Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a weather forecaster who is paid based on her performance. Each day, she forecasts the probability q [0, 1] that it will rain

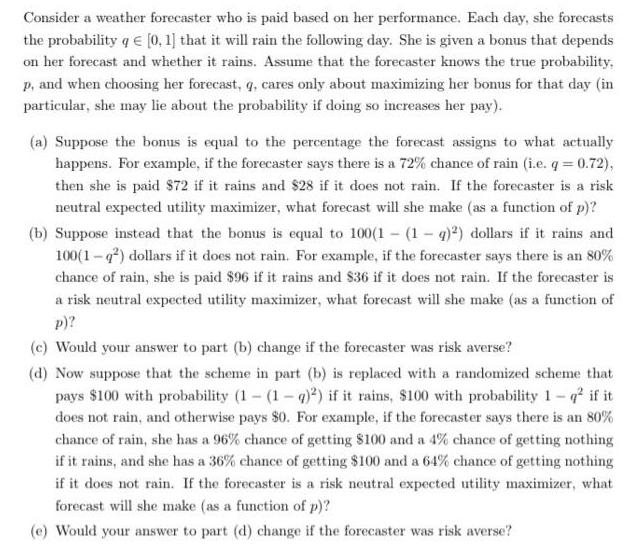

Consider a weather forecaster who is paid based on her performance. Each day, she forecasts the probability q [0, 1] that it will rain the following day. She is given a bonus that depends on her forecast and whether it rains. Assume that the forecaster knows the true probability, p, and when choosing her forecast, q, cares only about maximizing her bonus for that day (in particular, she may lie about the probability if doing so increases her pay). (a) Suppose the bonus is equal to the percentage the forecast assigns to what actually happens. For example, if the forecaster says there is a 72% chance of rain (i.e. q = 0.72), then she is paid $72 if it rains and $28 if it does not rain. If the forecaster is a risk neutral expected utility maximizer, what forecast will she make (as a function of p)? (b) Suppose instead that the bonus is equal to 100(1-(1-q)2) dollars if it rains and 100(1-q) dollars if it does not rain. For example, if the forecaster says there is an 80% chance of rain, she is paid $96 if it rains and $36 if it does not rain. If the forecaster is a risk neutral expected utility maximizer, what forecast will she make (as a function of p)? (c) Would your answer to part (b) change if the forecaster was risk averse? (d) Now suppose that the scheme in part (b) is replaced with a randomized scheme that pays $100 with probability (1-(1-q)2) if it rains, $100 with probability 1-q if it does not rain, and otherwise pays 80. For example, if the forecaster says there is an 80% chance of rain, she has a 96% chance of getting $100 and a 4% chance of getting nothing if it rains, and she has a 36% chance of getting $100 and a 64% chance of getting nothing if it does not rain. If the forecaster is a risk neutral expected utility maximizer, what forecast will she make (as a function of p)? (e) Would your answer to part (d) change if the forecaster was risk averse?

Step by Step Solution

★★★★★

3.62 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

a If the bonus is equal to the percentage the forecast assigns to what actually happens then the forecaster will always make a forecast of 100 if p0 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started