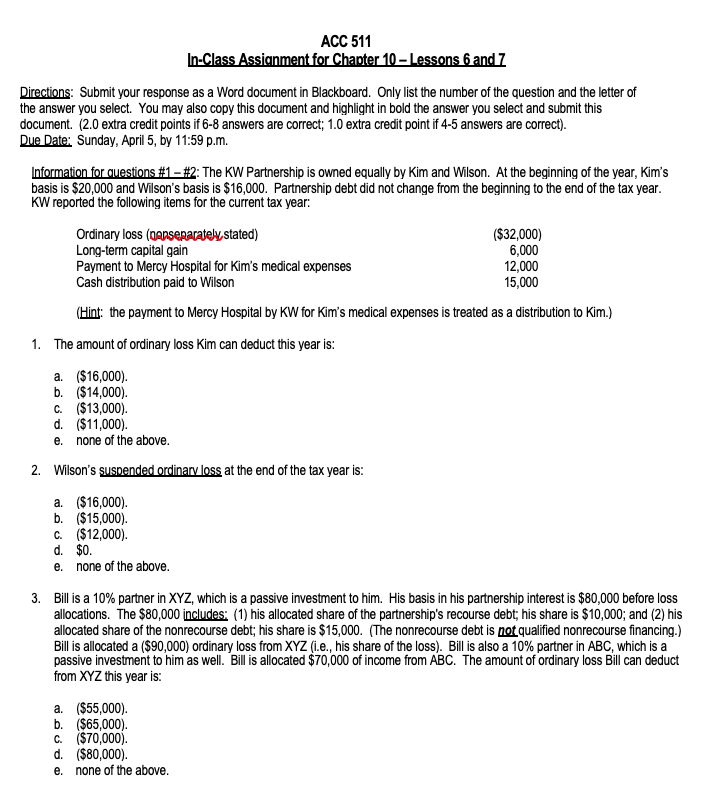

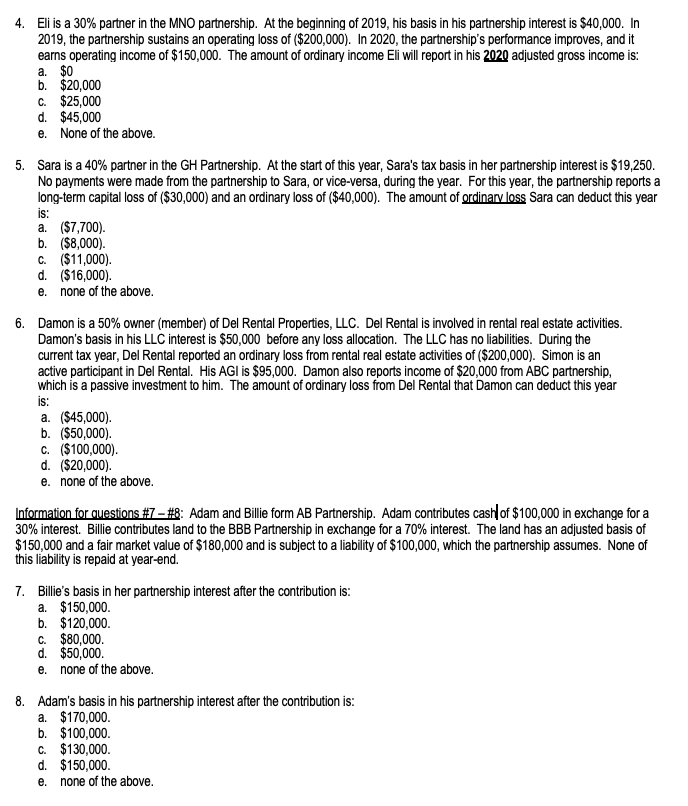

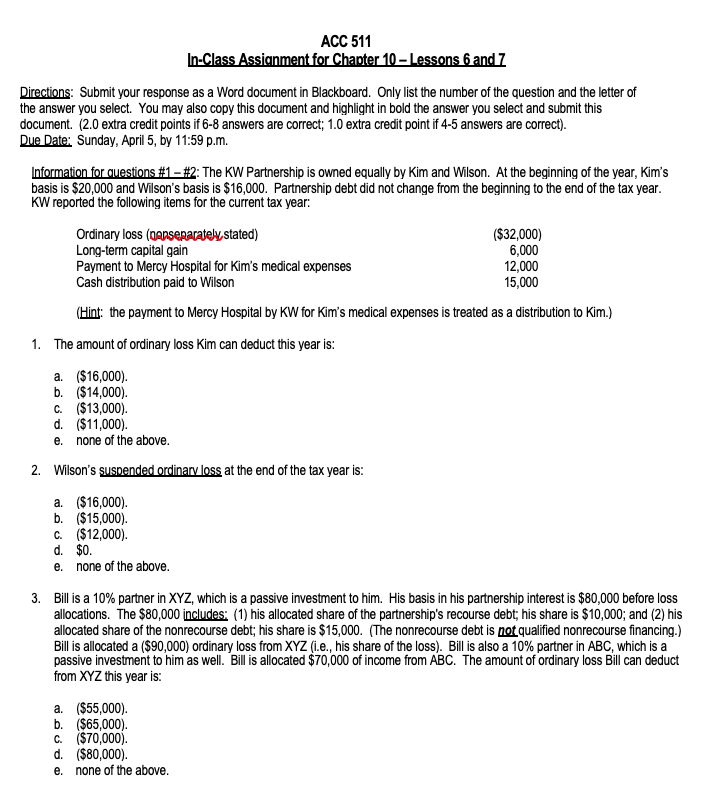

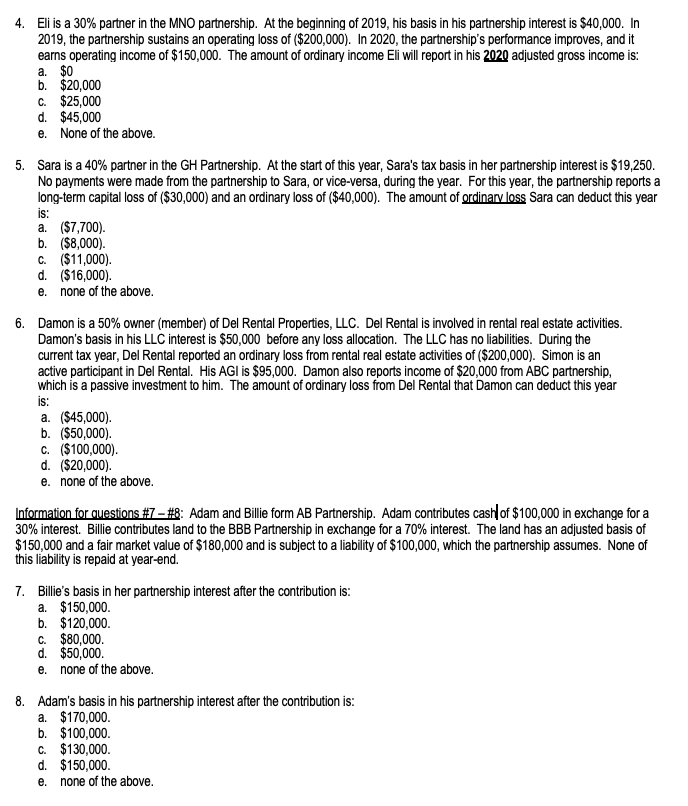

ACC 511 In-Class Assignment for Chapter 10 - Lessons 6 and 7 Directions: Submit your response as a Word document in Blackboard. Only list the number of the question and the letter of the answer you select. You may also copy this document and highlight in bold the answer you select and submit this document. (2.0 extra credit points if 6-8 answers are correct; 1.0 extra credit point if 4-5 answers are correct). Due Date: Sunday, April 5, by 11:59 p.m. Information for questions #1 - #2: The KW Partnership is owned equally by Kim and Wilson. At the beginning of the year, Kim's basis is $20,000 and Wilson's basis is $16,000. Partnership debt did not change from the beginning to the end of the tax year. KW reported the following items for the current tax year: Ordinary loss (Danseparately stated) Long-term capital gain Payment to Mercy Hospital for Kim's medical expenses Cash distribution paid to Wilson ($32,000) 6,000 12,000 15,000 (Hint: the payment to Mercy Hospital by KW for Kim's medical expenses is treated as a distribution to Kim.) 1. The amount of ordinary loss Kim can deduct this year is: a. ($16,000). b. ($14,000). C. ($13,000). d. ($11,000). e. none of the above. 2. Wilson's suspended ordinary loss at the end of the tax year is: a. ($16,000). b. ($15,000). C. ($12,000). d. $0. e. none of the above. 3. Bill is a 10% partner in XYZ, which is a passive investment to him. His basis in his partnership interest is $80,000 before loss allocations. The $80,000 includes: (1) his allocated share of the partnership's recourse debt; his share is $10,000; and (2) his allocated share of the nonrecourse debt; his share is $15,000. (The nonrecourse debt is not qualified nonrecourse financing.) Bill is allocated a ($90,000) ordinary loss from XYZ (.e., his share of the loss). Bill is also a 10% partner in ABC, which is a passive investment to him as well. Bill is allocated $70,000 of income from ABC. The amount of ordinary loss Bill can deduct from XYZ this year is: a. ($55,000). b. ($65,000). C. ($70,000) d. ($80,000). e. none of the above. 