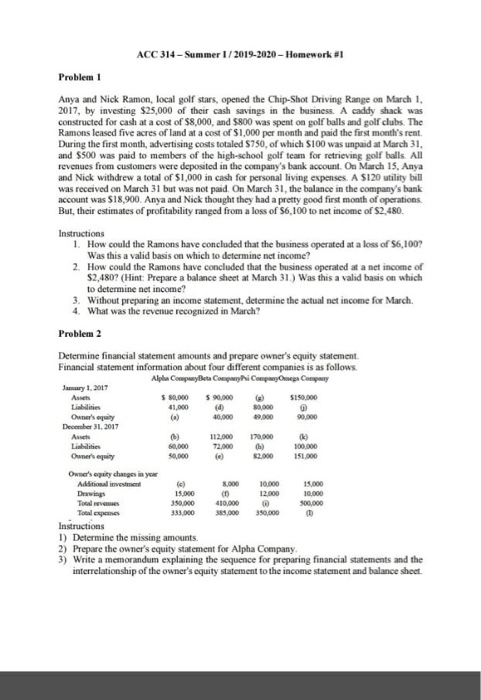

ACC 314 - Summer 1/2019-2020 - Homework #1 Problem 1 Anya and Nick Ramon, local golf stars, opened the Chip-Shot Driving Range on March 1, 2017, by investing $25,000 of their cash savings in the business. A caddy shack was constructed for cash at a cost of $8,000, and $800 was spent on golf balls and golf clubs. The Ramons leased five acres of land at a cost of $1,000 per month and paid the first month's rent. During the first month, advertising costs totaled S750, of which S100 was unpaid at March 31, and $500 was paid to members of the high-school golf team for retrieving golf balls. All revenues from customers were deposited in the company's bank account. On March 15, Anya and Nick withdrew a total of $1,000 in cash for personal living expenses. A $120 utility bill was received on March 31 but was not paid. On March 31, the balance in the company's bank account was $18,900. Anya and Nick thought they had a pretty good first month of operations But, their estimates of profitability ranged from a loss of 56,100 to net income of 52,480. Instructions 1. How could the Ramons have concluded that the business operated at a loss of S6,100? Was this a valid basis on which to determine net income? 2. How could the Ramons have concluded that the business operated at a net income of $2,480? (Hint: Prepare a balance sheet at March 31.) Was this a valid basis on which to determine net income? 3. Without preparing an income statement, determine the actual net income for March 4. What was the revenue recognized in March? Problem 2 Determine financial statement amounts and prepare owner's equity statement Financial statement information about four different companies is as follows. Alphus Complete Company Company Omega Company Jamy 1, 2017 Ae $ 30,000 $ 0.00 $150,000 Liabilities 41,000 80,000 Owner's 40.000 90.000 December 31, 2017 Anh 170,000 60,000 72.000 0) 100.000 Owner's quity 50,000 151.000 Owner's may changes in your Additional investment 8.000 10.000 Dewings 15.000 12.000 10.000 Totalves 350.000 410,000 500,000 385,000 350.000 Instructions 1) Determine the missing amounts. 2) Prepare the owner's equity statement for Alpha Company 3) Write a memorandum explaining the sequence for preparing financial statements and the interrelationship of the owner's equity statement to the income statement and balance sheet. k