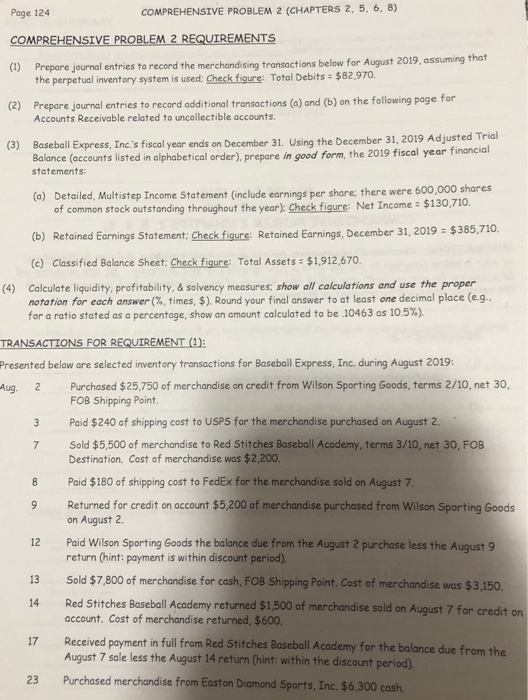

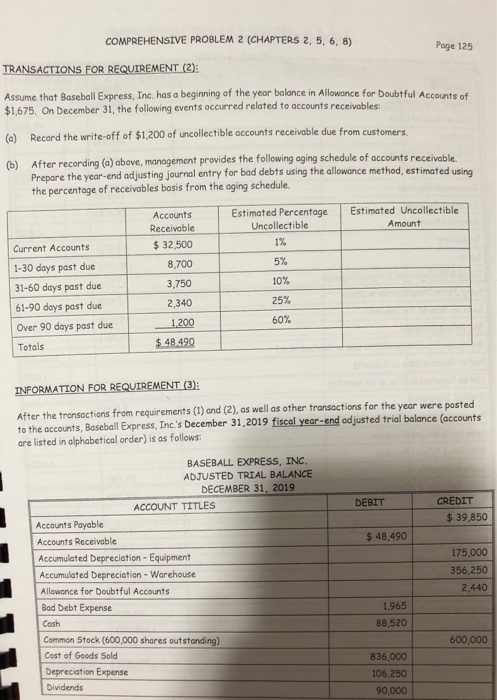

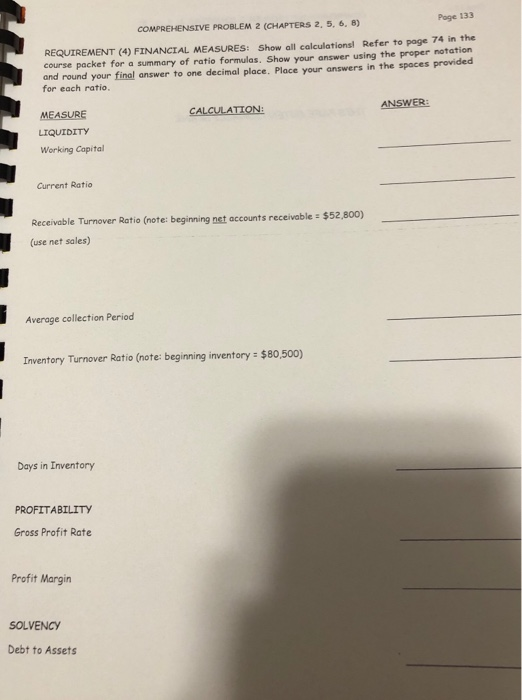

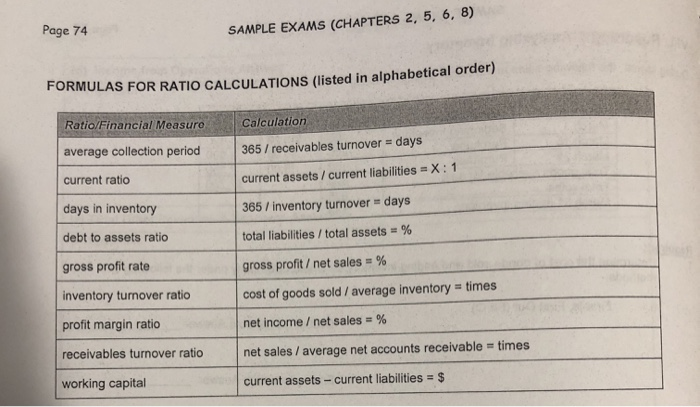

ACC 255 FALL 2019 COVER SHEET FOR COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) INSTRUCTIONS: Complete all requirements for the comprehensive problem and turn in the original of your problem (stapled) by the due date & time specified by your professor. No late problems will be accepted for any reason!!! You should take pictures of your solution to check your answers with the solutions which will be provided on BbLearn. REQUIREMENTS: (1) PREPARE JOURNAL ENTRIES FOR MERCHANDISING TRANSACTIONS (2) PREPARE JOURNAL ENTRIES FOR ACCOUNTS RECEIVABLE TRANSACTIONS PREPARE FINANCIAL STATEMENTS: (a) MULTIPLE-STEP INCOME STATEMENT (b) RETAINED EARNINGS STATEMENT (c) CLASSIFIED BALANCE SHEET (4) CALCULATE LIQUIDITY, PROFITABILITY, & SOLVENCY MEASURES Page 124 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) COMPREHENSIVE PROBLEM 2 REQUIREMENTS (1) Prepare journal entries to record the merchandising transactions below for August 2019, assuming that the perpetual inventory system is used: Check figure: Total Debits = $82,970. (2) Prepare journal entries to record additional transactions (a) and (b) on the following page for Accounts Receivable related to uncollectible accounts. (3) Baseball Express, Inc.'s fiscal year ends on December 31. Using the December 31, 2019 Adjusted Trial Balance (accounts listed in alphabetical order), prepare in good form, the 2019 fiscal year financial statements: (a) Detailed, Multistep Income Statement (include earnings per share there were 600,000 shares of common stock outstanding throughout the year): Check figure: Net Income = $130,710. (b) Retained Earnings Statement: Check figure: Retained Earnings, December 31, 2019 = $385,710. (c) Classified Balance Sheet: Check figure: Total Assets = $1,912,670. (4) Calculate liquidity, profitability, & solvency measures: show all calculations and use the proper notation for each answer (%, times, $). Round your final answer to at least one decimal place (e.g. for a ratio stated as a percentage, show an amount calculated to be 10463 as 10.5%). TRANSACTIONS FOR REQUIREMENT (1): Presented below are selected inventory transactions for Baseball Express, Inc. during August 2019: Aug. 2 Purchased $25,750 of merchandise on credit from Wilson Sporting Goods, terms 2/10, net 30. FOB Shipping Point. Paid $240 of shipping cost to USPS for the merchandise purchased on August 2. Sold $5,500 of merchandise to Red Stitches Baseball Academy, terms 3/10, net 30, FOB Destination Cost of merchandise was $2,200. Paid $180 of shipping cost to FedEx for the merchandise sold on August 7. Returned for credit on account $5,200 of merchandise purchased from Wilson Sporting Goods on August 2 Paid Wilson Sporting Goods the balance due from the August 2 purchase less the August 9 return (hint: payment is within discount period). Sold $7,800 of merchandise for cash, FOB Shipping Point Cost of merchandise was $3,150, Red Stitches Baseball Academy returned $1,500 of merchandise sold on August 7 for credit on account. Cost of merchandise returned, $600. Received payment in full from Red Stitches