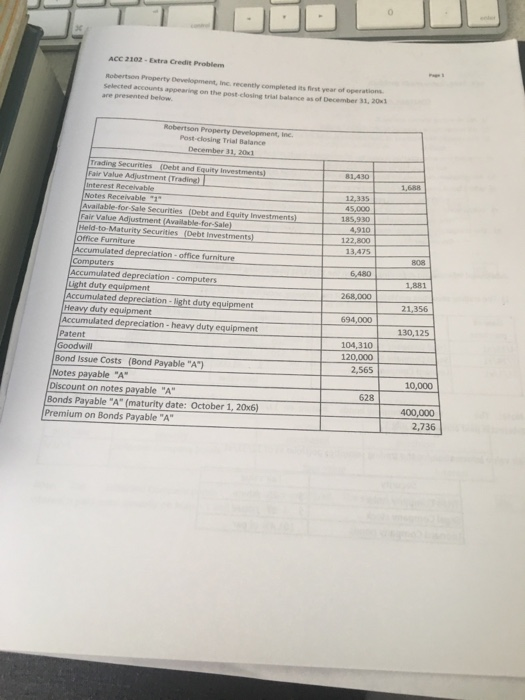

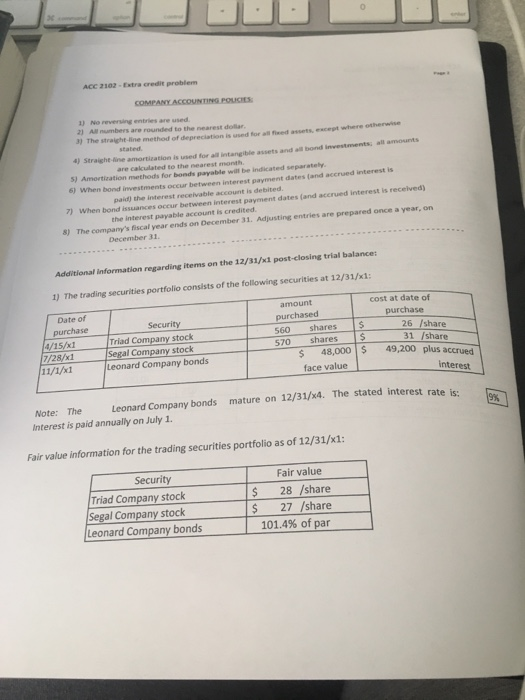

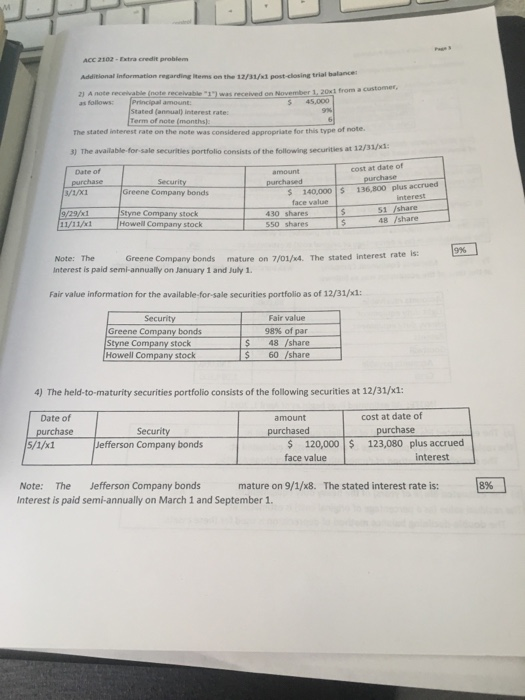

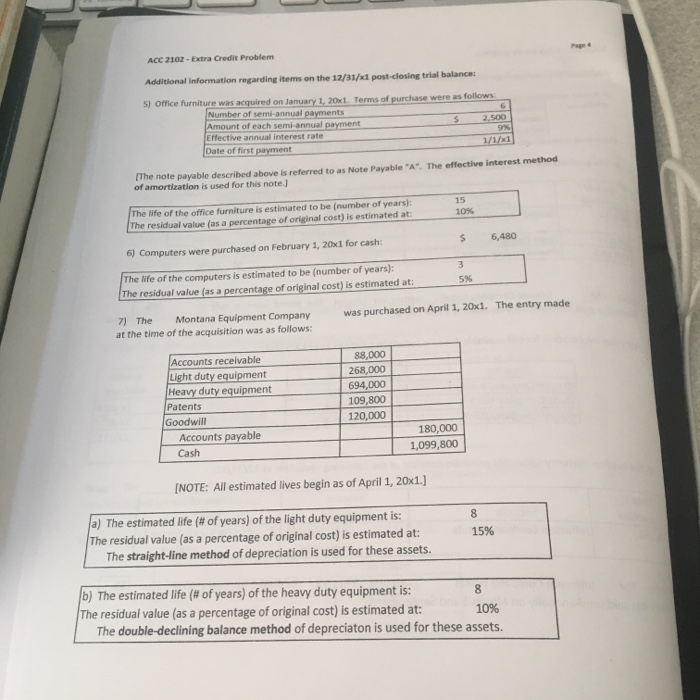

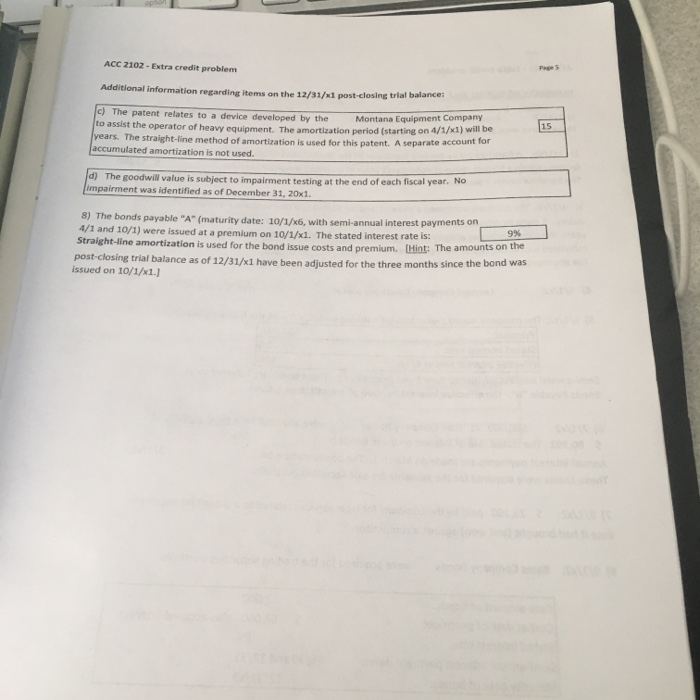

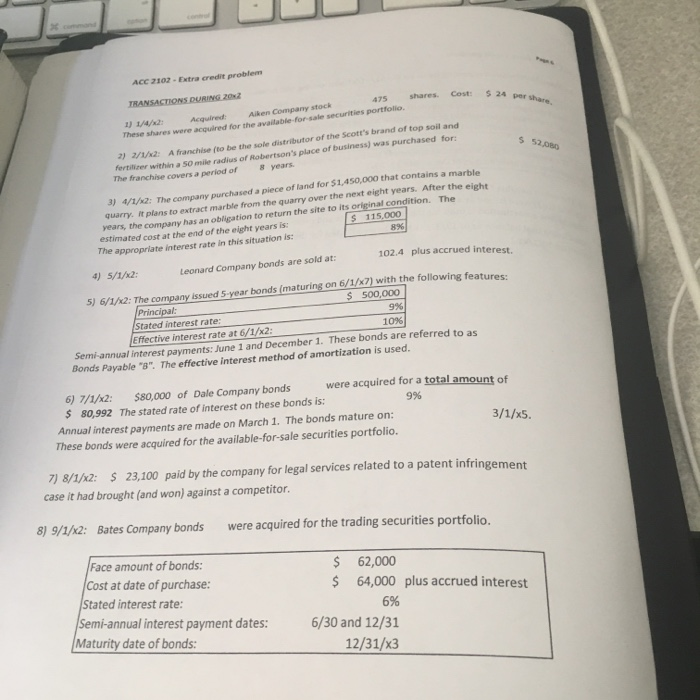

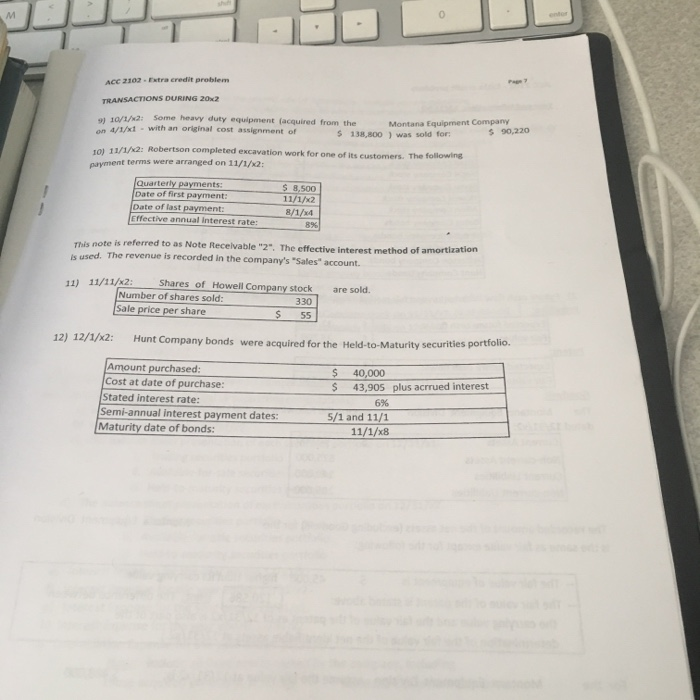

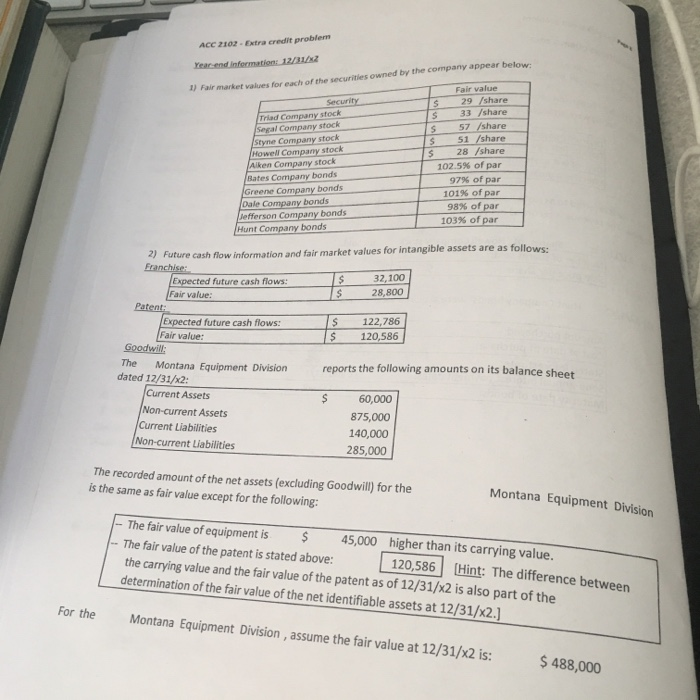

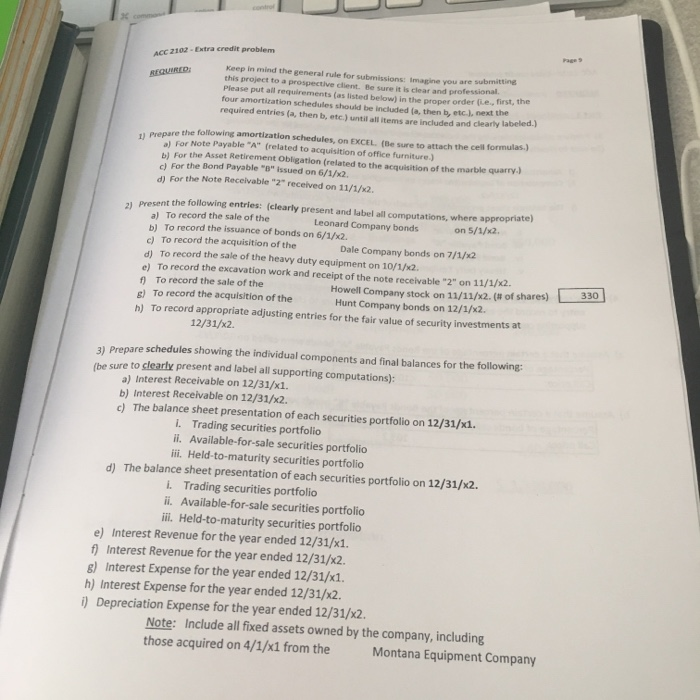

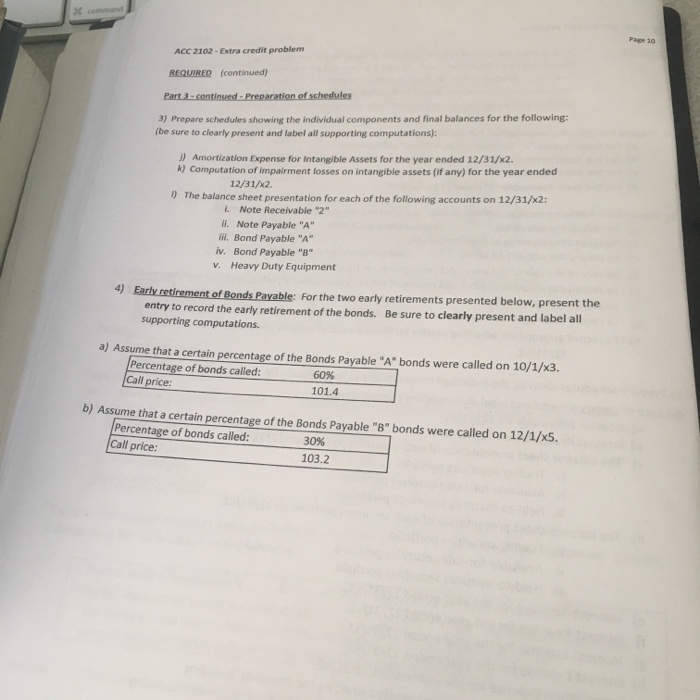

ACC 2102-Extra Credit Problem Robertson Property Development, Inc. recently completed its first year of operations Selected are presented below ng on the post-closing trial balance as of December 31, 20 accounts appear Post-closing Trial Balance December 31, 20x1 81,430 Fair Value Adjustment (Trading) Interest Recelvable Notes Receivable "1 Available-for Sale Securities (Debt and Equity Investments Fair Value Adjustment (Available-for-Sale) 1,688 45,000 185,930 910 122,800 Held-to Maturity Securities (Debt Investments) 808 ted depreciation- office furniture Computers 1,881 21,356 130,125 Accumulated depreciation-computers ight duty equipment Accumulated depreciation- light duty equipment 694,0005 Heavy duty equipment Accumulated depreciation - heavy duty equipment Patent Goodwi Bond Issue Costs (Bond Payable "A") Notes payable "A 104,310 120,000 2,565 10,000 628 Discount on notes payable "A" 400,000 Bonds Payable "A" (maturity date: October 1, 20x6) Premium on Bonds Payable "A" 2,736 ACC 2102-Extra credit problem 1) No reversing entries ane used 21 All numbers are rounded to the nearest dollar 3) The straight-line method of depreciation is used for all fined assets, scept stated is used for all intangible assets and all bond investments; all amounts are calculated to the month ne S) Amortization methods for bonds payable will be indicated separately. bond investments occur between interest payment dates (and accrued interest is ted. paid) the interest receivable account is debi issuances occur between interest payment dates (and accrued interest is received) the interest payable account is credited. 7) When bond entries are prepared once a year, on December 31. Additional information regarding items on the 12/31/x1 post-closing trial balance 1) The trading securities portfolio consists of the following securities at 12/31/x1 Date of cost at date of amount purchased 560 shares $ purchase Security purchase 26 /share 31 /share Triad Company stock /15/x1 281 Segal Company stock 11/1/x1 570 shares 5 48,000 49.200 plus accrued Leonard Company bonds face value interest Leonard Company bonds mature on 12/31/x4. The stated interest rate is Note: The Interest is paid annually on July 1 Fair value information for the trading securities portfolio as of 12/31/x1: Security Fair value $28 /share s 27 /share 101.4% of par Triad Company stock Segal Company stock Leonard Company bonds ACC 210-Extra credit nblem Additional Information regarding items on the 13/311 post-closing trial balance 2) A note recewabletnote receivable. wasreceivedenNovemberL20x1 from a as followsPrincipal amount 5 45,000 Stated (annual) interest rate: Term of note (months) of note. The stated interest rate on the note was considered appropriate for this type The available-for sale securities portfollo consists of the following securitiles at 12/31/1 s at 12/31/x3 3) cost at date of purchase Security 140,000 136,800 plus accrued face value purchased /a/xi eene Companytere 51 /share 48 /share Styne Company stock Howell Company stock 430 shares sso shares 9% Note: The interest is paid semi-annually on