4. Eli is a 30% partner in the MNO partnership. At the beginning of 2019, his basis in his partnership interest is $40,000. In 2019, the partnership sustains an operating loss of ($200,000). In 2020, the partnership's performance improves, and it earns operating income of $150,000. The amount of ordinary income Eli will report in his 2020 adjusted gross income is: a. $0 b. $20,000 C. $25,000 d. $45,000 e. None of the above. 5. Sara is a 40% partner in the GH Partnership. At the start of this year, Sara's tax basis in her partnership interest is $19,250. No payments were made from the partnership to Sara, or vice-versa, during the year. For this year, the partnership reports a long-term capital loss of ($30,000) and an ordinary loss of ($40,000). The amount of ordinary loss Sara can deduct this year a. ($7,700). b. ($8,000). C. ($11,000). d. ($16,000). e. none of the above. 6. Damon is a 50% owner (member) of Del Rental Properties, LLC. Del Rental is involved in rental real estate activities. Damon's basis in his LLC interest is $50,000 before any loss allocation. The LLC has no liabilities. During the current tax year, Del Rental reported an ordinary loss from rental real estate activities of ($200,000). Simon is an active participant in Del Rental. His AGI is $95,000. Damon also reports income of $20,000 from ABC partnership, which is a passive investment to him. The amount of ordinary loss from Del Rental that Damon can deduct this year a. ($45,000). b. ($50,000). C. ($100,000). d. ($20,000) e. none of the above. Information for questions #7 #8: Adam and Billie form AB Partnership. Adam contributes cash of $100,000 in exchange for a 30% interest. Billie contributes land to the BBB Partnership in exchange for a 70% interest. The land has an adjusted basis of $150,000 and a fair market value of $180,000 and is subject to a liability of $100,000, which the partnership assumes. None of this liability is repaid at year-end. 7. Billie's basis in her partnership interest after the contribution is: a. $150,000. b. $120,000 C. $80,000 d. $50,000 e. none of the above. 