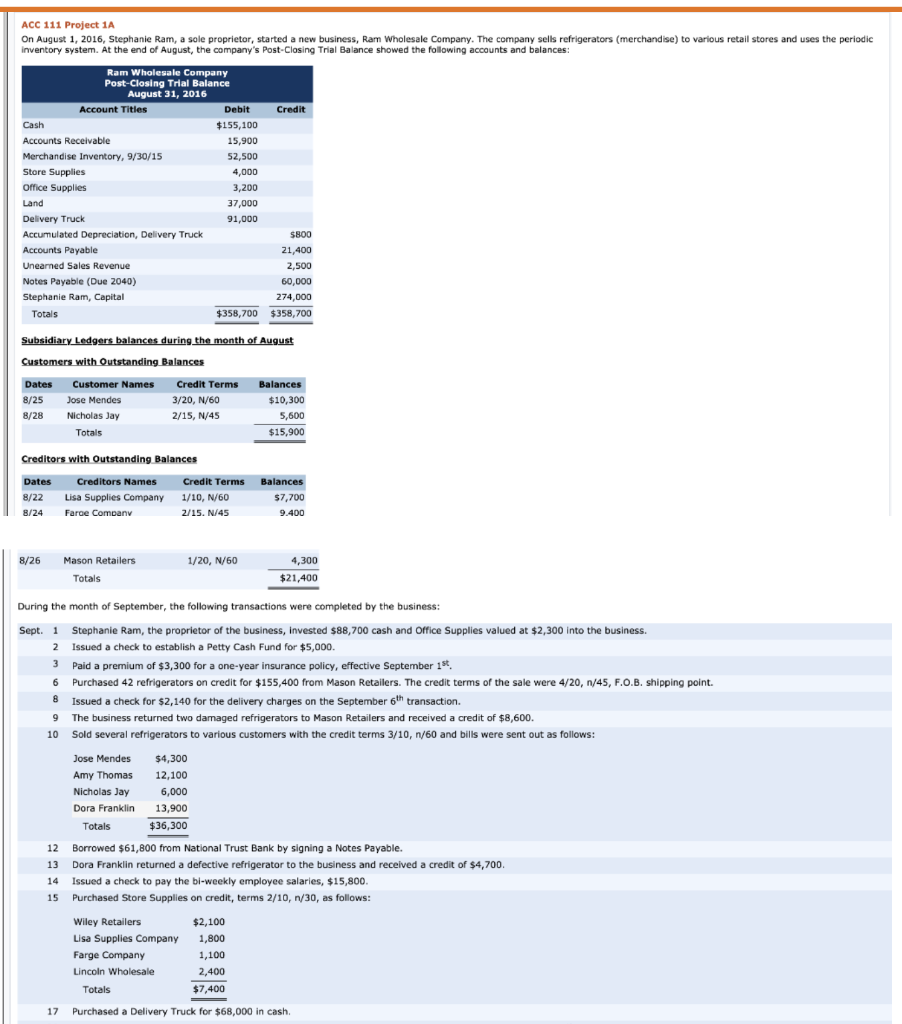

Question: ACC 111 Project 1A On August 1, 2016, Stephanie Ram, a sole proprietor, started a new business, Ram Wholesale Company. The company sells refrigerators (merchandise)