Baseball Academy for the balance due from the August 7 sale less the August 14 return (hint: within the discount period) Purchased merchandise from Easton Diamond Sports, Inc. $6,300 cash 17 23 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) Page 125 TRANSACTIONS FOR REQUIREMENT (2): Assume that Baseball Express, Inc. has a beginning of the year balance in Allowance for Doubtful Accounts of $1,675. On December 31, the following events occurred related to accounts receivables: (a) Record the write-off of $1,200 of uncollectible accounts receivable due from customers (b) After recording (a) above, management provides the following aging schedule of accounts receivable Prepare the year-end adjusting journal entry for bad debts using the allowance method, estimated using the percentage of receivables basis from the aging schedule. Estimated Percentage Uncollectible 1% Estimated Uncollectible Amount Accounts Receivable $ 32,500 8,700 Current Accounts 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due 3,750 2,340 5% 10% 25% 60% 1200 $ 48.490 Totals INFORMATION FOR REQUIREMENT (3): After the transactions from requirements (1) and (2), as well as other transactions for the year were posted to the accounts, Baseball Express, Inc.'s December 31, 2019 fiscal year-end adjusted trial balance (accounts are listed in alphabetical order) is as follows: DEBIT CREDIT $ 39,850 $ 48,490 BASEBALL EXPRESS, INC. ADJUSTED TRIAL BALANCE DECEMBER 31, 2019 ACCOUNT TITLES Accounts Payable Accounts Receivable Accumulated Depreciation - Equipment Accumulated Depreciation - Warehouse Allowance for Doubtful Accounts Bad Debt Expense Cash Common Stock (600,000 shares outstanding) Cost of Goods Sold Depreciation Expense Dividends 175,000 356,250 2.440 1,965 88,520 600,000 836,000 106,250 90,000 Page 126 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) CREDIT DEBIT 245,000 14,935 25,800 95,000 46,830 6,585 18,800 26,400 2,600 93,500 185,000 11,700 76,500 5,200 25,360 ACCOUNT TITLES Equipment Freight-Out Expense Gain on Sale of Land Goodwill Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Payable Inventory Land Legal & Professional Service Expense Long-Term Investments in Stock Loss on Sale of Equipment Marketing Expense Mortgage Payable ($60,000 due within one year) Notes Payable (due in 2 years) Notes Receivable (due in 18 months) Prepaid Insurance Retained Earnings (January 1, 2019) Salaries & Wages Expense Salaries & Wages Payable Sales Discounts Sales Returns & Allowances Sales Revenue Short-Term Debt Investments Supplies Supplies Expense Trademarks Unearned Sales Revenue Utilities Expense Warehouse 800,000 71,000 7,000 6,800 345,000 175,000 4,300 33,250 82,750 1,520,000 15,000 2,600 5,850 157.950 2,625 24,800 1,425,000 Totals $ 3.951.450 $3.951.450 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) Page 127 GENERAL JOURNAL ACCOUNT TITLES REQUIREMENT (1) JOURNAL ENTRIES: DEBIT DATE 2019 CREDIT Page 128 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) GENERAL JOURNAL ACCOUNT TITLES DEBIT CREDIT DATE 2019 REQUIREMENT (2) JOURNAL ENTRIES: (a) Dec. 31 (b) Dec. 31 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) Page 129 BASEBALL EXPRESS, INC. INCOME STATEMENT Complete the date line = Page 130 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) INCOME STATEMENT (CONTINUED) BASEBALL EXPRESS, INC. RETAINED EARNINGS STATEMENT Complete the date line Page 131 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6. 