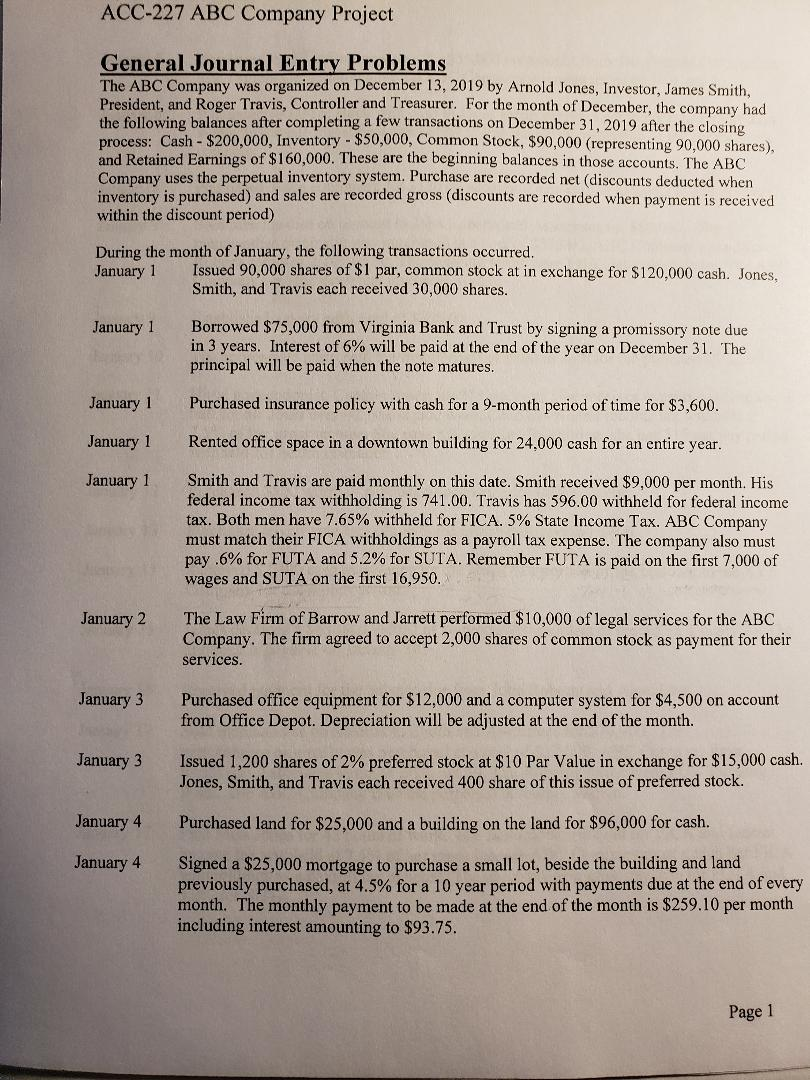

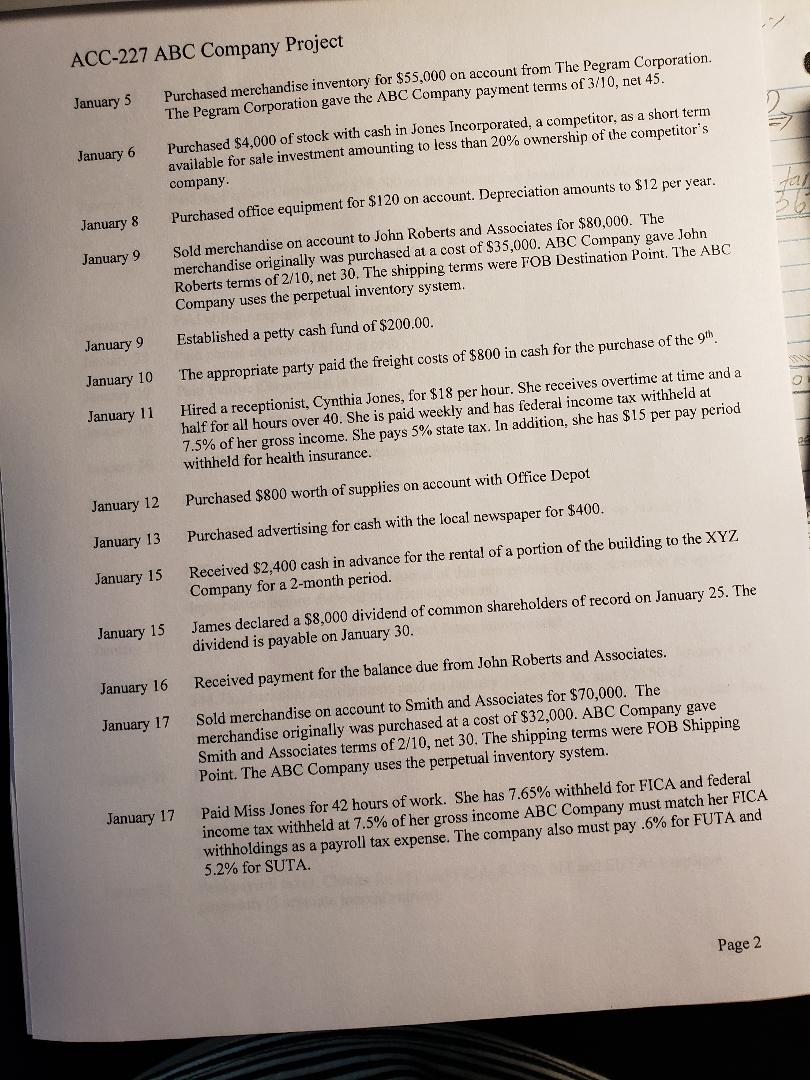

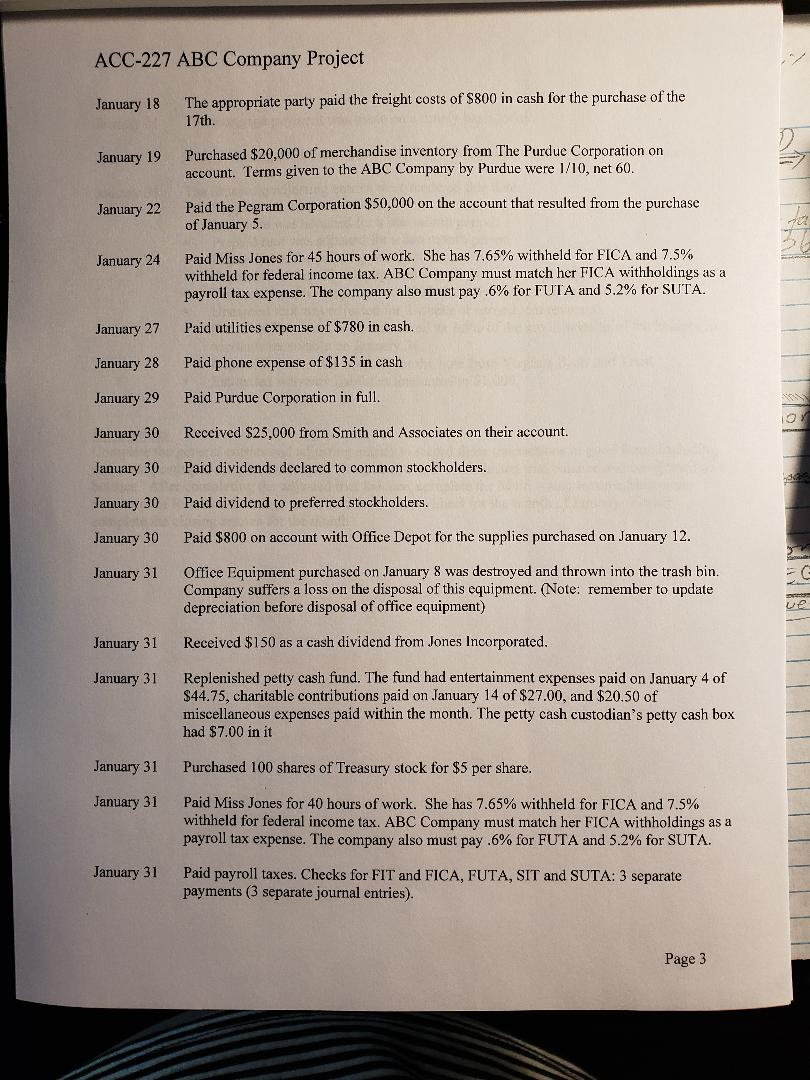

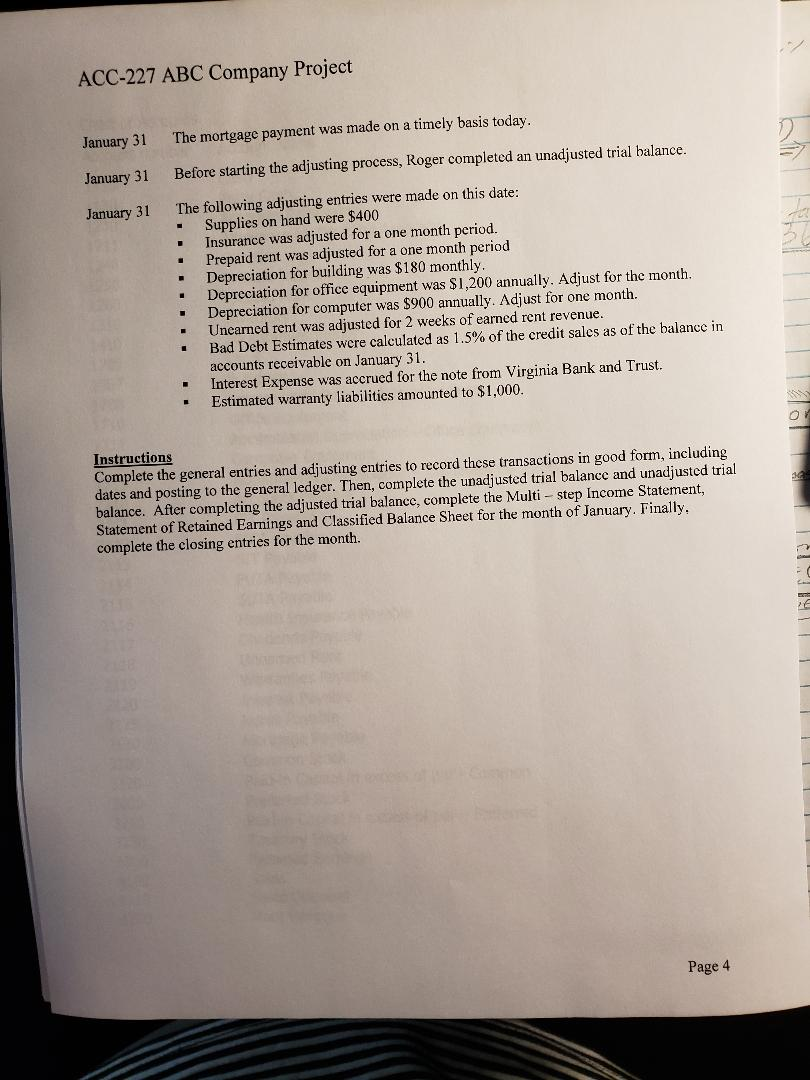

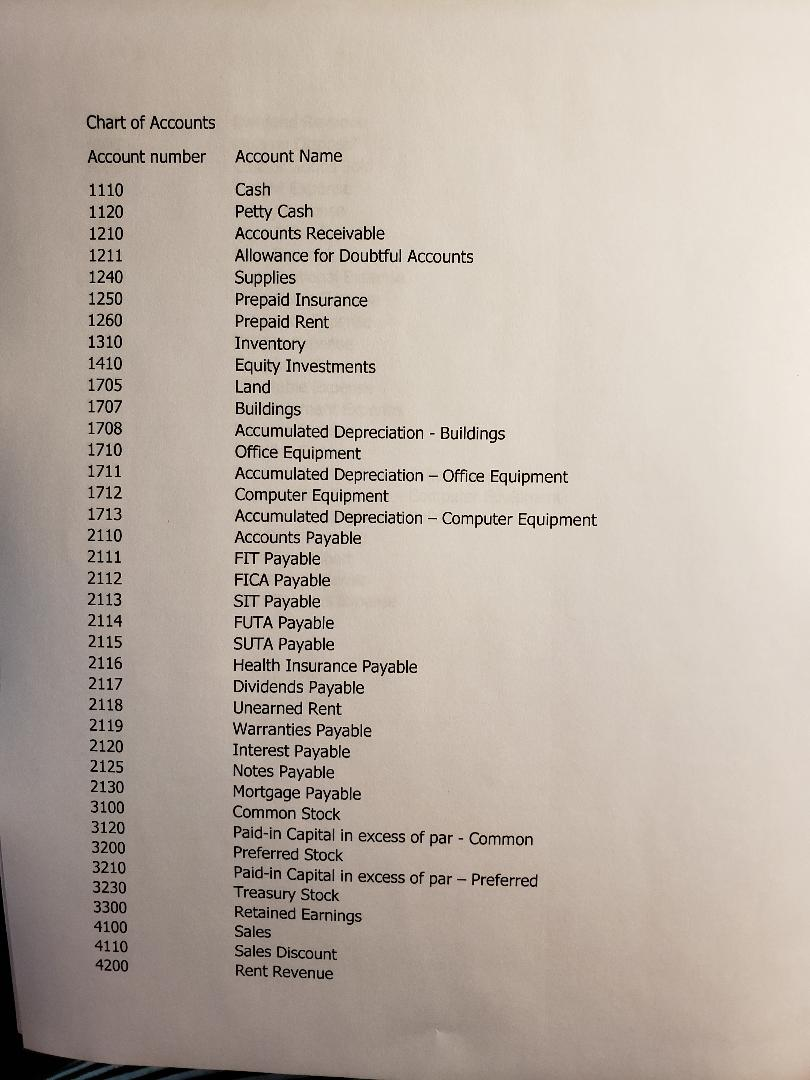

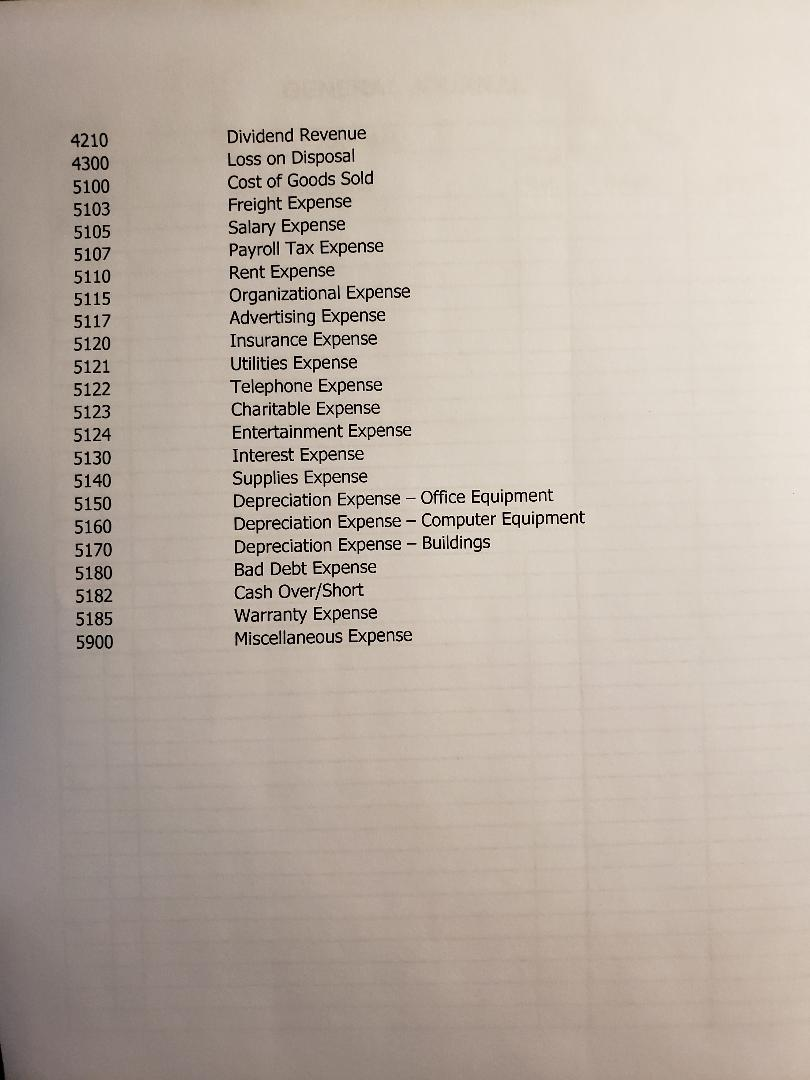

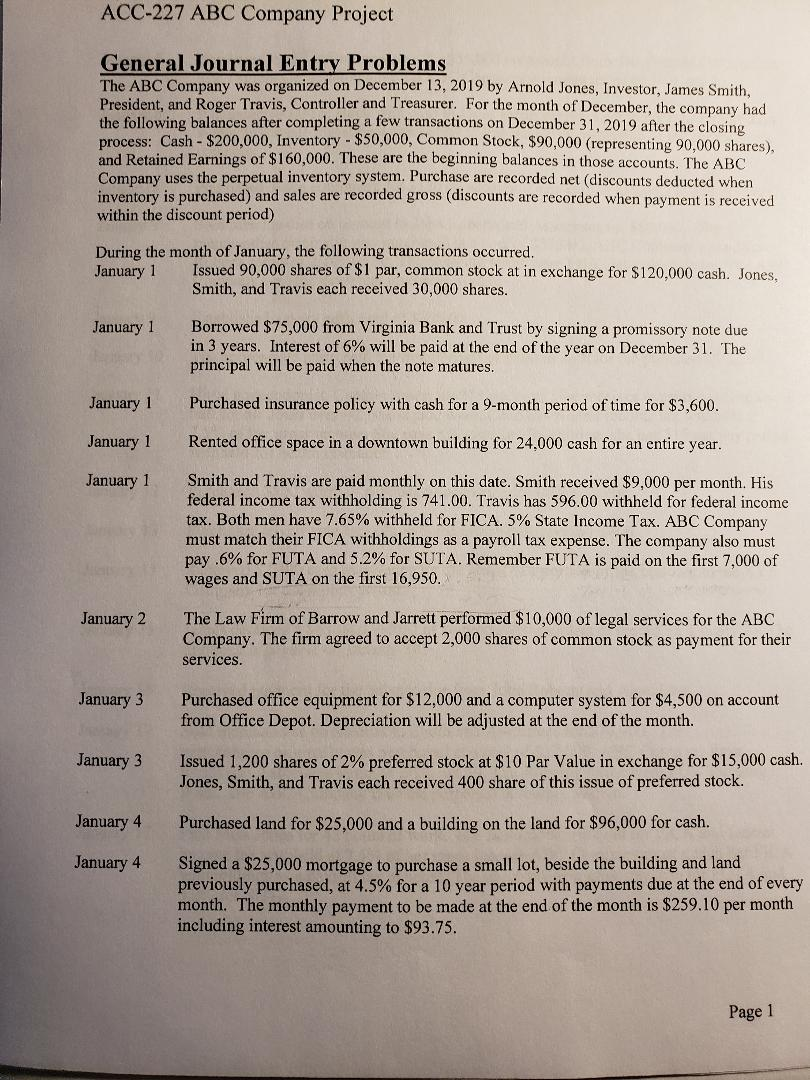

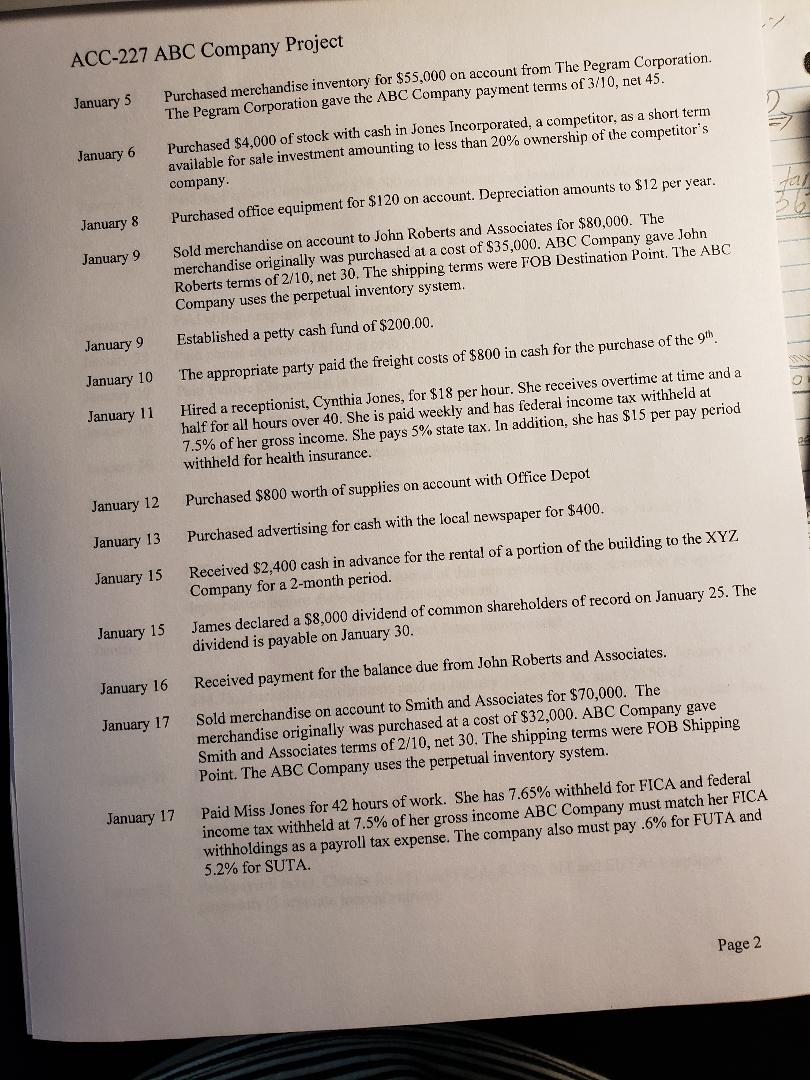

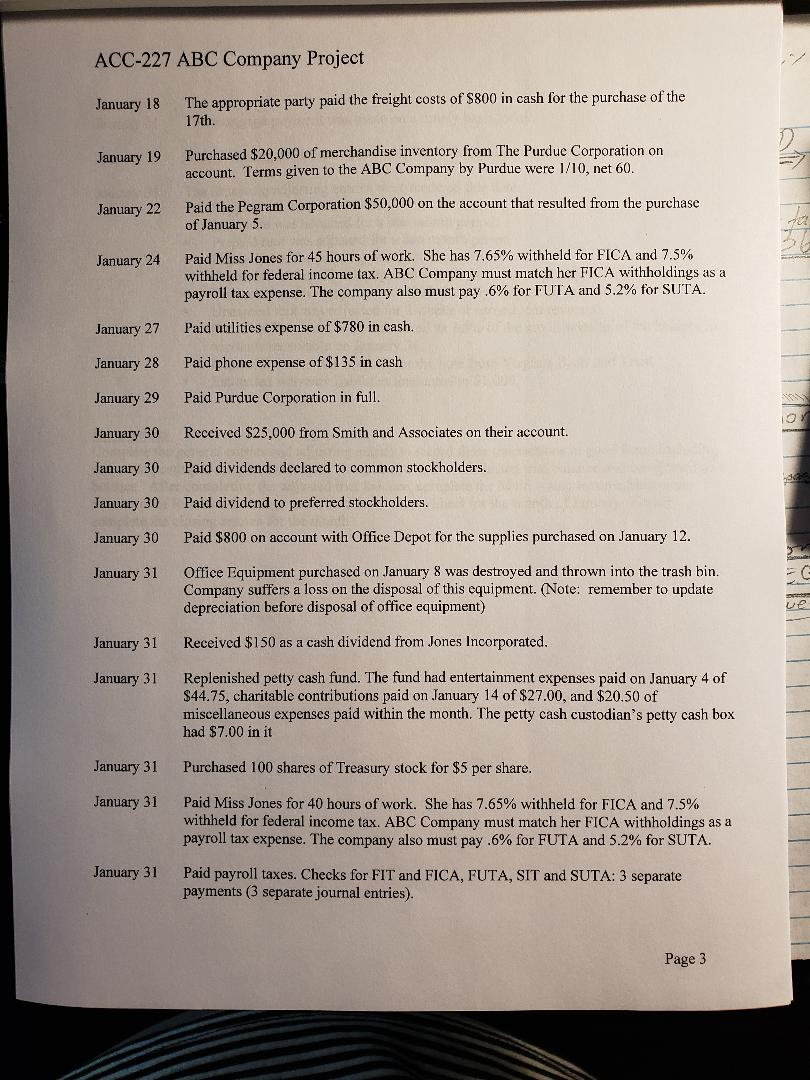

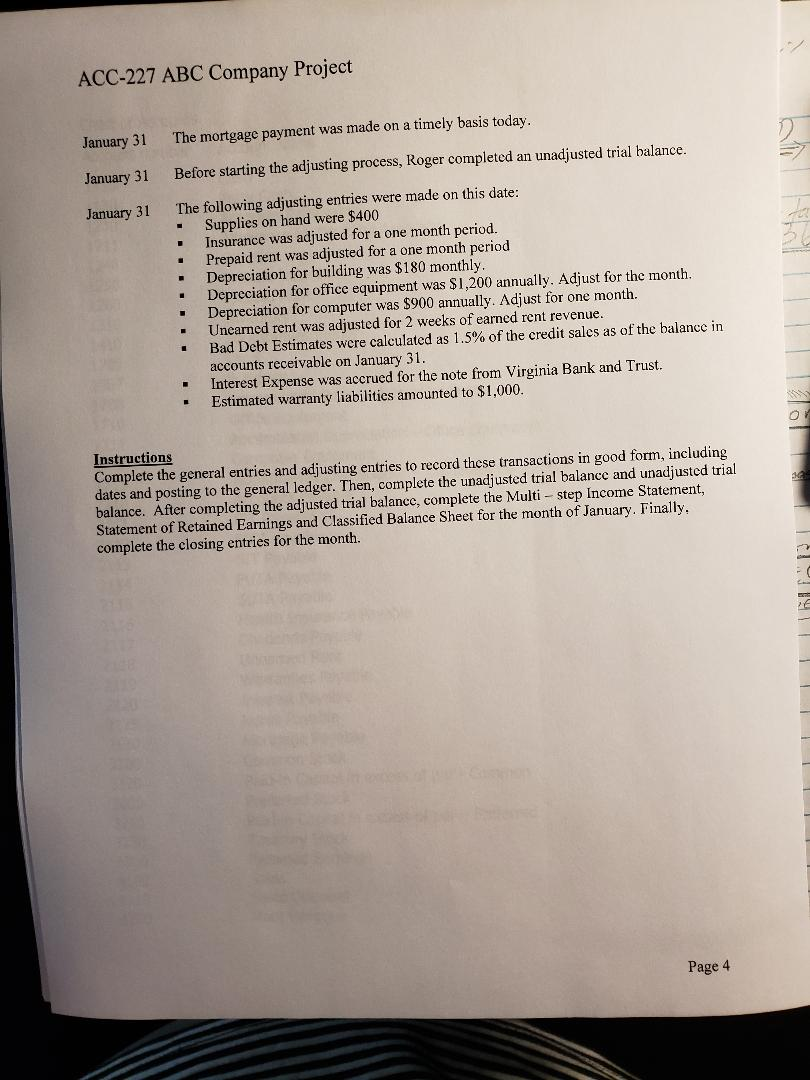

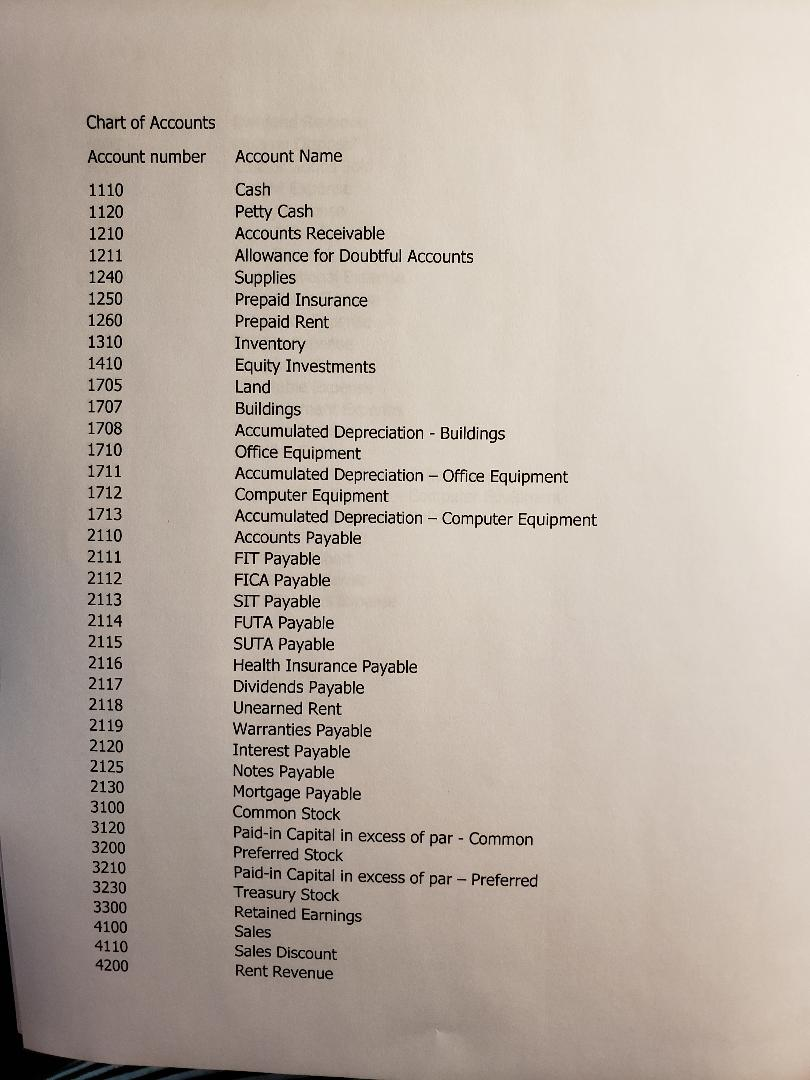

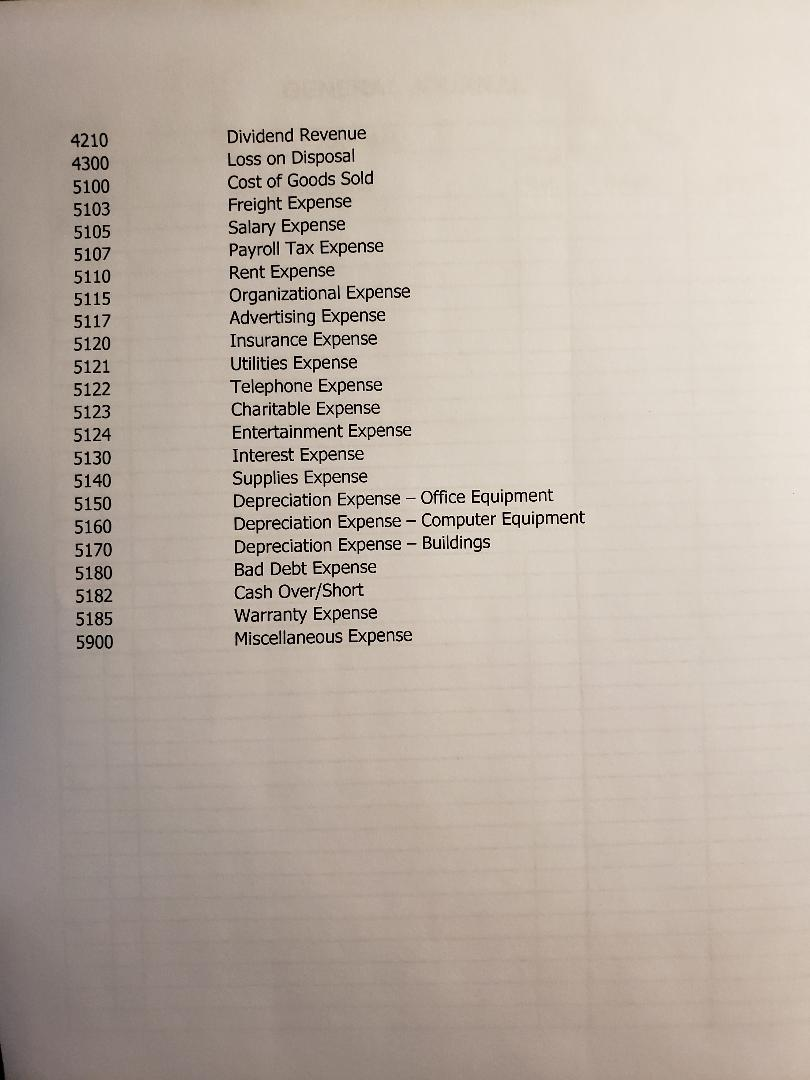

ACC-227 ABC Company Project General Journal Entry Problems The ABC Company was organized on December 13, 2019 by Arnold Jones, Investor. James Smith, President and Roger Travis, Controller and Treasurer. For the month of December, the company had the following balances after completing a few transactions on December 31, 2019 after the closing process: Cash - $200,000, Inventory - $50,000, Common Stock, $90,000 (representing 90,000 shares), and Retained Earnings of $160,000. These are the beginning balances in those accounts. The ABC Company uses the perpetual inventory system. Purchase