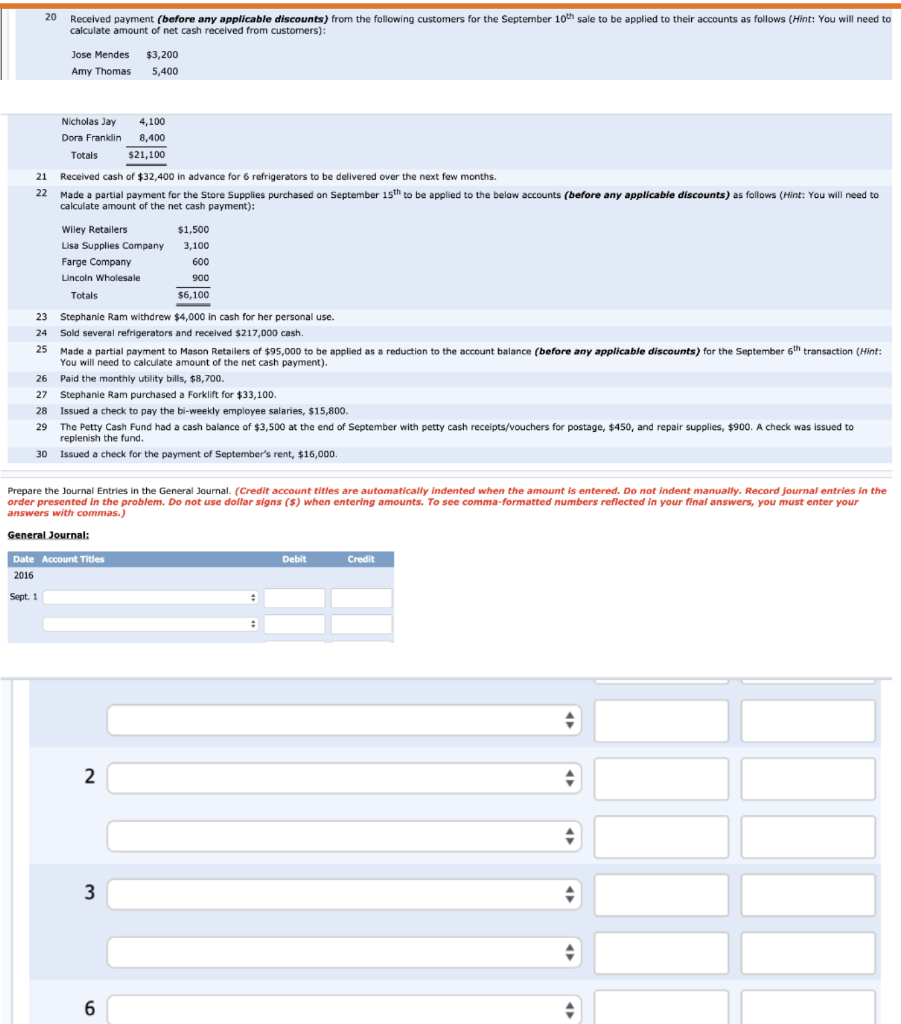

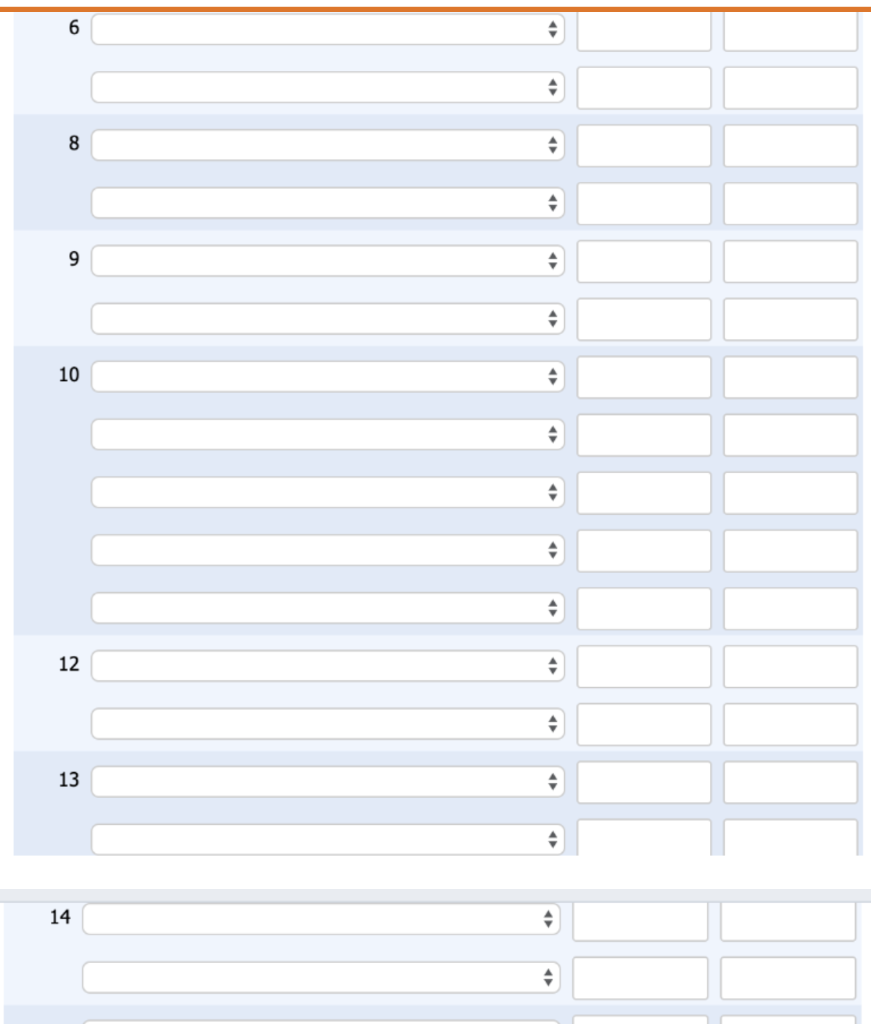

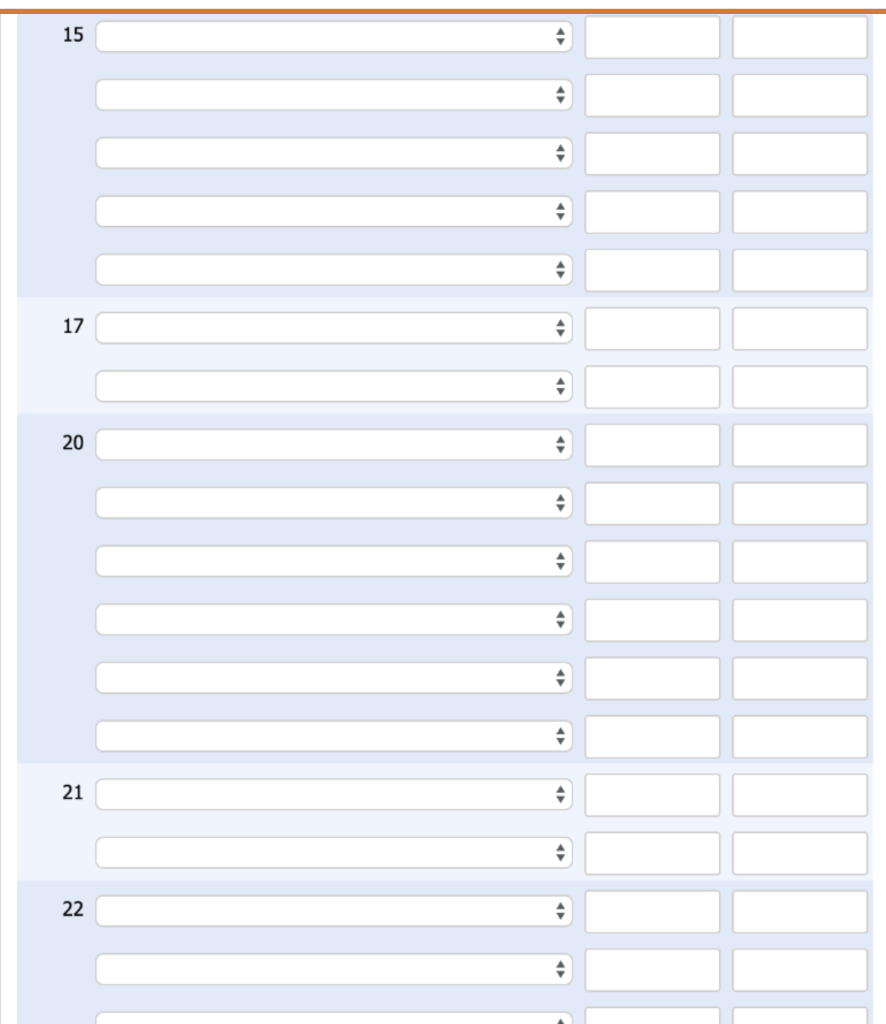

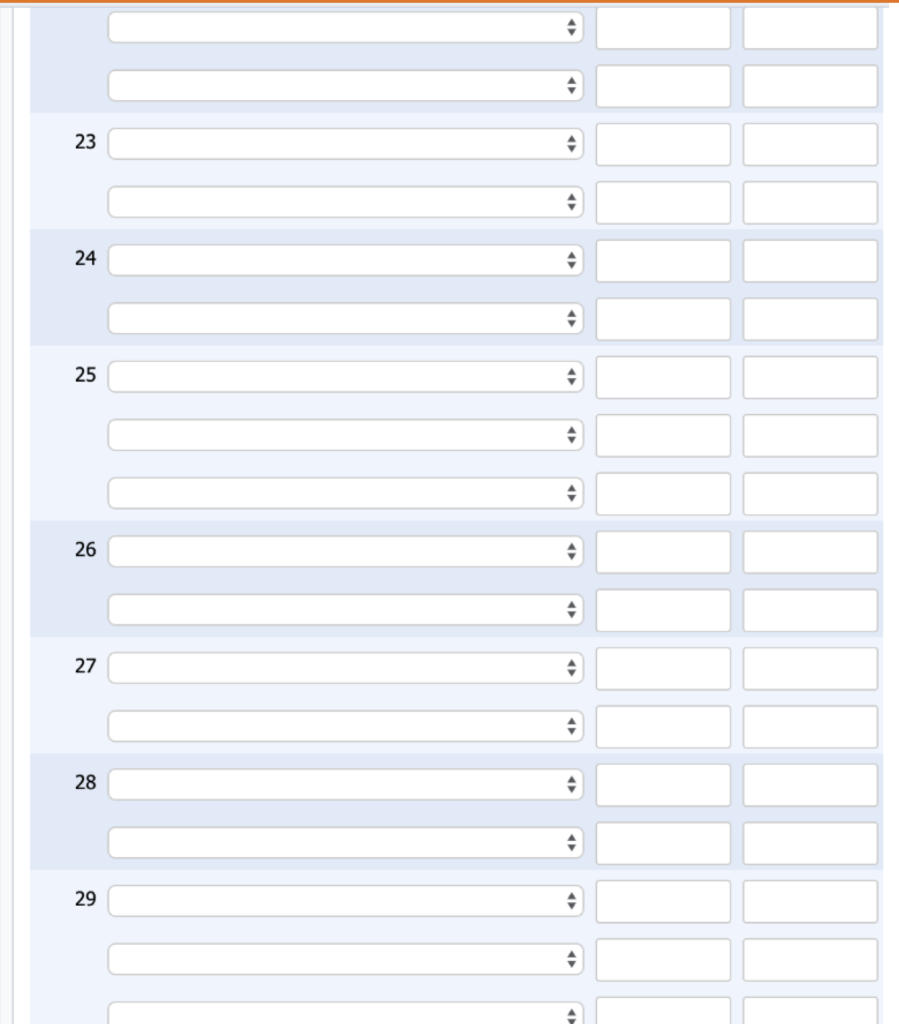

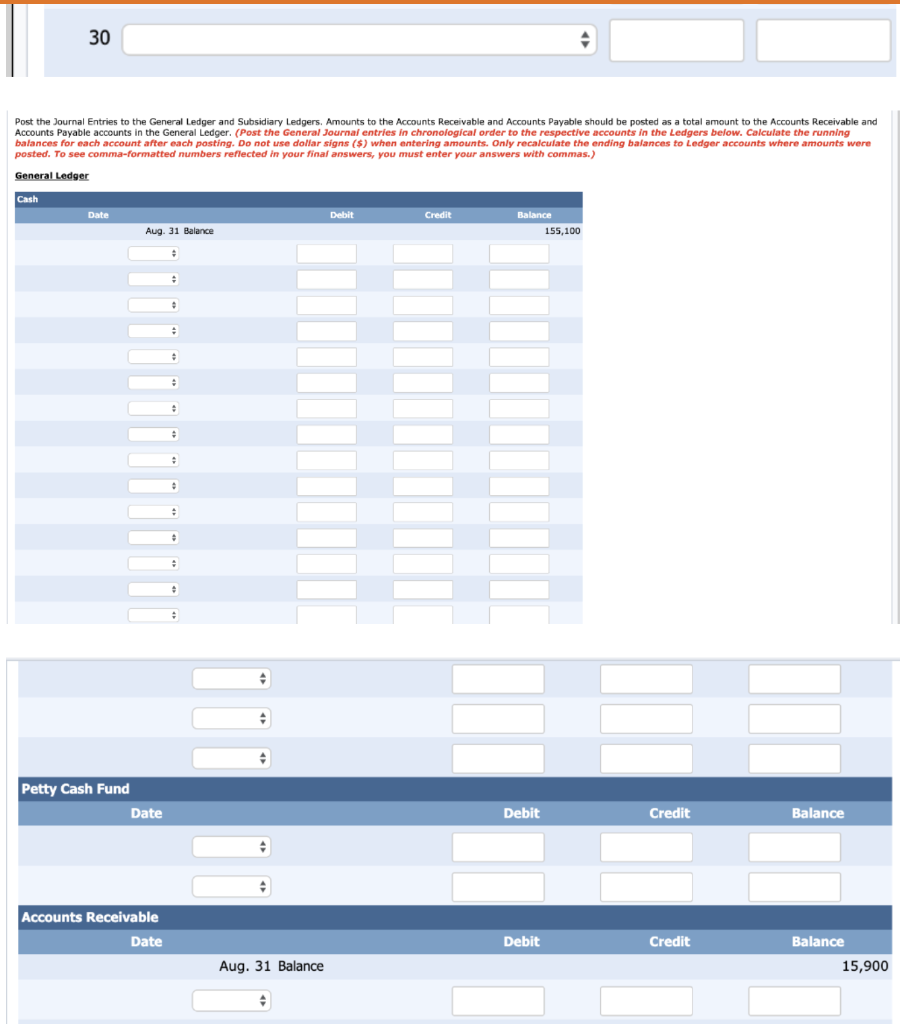

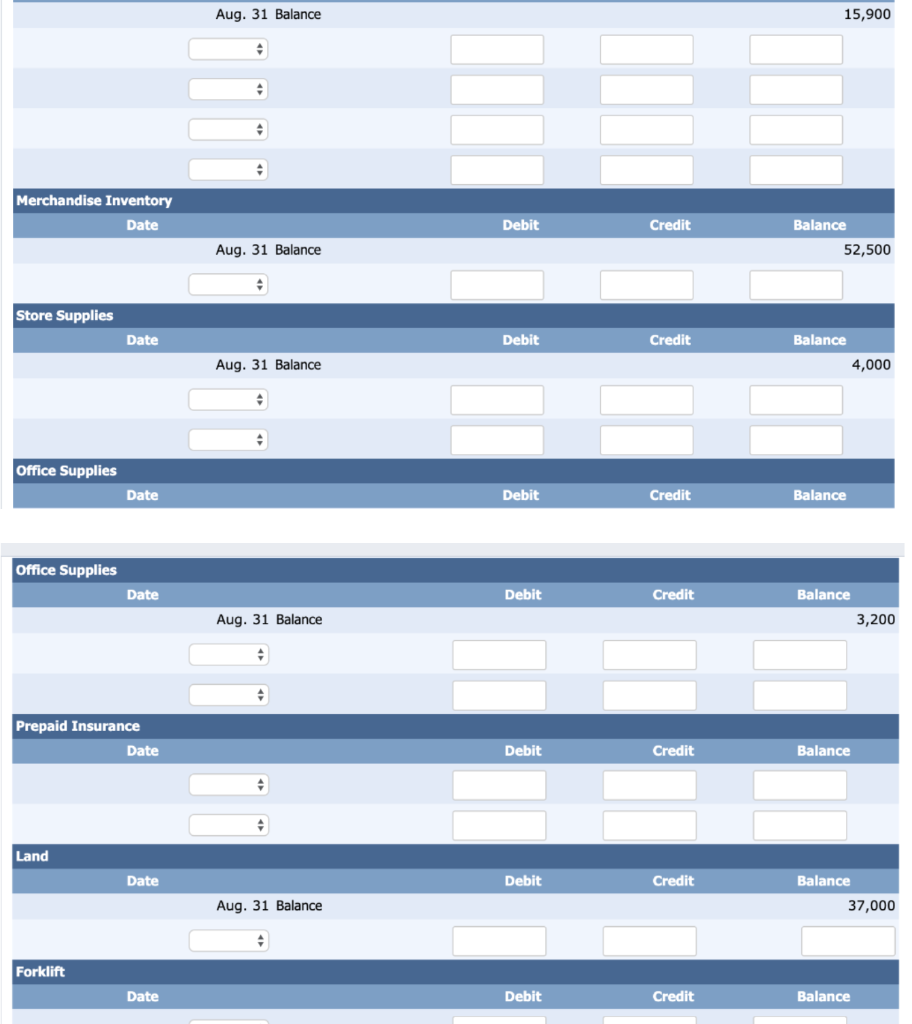

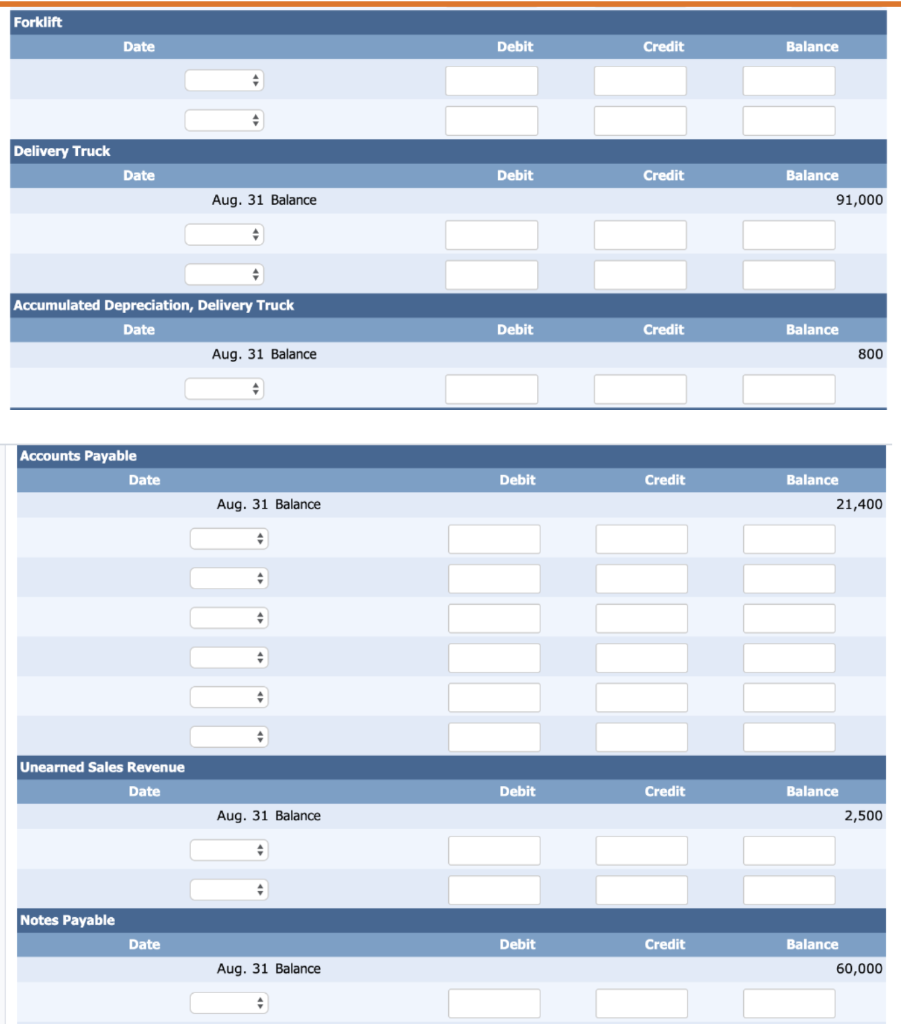

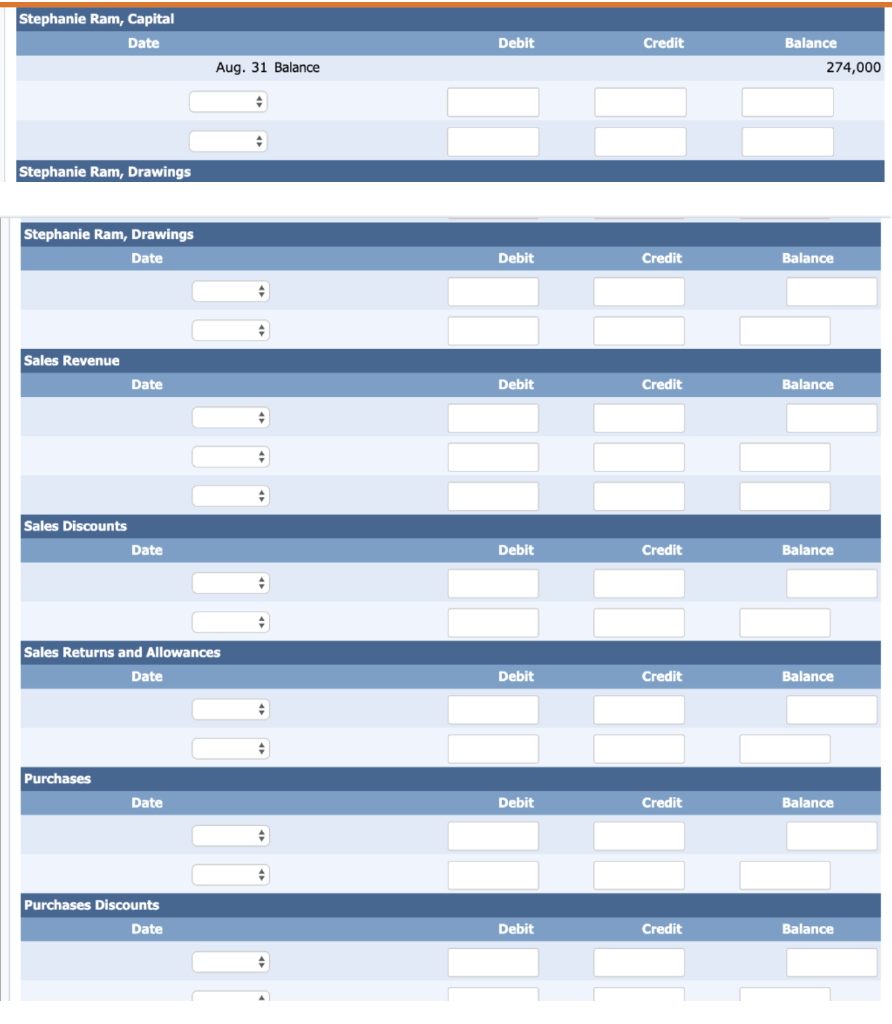

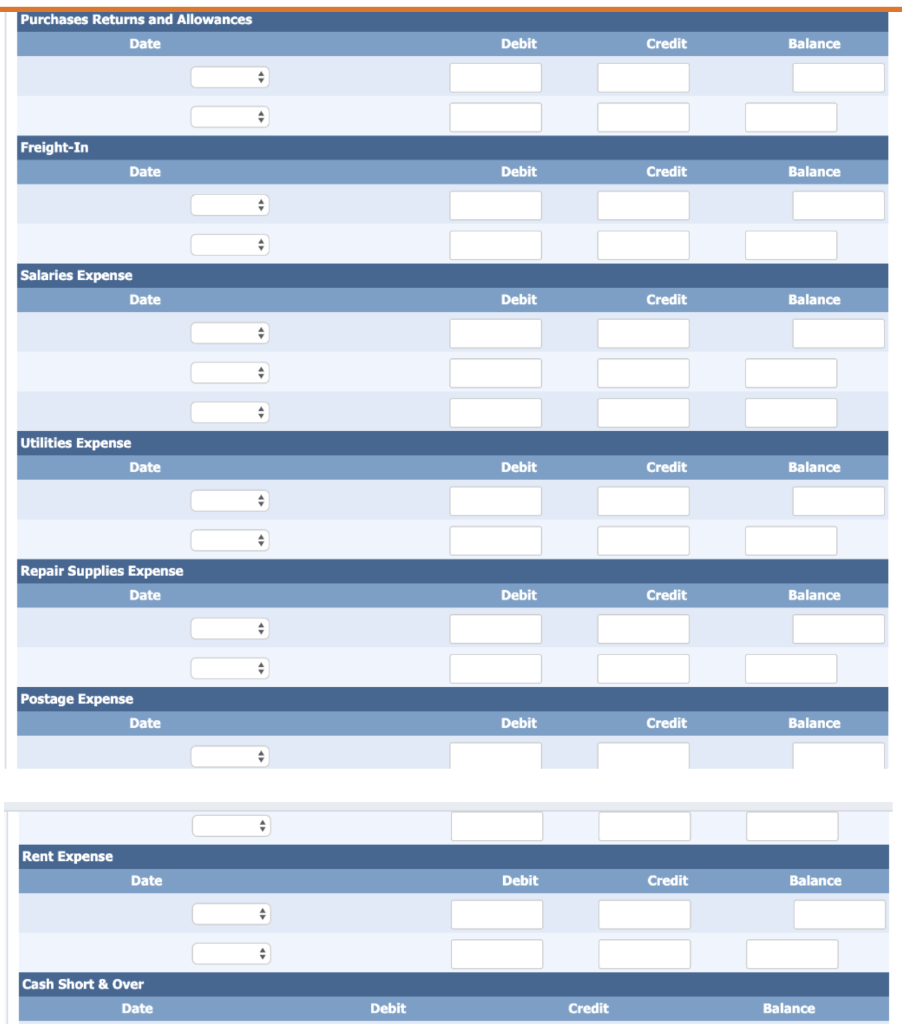

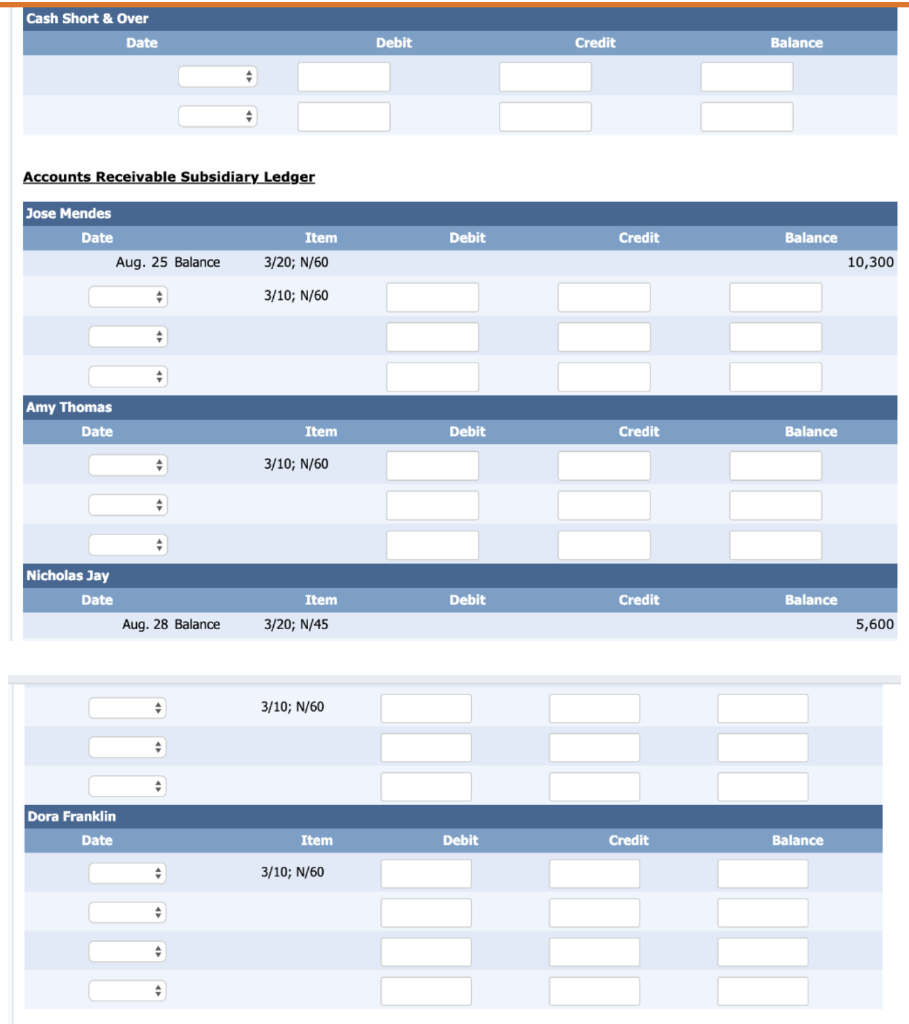

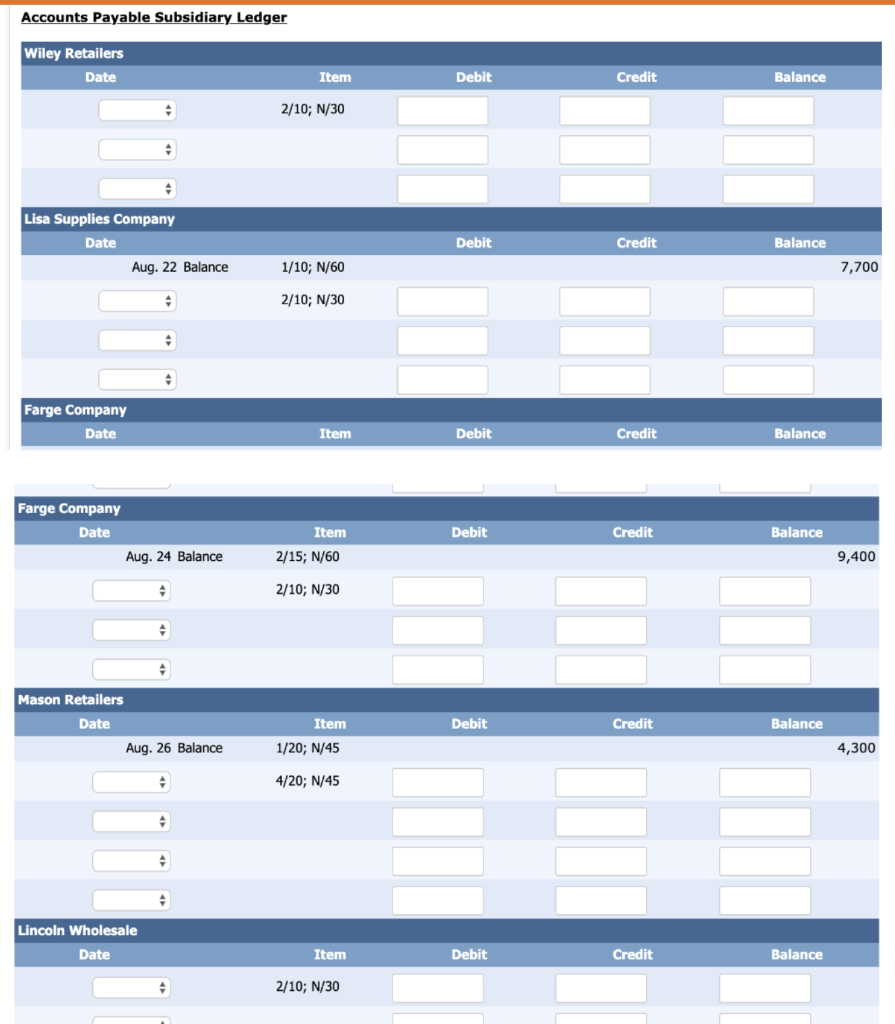

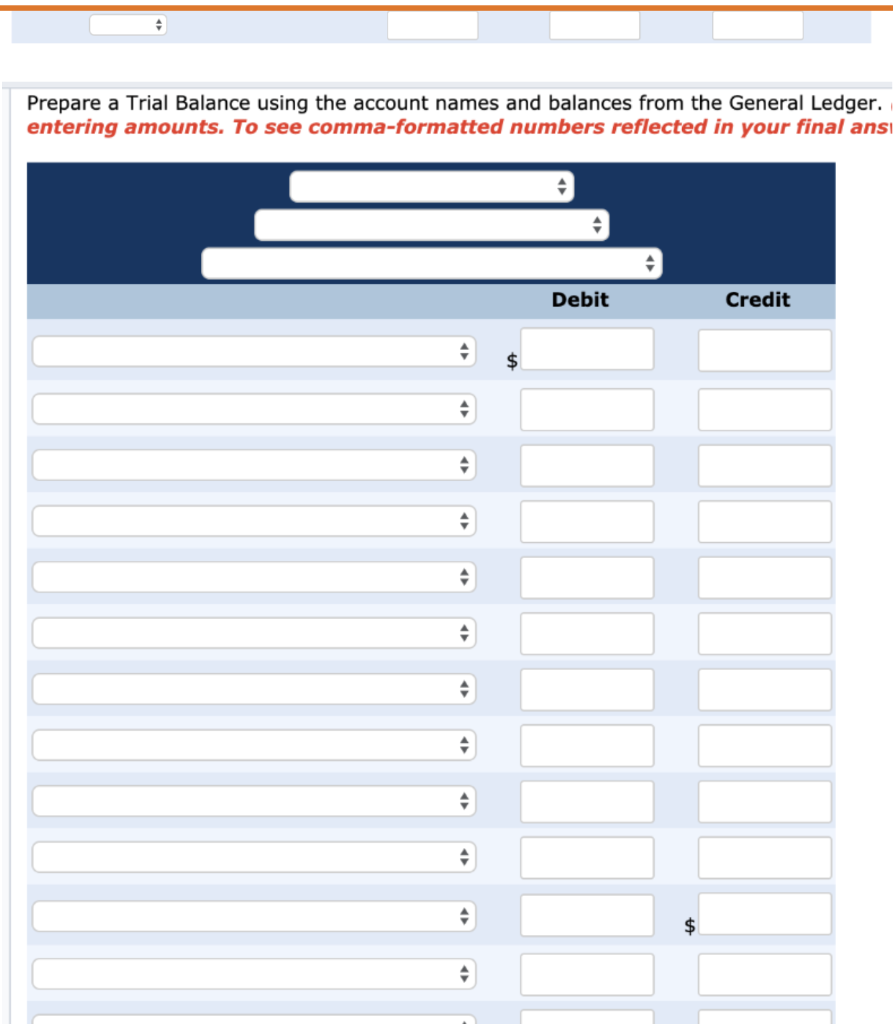

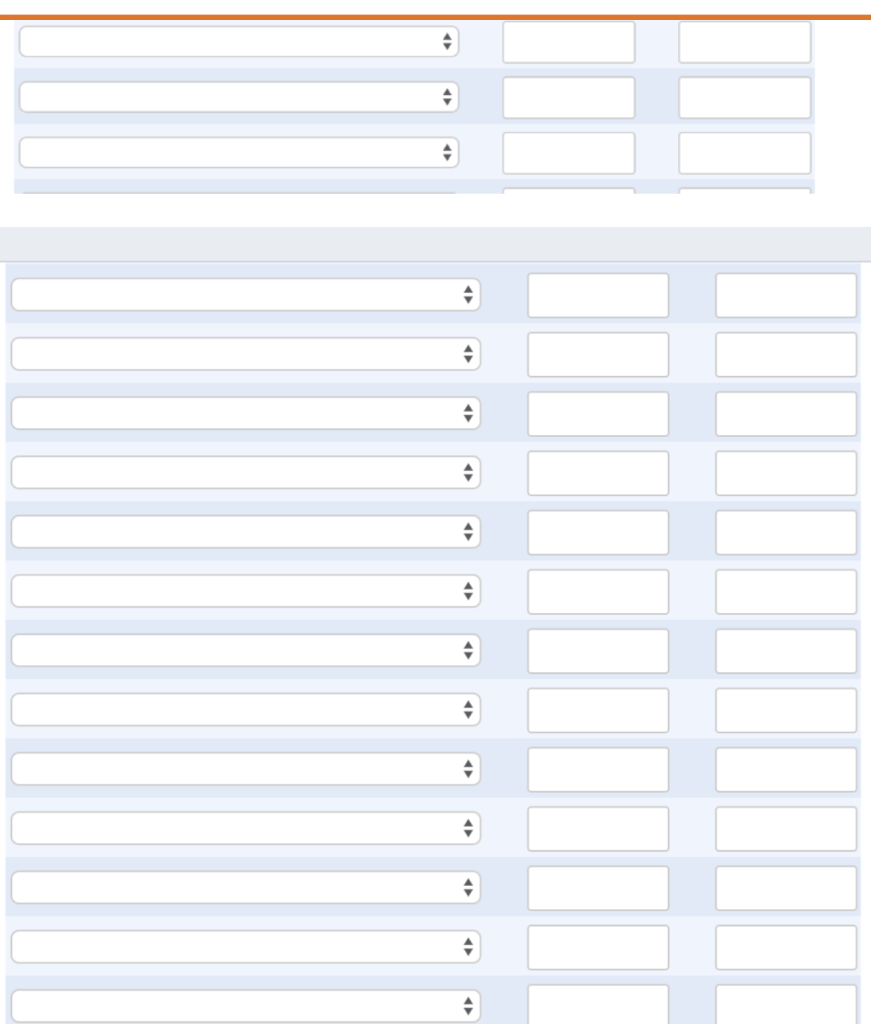

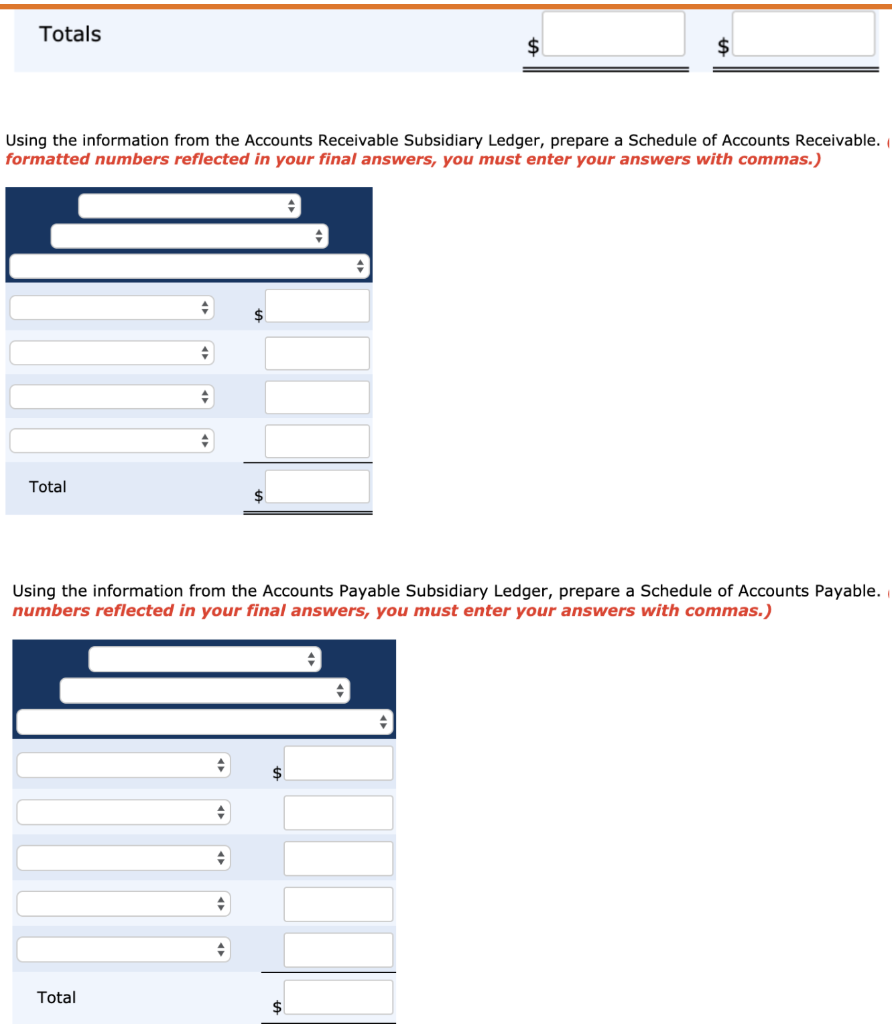

ACC 111 Project 1A On August 1, 2016, Stephanie Ram, a sole proprietor, started a new business, Ram Wholesale Company. The company sells refrigerators (merchandise) to various retail stores and uses the periodic inventory system. At the end of August, the company's Post-Closing Trial Balance showed the following accounts and balances: Credit Ram Wholesale Company Post-Closing Tral Balance August 31, 2016 Account Titles Debit Cash $155,100 Accounts Receivable 15,900 Merchandise Inventory, 9/30/15 52,500 Store Supplies 4,000 Office Supplies 3,200 Land 37,000 Delivery Truck 91,000 Accumulated Depreciation, Delivery Truck Accounts Payable Unearned Sales Revenue Notes Payable (Due 2040) Stephanie Ram, Capital Totals $358,700 5800 21,400 2,500 60,000 274,000 $358,700 Subsidiary Ledgers balances during the month of August Customers with Outstanding Balances Dates 8/25 8/28 Customer NamesCredit Terms Jose Mendes 3/20, N/60 Nicholas Jay 2/15, N/45 Totals Balances $10,300 5,600 $15,900 Creditors with Outstanding Balances Dates 8/22 8/24 Creditors Names Lisa Supplies Company Farge Company Credit Terms 1/10, N/60 2/15. N/45 Balances $7,700 9.400 8/26 Mason Retailers 1/20, N/60 4,300 Totals $21.400 During the month of September, the following transactions were completed by the business: Sept. 1 2 3 6 8 9 10 Stephanie Ram, the proprietor of the business, invested $88,700 cash and Office Supplies valued at $2,300 into the business Issued a check to establish a Petty Cash Fund for $5,000. Paid a premium of $3,300 for a one-year insurance policy, effective September 18 Purchased 42 refrigerators on credit for $155,400 from Mason Retailers. The credit terms of the sale were 4/20, n/45, F.O.B. shipping point. Issued a check for $2,140 for the delivery charges on the September 6th transaction. The business