Question

ACC213- Introduction to Income Tax For the quarter ended 31 December 2016, Justice Pte Ltd (JPL), a goods and services tax (GST) registered trader, recorded

ACC213- Introduction to Income Tax

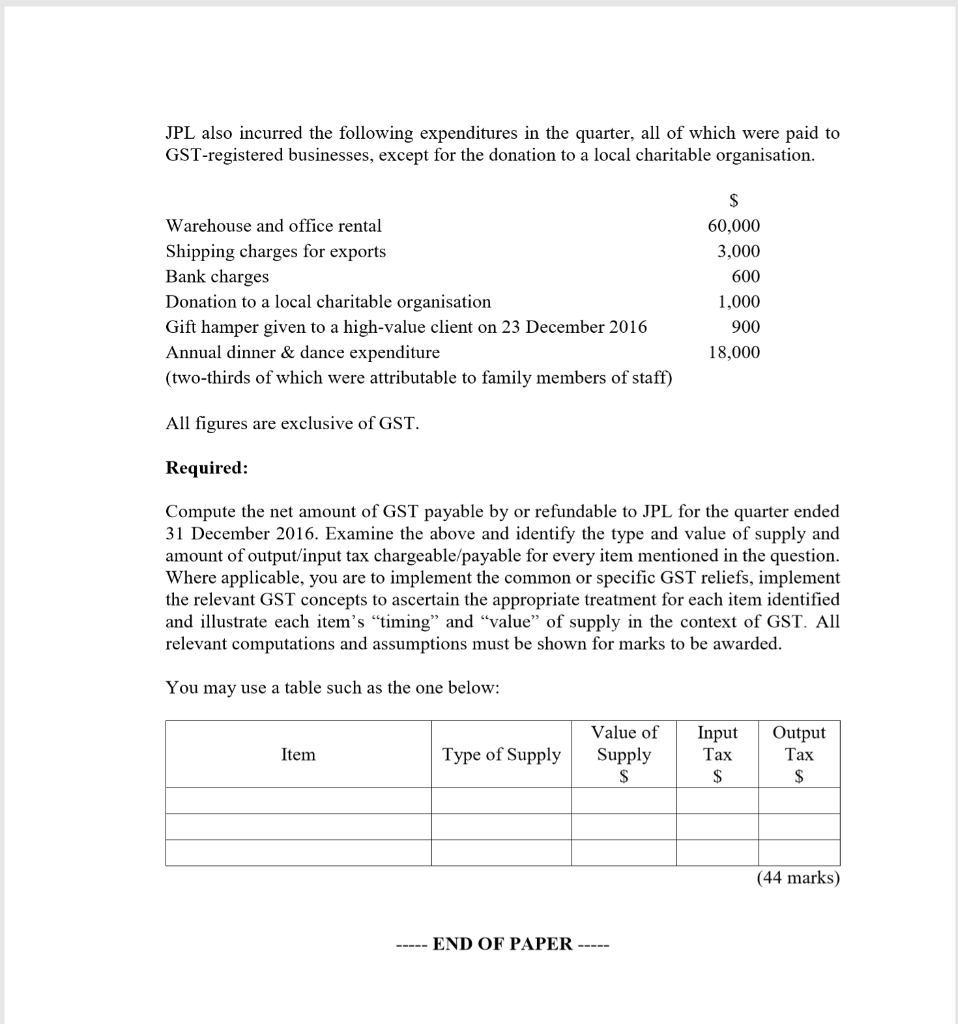

For the quarter ended 31 December 2016, Justice Pte Ltd (JPL), a goods and services tax (GST) registered trader, recorded the following transactions from trading in legal literature: Sold $1,000,000 worth of goods to customers; 30% were exported overseas, 40% were sold to GST-registered companies in Singapore, 25% were sold to non GST-registered companies in Singapore, and 5% were sold in Free Trade Zones. Absorbed the GST on a sale to a local, non GST-registered customer. This sale amounted to 20% of JPLs total sales. Transferred a delivery van worth $13,000 to an affiliated company at no charge. Purchased $300,000 worth of goods from local suppliers, 90% of which were from GST-registered businesses. Imported goods worth $200,000 from an overseas supplier who has no permanent establishment in Singapore. Purchased $50,000 worth of goods from an overseas supplier who has no permanent establishment in Singapore and these goods were shipped from the suppliers country to another overseas country, other than Singapore. Leased a SOHO unit it owns with an annual value of $128,000 to a foreign businessman at a monthly rental of $13,000. The SOHO unit is assessed to be 60% residential and 40% commercial in composition. Charged a local customer $300 late payment interest on its outstanding receivables. Issued a Credit Note to a GST-registered business for goods rejected amounting to $11,000. Recovered cash amounting to $30,000 from a bad debtor, of whom, bad debt relief on a sale of $40,000 (excluding GST) has been claimed from the Comptroller of GST in the prior reporting quarters. Collected a deposit of $30,000 from a local customer on 18 December 2016. Of which, $10,000 is a security deposit and $20,000 is related to the supply of goods amounting to $35,000 on 19 December 2016. Tax invoice for this supply of goods has yet to be issued as at 31 December 2016.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started