Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACC 212 Real World Problem 1: Analyzing Financial Statements As you move into your career, you will have a 401K and investments that requires knowledge

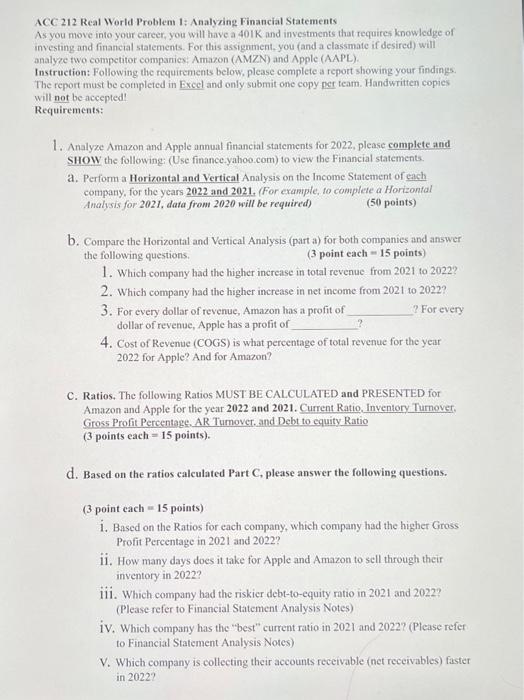

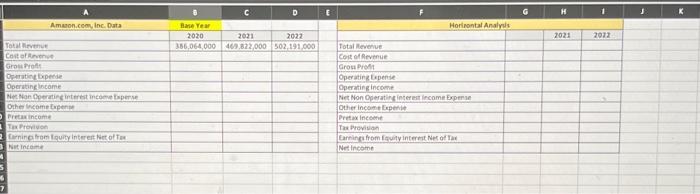

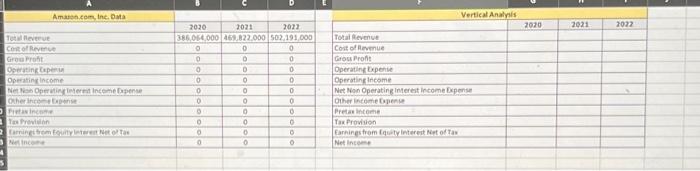

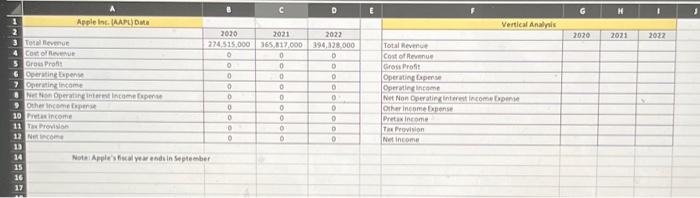

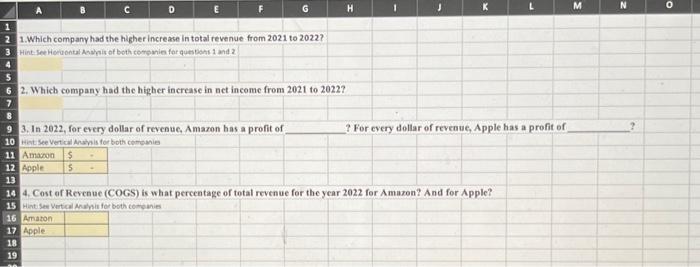

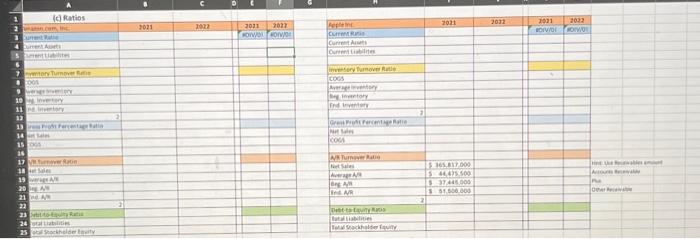

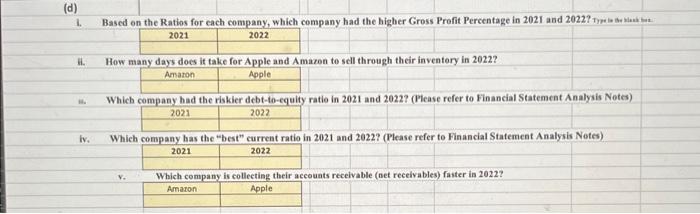

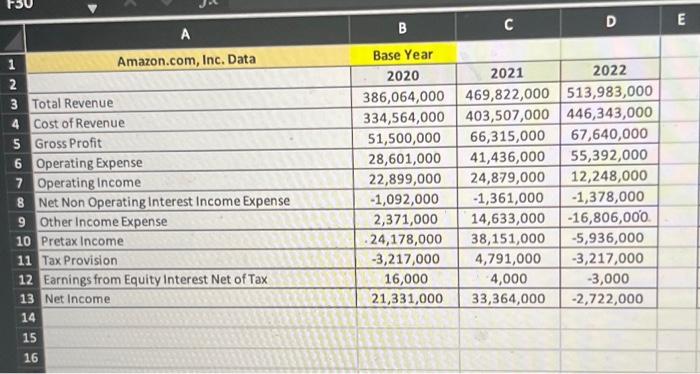

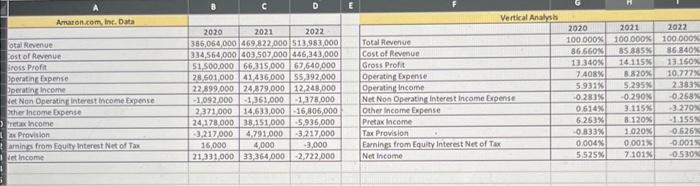

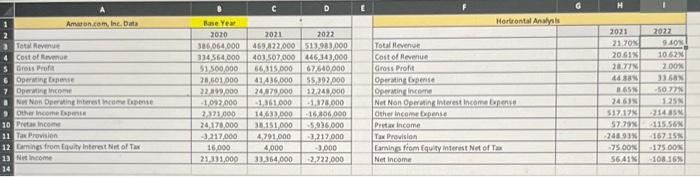

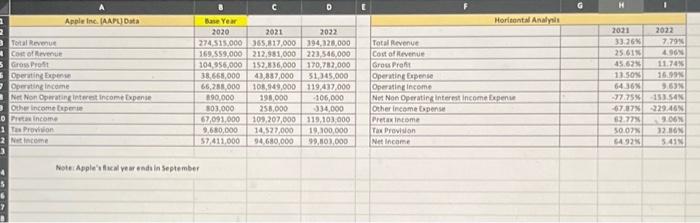

ACC 212 Real World Problem 1: Analyzing Financial Statements As you move into your career, you will have a 401K and investments that requires knowledge of investing and financial statements. For this assignment, you (and a classmate if desired) will analyze two competitor companies: Amazon (AMZN) and Apple (AAPL). Instruction: Following the requirements below, please complete a report showing your findings. The report must be completed in Excel and only submit one copy per team. Handwritten copies will not be accepted! Requirements: 1. Analyze Amazon and Apple annual financial statements for 2022, please complete and SHOW the following: (Use finance.yahoo.com) to view the Financial statements. a. Perform a Horizontal