returned two damaged refrigerators to Mason Retailers and received a credit of $8,600. Sold several refrigerators to various customers with the credit terms 3/10, n/60 and bills were sent out as follows: Jose Mendes Amy Thomas Nicholas Jay Dora Franklin Totals $4,300 12,100 6,000 13,900 $36,300 12 13 14 15 Borrowed $61,800 from National Trust Bank by signing a Notes Payable. Dora Franklin returned a defective refrigerator to the business and received a credit of $4,700 Issued a check to pay the bi-weekly employee salaries, $15,800 Purchased Store Supplies on credit, terms 2/10, n/30, as follows: Wiley Retailers Lisa Supplies Company Farge Company Lincoln Wholesale Totals $2,100 1,800 1,100 2,400 $7,400 17 Purchased a Delivery Truck for $68,000 in cash. 20 Received payment (before any applicable discounts) from the following customers for the September 10th sale to be applied to their accounts as follows (Hint: You will need to calculate amount of net cash received from customers): Jose Mendes Amy Thomas $3,200 5,400 Nicholas Jay Dora Franklin Totals 4,100 8,400 $21,100 21 22 Received cash of $32,400 in advance for 6 refrigerators to be delivered over the next few months. Made a partial payment for the Store Supplies purchased on September 15th to be applied to the below accounts (before any applicable discounts) as follows (Hint: You will need to calculate amount of the net cash payment): Wiley Retailers Lisa Supplies Company Farge Company Lincoln Wholesale Totals $1,500 3,100 600 900 $6,100 23 24 25 26 27 28 29 Stephanie Ram withdrew $4,000 in cash for her personal use. Sold several refrigerators and received $217,000 cash. Made a partial payment to Mason Retailers of $95,000 to be applied as a reduction to the account balance (before any applicable discounts) for the September 6th transaction (Hint: You will need to calculate amount of the net cash payment). Paid the monthly utility bills, $8,700. Stephanie Ram purchased a Forklift for $33,100. Issued a check to pay the bi-weekly employee salaries, $15,800. The Petty Cash Fund had a cash balance of $3,500 at the end of September with petty cash receipts/vouchers for postage, $450, and repair supplies, $900. A check was issued to replenish the fund. Issued a check for the payment of September's rent, $16,000. 30 Prepare the Journal Entries in the General Journal. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Do not use dollar signs (S) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) General Journal: Debit Credit Date Account Titles 2016 Sept. 1 12 : | 20 | 21 : 26 27 : Post the Journal Entries to the General Ledger and Subsidiary Ledgers. Amounts to the Accounts Receivable and Accounts Payable should be posted as a total amount to the Accounts Receivable and Accounts Payable accounts in the General Ledger (Post the General Journal entries in chronological order to the respective accounts in the Ledgers below. Calculate the running balances for each account after each posting. Do not use dollar signs ($) when entering amounts. Only recalculate the ending balances to Ledger accounts where amounts were posted. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) General Ledger Cash Date Debit Credit Balance 155,100 Petty Cash Fund Date Debit Credit Balance Accounts Receivable Date Debit Credit Balance 15,900 Aug. 31 Balance Aug. 31 Balance 15,900 Merchandise Inventory Date Debit Credit Balance 52,500 Aug. 31 Balance Store Supplies Date Debit Credit Balance Aug. 31 Balance 4,000 Office Supplies Date Debit Credit Balance Office Supplies Date Debit Credit Balance 3,200 Aug. 31 Balance Prepaid Insurance Date Debit Credit Balance Land Date Debit Credit Balance 37,000 Aug. 31 Balance Forklift Date Debit Credit Balance Forklift Date Debit Credit Balance Delivery Truck Date Debit Credit Balance 91,000 Aug. 31 Balance Accumulated Depreciation, Delivery Truck Date Aug. 31 Balance Debit Credit Balance 800 Accounts Payable Date Debit Credit Balance 21,400 Aug. 31 Balance Unearned Sales Revenue Date Debit Credit Balance 2,500 Aug. 31 Balance Notes Payable Date Debit Credit Balance 60,000 Aug. 31 Balance Stephanie Ram, Capital Date Debit Credit Balance 274,000 Aug. 31 Balance Stephanie Ram, Drawings Stephanie Ram, Drawings Date Debit Credit Balance Sales Revenue Date Debit Credit Balance Sales Discounts Date Debit Credit Balance Sales Returns and Allowances Date Debit Credit Balance Purchases Date Debit Credit Balance Purchases Discounts Date Debit Credit Balance Purchases Returns and Allowances Date Debit Credit Balance Freight-In Date Debit Credit Balance Salaries Expense Date Debit Credit Balance Utilities Expense Date Debit Credit Balance Repair Supplies Expense Date Debit Credit Balance Postage Expense Date Debit Credit Balance Rent Expense Date Debit Credit Balance Cash