January 1 and July 1 Greene Company bonds mature on 7/01/s4. The stated interest rate is: Fair value information for the available-for-sale securities portfolio as of 12/31/x1: Security Fair value 98% of par $48 /share $ 60 /share Greene Company bonds stock 4) The held-to-maturity securities portfolio consists of the following securities at 12/31/x1 cost at date of Date of purchase amount sed 120,000 face value 123,080 plus accrued 5/1/x1 Jefferson Company bonds interest Note: The Jefferson Company bonds Interest is paid semi-annually on March 1 and September 1. mature on 9/1/x8. The stated interest rate is: 8% ACC 2102-Extra Credit Problem Additional information regarding items on the 12/31/x1 post-closing trial balance: Office furniture was acquired on January 1, 20x1. Terms of purchase were as follows Number of semi-annual payments Amount of each semi-annual payment Effective annual interest rate Date of first payment 2.500 1/1/x1 The note payable described above is referred to as Note Payable "A" The effective interest method of amortization is used for this note.J The life of the office furniture is estimated to be (number of years): The residual value (as a percentage of original cost) is estimated at 15 10% $ 6,480 6) Computers were purchased on February 1, 20x1 for cash: The life of the computers is estimated to be (number of years); 5% The residual value (as a percentage of original cost) is estimated at 7) The Montana Equipment Companywas purchased on April 1, 20x1. at the time of the acquisition was as follows: The entry made Accounts receivable Light duty equipment Heavy duty equipment Patents Goodwill 88,000 268,000 694,000 109,800 120,000 180,000 1,099,800 Accounts payable Cash NOTE: All estimated lives begin as of April 1, 20x1.) a) The estimated life (# of years) of the light duty equipment is: The residual value (as a percentage of original cost) is estimated at 8 15% The straight-line method of depreciation is used for these assets. b) The estimated life (# of years) of the heavy duty equipment is: The residual value (as a percentage of original cost) is estimated at: 10% The double-declining balance method of depreciaton is used for these assets. ACC 2102-Extra credit problem Page 5 Additional information regarding items on the 12/31/x1 post-closing trial balance: c) The patent relates to a device developed by the to assist the operator of hea years. The straight-line method of amortization is used for this patent. A separate account for Montana Equipment Company vy equipment. The amortization period (starting on 4/1/x1) will be 15 accumulated amortization is not used. The goodwill value is subject to impairment testing at the end of each fiscal year. No impairment was identified as of December 31, 20x1. 8) The bonds payable "A" (maturity date: 10/1/x6, with semi-annual interest payments on /1 and 10/1) were issued at a premium on 10/1/x1. The stated interest rate i Straight-line amortization is used for the bond issue costs and premium. Hint: 9% post-closing trial balance as of 12/31/x1 have been adjusted for the three months since the bond was issued on 10/1/x1.] ACC 2102 Extra credit problem 475 shares. Cost: $ 24 per Aiken Company stock Acquired: 1) 1/4/%2 These shares were acquired for the available-for-sale securities portfollio. 