8. Adam's basis in his partnership interest after the contribution is: a. $170,000. b. $100,000. C. $130,000 d. $150,000. e. none of the above. ACC 511 In-Class Assignment for Chapter 10 - Lessons 6 and 7 Directions: Submit your response as a Word document in Blackboard. Only list the number of the question and the letter of the answer you select. You may also copy this document and highlight in bold the answer you select and submit this document. (2.0 extra credit points if 6-8 answers are correct; 1.0 extra credit point if 4-5 answers are correct). Due Date: Sunday, April 5, by 11:59 p.m. Information for questions #1 - #2: The KW Partnership is owned equally by Kim and Wilson. At the beginning of the year, Kim's basis is $20,000 and Wilson's basis is $16,000. Partnership debt did not change from the beginning to the end of the tax year. KW reported the following items for the current tax year: Ordinary loss (Danseparately stated) Long-term capital gain Payment to Mercy Hospital for Kim's medical expenses Cash distribution paid to Wilson ($32,000) 6,000 12,000 15,000 (Hint: the payment to Mercy Hospital by KW for Kim's medical expenses is treated as a distribution to Kim.) 1. The amount of ordinary loss Kim can deduct this year is: a. ($16,000). b. ($14,000). C. ($13,000). d. ($11,000). e. none of the above. 2. Wilson's suspended ordinary loss at the end of the tax year is: a. ($16,000). b. ($15,000). C. ($12,000). d. $0. e. none of the above. 3. Bill is a 10% partner in XYZ, which is a passive investment to him. His basis in his partnership interest is $80,000 before loss allocations. The $80,000 includes: (1) his allocated share of the partnership's recourse debt; his share is $10,000; and (2) his allocated share of the nonrecourse debt; his share is $15,000. (The nonrecourse debt is not qualified nonrecourse financing.) Bill is allocated a ($90,000) ordinary loss from XYZ (.e., his share of the loss). Bill is also a 10% partner in ABC, which is a passive investment to him as well. Bill is allocated $70,000 of income from ABC. The amount of ordinary loss Bill can deduct from XYZ this year is: a. ($55,000). b. ($65,000). C. ($70,000) d. ($80,000). e. none of the above. 