Short & Over Date Debit Credit Balance Cash Short & Over Date Debit Credit Balance Accounts Receivable Subsidiary Ledger Jose Mendes Date Aug. 25 Balance Debit Credit Balance Item 3/20; N/60 10,300 3/10; N/60 Amy Thomas Date Item Debit Credit Balance 3/10; N/60 Nicholas Jay Date Debit Credit Balance Item 3/20; N/45 Aug. 28 Balance 5,600 3/10; N/60 Dora Franklin Date Item Debit Credit Balance 3/10; N/60 Accounts Payable Subsidiary Ledger Wiley Retailers Date Item Debit Credit Balance 2/10; N/30 Lisa Supplies Company Date Aug. 22 Balance Debit Credit Balance 1/10; N/60 7,700 2/10; N/30 Farge Company Date Item Debit Credit Balance Farge Company Date Aug. 24 Balance Debit Credit Balance Item 2/15; N/60 9,400 2/10; N/30 Mason Retailers Date Aug. 26 Balance Item Debit Credit Balance 1/20; N/45 4,300 4/20; N/45 Lincoln Wholesale Date Item Debit Credit Balance 2/10; N/30 Prepare a Trial Balance using the account names and balances from the General Ledger. entering amounts. To see comma-formatted numbers reflected in your final ans Debit Credit Totals Using the information from the Accounts Receivable Subsidiary Ledger, prepare a Schedule of Accounts Receivable. formatted numbers reflected in your final answers, you must enter your answers with commas.) Total Using the information from the Accounts Payable Subsidiary Ledger, prepare a Schedule of Accounts Payable. numbers reflected in your final answers, you must enter your answers with commas.) Total S ACC 111 Project 1A On August 1, 2016, Stephanie Ram, a sole proprietor, started a new business, Ram Wholesale Company. The company sells refrigerators (merchandise) to various retail stores and uses the periodic inventory system. At the end of August, the company's Post-Closing Trial Balance showed the following accounts and balances: Credit Ram Wholesale Company Post-Closing Tral Balance August 31, 2016 Account Titles Debit Cash $155,100 Accounts Receivable 15,900 Merchandise Inventory, 9/30/15 52,500 Store Supplies 4,000 Office Supplies 3,200 Land 37,000 Delivery Truck 91,000 Accumulated Depreciation, Delivery Truck Accounts Payable Unearned Sales Revenue Notes Payable (Due 2040) Stephanie Ram, Capital Totals $358,700 5800 21,400 2,500 60,000 274,000 $358,700 Subsidiary Ledgers balances during the month of August Customers with Outstanding Balances Dates 8/25 8/28 Customer NamesCredit Terms Jose Mendes 3/20, N/60 Nicholas