2) /2: A franchise (to be the sole distributor of the Scott's brand of top soil and fertilizer within a 50 mile radius of Robertson's place of business) was purchased for $ 52,080 The franchise covers a period of 8years quarry. It plans to extract marble from the quarry over the next eight years. After the eight years, the company has an obligation to return the site to its original condition. The 3) 4/1/: The company purchased a piece of land for $1,450,000 that contains a marble S 115,000 896 estimated cost at the end of the eight years is: The approprlate interest rate in this situation is: 102.4 plus accrued interest. Leonard Company bonds are sold at: 4) 5/1/x2: 5)6/1: The company issued S year bonds (maturing on 6/1/7) with the following features 500,000 9% 10% $ Stated interest rate: Effective interest rate at 6/1/x2: -annual interest payments: June 1 and December 1. These bonds are referred to as nds Payable "8" The effective interest method of amortization is used 6) 7/1/: $80,000 of Dale Company bonds were acquired for a total amount of 9% 5 80,992 The stated rate of interest on these bonds is: Annual interest payments are made on March 1. The bonds mature on: These bonds were acquired for the available-for-sale securities portfolio. 3/1/x5. ) 8//: 23,100 paid by the company for legal services related to a patent infringeme case it had brought (and won) against a competitor 9/1/2: Bates Company bonds were acquired for the trading securities portfolio. Face amount of bonds: Cost at date of purchase Stated interest rate: $ 62,000 64,000 plus accrued interest 6% 6/30 and 12/31 Semi-annual interest payment dates: Maturity date of bonds: 12/31/x3 0 ACC 2102 Extra credit problem TRANSACTIONS DURING 20x2 Some heavy duty equipment (acquired from the 9)10/1/2: on 4/1/x1 with an original cost assignment of Montana Equipment Company s 90,220o S 138,800 was sold for 11/1/x2: Robertson completed excavation work for one of its customers. The followine 10) payment terms were arranged on 11/1/x2 $ 8,500 11/1/x2 Date of first payment Date of last payment Effective annual interest rate: This note is referred to as is used. The revenue is recorded in the company's "Sales" account. Note Recelvable "2". The effective interest method of amortization Shares of Howell Company stock are sold. 11) 11/11/x2 Number of shares sold: Sale price per share 330 S 55 12) 12/1/x2: Hunt Company bonds were acquired for the Held-to-Maturity securities portfolio. Amount purchased Cost at date of purchase: Stated interest rate: Semi-annual interest payment dates: Maturity date of bonds: $ 40,000 $ 43,905 plus acrrued interest 6% 11/1/x8 ACC 2102 Extra credit problern Year end infermation: 12/312 1) Fair market values for each of the securities owned by the company appear below Fair value 29 5 33 /share S 57/share S 51 /share 28 /share 102.5% of par 97% of par 101% of par 98% of par 103% of par Trlad Company stock Segal Company stock Styne Company stock stock Howell Company Aiken Cormpany stock Bates Company bonds Greene Company bonds lefferson Company bonds Hunt Company bonds 2) Fut ture cash flow information and fair market values for intangible assets are as follows: 32,100 28,800 Fair value Expected future cash flows: Fair value 5 122,786 $ 120,586 The dated 12/31/x2 Montana Equipment Division Current Assets Non-current Assets reports the following amounts on its balance sheet $ 60,000 875,000 140,000 285,000 Current Liabilities Non-current Liabilities The recorded amount of the net assets (excluding Goodwill) for the is the same as fair value except for the following: Montana Equipment Division The fair value of equipment is 45,000 higher than its carrying value. The fair value of the patent is stated