Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a,Calculate these ratio: Formula Calculation Result Ratio Current Current Asset/Current Liabilities Quick Cash NWC to Total Assets Interval Total Debt Euity Multiplier Long term Debt

a,Calculate these ratio:

| Formula | Calculation | Result | |

| Ratio | |||

| Current | Current Asset/Current Liabilities | ||

| Quick | |||

| Cash | |||

| NWC to Total Assets | |||

| Interval | |||

| Total Debt | |||

| Euity Multiplier | |||

| Long term Debt | |||

| Times Interest Earned | |||

| Cash coverage | |||

| Inventory Turnover | |||

| Day's Sales in Inventory | |||

| Receivables Turnover | |||

| NWC Turnover | |||

| Fixed Asset Turnover | |||

| Total Asset Turnover | |||

| Gross Profit Margin | |||

| Operating Profit Margin | |||

| Profit Margin | |||

| Return on Total Assets | |||

| Return on Equity | |||

| Price Earnings Ratio | |||

| Price to Cash Flow from Assets | |||

| Earning per share |

b,Using this excel spreadsheet, prepare the common size statement for Slightly-Sloe Computers. (10 marks) (Income Statement and Balance Sheet)

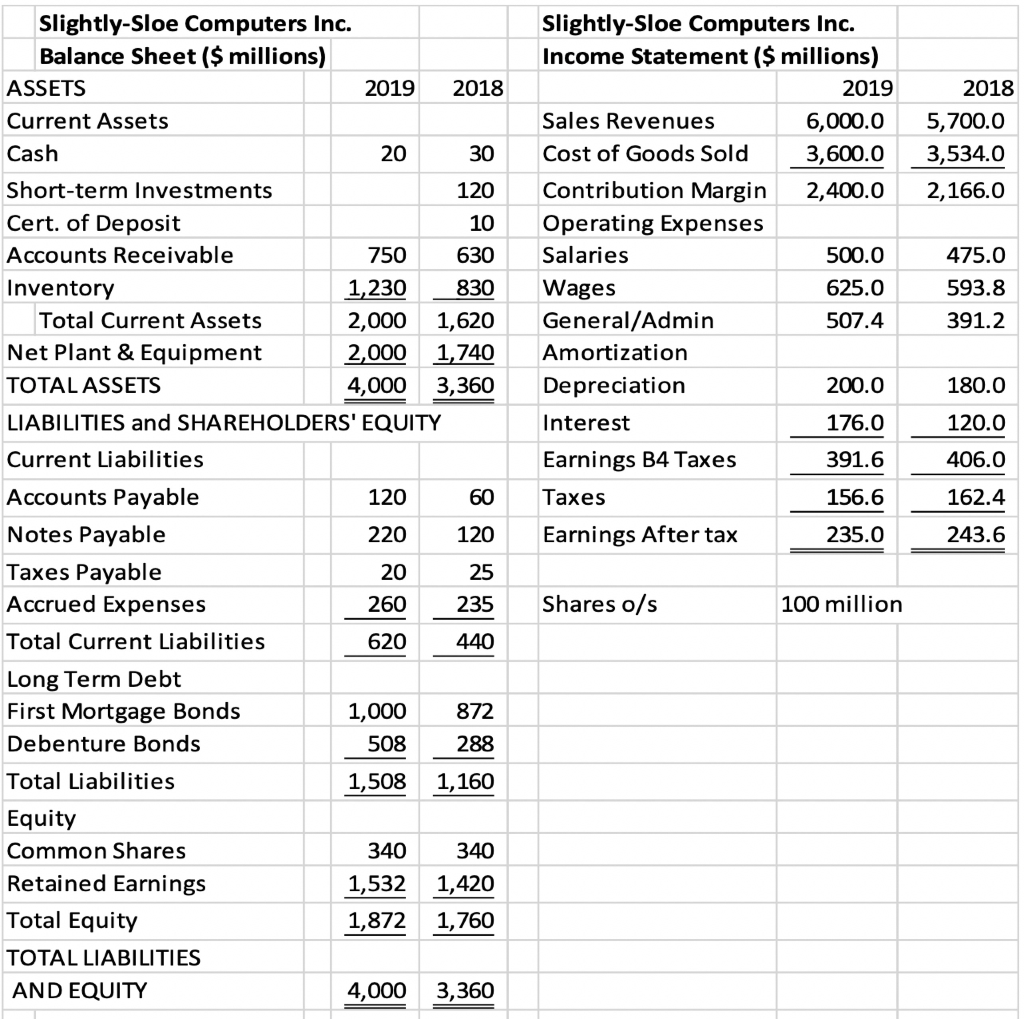

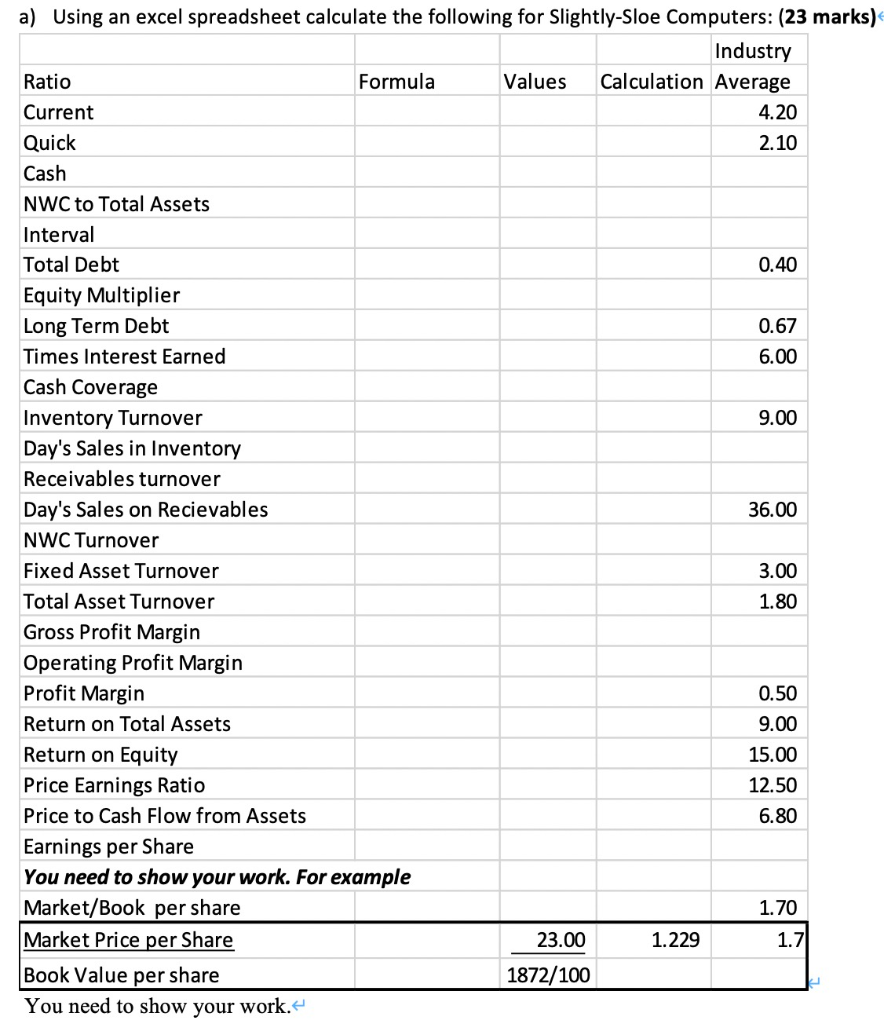

2018 5,700.0 3,534.0 2,166.0 Slightly-Sloe Computers Inc. Income Statement ($ millions) 2019 Sales Revenues 6,000.0 Cost of Goods Sold 3,600.0 Contribution Margin 2,400.0 Operating Expenses Salaries 500.0 Wages 625.0 General/Admin 507.4 Amortization Depreciation 200.0 Interest 176.0 475.0 593.8 391.2 180.0 120.0 391.6 406.0 Earnings B4 Taxes Taxes 156.6 162.4 Slightly-Sloe Computers Inc. Balance