Jay 2/15, N/45 Totals Balances $10,300 5,600 $15,900 Creditors with Outstanding Balances Dates 8/22 8/24 Creditors Names Lisa Supplies Company Farge Company Credit Terms 1/10, N/60 2/15. N/45 Balances $7,700 9.400 8/26 Mason Retailers 1/20, N/60 4,300 Totals $21.400 During the month of September, the following transactions were completed by the business: Sept. 1 2 3 6 8 9 10 Stephanie Ram, the proprietor of the business, invested $88,700 cash and Office Supplies valued at $2,300 into the business Issued a check to establish a Petty Cash Fund for $5,000. Paid a premium of $3,300 for a one-year insurance policy, effective September 18 Purchased 42 refrigerators on credit for $155,400 from Mason Retailers. The credit terms of the sale were 4/20, n/45, F.O.B. shipping point. Issued a check for $2,140 for the delivery charges on the September 6th transaction. The business returned two damaged refrigerators to Mason Retailers and received a credit of $8,600. Sold several refrigerators to various customers with the credit terms 3/10, n/60 and bills were sent out as follows: Jose Mendes Amy Thomas Nicholas Jay Dora Franklin Totals $4,300 12,100 6,000 13,900 $36,300 12 13 14 15 Borrowed $61,800 from National Trust Bank by signing a Notes Payable. Dora Franklin returned a defective refrigerator to the business and received a credit of $4,700 Issued a check to pay the bi-weekly employee salaries, $15,800 Purchased Store Supplies on credit, terms 2/10, n/30, as follows: Wiley Retailers Lisa Supplies Company Farge Company Lincoln Wholesale Totals $2,100 1,800 1,100 2,400 $7,400 17 Purchased a Delivery Truck for $68,000 in cash. 20 Received payment (before any applicable discounts) from the following customers for the September 10th sale to be applied to their accounts as follows (Hint: You will need to calculate amount of net cash received from customers): Jose Mendes Amy Thomas $3,200 5,400 Nicholas Jay Dora Franklin Totals 4,100 8,400 $21,100 21 22 Received cash of $32,400 in advance for 6 refrigerators to be delivered over the next few months. Made a partial payment for the Store Supplies purchased on September 15th to be applied to the below accounts (before any applicable discounts) as follows (Hint: You will need to calculate amount of the net cash payment): Wiley Retailers Lisa Supplies Company Farge Company Lincoln Wholesale Totals $1,500 3,100 600 900 $6,100 23 24 