are recorded net (discounts deducted when inventory is purchased) and sales are recorded gross (discounts are recorded when payment is received within the discount period) During the month of January, the following transactions occurred. January 1 Issued 90,000 shares of $1 par, common stock at in exchange for $120,000 cash. Jones, Smith, and Travis each received 30,000 shares. January 1 Borrowed $75,000 from Virginia Bank and Trust by signing a promissory note due in 3 years. Interest of 6% will be paid at the end of the year on December 31. The principal will be paid when the note matures. January 1 Purchased insurance policy with cash for a 9-month period of time for $3,600. January 1 Rented office space in a downtown building for 24,000 cash for an entire year. January 1 Smith and Travis are paid monthly on this date. Smith received $9,000 per month. His federal income tax withholding is 741.00. Travis has 596.00 withheld for federal income tax. Both men have 7.65% withheld for FICA. 5% State Income Tax. ABC Company must match their FICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. Remember FUTA is paid on the first 7,000 of wages and SUTA on the first 16,950. January 2 The Law Firm of Barrow and Jarrett performed $10,000 of legal services for the ABC Company. The firm agreed to accept 2,000 shares of common stock as payment for their services. January 3 Purchased office equipment for $12,000 and a computer system for $4,500 on account from Office Depot. Depreciation will be adjusted at the end of the month. January 3 Issued 1,200 shares of 2% preferred stock at $10 Par Value in exchange for $15,000 cash. Jones, Smith, and Travis each received 400 share of this issue of preferred stock. January 4 Purchased land for $25,000 and a building on the land for $96,000 for cash. January 4 Signed a $25,000 mortgage to purchase a small lot, beside the building and land previously purchased, at 4.5% for a 10 year period with payments due at the end of every month. The monthly payment to be made at the end of the month is $259.10 per month including interest amounting to $93.75. Page 1 ACC-227 ABC Company Project January 5 Purchased