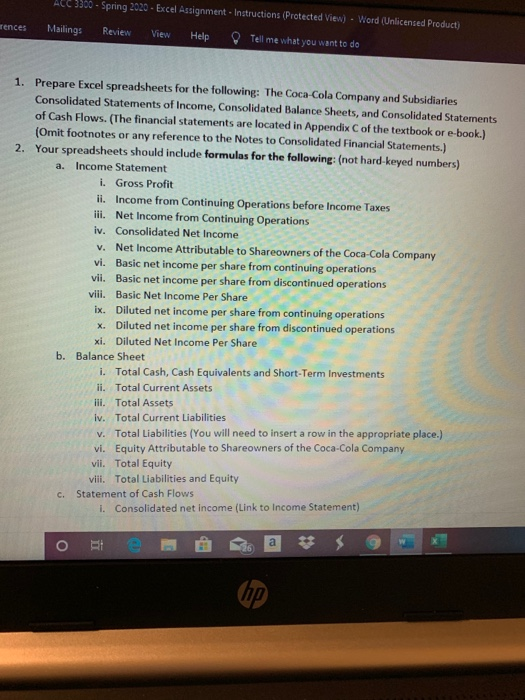

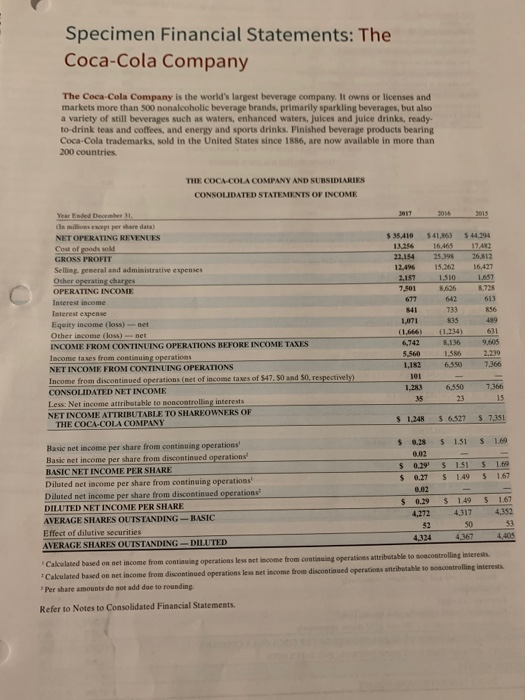

ACC 3360 - Spring 2020 - Excel Assignment - Instructions (Protected view) - Word (Unlicensed Product) mences Mailings Review View Help Tell me what you want to do 1. Prepare Excel spreadsheets for the following: The Coca-Cola Company and Subsidiaries Consolidated Statements of Income, Consolidated Balance Sheets, and Consolidated Statements of Cash Flows. (The financial statements are located in Appendix C of the textbook or e-book.) (Omit footnotes or any reference to the Notes to Consolidated Financial Statements.) 2. Your spreadsheets should include formulas for the following: (not hard-keyed numbers) a. Income Statement i. Gross Profit il. Income from Continuing Operations before Income Taxes iii. Net Income from Continuing Operations iv. Consolidated Net Income V. Net Income Attributable to Shareowners of the Coca-Cola Company vi. Basic net income per share from continuing operations vil. Basic net income per share from discontinued operations viii. Basic Net Income Per Share ix. Diluted net income per share from continuing operations X. Diluted net income per share from discontinued operations xi. Diluted Net Income Per Share b. Balance Sheet i. Total Cash, Cash Equivalents and Short-Term Investments ii. Total Current Assets iii. Total Assets iv. Total Current Liabilities V. Total Liabilities (You will need to insert a row in the appropriate place.) vi. Equity Attributable to Shareowners of the Coca-Cola Company vii. Total Equity viii. Total Liabilities and Equity c. Statement of Cash Flows I. Consolidated net income (Link to Income Statement) Specimen Financial Statements: The Coca-Cola Company The Coca-Cola Company is the world's largest beverage company. It owns or licenses and markets more than 500 nonalcoholic beverage brands. primarily sparkling beverages, but also a variety of still beverages such as waters, enhanced waters, Juices and juice drinks, ready. to-drink teas and coffees, and energy and sports drinks. Finished beverage products bearing Coca-Cola trademarks, sold in the United States since 1886, are now available in more than 200 countries THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME 2017 2016 Year Ended December 31. (in millions except per share data) NET OPERATING REVENUES Cost of poods sold GROSS PROFIT Selling general and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss) - net $35.410 13,256 22,154 12,496 2.157 7.501 541,363 16,465 25.393 15.262 1.510 8,626 $44.294 17,482 26,812 16,427 1.657 8.728 1,071 (1,656) 631 Other 733 835 (1,234) 8,136 5 .550 6 7.366 INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income from discontinued operations (net of income taxes of $47. SO and $0, respectively) CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 5.500 1,182 101 1.283 6.550 7,366 2315 35 $ 1.248 $ 6.527 $ 7,351 $ $ 1.51 $ 1.69 0.28 002 0.19 0.27 $ $ $ $ 1.51 1.49 $ $ 1.69 1.67 Basic net income per share from continuing operations Basie net income per share from discontinued operations BASIC NET INCOME PER SHARE Diluted set income per share from continuing operations! Diluted net income per share from discontinued operations DILUTED NET INCOME PER SHARE AVERAGE SHARES OUTSTANDING-BASIC Effect of dilutive securities AVERAGE SHARES OUTSTANDING DILUTED $ $ 0.19 $ 4,2724 $ 2 4.334 1.49 ,317 50 4367 1.67 4.352 $3 4.405 Calculated based on net income from continuing operations less net income from continuing operations attributable to socontrolling Interests Calculated based on net income from discontinued operations less net income from discontinued operations attributable to controlling interests Per share amounts do not add due to rounding. Refer to