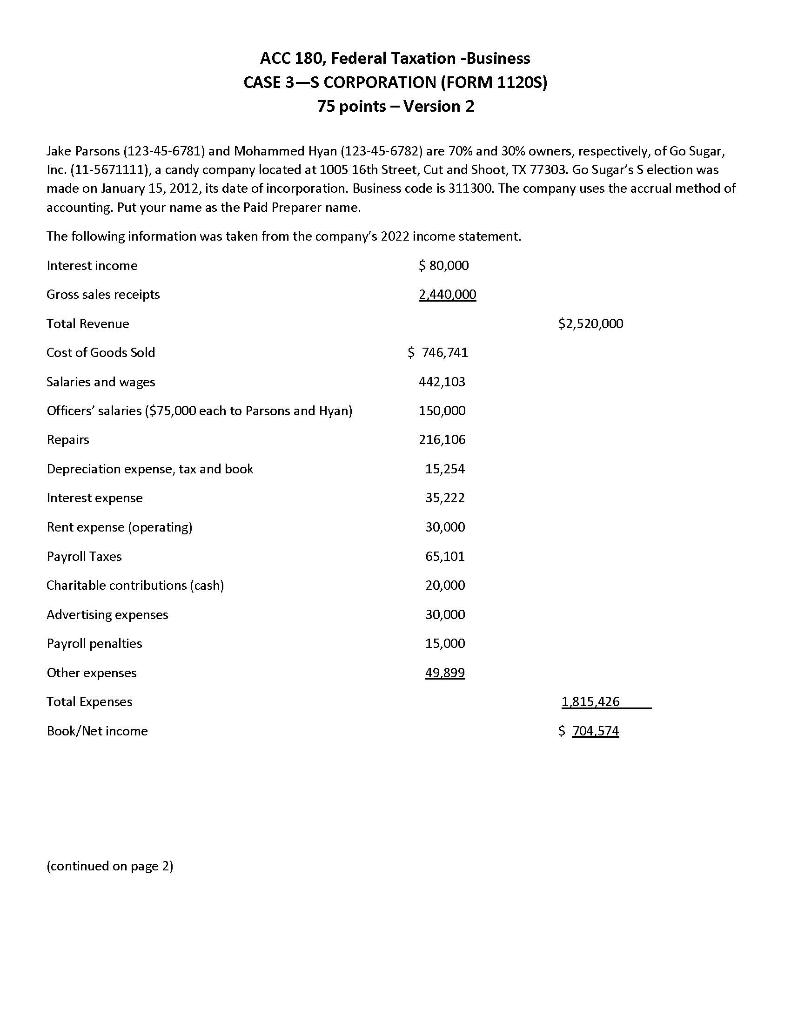

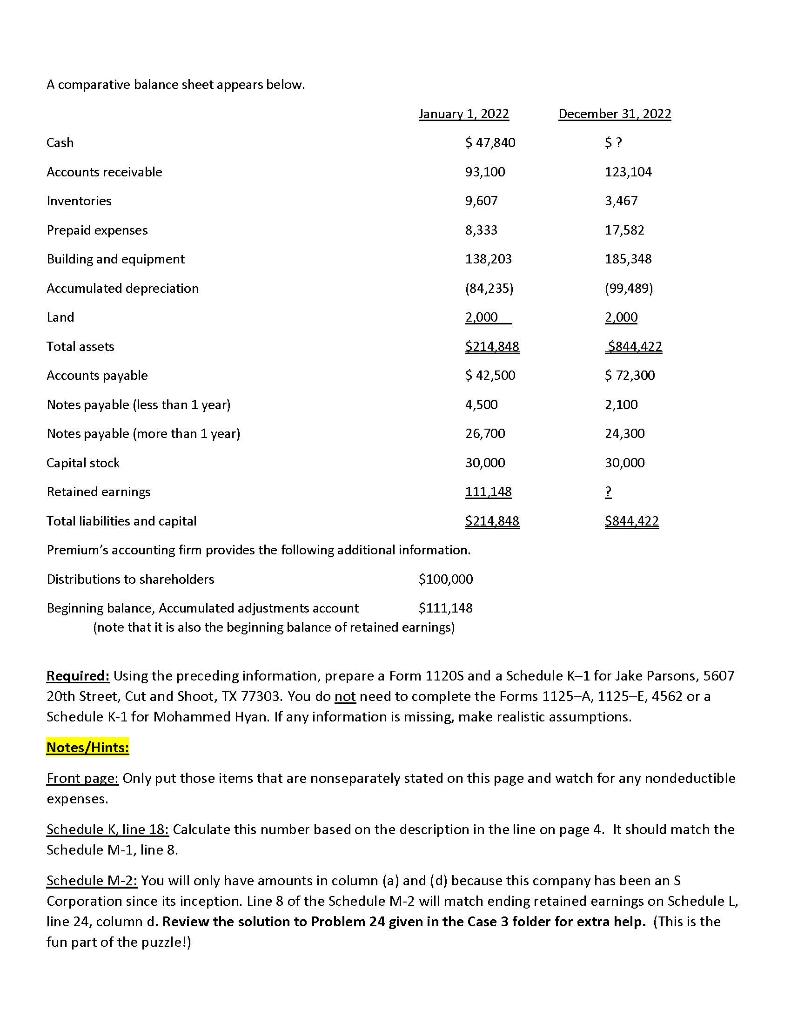

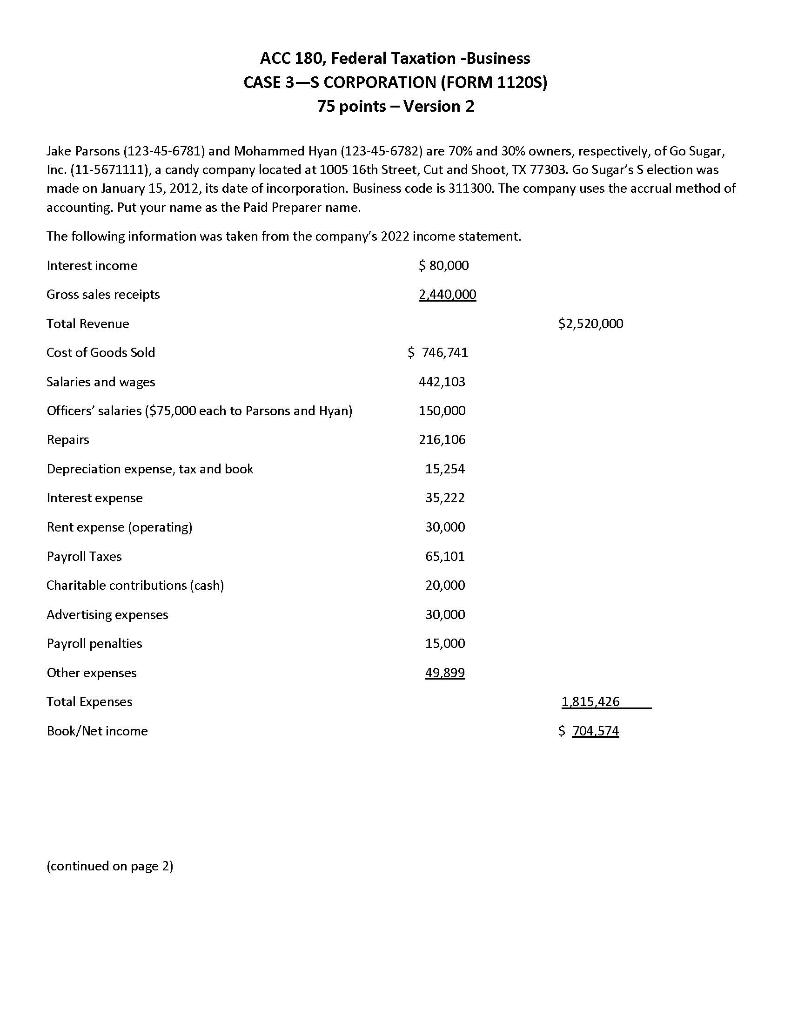

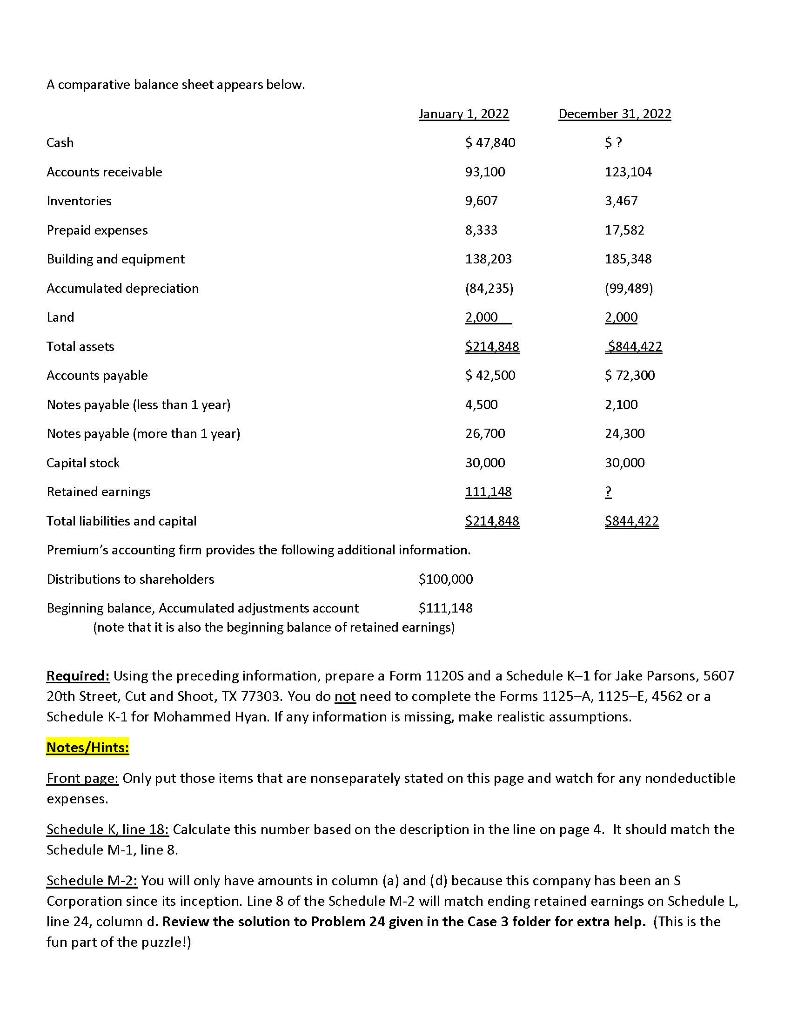

ACC 180, Federal Taxation -Business CASE 3-S CORPORATION (FORM 1120S) 75 points - Version 2 Jake Parsons (123-45-6781) and Mohammed Hyan (123-45-6782) are 70\% and 30\% owners, respectively, of Go Sugar, Inc. (11-5671111), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Go Sugar's S election was ff A romnarative halanre sheet annears helmes Beginning balance, Accumulated adjustments account $111,148 (note that it is also the beginning balance of retained earnings) Required: Using the preceding information, prepare a Form 11205 and a Schedule K-1 for Jake Parsons, 5607 20th Street, Cut and Shoot, TX 77303. You do not need to complete the Forms 1125-A, 1125-E, 4562 or a Schedule K1 for Mohammed Hyan. If any information is missing, make realistic assumptions. Notes/Hints: Front page: Only put