above: 120,586 (Hint: The difference between the carrying value and the fair value of the patent as of 12/31/x2 is also part of the determination of the fair value of the net identifiable assets at 12/31/x2.] For the Montana Equipment Division, assume the fair value at 12/31/2 is: $ 488,000 2% ACC 2102 -Extra credit problem Keep in mind the general rule for submissions: Imagine you are this project to a prospective client. Be sure it is clear and professional. Please put all requirements (as listed below) in the proper order (i.e, first, the four amortization schedules should be included (e, then b, etc.), next the required entries (a, then b, etc.) until all items are included and clearly labelea. amortization schedules, on EXCEL. (Be sure to attach the cell formulas.) 1) Prepare the following Note Payable "A" (related to acquisition of office furniture) b) For the Asset Retirement Obligation (related to the acquisition of the marble quarty c) For the Bond Payable "B" issued on 6/1/x2. d) For the Note Receivable "2" received on 11/1/x2. Present the following entries: (clearly present and label all computations, where appropriate) 2) To record the sale of the a) b) To record the issuance of bonds on 6/1/x2. c) To record the acquisition of the Leonard Company bonds on 5/1/x2 Dale Company bonds on 7/1/x2 To record the sale of the heavy duty equipment on 10/1/x2. e) To record the excavation work and receipt of the note receivable "2" on 11/1/x2. f) To record the sale of the g) To record the acquisition of the h) To record appropriate adjusting entries for the fair value of security investments at [ 330] Howell Company stock on 11/11/x2. (# of shares) Hunt Company bonds on 12/1/x2. 12/31/x2. 3) Prepare schedules showing the individual components and final balances for the following: sure to clearbe present and label all supporting computations): a) Interest Receivable on 12/31/x1. b) Interest Receivable on 12/31/x2. c) The balance sheet presentation of each securities portfolio on 12/31/x1. i. Trading securities portfolio ii. Available-for-sale securities portfolio ii. Held-to-maturity securities portfolio d) The balance sheet presentation of each securities portfolio on 12/31/x2. i. Trading securities portfolio ii. Available-for-sale securities portfolio ili. Held-to-maturity securities portfolio e) Interest Revenue for the year ended 12/31/x1. f) Interest Revenue for the year ended 12/31/x2. g) Interest Expense for the year ended 12/31/x1. h) Interest Expense for the year ended 12/31/x2. i)Depreciation Expense for the year ended 12/31/x2. Note: Include all fixed assets owned by the company, including those acquired on 4/1/x1 from the Montana Equipment Company Page 10 ACC 2102-Extra credit problem REQUIRED (continued) 3) Prepare schedules showing the individual components and final balances for the following: be sure to clearly present and label all supporting computations) ) Amortization Expense for Intangible Assets for the year ended 12/31/x2. k) Computation of impairment losses on intangible assets (if any) for the year ended 12/31/x2 0 The balance sheet presentation for each of the following accounts on 12/31/x2: . Note Receivable "2" ii. Note Payable "A" lli. Bond Payable "A iv. Bond Payable "8 v. Heavy Duty Equipment 4) For the two early retirements presented below, present the entry to record the early retirement of the bonds. supporting computations. Be sure to clearly present and label all a) Assume that a certain percentage of the Bonds Payable "A" bonds