8) BASEBALL EXPRESS, INC. BALANCE SHEET Complete the date line Page 132 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) BALANCE SHEET (CONTINUED) COMPREHENSIVE PROBLEM 2 (CHAPTERS 2.5, 6, ) Page 133 REQUIREMENT (4) FINANCIAL MEASURES: Show all calculations Refer to page 74 in the course pocket for a summary of ratio formulas. Show your answer using the proper notation and round your final answer to one decimal place. Place your answers in the spaces provided for each ratio. ANSWER: CALCULATION: MEASURE LIQUIDITY Working Capital Current Ratio Receivable Turnover Ratio (note: beginning net accounts receivable = $52,800) (use net sales) Average collection Period Inventory Turnover Ratio (note: beginning inventory = $80,500) Days in Inventory PROFITABILITY Gross Profit Rate Profit Margin SOLVENCY Debt to Assets Page 74 SAMPLE EXAMS (CHAPTERS 2, 5, 6, 8) FORMULAS FOR RATIO CALCULATIONS (listed in alphabetical order) Ratio/Financial Measure Calculation 365 / receivables turnover = days average collection period current ratio current assets/ current liabilities = X: 1 days in inventory 365 / inventory turnover - days debt to assets ratio total liabilities / total assets - % gross profit rate gross profit/ net sales = % inventory turnover ratio cost of goods sold / average inventory = times profit margin ratio net income / net sales = % receivables turnover ratio net sales / average net accounts receivable = times working capital current assets -current liabilities = $ ACC 255 FALL 2019 COVER SHEET FOR COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) INSTRUCTIONS: Complete all requirements for the comprehensive problem and turn in the original of your problem (stapled) by the due date & time specified by your professor. No late problems will be accepted for any reason!!! You should take pictures of your solution to check your answers with the solutions which will be provided on BbLearn. REQUIREMENTS: (1) PREPARE JOURNAL ENTRIES FOR MERCHANDISING TRANSACTIONS (2) PREPARE JOURNAL ENTRIES FOR ACCOUNTS RECEIVABLE TRANSACTIONS PREPARE FINANCIAL STATEMENTS: (a) MULTIPLE-STEP INCOME STATEMENT (b) RETAINED EARNINGS STATEMENT (c) CLASSIFIED BALANCE SHEET (4) CALCULATE LIQUIDITY, PROFITABILITY, & SOLVENCY MEASURES Page 124 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) COMPREHENSIVE PROBLEM 2 REQUIREMENTS (1) Prepare journal entries to record the merchandising transactions below for August 2019, assuming that the perpetual inventory system is used: Check figure: Total Debits = $82,970. (2) Prepare journal entries to record additional transactions (a) and (b) on the following page for Accounts Receivable related to uncollectible accounts. (3) Baseball Express, Inc.'s fiscal year ends on December 31. Using the December 31, 2019 Adjusted Trial Balance (accounts listed in alphabetical order), prepare in good form, the 2019 fiscal year financial statements: (a) Detailed, Multistep Income Statement (include earnings per share there were 600,000 shares of common stock outstanding throughout