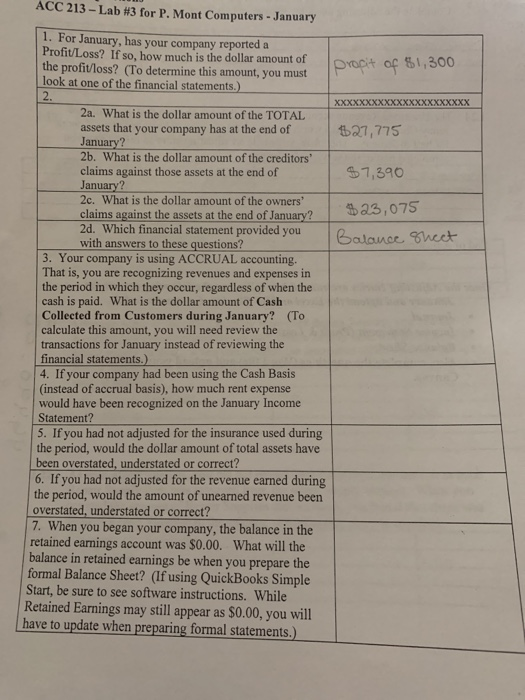

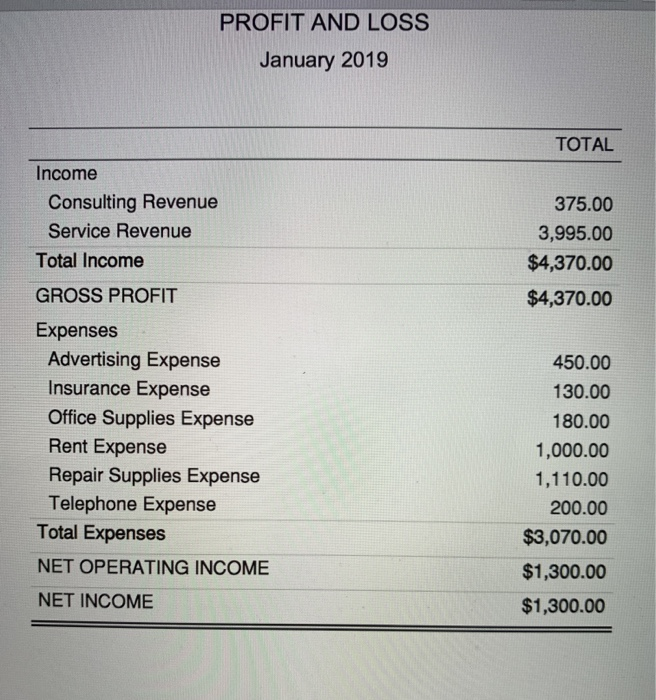

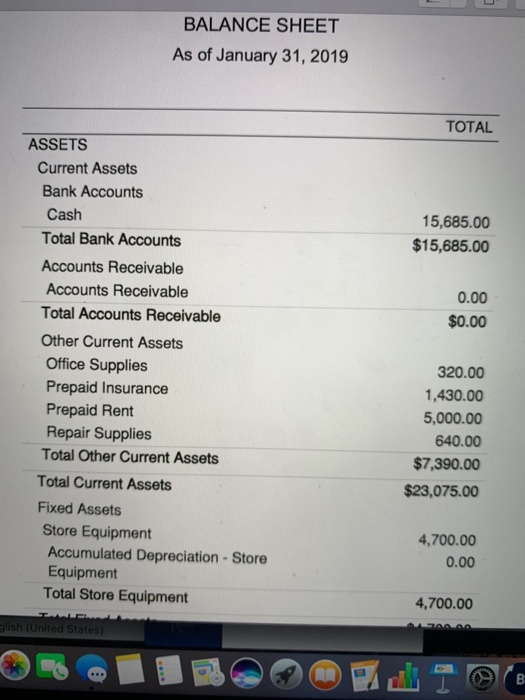

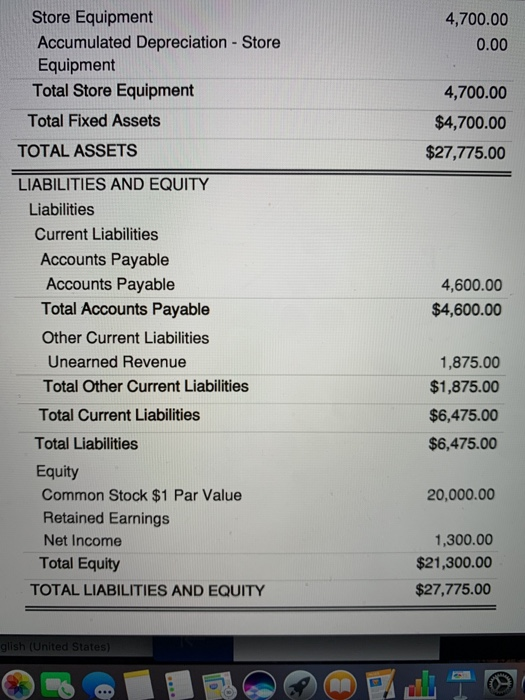

ACC 213-Lab # 3 for P. Mont Computers- January 1. For January, has your company reported a Profit/Loss? If so, how much is the dollar amount of the profit/loss? (To determine this amount, you must look at one of the financial statements.) 2 propit af $1,300 : 2a. What is the dollar amount of the TOTAL assets that your company has at the end of t27,775 January? 2b. What is the dollar amount of the creditors claims against those assets at the end of $7,390 January? 2c. What is the dollar amount of the owners' claims against the assets at the end of January? 2d. Which financial statement provided you with answers to these questions? 3. Your company is using ACCRUAL accounting. That is, you are recognizing revenues and expenses in the period in which they occur, regardless of when the cash is paid. What is the dollar amount of Cash Collected from Customers during January? (To calculate this amount, you will need review the transactions for January instead of reviewing the $23,075 Balance heet financial statements.) 4. If your company had been using the Cash Basis (instead of accrual basis), how much rent expense would have been recognized on the January Income Statement? 5. If you had not adjusted for the insurance used during the period, would the dollar amount of total assets have been overstated, understated or correct? 6. If you had not adjusted for the revenue earned during the period, would the amount of unearned revenue been overstated, understated or correct? 