were called on 10/1/x3. Percentage of bonds called: Call 60% 101.4 price: b) Assume that a certain percentage of the Bonds Payable "B" bonds were called on 12/1/x5. Percentage of bonds called Call price 30% 103.2 ACC 2102-Extra Credit Problem Robertson Property Development, Inc. recently completed its first year of operations Selected are presented below ng on the post-closing trial balance as of December 31, 20 accounts appear Post-closing Trial Balance December 31, 20x1 81,430 Fair Value Adjustment (Trading) Interest Recelvable Notes Receivable "1 Available-for Sale Securities (Debt and Equity Investments Fair Value Adjustment (Available-for-Sale) 1,688 45,000 185,930 910 122,800 Held-to Maturity Securities (Debt Investments) 808 ted depreciation- office furniture Computers 1,881 21,356 130,125 Accumulated depreciation-computers ight duty equipment Accumulated depreciation- light duty equipment 694,0005 Heavy duty equipment Accumulated depreciation - heavy duty equipment Patent Goodwi Bond Issue Costs (Bond Payable "A") Notes payable "A 104,310 120,000 2,565 10,000 628 Discount on notes payable "A" 400,000 Bonds Payable "A" (maturity date: October 1, 20x6) Premium on Bonds Payable "A" 2,736 ACC 2102-Extra credit problem 1) No reversing entries ane used 21 All numbers are rounded to the nearest dollar 3) The straight-line method of depreciation is used for all fined assets, scept stated is used for all intangible assets and all bond investments; all amounts are calculated to the month ne S) Amortization methods for bonds payable will be indicated separately. bond investments occur between interest payment dates (and accrued interest is ted. paid) the interest receivable account is debi issuances occur between interest payment dates (and accrued interest is received) the interest payable account is credited. 7) When bond entries are prepared once a year, on December 31. Additional information regarding items on the 12/31/x1 post-closing trial balance 1) The trading securities portfolio consists of the following securities at 12/31/x1 Date of cost at date of amount purchased 560 shares $ purchase Security purchase 26 /share 31 /share Triad Company stock /15/x1 281 Segal Company stock 11/1/x1 570 shares 5 48,000 49.200 plus accrued Leonard Company bonds face value interest Leonard Company bonds mature on 12/31/x4. The stated interest rate is Note: The Interest is paid annually on July 1 Fair value information for the trading securities portfolio as of 12/31/x1: Security Fair value $28 /share s 27 /share 101.4% of par Triad Company stock Segal Company stock Leonard Company bonds ACC 210-Extra credit nblem Additional Information regarding items on the 13/311 post-closing trial balance 2) A note recewabletnote receivable. wasreceivedenNovemberL20x1 from a as followsPrincipal amount 5 45,000 Stated (annual) interest rate: Term of note (months) of note. The stated interest rate on the note was considered appropriate for this type The available-for sale securities portfollo consists of the following securitiles at 12/31/1 s at 12/31/x3 3) cost at date of purchase Security 140,000 136,800 plus accrued face value purchased /a/xi eene Companytere 51 /share 48 /share Styne Company stock Howell Company stock 430 shares sso shares 9% Note: The interest is paid semi-annually on January 1 and July 1 Greene Company bonds mature on 7/01/s4. The stated interest rate is: Fair value information for the available-for-sale securities portfolio as of 12/31/x1: Security Fair value 98% of par $48 /share $ 60 /share Greene Company bonds stock 4) The held-to-maturity securities portfolio consists of the following securities at 12/31/x1 cost at date of Date of purchase amount sed 120,000 face value 123,080 plus accrued 5/1/x1 Jefferson Company bonds interest Note: The Jefferson Company bonds Interest is paid semi-annually on March 1 and September 1. mature on 9/1/x8. The stated interest rate is: 8% ACC 2102-Extra Credit Problem Additional information regarding items on the 12/31/x1 post-closing trial balance: Office furniture was acquired on January 1, 20x1. Terms of purchase were as follows Number of semi-annual payments Amount of each semi-annual payment Effective annual interest rate Date of first payment 2.500 1/1/x1 The note payable described above is referred to as Note Payable "A" The effective interest method of amortization is used for this note.J The life of the office furniture is estimated to be (number of years): The residual value (as a percentage of original cost) is estimated at 15 10% $ 6,480 6) Computers were purchased on February 1, 20x1 for cash: The life of the computers is estimated to be (number of years); 5% The residual value (as a percentage of original cost) is estimated at 7) The Montana Equipment Companywas purchased on April 1, 20x1. at the time of the acquisition was as follows: The entry made Accounts receivable Light duty equipment Heavy duty equipment Patents Goodwill 88,000 268,000 694,000 109,800 120,000 180,000 1,099,800 Accounts payable Cash NOTE: All estimated lives begin as of April 1, 20x1.) a) The estimated life (# of years) of the light duty equipment is: The residual value (as a percentage of original cost) is estimated at 8 15% The straight-line method of depreciation is used for these assets. b) The estimated life (# of years) of the heavy duty equipment is: The residual value (as a percentage of original cost) is estimated at: 10% The double-declining balance method of depreciaton is used for these assets. ACC 2102-Extra credit problem Page 5 Additional information regarding items on the 12/31/x1 post-closing trial balance: c) The patent relates to a device developed by the to assist the operator of hea years. The straight-line method of amortization is used for this patent. A separate account for Montana Equipment Company vy equipment. The amortization period (starting on 4/1/x1) will be 15 accumulated amortization is not used. The goodwill value is subject to impairment testing at the end of each fiscal year. No impairment was identified as of December 31, 20x1. 8) The bonds payable "A" (maturity date: 10/1/x6, with semi-annual interest payments on /1 and 10/1) were issued at a premium on 10/1/x1. The stated interest rate i Straight-line amortization is used for the bond issue costs and premium. Hint: 9% post-closing trial balance as of 12/31/x1 have been adjusted for the three months since the bond was issued on 10/1/x1.] ACC 2102 Extra credit problem 475 shares. Cost: $ 24 per Aiken Company stock Acquired: 1) 1/4/%2 These shares were acquired for the available-for-sale securities portfollio. 