and Vertical Analysis on the Income Statement of each company, for the years 2022 and 2021. (For example, to complete a Horizontal Analysis for 2021, data from 2020 will be required) b. Compare the Horizontal and Vertical Analysis (part a) for both companies and answer the following questions. 1. Which company had the higher increase in total revenue from 2021 to 2022? 2. Which company had the higher increase in net income from 2021 to 2022? 3. For every dollar of revenue, Amazon has a profit of ? For every dollar of revenue, Apple has a profit of 4. Cost of Revenue (COGS) is what percentage of total revenue for the year 2022 for Apple? And for Amazon? C. Ratios. The following Ratios MUST BE CALCULATED and PRESENTED for Amazon and Apple for the year 2022 and 2021. Current Ratio, Inventory Turnover, Gross Profit Percentage, AR Turnover, and Debt to equity Ratio. d. Based on the ratios calculated Part C, please answer the following questions. 1. Based on the Ratios for each company, which company had the higher Gross Profit Percentage in 2021 and 2022? ii. How many days does it take for Apple and Amazon to sell through their inventory in 2022? iii. Which company had the riskier debt-to-equity ratio in 2021 and 2022? iv. Which company has the "best" current ratio in 2021 and 2022? V. Which company is collecting their accounts receivable (net receivables) faster in 2022?