25 26 27 28 29 Stephanie Ram withdrew $4,000 in cash for her personal use. Sold several refrigerators and received $217,000 cash. Made a partial payment to Mason Retailers of $95,000 to be applied as a reduction to the account balance (before any applicable discounts) for the September 6th transaction (Hint: You will need to calculate amount of the net cash payment). Paid the monthly utility bills, $8,700. Stephanie Ram purchased a Forklift for $33,100. Issued a check to pay the bi-weekly employee salaries, $15,800. The Petty Cash Fund had a cash balance of $3,500 at the end of September with petty cash receipts/vouchers for postage, $450, and repair supplies, $900. A check was issued to replenish the fund. Issued a check for the payment of September's rent, $16,000. 30 Prepare the Journal Entries in the General Journal. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Do not use dollar signs (S) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) General Journal: Debit Credit Date Account Titles 2016 Sept. 1 12 : | 20 | 21 : 26 27 : Post the Journal Entries to the General Ledger and Subsidiary Ledgers. Amounts to the Accounts Receivable and Accounts Payable should be posted as a total amount to the Accounts Receivable and Accounts Payable accounts in the General Ledger (Post the General Journal entries in chronological order to the respective accounts in the Ledgers below. Calculate the running balances for each account after each posting. Do not use dollar signs ($) when entering amounts. Only recalculate the ending balances to Ledger accounts where amounts were posted. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) General Ledger Cash Date Debit Credit Balance 155,100 Petty Cash Fund Date Debit Credit Balance Accounts Receivable Date Debit Credit Balance 15,900 Aug. 31 Balance Aug. 31 Balance 15,900 Merchandise Inventory Date Debit Credit Balance 52,500 Aug. 31 Balance Store Supplies Date Debit Credit Balance Aug. 31 Balance 4,000 Office Supplies Date Debit Credit Balance Office Supplies Date Debit Credit Balance 3,200 Aug. 31 Balance Prepaid Insurance Date Debit Credit Balance Land Date Debit Credit Balance 37,000 Aug. 31 Balance Forklift Date Debit Credit Balance Forklift Date Debit Credit Balance Delivery Truck Date Debit Credit Balance 91,000 Aug. 31 Balance Accumulated Depreciation, Delivery Truck Date Aug. 31 Balance Debit Credit Balance 800 