the year): Check figure: Net Income = $130,710. (b) Retained Earnings Statement: Check figure: Retained Earnings, December 31, 2019 = $385,710. (c) Classified Balance Sheet: Check figure: Total Assets = $1,912,670. (4) Calculate liquidity, profitability, & solvency measures: show all calculations and use the proper notation for each answer (%, times, $). Round your final answer to at least one decimal place (e.g. for a ratio stated as a percentage, show an amount calculated to be 10463 as 10.5%). TRANSACTIONS FOR REQUIREMENT (1): Presented below are selected inventory transactions for Baseball Express, Inc. during August 2019: Aug. 2 Purchased $25,750 of merchandise on credit from Wilson Sporting Goods, terms 2/10, net 30. FOB Shipping Point. Paid $240 of shipping cost to USPS for the merchandise purchased on August 2. Sold $5,500 of merchandise to Red Stitches Baseball Academy, terms 3/10, net 30, FOB Destination Cost of merchandise was $2,200. Paid $180 of shipping cost to FedEx for the merchandise sold on August 7. Returned for credit on account $5,200 of merchandise purchased from Wilson Sporting Goods on August 2 Paid Wilson Sporting Goods the balance due from the August 2 purchase less the August 9 return (hint: payment is within discount period). Sold $7,800 of merchandise for cash, FOB Shipping Point Cost of merchandise was $3,150, Red Stitches Baseball Academy returned $1,500 of merchandise sold on August 7 for credit on account. Cost of merchandise returned, $600. Received payment in full from Red Stitches Baseball Academy for the balance due from the August 7 sale less the August 14 return (hint: within the discount period) Purchased merchandise from Easton Diamond Sports, Inc. $6,300 cash 17 23 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) Page 125 TRANSACTIONS FOR REQUIREMENT (2): Assume that Baseball Express, Inc. has a beginning of the year balance in Allowance for Doubtful Accounts of $1,675. On December 31, the following events occurred related to accounts receivables: (a) Record the write-off of $1,200 of uncollectible accounts receivable due from customers (b) After recording (a) above, management provides the following aging schedule of accounts receivable Prepare the year-end adjusting journal entry for bad debts using the allowance method, estimated using the percentage of receivables basis from the aging schedule. Estimated Percentage Uncollectible 1% Estimated Uncollectible Amount Accounts Receivable $ 32,500 8,700 Current Accounts 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due 3,750 2,340 5% 10% 25% 60% 1200 $ 48.490 Totals INFORMATION FOR REQUIREMENT (3): After the transactions from requirements (1) and (2), as well as other transactions for the year were posted to the accounts, Baseball Express, Inc.'s December 31, 2019 fiscal year-end adjusted trial balance (accounts are listed in alphabetical order) is as follows: DEBIT CREDIT $ 39,850 $ 48,490 BASEBALL EXPRESS, INC. ADJUSTED TRIAL BALANCE DECEMBER 31, 2019 ACCOUNT TITLES Accounts Payable Accounts Receivable Accumulated Depreciation - Equipment Accumulated Depreciation - Warehouse Allowance for Doubtful Accounts Bad Debt Expense Cash Common Stock (600,000 shares outstanding) Cost of Goods Sold Depreciation Expense Dividends 175,000 356,250 2.440 1,965 88,520 600,000 836,000 106,250 90,000 Page 126 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) CREDIT DEBIT 245,000 14,935 25,800 95,000 46,830 6,585 18,800 26,400 2,600 93,500 185,000 11,700 76,500 5,200 25,360 ACCOUNT TITLES Equipment Freight-Out Expense Gain on Sale of Land Goodwill Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Payable Inventory Land Legal & Professional Service Expense Long-Term Investments in Stock Loss on Sale of Equipment Marketing Expense Mortgage Payable ($60,000 due within one year) Notes Payable (due in 2 years) Notes Receivable (due in 18 months) Prepaid Insurance Retained Earnings (January 1, 2019) Salaries & Wages Expense Salaries & Wages Payable Sales Discounts Sales Returns & Allowances Sales Revenue Short-Term Debt Investments Supplies Supplies Expense Trademarks Unearned Sales Revenue Utilities Expense Warehouse 800,000 71,000 7,000 6,800 345,000 175,000 4,300 33,250 82,750 1,520,000 15,000 2,600 5,850 157.950 2,625 24,800 1,425,000 Totals $ 3.951.450 $3.951.450 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) Page 127 GENERAL JOURNAL ACCOUNT TITLES REQUIREMENT (1) JOURNAL ENTRIES: DEBIT DATE 2019 CREDIT Page 128 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) GENERAL JOURNAL ACCOUNT TITLES DEBIT CREDIT DATE 2019 REQUIREMENT (2) JOURNAL ENTRIES: (a) Dec. 31 (b) Dec. 31 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) Page 129 BASEBALL EXPRESS, INC. INCOME STATEMENT Complete the date line = Page 130 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) INCOME STATEMENT (CONTINUED) BASEBALL EXPRESS, INC. RETAINED EARNINGS STATEMENT Complete the date line Page 131 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6. 8) BASEBALL EXPRESS, INC. BALANCE SHEET Complete the date line Page 132 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5, 6, 8) BALANCE SHEET (CONTINUED) COMPREHENSIVE PROBLEM 2 (CHAPTERS 2.5, 6, ) Page 133 REQUIREMENT (4) FINANCIAL MEASURES: Show all calculations Refer to page 74 in the course pocket for a summary of ratio formulas. Show your answer using the proper notation and round your final answer to one decimal place. Place your answers in the spaces provided for each ratio. ANSWER: CALCULATION: MEASURE LIQUIDITY Working Capital Current Ratio Receivable Turnover Ratio (note: beginning net accounts receivable = $52,800) (use net sales) Average collection Period Inventory Turnover Ratio (note: beginning inventory = $80,500) Days in Inventory PROFITABILITY Gross Profit Rate Profit Margin SOLVENCY Debt to Assets Page 74 SAMPLE EXAMS (CHAPTERS 2, 5, 6, 8) FORMULAS FOR RATIO CALCULATIONS (listed in alphabetical order) Ratio/Financial Measure Calculation 365 / receivables turnover = days average collection period current ratio current assets/ current liabilities = X: 1 days in inventory 365 / inventory turnover - days debt to assets ratio total liabilities / total assets - % gross profit rate gross profit/ net sales = % inventory turnover ratio cost of goods sold / average inventory = times profit margin ratio net income / net sales = % receivables turnover ratio net sales / average net accounts receivable = times working capital current assets -current liabilities = $