I have finished part A the horizontal and vertical analyses. I need someone to please check my work and help me with parts b,c, and d

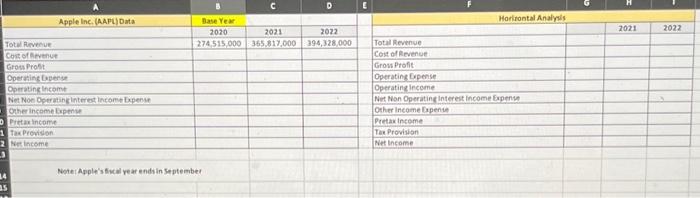

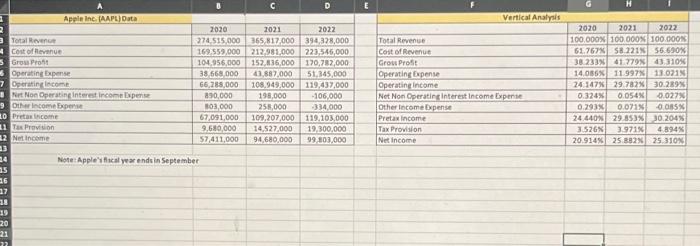

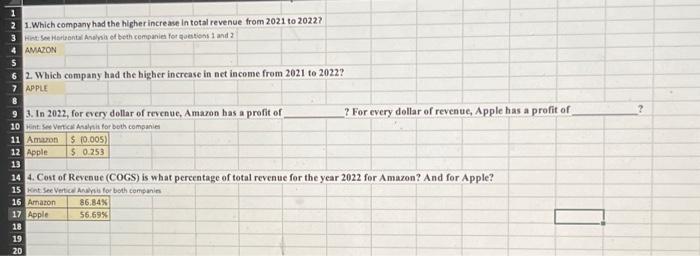

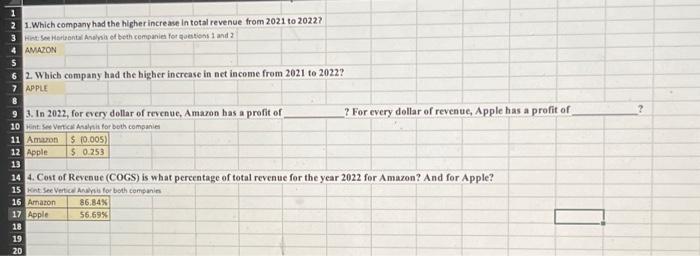

part b

Note: Apple'iflical warends in September 1.Which company had the higher increase in total revenue from 2021 to 2022 ? 2. Which company had the higher increase in act income from 2021 to 2022 ? 3. In 2022, for every dollar of revenue, Amazon bas a profit of ? For every dollar of revenue, Appl Hint See Vertical Anshis for both comeanie 4. Cost of Revenue (COGS) is what percentage of total revenue for the year 2022 for Amazon? And for Apple? Hint See Vertical Mnwhis for both centanie \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline 1 & Amazon.com, Inc. Data & Base Year & & \\ \hline 2 & & 2020 & 2021 & 2022 \\ \hline 3 & Total Revenue & 386,064,000 & 469,822,000 & 513,983,000 \\ \hline 4 & Cost of Revenue & 334,564,000 & 403,507,000 & 446,343,000 \\ \hline 5 & Gross Profit & 51,500,000 & 66,315,000 & 67,640,000 \\ \hline 6 & Operating Expense & 28,601,000 & 41,436,000 & 55,392,000 \\ \hline 7 & Operating Income & 22,899,000 & 24,879,000 & 12,248,000 \\ \hline 8 & Net Non Operating Interest Income Expense & 1,092,000 & 1,361,000 & 1,378,000 \\ \hline 9 & Other Income Expense & 2,371,000 & 14,633,000 & 16,806,000 \\ \hline 10 & Pretax Income & .24,178,000 & 38,151,000 & 5,936,000 \\ \hline 11 & Tax Provision & 3,217,000 & 4,791,000 & 3,217,000 \\ \hline 12 & Earnings from Equity Interest Net of Tax & 16,000 & 4,000 & 3,000 \\ \hline 13 & Net Income & 21,331,000 & 33,364,000 & 2,722,000 \\ \hline \end{tabular} ii. How many days does if take for Apple and Amazon to sell through their inventery in 2022 ? 4. Which combany had the riskier debt-to-equity ratio in 2021 and 2022 ? (Please refer to Financial Statement Analysis Netes) fv. Which company has the "best" current ratio in 2021 and 2022 (Please refer to Financial Statement Analysis Netes) \begin{tabular}{|c|c|} \hline 2021 & 2022 \\ \hline & \\ \hline \end{tabular} v. Which company is collecting their accounts receivable (net receivables) faster in 2022? ACC 212 Real Werld Problem 1: Analyzing Financial Statements As you move into your career, you will have a 40KK and investments that requires knowledge of investing and financial statements. For this assignment, you (and a classmate if desired) will analyze two competitor companics: Amazon (AMZN) and Apple (AAPL). Instruction: Following the requirements below, please complete a report showing your findings. The report must be completed in Excel and onty submit one copy net team. Handwritten copies will not be accepted! Requirements: 1. Analyze Amazon and Apple annual financial statements for 2022, please complete and SHOW the following: (Use