 2397 Total non-current Assets 41.121 Current assets Inventories 9 3.383 Contract assets 8 a) 1,159 Trade and other receivables 10 42301 Short term deposit 11 10,000 Bank balances and cash 11 31 234 Total current 88077 Total assets 129,198 ON 31.079 635 3.515 1,020 2157 38.412 4.522 sa 925 20,000 28,722 112169 150,581 EQUITY AND LIABILITIES Equity Share capital 12 6.900 6,000 Legal reserve 13 2.300 2,300 Retained earnings 30,032 33,999 Special reserve 14 2,104 2104 Total equity 41.336 Liabilities Non-current liabilities Non-current portion of lease fiabilities 70) 2.946 2.631 Non-current portion of other payables 16 2.222 Employees end of service benefits 22) 211 Total non-current liabilities 5.379 2004 Current liabilities Current portion of lease liable 70) 1,329 1.025 Trade and other payables 16 35,780 45.228 Contract liabilities 8b) 254 112 Bank borrowings 17 44,731 56,032 Taxation 24 388 917 Total current liabilities 62.483 102.314 Total abilities 67.882 105 278 Total equity and liabilities 129,120 150,581 Net assets per share 0.599 0.657 These financial statements were authorized for issue and approved by the Board of Directors on 22 February 2021 and were signed on their behalf by Chairman Director The attached notes 1 to 30 form part of these financial statements. Page 5 que Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2020 Statement of comprehensive income Note 4 e) and 19 INCOME Revenue from contracts with customers Cost of sales Gross profit Other income 2020 RO'000 333,762 (313,673) 20,089 2019 Roo0o 465,914 (438,829) 27,085 20 4,907 24,996 4,305 31,390 EXPENSES Operating and administration expenses Salaries and other employee related costs Depreciation on property, plant and equipment Depreciation on investment properties Depreciation on right of use assets Finance charges 21 22 a) 5 6 7 b) 23 11,687 5,406 3,894 1.131 1,810 23,975 47 15,411 5,377 4,408 47 1,010 1.128 27,381 4,009 1,021 24 (158) (601) 863 Profit for the year before taxation Taxation Net profit and total comprehensive income for the year Basic earnings per share 25 Note: The Company has no items of other comprehensive income 3,408 0.049 0.013 Academic Year 2020-2021, Semester - III BAFI2110 & BAFI2109, Financial Management - I Assignment Guidelines and Format Dear Students, The following are the guidelines and format for assignment. Group of two students Company balance sheet and income statement will be given Calculate the following ratios and give interpretations Viva will be conducted after submitting the assignment FORMAT Introduction: (1 mark) Brief introduction about the selected company. Ratio Analysis: (5 marks) Calculate the following ratios for the years 2018 and 2019 S.NO Ratio Formula 2018 2019 1 Current ratio 2 Quick ratio 3 Gross profit ratio 4 Operating profit ratio 5 Net profit ratio 6 Price Earnings Ratio 7 Inventory turnover ratio & Receivable turnover ratio 9 Payables turnover ratio 10 Fixed assets turnover ratio Interpretation: (2 mark) Give interpretation for all the ratios Viva-voce: (2 Marks) Questions will be asked after submitting the assignment. 2019 R t0 Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2020 Statement of financial position Note 2020 ROY000 ASSETS Non-current assets Property, plant and equipment 30,300 Investment properties 580 Right of use asset 7 4,072 Contract assets 8a) 3.700 Deferred tax asset 2397 Total non-current Assets 41.121 Current assets Inventories 9 3.383 Contract assets 8 a) 1,159 Trade and other receivables 10 42301 Short term deposit 11 10,000 Bank balances and cash 11 31 234 Total current 88077 Total assets 129,198 ON 31.079 635 3.515 1,020 2157 38.412 4.522 sa 925 20,000 28,722 112169 150,581 EQUITY AND LIABILITIES Equity Share capital 12 6.900 6,000 Legal reserve 13 2.300 2,300 Retained earnings 30,032 33,999 Special reserve 14 2,104 2104 Total equity 41.336 Liabilities Non-current liabilities Non-current portion of lease fiabilities 70) 2.946 2.631 Non-current portion of other payables 16 2.222 Employees end of service benefits 22) 211 Total non-current liabilities 5.379 2004 Current liabilities Current portion of lease liable 70) 1,329 1.025 Trade and other payables 16 35,780 45.228 Contract liabilities 8b) 254 112 Bank borrowings 17 44,731 56,032 Taxation 24 388 917 Total current liabilities 62.483 102.314 Total abilities 67.882 105 278 Total equity and liabilities 129,120 150,581 Net assets per share 0.599 0.657 These financial statements were authorized for issue and approved by the Board of Directors on 22 February 2021 and were signed on their behalf by Chairman Director The attached notes 1 to 30 form part of these financial statements. Page 5 que Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2020 Statement of comprehensive income Note 4 e) and 19 INCOME Revenue from contracts with customers Cost of sales Gross profit Other income 2020 RO'000 333,762 (313,673) 20,089 2019 Roo0o 465,914 (438,829) 27,085 20 4,907 24,996 4,305 31,390 EXPENSES Operating and administration expenses Salaries and other employee related costs Depreciation on property, plant and equipment Depreciation on investment properties Depreciation on right of use assets Finance charges 21 22 a) 5 6 7 b) 23 11,687 5,406 3,894 1.131 1,810 23,975 47 15,411 5,377 4,408 47 1,010 1.128 27,381 4,009 1,021 24 (158) (601) 863 Profit for the year before taxation Taxation Net profit and total comprehensive income for the year Basic earnings per share 25 Note: The Company has no items of other comprehensive income 3,408 0.049 0.013