2) /2: A franchise (to be the sole distributor of the Scott's brand of top soil and fertilizer within a 50 mile radius of Robertson's place of business) was purchased for $ 52,080 The franchise covers a period of 8years quarry. It plans to extract marble from the quarry over the next eight years. After the eight years, the company has an obligation to return the site to its original condition. The 3) 4/1/: The company purchased a piece of land for $1,450,000 that contains a marble S 115,000 896 estimated cost at the end of the eight years is: The approprlate interest rate in this situation is: 102.4 plus accrued interest. Leonard Company bonds are sold at: 4) 5/1/x2: 5)6/1: The company issued S year bonds (maturing on 6/1/7) with the following features 500,000 9% 10% $ Stated interest rate: Effective interest rate at 6/1/x2: -annual interest payments: June 1 and December 1. These bonds are referred to as nds Payable "8" The effective interest method of amortization is used 6) 7/1/: $80,000 of Dale Company bonds were acquired for a total amount of 9% 5 80,992 The stated rate of interest on these bonds is: Annual interest payments are made on March 1. The bonds mature on: These bonds were acquired for the available-for-sale securities portfolio. 3/1/x5. ) 8//: 23,100 paid by the company for legal services related to a patent infringeme case it had brought (and won) against a competitor 9/1/2: Bates Company bonds were acquired for the trading securities portfolio. Face amount of bonds: Cost at date of purchase Stated interest rate: $ 62,000 64,000 plus accrued interest 6% 6/30 and 12/31 Semi-annual interest payment dates: Maturity date of bonds: 12/31/x3 0 ACC 2102 Extra credit problem TRANSACTIONS DURING 20x2 Some heavy duty equipment (acquired from the 9)10/1/2: on 4/1/x1 with an original cost assignment of Montana Equipment Company s 90,220o S 138,800 was sold for 11/1/x2: Robertson completed excavation work for one of its customers. The followine 10) payment terms were arranged on 11/1/x2 $ 8,500 11/1/x2 Date of first payment Date of last payment Effective annual interest rate: This note is referred to as is used. The revenue is recorded in the company's "Sales" account. Note Recelvable "2". The effective interest method of amortization Shares of Howell Company stock are sold. 11) 11/11/x2 Number of shares sold: Sale price per share 330 S 55 12) 12/1/x2: Hunt Company bonds were acquired for the Held-to-Maturity securities portfolio. Amount purchased Cost at date of purchase: Stated interest rate: Semi-annual interest payment dates: Maturity date of bonds: $ 40,000 $ 43,905 plus acrrued interest 6% 11/1/x8 ACC 2102 Extra credit problern Year end infermation: 12/312 1) Fair market values for each of the securities owned by the company appear below Fair value 29 5 33 /share S 57/share S 51 /share 28 /share 102.5% of par 97% of par 101% of par 98% of par 103% of par Trlad Company stock Segal Company stock Styne Company stock stock Howell Company Aiken Cormpany stock Bates Company bonds Greene Company bonds lefferson Company bonds Hunt Company bonds 2) Fut ture cash flow information and fair market values for intangible assets are as follows: 32,100 28,800 Fair value Expected future cash flows: Fair value 5 122,786 $ 120,586 The dated 12/31/x2 Montana Equipment Division Current Assets Non-current Assets reports the following amounts on its balance sheet $ 60,000 875,000 140,000 285,000 Current Liabilities Non-current Liabilities The recorded amount of the net assets (excluding Goodwill) for the is the same as fair value except for the following: Montana Equipment Division The fair value of equipment is 45,000 higher than its carrying value. The fair value of the patent is stated above: 120,586 (Hint: The difference between the carrying value and the fair value of the patent as of 12/31/x2 is also part of the determination of the fair value of the net identifiable assets at 12/31/x2.] For