7. When you began your company, the balance in the retained earnings account was $0.00. What will the balance in retained earnings be when you prepare the formal Balance Sheet? (If using QuickBooks Simple Start, be sure to see software instructions. While Retained Earnings may still appear as $0.00, you will have to update when preparing formal statements.) PROFIT AND LOSS January 2019 TOTAL Income Consulting Revenue 375.00 Service Revenue 3,995.00 Total Income $4,370.00 GROSS PROFIT $4,370.00 Expenses Advertising Expense Insurance Expense 450.00 130.00 Office Supplies Expense Rent Expense 180.00 1,000.00 Repair Supplies Expense Telephone Expense Total Expenses 1,110.00 200.00 $3,070.00 NET OPERATING INCOME $1,300.00 NET INCOME $1,300.00 BALANCE SHEET As of January 31, 2019 TOTAL ASSETS Current Assets Bank Accounts Cash 15,685.00 Total Bank Accounts $15,685.00 Accounts Receivable Accounts Receivable 0.00 Total Accounts Receivable $0.00 Other Current Assets Office Supplies Prepaid Insurance Prepaid Rent 320.00 1,430.00 5,000.00 Repair Supplies 640.00 Total Other Current Assets $7,390.00 Total Current Assets $23,075.00 Fixed Assets Store Equipment 4,700.00 Accumulated Depreciation - Store Equipment Total Store Equipment 0.00 4,700.00 lish (United States) B Store Equipment 4,700.00 Accumulated Depreciation Store Equipment Total Store Equipment 0.00 4,700.00 Total Fixed Assets $4,700.00 TOTAL ASSETS $27,775.00 LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable 4,600.00 Total Accounts Payable $4,600.00 Other Current Liabilities Unearned Revenue 1,875.00 $1,875.00 Total Other Current Liabilities Total Current Liabilities $6,475.00 Total Liabilities $6,475.00 Equity Common Stock $1 Par Value Retained Earnings 20,000.00 1,300.00 Net Income Total Equity $21,300.00 $27,775.00 TOTAL LIABILITIES AND EQUITY glish (UnitedStates)