Accounts Payable Date Debit Credit Balance 21,400 Aug. 31 Balance Unearned Sales Revenue Date Debit Credit Balance 2,500 Aug. 31 Balance Notes Payable Date Debit Credit Balance 60,000 Aug. 31 Balance Stephanie Ram, Capital Date Debit Credit Balance 274,000 Aug. 31 Balance Stephanie Ram, Drawings Stephanie Ram, Drawings Date Debit Credit Balance Sales Revenue Date Debit Credit Balance Sales Discounts Date Debit Credit Balance Sales Returns and Allowances Date Debit Credit Balance Purchases Date Debit Credit Balance Purchases Discounts Date Debit Credit Balance Purchases Returns and Allowances Date Debit Credit Balance Freight-In Date Debit Credit Balance Salaries Expense Date Debit Credit Balance Utilities Expense Date Debit Credit Balance Repair Supplies Expense Date Debit Credit Balance Postage Expense Date Debit Credit Balance Rent Expense Date Debit Credit Balance Cash Short & Over Date Debit Credit Balance Cash Short & Over Date Debit Credit Balance Accounts Receivable Subsidiary Ledger Jose Mendes Date Aug. 25 Balance Debit Credit Balance Item 3/20; N/60 10,300 3/10; N/60 Amy Thomas Date Item Debit Credit Balance 3/10; N/60 Nicholas Jay Date Debit Credit Balance Item 3/20; N/45 Aug. 28 Balance 5,600 3/10; N/60 Dora Franklin Date Item Debit Credit Balance 3/10; N/60 Accounts Payable Subsidiary Ledger Wiley Retailers Date Item Debit Credit Balance 2/10; N/30 Lisa Supplies Company Date Aug. 22 Balance Debit Credit Balance 1/10; N/60 7,700 2/10; N/30 Farge Company Date Item Debit Credit Balance Farge Company Date Aug. 24 Balance Debit Credit Balance Item 2/15; N/60 9,400 2/10; N/30 Mason Retailers Date Aug. 26 Balance Item Debit Credit Balance 1/20; N/45 4,300 4/20; N/45 Lincoln Wholesale Date Item Debit Credit Balance 2/10; N/30 Prepare a Trial Balance using the account names and balances from the General Ledger. entering amounts. To see comma-formatted numbers reflected in your final ans Debit Credit Totals Using the information from the Accounts Receivable Subsidiary Ledger, prepare a Schedule of Accounts Receivable. formatted numbers reflected in your final answers, you must enter your answers with commas.) Total Using the information from the Accounts Payable Subsidiary Ledger, prepare a Schedule of Accounts Payable. numbers reflected in your final answers, you must enter your answers with commas.) Total S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts