Answered step by step

Verified Expert Solution

Question

1 Approved Answer

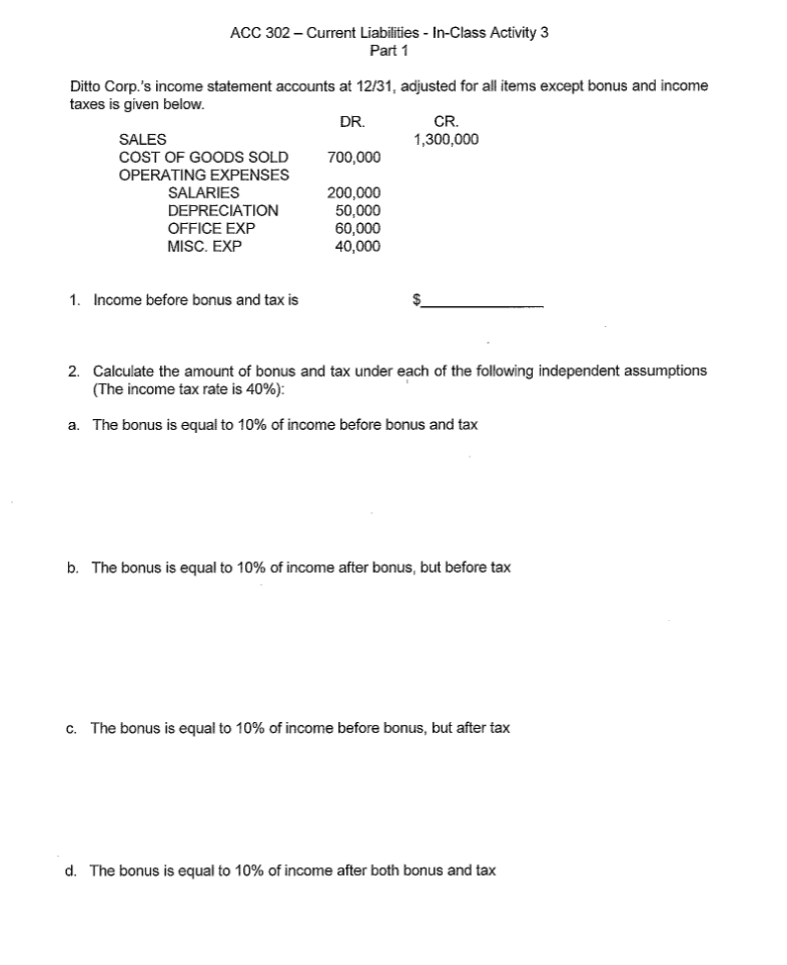

ACC 302 - Current Liabilities - In-Class Activity 3 Part 1 Ditto Corp.'s income statement accounts at 12/31, adjusted for all items except bonus and

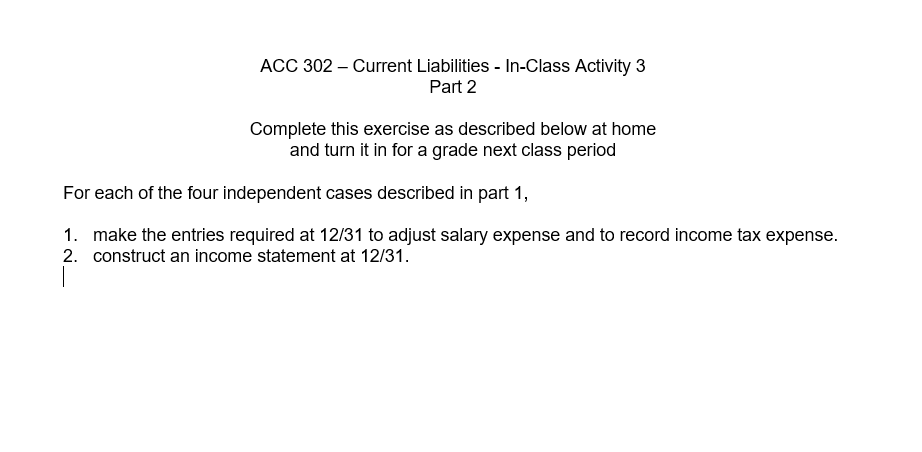

ACC 302 - Current Liabilities - In-Class Activity 3 Part 1 Ditto Corp.'s income statement accounts at 12/31, adjusted for all items except bonus and income taxes is given below. 1. Income before bonus and tax is $ 2. Calculate the amount of bonus and tax under each of the following independent assumptions (The income tax rate is 40% ): a. The bonus is equal to 10% of income before bonus and tax b. The bonus is equal to 10% of income after bonus, but before tax c. The bonus is equal to 10% of income before bonus, but after tax d. The bonus is equal to 10% of income after both bonus and tax ACC 302 - Current Liabilities - In-Class Activity 3 Part 2 Complete this exercise as described below at home and turn it in for a grade next class period For each of the four independent cases described in part 1 , make the entries required at 12/31 to adjust salary expense and to record income tax expense. construct an income statement at 12/31. ACC 302 - Current Liabilities - In-Class Activity 3 Part 1 Ditto Corp.'s income statement accounts at 12/31, adjusted for all items except bonus and income taxes is given below. 1. Income before bonus and tax is $ 2. Calculate the amount of bonus and tax under each of the following independent assumptions (The income tax rate is 40% ): a. The bonus is equal to 10% of income before bonus and tax b. The bonus is equal to 10% of income after bonus, but before tax c. The bonus is equal to 10% of income before bonus, but after tax d. The bonus is equal to 10% of income after both bonus and tax ACC 302 - Current Liabilities - In-Class Activity 3 Part 2 Complete this exercise as described below at home and turn it in for a grade next class period For each of the four independent cases described in part 1 , make the entries required at 12/31 to adjust salary expense and to record income tax expense. construct an income statement at 12/31

ACC 302 - Current Liabilities - In-Class Activity 3 Part 1 Ditto Corp.'s income statement accounts at 12/31, adjusted for all items except bonus and income taxes is given below. 1. Income before bonus and tax is $ 2. Calculate the amount of bonus and tax under each of the following independent assumptions (The income tax rate is 40% ): a. The bonus is equal to 10% of income before bonus and tax b. The bonus is equal to 10% of income after bonus, but before tax c. The bonus is equal to 10% of income before bonus, but after tax d. The bonus is equal to 10% of income after both bonus and tax ACC 302 - Current Liabilities - In-Class Activity 3 Part 2 Complete this exercise as described below at home and turn it in for a grade next class period For each of the four independent cases described in part 1 , make the entries required at 12/31 to adjust salary expense and to record income tax expense. construct an income statement at 12/31. ACC 302 - Current Liabilities - In-Class Activity 3 Part 1 Ditto Corp.'s income statement accounts at 12/31, adjusted for all items except bonus and income taxes is given below. 1. Income before bonus and tax is $ 2. Calculate the amount of bonus and tax under each of the following independent assumptions (The income tax rate is 40% ): a. The bonus is equal to 10% of income before bonus and tax b. The bonus is equal to 10% of income after bonus, but before tax c. The bonus is equal to 10% of income before bonus, but after tax d. The bonus is equal to 10% of income after both bonus and tax ACC 302 - Current Liabilities - In-Class Activity 3 Part 2 Complete this exercise as described below at home and turn it in for a grade next class period For each of the four independent cases described in part 1 , make the entries required at 12/31 to adjust salary expense and to record income tax expense. construct an income statement at 12/31 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started