Sheet ($ millions) ASSETS 2019 2018 Current Assets Cash 20 30 Short-term Investments 120 Cert. of Deposit 10 Accounts Receivable 750 630 Inventory 1,230 830 Total Current Assets 2,000 1,620 Net Plant & Equipment 2,000 1,740 TOTAL ASSETS 4,000 3,360 LIABILITIES and SHAREHOLDERS' EQUITY Current Liabilities Accounts Payable 120 60 Notes Payable 220 120 Taxes Payable 20 25 Accrued Expenses 260 Total Current Liabilities 620 440 Long Term Debt First Mortgage Bonds 1,000 872 Debenture Bonds 508 288 Total Liabilities 1,508 1,160 Equity Common Shares 340 340 Retained Earnings 1,532 1,420 Total Equity 1,872 1,760 TOTAL LIABILITIES AND EQUITY 4,000 3,360 Earnings After tax 235.0 243.6 235 Shares o/s 100 million a) Using an excel spreadsheet calculate the following for Slightly-Sloe Computers: (23 marks) Industry Ratio Formula Values Calculation Average Current 4.20 Quick 2.10 Cash NWC to Total Assets Interval Total Debt 0.40 Equity Multiplier Long Term Debt 0.67 Times Interest Earned 6.00 Cash Coverage Inventory Turnover 9.00 Day's Sales in Inventory Receivables turnover Day's Sales on Recievables 36.00 NWC Turnover Fixed Asset Turnover 3.00 Total Asset Turnover 1.80 Gross Profit Margin Operating Profit Margin Profit Margin 0.50 Return on Total Assets 9.00 Return on Equity 15.00 Price Earnings Ratio 12.50 Price to Cash Flow from Assets 6.80 Earnings per Share You need to show your work. For example Market/Book per share 1.70 Market Price per Share 23.00 1.229 1.7 Book Value per share 1872/100 You need to show your workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started