the Montana Equipment Division, assume the fair value at 12/31/2 is: $ 488,000 2% ACC 2102 -Extra credit problem Keep in mind the general rule for submissions: Imagine you are this project to a prospective client. Be sure it is clear and professional. Please put all requirements (as listed below) in the proper order (i.e, first, the four amortization schedules should be included (e, then b, etc.), next the required entries (a, then b, etc.) until all items are included and clearly labelea. amortization schedules, on EXCEL. (Be sure to attach the cell formulas.) 1) Prepare the following Note Payable "A" (related to acquisition of office furniture) b) For the Asset Retirement Obligation (related to the acquisition of the marble quarty c) For the Bond Payable "B" issued on 6/1/x2. d) For the Note Receivable "2" received on 11/1/x2. Present the following entries: (clearly present and label all computations, where appropriate) 2) To record the sale of the a) b) To record the issuance of bonds on 6/1/x2. c) To record the acquisition of the Leonard Company bonds on 5/1/x2 Dale Company bonds on 7/1/x2 To record the sale of the heavy duty equipment on 10/1/x2. e) To record the excavation work and receipt of the note receivable "2" on 11/1/x2. f) To record the sale of the g) To record the acquisition of the h) To record appropriate adjusting entries for the fair value of security investments at [ 330] Howell Company stock on 11/11/x2. (# of shares) Hunt Company bonds on 12/1/x2. 12/31/x2. 3) Prepare schedules showing the individual components and final balances for the following: sure to clearbe present and label all supporting computations): a) Interest Receivable on 12/31/x1. b) Interest Receivable on 12/31/x2. c) The balance sheet presentation of each securities portfolio on 12/31/x1. i. Trading securities portfolio ii. Available-for-sale securities portfolio ii. Held-to-maturity securities portfolio d) The balance sheet presentation of each securities portfolio on 12/31/x2. i. Trading securities portfolio ii. Available-for-sale securities portfolio ili. Held-to-maturity securities portfolio e) Interest Revenue for the year ended 12/31/x1. f) Interest Revenue for the year ended 12/31/x2. g) Interest Expense for the year ended 12/31/x1. h) Interest Expense for the year ended 12/31/x2. i)Depreciation Expense for the year ended 12/31/x2. Note: Include all fixed assets owned by the company, including those acquired on 4/1/x1 from the Montana Equipment Company Page 10 ACC 2102-Extra credit problem REQUIRED (continued) 3) Prepare schedules showing the individual components and final balances for the following: be sure to clearly present and label all supporting computations) ) Amortization Expense for Intangible Assets for the year ended 12/31/x2. k) Computation of impairment losses on intangible assets (if any) for the year ended 12/31/x2 0 The balance sheet presentation for each of the following accounts on 12/31/x2: . Note Receivable "2" ii. Note Payable "A" lli. Bond Payable "A iv. Bond Payable "8 v. Heavy Duty Equipment 4) For the two early retirements presented below, present the entry to record the early retirement of the bonds. supporting computations. Be sure to clearly present and label all a) Assume that a certain percentage of the Bonds Payable "A" bonds were called on 10/1/x3. Percentage of bonds called: Call 60% 101.4 price: b) Assume that a certain percentage of the Bonds Payable "B" bonds were called on 12/1/x5. Percentage of bonds called Call price 30% 103.2