Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACC 460 TAX PROBLEM # 5, SPRING 2022 (15 pts.) PART 1. Anthony and Kate are married and wish to file a joint return

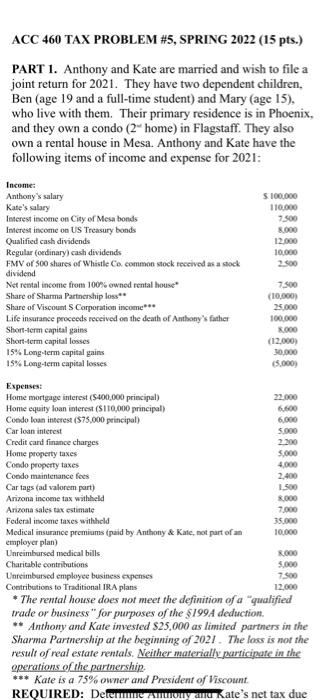

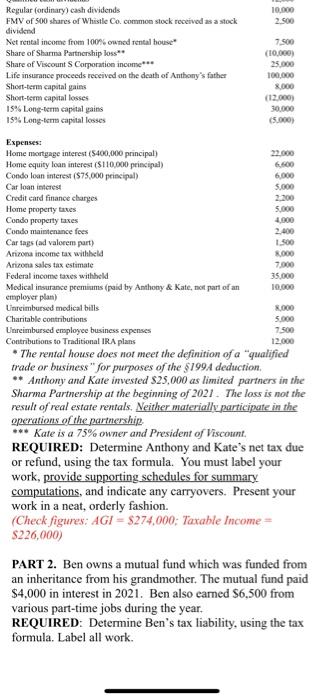

ACC 460 TAX PROBLEM # 5, SPRING 2022 (15 pts.) PART 1. Anthony and Kate are married and wish to file a joint return for 2021. They have two dependent children, Ben (age 19 and a full-time student) and Mary (age 15), who live with them. Their primary residence is in Phoenix, and they own a condo (2" home) in Flagstaff. They also own a rental house in Mesa. Anthony and Kate have the following items of income and expense for 2021: Income: Anthony's salary Kate's salary Interest income on City of Mesa bonds $ 100,000 110,000 7500 8,000 Interest income on US Treasury bonds Qualified cash dividends 12,000 Regular (ordinary) cash dividends 10,000 FMV of 500 shares of Whistle Co. common stock received as a stock dividend 2,500 Net rental income from 100% owned rental house" 7,500 Share of Sharma Partnership loss** (10,000) Share of Viscount S Corporation income*** 25,000 Life insurance proceeds received on the death of Anthony's father 100,000 Short-term capital gains 8,000 Short-term capital losses (12,000) 15% Long-term capital gains 30,000 15% Long-term capital losses (5,000) Expenses: Home mortgage interest ($400,000 principal) 22,000 Home equity loan interest ($110,000 principal) 6,600 Condo loan interest ($75,000 principal) 6,000 Car loan interest 5,000 Credit card finance charges 2,200 Home property taxes Condo property taxes Condo maintenance fees Car tags (ad valorem part) 5,000 4,000 2,400 1,500 Arizona income tax withheld Arizona sales tax estimate Federal income taxes withheld employer plan) Unreimbursed medical bills Charitable contributions Unreimbursed employee business expenses Contributions to Traditional IRA plans 8,000 7,000 35,000 Medical insurance premiums (paid by Anthony & Kate, not part of an 10,000 8,000 5,000 7.500 12,000 *The rental house does not meet the definition of a "qualified trade or business" for purposes of the $199A deduction. **Anthony and Kate invested $25,000 as limited partners in the Sharma Partnership at the beginning of 2021. The loss is not the result of real estate rentals. Neither materially participate in the operations of the partnership. *** Kate is a 75% owner and President of Viscount REQUIRED: Determine Ammony and Kate's net tax due

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started