financeyahoo.com) to view the Financial statements. a. Perform a Horizontal and Vertical Analysis on the Income Statement of each company, for the ycars 2022 and 2021. (For example, fo complete a Horizontal Analysis for 2021 , data from 2020 will be required) (50 points) b. Compare the Horizontal and Vertical Analysis (part a) for both companies and answer the following questions. ( 3 point each =15 points) 1. Which company had the higher increase in total revenue from 2021 to 2022 ? 2. Which company had the higher increase in net income from 2021 to 2022 ? 3. For every dollar of revenue, Amazon has a profit of ? For every dollar of revenue, Apple has a profit of 4. Cost of Revenue (COGS) is what percentage of total revenue for the year 2022 for Apple? And for Amazon? C. Ratios. The following Ratios MUST BE CALCULATED and PRESENTED for Amazon and Apple for the year 2022 and 2021. Current Ratio, Inventory Turnover. Gross Profit Percentage, AR Tumover, and Debt to equity Ratio (3 points each =15 points). d. Based on the ratios calculated Part C, please answer the following questions. (3 point each =15 points) i. Based on the Ratios for each company, which company had the higher Gross Profit Percentage in 2021 and 2022 ? ii. How many days does it take for Apple and Amazon to sell through their inventory in 2022 ? iii. Which company had the riskier debt-to-equity ratio in 2021 and 2022 ? (Please refer to Financial Statement Analysis Notes) iV. Which company has the "best" current ratio in 2021 and 2022 ? (Please refer to Financial Statement Analysis Notes) V. Which company is collecting their accounts receivable (net receivables) faster in 2022 ? \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{2}{*}{ Apple linc. (AAPL) Data } & \multicolumn{2}{|l|}{ Dase Year } & \\ \hline & 2020 & 2021 & 2022 \\ \hline Totw Rivenur. & 274.515 .000 & 365,817,000 & 396,328.000 \\ \hline Cons of Amevenut & & & \\ \hline Gross Prost: & & & \\ \hline Operatine Geverse & & & \\ \hline Operatine lheomt & & & \\ \hline Net Noe Operating interest income Depens & & & \\ \hline Other income Expenu & & & \\ \hline Pretaxincame & & & \\ \hline Taxprovision. & & a. & \\ \hline Ner income & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Moritontal Analyis. } \\ \hline & 2021 & 2022 \\ \hline \multicolumn{3}{|l|}{ Total Revenue. } \\ \hline \multicolumn{3}{|l|}{ Cost of Revenue. } \\ \hline \multicolumn{3}{|l|}{ Grow Profit } \\ \hline \multicolumn{3}{|l|}{ Operatine Gipense } \\ \hline \multicolumn{3}{|l|}{ Operatine income } \\ \hline Nirt Mon Operating interest income Expensh & & 3 \\ \hline \multicolumn{3}{|l|}{ Other Income Dapense } \\ \hline \multicolumn{3}{|l|}{ Pretaxincome } \\ \hline \multicolumn{3}{|l|}{ TacProwision } \\ \hline Net income & & \\ \hline \end{tabular} Note: Apple's sical rear endsin Septembed \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Amases.cem, inc, Duta & & & & Vert & & & \\ \hline & 2020 & 2021 & 2022 & & 2020 & 2021 & 2027 \\ \hline Tetwlileverue & 386.054 .000 & 462.822 .000 & 502,191,000 & Total Revense. & & & \\ \hline Cons of Reverue & 0 & 0 & 0 & Cott of hevmue & & & \\ \hline Groa Froht: & 0 & 0 & 0 & Grosi Froht: & & & \\ \hline Operyting laperan & 0 & D & 0 & Operating Depenve & & & \\ \hline Operating income & 0 & 0 & 0 & Operating income & & & \\ \hline Net Nos Opervincieterat Inseme Dopene & 0 & 0 & 0 & Ner, Non Operating Interest income Expense & & & 3 \\ \hline & 0 & 0 & 0 & Other inteme Gopence & & & \\ \hline Furtasinentis & & 0 & b. & Pretar income & & & \\ \hline Tan Provition & 0 & 0 & e & Tax frovision & & & \\ \hline & 0 & 0 & & Earhines from fquety interent Net of Tas. & & & \\ \hline Bertincent & 0 & 0 & 0 & Net Inteen & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline A & 8 & C & D \\ \hline \multicolumn{4}{|l|}{ Araroncom, inc, Duta } \\ \hline & 2020 & 2021 & 2022 \\ \hline otai Revenue & 386,064,000 & 469,822,000 & 513,983,000 \\ \hline fost of Revenue. & 334,564,000 & 403,507,000 & 446,343,000 \\ \hline jross Profit & 51,500,000 & 66.315,000 & 67,640,000 \\ \hline Joerating Expense & 2B,501,000 & 41,436,000 & 55,392,000 \\ \hline perating lincome & 22,899,000 & 24,879,000 & 12,248,000 \\ \hline Vet Non Operating interest income fxpense & -1.092 .000 & 1,361,000 & 1,378,000 \\ \hline ther income Expense & 2,371,000 & 14.633 .000 & 16,806,000 \\ \hline ritax hiome & 24,178,000 & 38,151,000 & 5,936,000 \\ \hline Exproviston & 3,217,000 & 4,791,000 & 3,217,000 \\ \hline amings from foulity haterest Net of Tax & 16,000 & 4,000 & 3,000 \\ \hline iet inconse & 21.331 .000 & 33,364,000 & 2,722,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline & 2020 & 2021 & 2022 \\ \hline Total flevenue: & 100.000% & 100.000x & 100.000x \\ \hline Cost of Revenue & 86.6505 & BS.385s & 86.8408 \\ \hline Gross Profit & 13.340x & 14115% & 13150x \\ \hline Operating Epenie & 7.408 & 8.820x & 10.7mx \\ \hline Operating income & 5.9318 & 5.295 & 2383K \\ \hline Net Noo Operating Interest income Erpense & 0.283 & 0.290K & 0.258x \\ \hline Other Income Expense & 0.514x & 3.115s & 3270x \\ \hline Pretax lacome & 6.263X & 8.120x & -1.1558 \\ \hline Tax Proviston & 0.833% & 1.020x & 0.626x \\ \hline Eamines from Equity Interest Net of Tax & 0.0048 & 0.0015 & -0.0015 \\ \hline Net income & 5.525 & 7.101x & 0.530x \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & A & 8 & C & 0 & E & I & G & M & 1 & t \\ \hline 1 & Aeple inc. purcious & & & & & Vertical Analois & & & & \\ \hline 2 & & 2020 & 2021 & 2022 & & & 2020 & 2021 & 2022 & \\ \hline 3 & Terel ficmue. & 274,515,000 & 365.517,000 & 394.328000 & & Total Reveruet. & & & & \\ \hline 4 & Cortolnevent & & 0 & 0 & & Cont of Aerenue. & & & & \\ \hline 5 & Orous Proflit & 0 & 0 & 0 & & Grosisproft: & & & & \\ \hline 6 & Gerutingtapense & 0 & 