Answered step by step

Verified Expert Solution

Question

1 Approved Answer

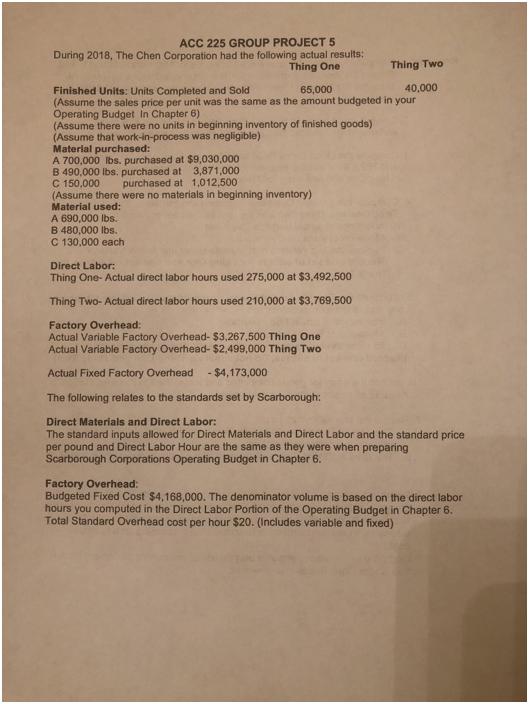

ACC 225 GROUP PROJECT 5 During 2018, The Chen Corporation had the following actual results: Thing One Thing Two Finished Units: Units Completed and

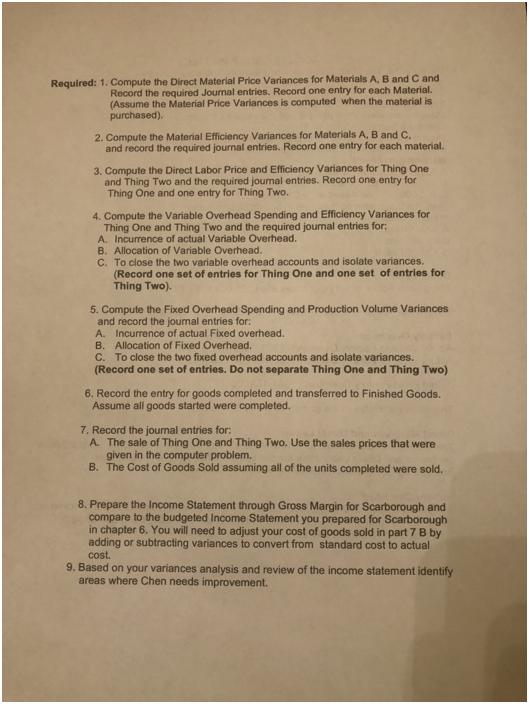

ACC 225 GROUP PROJECT 5 During 2018, The Chen Corporation had the following actual results: Thing One Thing Two Finished Units: Units Completed and Sold 65,000 40,000 (Assume the sales price per unit was the same as the amount budgeted in your Operating Budget In Chapter 6) (Assume there were no units in beginning inventory of finished goods) (Assume that work-in-process was negligible) Material purchased: A 700,000 lbs. purchased at $9,030,000 B 490,000 lbs. purchased at 3,871,000 C 150,000 purchased at 1,012,500 (Assume there were no materials in beginning inventory) Material used: A 690,000 lbs. B 480,000 lbs. C 130,000 each Direct Labor: Thing One-Actual direct labor hours used 275,000 at $3,492,500 Thing Two-Actual direct labor hours used 210,000 at $3,769,500 Factory Overhead: Actual Variable Factory Overhead- $3,267,500 Thing One Actual Variable Factory Overhead- $2,499,000 Thing Two Actual Fixed Factory Overhead - $4,173,000 The following relates to the standards set by Scarborough: Direct Materials and Direct Labor: The standard inputs allowed for Direct Materials and Direct Labor and the standard price per pound and Direct Labor Hour are the same as they were when preparing Scarborough Corporations Operating Budget in Chapter 6. Factory Overhead: Budgeted Fixed Cost $4,168,000. The denominator volume is based on the direct labor hours you computed in the Direct Labor Portion of the Operating Budget in Chapter 6. Total Standard Overhead cost per hour $20. (Includes variable and fixed) Required: 1. Compute the Direct Material Price Variances for Materials A, B and C and Record the required Journal entries. Record one entry for each Material. (Assume the Material Price Variances is computed when the material is purchased). 2. Compute the Material Efficiency Variances for Materials A, B and C. and record the required journal entries. Record one entry for each material. 3. Compute the Direct Labor Price and Efficiency Variances for Thing One and Thing Two and the required journal entries. Record one entry for Thing One and one entry for Thing Two. 4. Compute the Variable Overhead Spending and Efficiency Variances for Thing One and Thing Two and the required journal entries for; A. Incurrence of actual Variable Overhead. B. Allocation of Variable Overhead. C. To close the two variable overhead accounts and isolate variances. (Record one set of entries for Thing One and one set of entries for Thing Two). 5. Compute the Fixed Overhead Spending and Production Volume Variances and record the journal entries for: A. Incurrence of actual Fixed overhead. B. Allocation of Fixed Overhead. C. To close the two fixed overhead accounts and isolate variances. (Record one set of entries. Do not separate Thing One and Thing Two) 6. Record the entry for goods completed and transferred to Finished Goods. Assume all goods started were completed. 7. Record the journal entries for: A The sale of Thing One and Thing Two. Use the sales prices that were given in the computer problem. B. The Cost of Goods Sold assuming all of the units completed were sold. 8. Prepare the Income Statement through Gross Margin for Scarborough and compare to the budgeted Income Statement you prepared for Scarborough in chapter 6. You will need to adjust your cost of goods sold in part 7 B by adding or subtracting variances to convert from standard cost to actual cost. 9. Based on your variances analysis and review of the income statement identify areas where Chen needs improvement.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Direct Material Price Variances for Materials A B and C Material A 700000 lbs purchased at 9030000 Direct Material Price Variance 9030000 9000000 700000 6000 Journal Entry Debit Credit Inventory 600...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started