4. Eli is a 30% partner in the MNO partnership. At the beginning of 2019, his basis in his partnership interest is $40,000. In 2019, the partnership sustains an operating loss of ($200,000). In 2020, the partnership's performance improves, and it earns operating income of $150,000. The amount of ordinary income Eli will report in his 2020 adjusted gross income is: a. $0 b. $20,000 C. $25,000 d. $45,000 e. None of the above. 5. Sara is a 40% partner in the GH Partnership. At the start of this year, Sara's tax basis in her partnership interest is $19,250. No payments were made from the partnership to Sara, or vice-versa, during the year. For this year, the partnership reports a long-term capital loss of ($30,000) and an ordinary loss of ($40,000). The amount of ordinary loss Sara can deduct this year a. ($7,700). b. ($8,000). C. ($11,000). d. ($16,000). e. none of the above. 6. Damon is a 50% owner (member) of Del Rental Properties, LLC. Del Rental is involved in rental real estate activities. Damon's basis in his LLC interest is $50,000 before any loss allocation. The LLC has no liabilities. During the current tax year, Del Rental reported an ordinary loss from rental real estate activities of ($200,000). Simon is an active participant in Del Rental. His AGI is $95,000. Damon also reports income of $20,000 from ABC partnership, which is a passive investment to him. The amount of ordinary loss from Del Rental that Damon can deduct this year a. ($45,000). b. ($50,000). C. ($100,000). d. ($20,000) e. none of the above. Information for questions #7 #8: Adam and Billie form AB Partnership. Adam contributes cash of $100,000 in exchange for a 30% interest. Billie contributes land to the BBB Partnership in exchange for a 70% interest. The land has an adjusted basis of $150,000 and a fair market value of $180,000 and is subject to a liability of $100,000, which the partnership assumes. None of this liability is repaid at year-end. 7. Billie's basis in her partnership interest after the contribution is: a. $150,000. b. $120,000 C. $80,000 d. $50,000 e. none of the above. 8. Adam's basis in his partnership interest after the contribution is: a. $170,000. b. $100,000. C. $130,000 d. $150,000. e. none of the above