0. & 0 & & Operatiog bipense & & & & \\ \hline 7 & Conersting insome & 0 & 0 & 0 & & Oomerties intaent & & & & \\ \hline 0 & & 0 & 0. & 0 & & Net Non Opertatioglinterent income Goperpe & & & & \\ \hline 9 & OCher inceme foperie & 0 & 0 & 0 & & Oiker income bepense & & & & \\ \hline 10 & Pretusincome & 0 & 0 & 0 & & Pretixincome & & & & \\ \hline 11 & Tuminevision & 10 & a? & 0 & & Tar Provision & & & & \\ \hline n & Netincere & 0 & 0. & 0 & & Nes income & & & & \\ \hline 13 & & & & & & & & & & \\ \hline 34 & Nots Applers fical wex esda in September & & F. & & & & & & & \\ \hline 15 & & & & & & & & & & \\ \hline \begin{tabular}{l} 16 \\ 17 \end{tabular} & & & & & & & & & & \\ \hline \end{tabular} Noter Appleht fical vear esda in September \begin{tabular}{|c|c|c|c|} \hline Amaton rom, ine, Dats & Rase Yey & & \\ \hline & 2020 & 2021 & 2022 \\ \hline Fetal hermut & 346.064 .000 & 469,122,000 & 513,983,000 \\ \hline Cost of Emprue & 334.564 .000 & 403.507000 & 446,343,000 \\ \hline Gres Profit & 51,500,000 & 64,315,000 & 67.640,000 \\ \hline Operating tapesse & 78,501,000 & 41,436,000 & 55,397,000 \\ \hline Operinine linceme & 2290000 & 24$70000 & 12242000 \\ \hline Kit Non Deeruting interest Mceos fopense & 1,023000 & 1,361,000 & +1,178.000 \\ \hline Other heome Expenin & 2371.000 & 14,633,000 & 16,106,000 \\ \hline Pretas incoent & 24,170,000 & 38,151,000 & 5,936,000 \\ \hline Tax Provisien & 3.217,000 & 4.791000 & .1,212000 \\ \hline Eamines froes favily interot Nirt of Tax & 16.000 & 4,000 & 3,000 \\ \hline Net income & 21,311,000 & 33,364,000 & 2,222,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Hortrontal Analyele } \\ \hline & 2021 & 2072 \\ \hline Totai flevenue & 2170N & 940s \\ \hline Cost of Aevenue. & 20.618 & 10.62x \\ \hline Grow Profit & 2axy & 2.00x \\ \hline Gperating Gipense & 4asas & \\ \hline Geratins incene & 0.65N & 50ms \\ \hline Net Non Operatinf interest income Epente. & 24.635 & 125N \\ \hline Other income frpense. & 51717 & 214.15x \\ \hline Pritar income & 5770 & 115.56x \\ \hline Tax Provising & -248.936 & 157.15x \\ \hline Gaming fiom fquity inserest Nat of Ta. & .75005 & -175 oox \\ \hline Net income & 5641N & -108.165 \\ \hline \end{tabular} 1. Which company had the higher increase in total revenue from 2021 to 2022? AMARON 2. Which company had the higher increase in net income from 2021 to 2022 ? APPLE 3. In 2022, for every dollar of revenue, Amazon has a profit of ? For every dellar of revenue, Apple has a profit of \begin{tabular}{|c|c|} \hline Amomen & 5(0.005) \\ \hline Apple & \begin{tabular}{ll} 5 & 0.253 \end{tabular} \\ \hline \end{tabular} 4. Cost of Revenue (COGS) is what percentage of total revenue for the year 2022 for Amazon? And for Apple? pont See Vertical Mnuria for both compenin \begin{tabular}{|l|r|} \hline Amazon & 86.84K \\ \hline Apple & 56.698 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started