those items that are nonseparately stated on this page and watch for any nondeductible expenses. Schedule K, line 18: Calculate this number based on the description in the line on page 4. It should match the Schedule M1, line 8 Schedule M-2: You will only have amounts in column (a) and (d) because this company has been an S Corporation since its inception. Line 8 of the Schedule M-2 will match ending retained earnings on Schedule L, line 24 , column d. Review the solution to Problem 24 given in the Case 3 folder for extra help. (This is the fun part of the puzzle!) ACC 180, Federal Taxation -Business CASE 3-S CORPORATION (FORM 1120S) 75 points - Version 2 Jake Parsons (123-45-6781) and Mohammed Hyan (123-45-6782) are 70\% and 30\% owners, respectively, of Go Sugar, Inc. (11-5671111), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Go Sugar's S election was ff A romnarative halanre sheet annears helmes Beginning balance, Accumulated adjustments account $111,148 (note that it is also the beginning balance of retained earnings) Required: Using the preceding information, prepare a Form 11205 and a Schedule K-1 for Jake Parsons, 5607 20th Street, Cut and Shoot, TX 77303. You do not need to complete the Forms 1125-A, 1125-E, 4562 or a Schedule K1 for Mohammed Hyan. If any information is missing, make realistic assumptions. Notes/Hints: Front page: Only put those items that are nonseparately stated on this page and watch for any nondeductible expenses. Schedule K, line 18: Calculate this number based on the description in the line on page 4. It should match the Schedule M1, line 8 Schedule M-2: You will only have amounts in column (a) and (d) because this company has been an S Corporation since its inception. Line 8 of the Schedule M-2 will match ending retained earnings on Schedule L, line 24 , column d. Review the solution to Problem 24 given in the Case 3 folder for extra help. (This is the fun part of the puzzle!)