Answered step by step

Verified Expert Solution

Question

1 Approved Answer

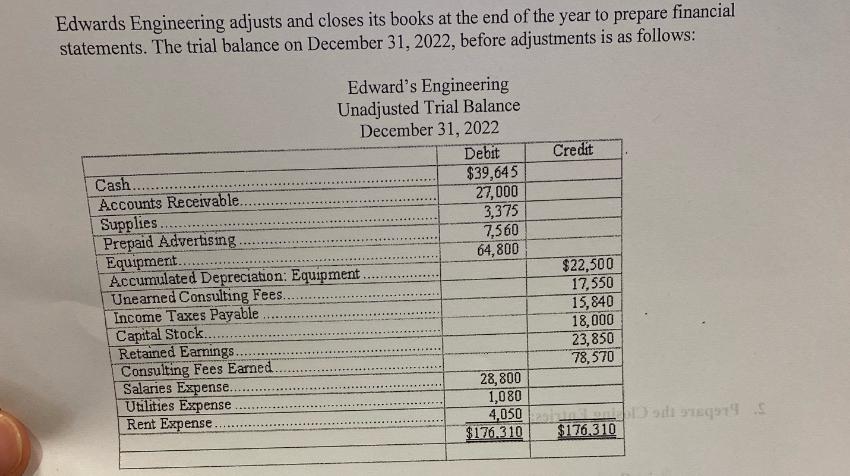

Edwards Engineering adjusts and closes its books at the end of the year to prepare financial statements. The trial balance on December 31, 2022,

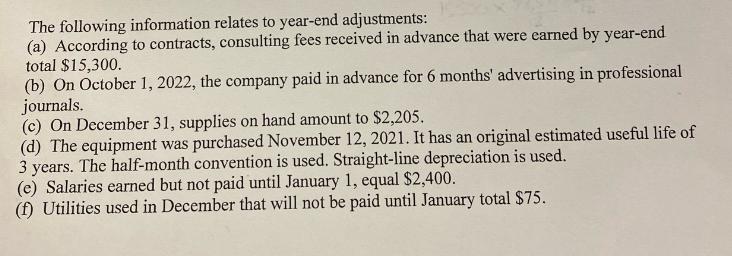

Edwards Engineering adjusts and closes its books at the end of the year to prepare financial statements. The trial balance on December 31, 2022, before adjustments is as follows: Edward's Engineering Unadjusted Trial Balance Cash. Accounts Receivable. Supplies. Prepaid Advertising. Equipment. Accumulated Depreciation: Equipment. Unearned Consulting Fees... Income Taxes Payable Capital Stock... Retained Earnings. Consulting Fees Earned. Salaries Expense.. Utilities Expense Rent Expense.. December 31, 2022 Debit Credit $39,645 27,000 3,375 7,560 64,800 $22,500 17,550 15,840 18,000 23,850 78,570 28,800 1,080 4,050 $176.310 $176.310 The following information relates to year-end adjustments: (a) According to contracts, consulting fees received in advance that were earned by year-end total $15,300. (b) On October 1, 2022, the company paid in advance for 6 months' advertising in professional journals. (c) On December 31, supplies on hand amount to $2,205. (d) The equipment was purchased November 12, 2021. It has an original estimated useful life of 3 years. The half-month convention is used. Straight-line depreciation is used. (e) Salaries earned but not paid until January 1, equal $2,400. (f) Utilities used in December that will not be paid until January total $75.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The information provided relates to yearend adjustments for Edwards Engineering Based on the adjustments provided we can calculate the necessary adjus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started