Notes to Consolidated Financial Statements. ACC 3360 - Spring 2020 - Excel Assignment - Instructions (Protected view) - Word (Unlicensed Product) mences Mailings Review View Help Tell me what you want to do 1. Prepare Excel spreadsheets for the following: The Coca-Cola Company and Subsidiaries Consolidated Statements of Income, Consolidated Balance Sheets, and Consolidated Statements of Cash Flows. (The financial statements are located in Appendix C of the textbook or e-book.) (Omit footnotes or any reference to the Notes to Consolidated Financial Statements.) 2. Your spreadsheets should include formulas for the following: (not hard-keyed numbers) a. Income Statement i. Gross Profit il. Income from Continuing Operations before Income Taxes iii. Net Income from Continuing Operations iv. Consolidated Net Income V. Net Income Attributable to Shareowners of the Coca-Cola Company vi. Basic net income per share from continuing operations vil. Basic net income per share from discontinued operations viii. Basic Net Income Per Share ix. Diluted net income per share from continuing operations X. Diluted net income per share from discontinued operations xi. Diluted Net Income Per Share b. Balance Sheet i. Total Cash, Cash Equivalents and Short-Term Investments ii. Total Current Assets iii. Total Assets iv. Total Current Liabilities V. Total Liabilities (You will need to insert a row in the appropriate place.) vi. Equity Attributable to Shareowners of the Coca-Cola Company vii. Total Equity viii. Total Liabilities and Equity c. Statement of Cash Flows I. Consolidated net income (Link to Income Statement) Specimen Financial Statements: The Coca-Cola Company The Coca-Cola Company is the world's largest beverage company. It owns or licenses and markets more than 500 nonalcoholic beverage brands. primarily sparkling beverages, but also a variety of still beverages such as waters, enhanced waters, Juices and juice drinks, ready. to-drink teas and coffees, and energy and sports drinks. Finished beverage products bearing Coca-Cola trademarks, sold in the United States since 1886, are now available in more than 200 countries THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME 2017 2016 Year Ended December 31. (in millions except per share data) NET OPERATING REVENUES Cost of poods sold GROSS PROFIT Selling general and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss) - net $35.410 13,256 22,154 12,496 2.157 7.501 541,363 16,465 25.393 15.262 1.510 8,626 $44.294 17,482 26,812 16,427 1.657 8.728 1,071 (1,656) 631 Other 733 835 (1,234) 8,136 5 .550 6 7.366 INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income from discontinued operations (net of income taxes of $47. SO and $0, respectively) CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 5.500 1,182 101 1.283 6.550 7,366 2315 35 $ 1.248 $ 6.527 $ 7,351 $ $ 1.51 $ 1.69 0.28 002 0.19 0.27 $ $ $ $ 1.51 1.49 $ $ 1.69 1.67 Basic net income per share from continuing operations Basie net income per share from discontinued operations BASIC NET INCOME PER SHARE Diluted set income per share from continuing operations! Diluted net income per share from discontinued operations DILUTED NET INCOME PER SHARE AVERAGE SHARES OUTSTANDING-BASIC Effect of dilutive securities AVERAGE SHARES OUTSTANDING DILUTED $ $ 0.19 $ 4,2724 $ 2 4.334 1.49 ,317 50 4367 1.67 4.352 $3 4.405 Calculated based on net income from continuing operations less net income from continuing operations attributable to socontrolling Interests Calculated based on net income from discontinued operations less net income from discontinued operations attributable to controlling interests Per share amounts do not add due to rounding. Refer to Notes to Consolidated Financial Statements