merchandise inventory for $55,000 on account from The Pegram Corporation. The Pegram Corporation gave the ABC Company payment terms of 3/10, net 45. January 6 Purchased $4,000 of stock with cash in Jones Incorporated, a competitor, as a short term available for sale investment amounting to less than 20% ownership of the competitor's company. January 8 Purchased office equipment for $120 on account. Depreciation amounts to $12 per year. January 9 Sold merchandise on account to John Roberts and Associates for $80,000. The merchandise originally was purchased at a cost of $35,000. ABC Company gave John Roberts terms of 2/10, net 30. The shipping terms were FOB Destination Point. The ABC Company uses the perpetual inventory system. January 9 Established a petty cash fund of $200.00. January 10 The appropriate party paid the freight costs of $800 in cash for the purchase of the 9th January 11 Hired a receptionist, Cynthia Jones, for $18 per hour. She receives overtime at time and a half for all hours over 40. She is paid weekly and has federal income tax withheld at 7.5% of her gross income. She pays 5% state tax. In addition, she has $15 per pay period withheld for health insurance. January 12 Purchased $800 worth of supplies on account with Office Depot January 13 Purchased advertising for cash with the local newspaper for $400. January 15 Received $2,400 cash in advance for the rental of a portion of the building to the XYZ Company for a 2-month period. January 15 James declared a $8,000 dividend of common shareholders of record on January 25. The dividend is payable on January 30. January 16 Received payment for the balance due from John Roberts and Associates. January 17 Sold merchandise on account to Smith and Associates for $70,000. The merchandise originally was purchased at a cost of $32,000. ABC Company gave Smith and Associates terms of 2/10, net 30. The shipping terms were FOB Shipping Point. The ABC Company uses the perpetual inventory system. January 17 Paid Miss Jones for 42 hours of work. She has 7.65% withheld for FICA and federal income tax withheld at 7.5% of her gross income ABC Company must match her FICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. Page 2 ACC-227 ABC Company Project January 18 The appropriate party paid the freight costs of $800 in cash for the purchase of the 17th. January 19 Purchased $20,000 of merchandise inventory from The Purdue Corporation on account. Terms given to the ABC Company by Purdue were 1/10, net 60. January 22 Paid the Pegram Corporation $50,000 on the account that resulted from the purchase of January 5. January 24 Paid Miss Jones for 45 hours of work. She has 7.65% withheld for FICA and 7.5% withheld for federal income tax. ABC Company must match her TICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. January 27 Paid utilities expense of $780 in cash. January 28 Paid phone expense of $135 in cash January 29 Paid Purdue Corporation in full. January 30 Received $25,000 from Smith and Associates on their account. January 30 Paid dividends declared to common stockholders. January 30 Paid dividend to preferred stockholders. January 30 Paid $800 on account with Office Depot for the supplies purchased on January 12. January 31 Office Equipment purchased on January 8 was destroyed and thrown into the trash bin. Company suffers a loss on the disposal of this equipment. (Note: remember to update depreciation before disposal of office equipment) January 31 Received $150 as a cash dividend from Jones Incorporated. January 31 Replenished petty cash fund. The fund had entertainment expenses paid on January 4 of $44.75, charitable contributions paid on January 14 of $27.00, and $20.50 of miscellaneous expenses paid within the month. The petty cash custodian's petty cash box had $7.00 in it January 31 Purchased 100 shares of Treasury stock for $5 per share. January 31 Paid Miss Jones for 40 hours of work. She has 7.65% withheld for FICA and 7.5% withheld for federal income tax. ABC Company must match her FICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. January 31 Paid payroll taxes. Checks for FIT and FICA, FUTA, SIT and SUTA: 3 separate payments (3 separate journal entries). Page 3 ACC-227 ABC Company Project January 31 The mortgage payment was made on a timely basis today. January 31 Before starting the adjusting process, Roger completed an unadjusted trial balance. January 31 The following adjusting entries were made on this date: Supplies on hand were $400 Insurance was adjusted for a one month period. Prepaid rent was adjusted for a one month period Depreciation for building was $180 monthly Depreciation for office equipment was $1,200 annually. Adjust for the month. Depreciation for computer was $900 annually. Adjust for one month. Unearned rent was adjusted for 2 weeks of earned rent revenue. Bad Debt Estimates were calculated as 1.5% of the credit sales as of the balance in accounts receivable on January 31. Interest Expense was accrued for the note from Virginia Bank and Trust. Estimated warranty liabilities amounted to $1,000. Instructions Complete the general entries and adjusting entries to record these transactions in good form, including dates and posting to the general ledger. Then, complete the unadjusted trial balance and unadjusted trial balance. After completing the adjusted trial balance, complete the Multi-step Income Statement, Statement of Retained Earnings and Classified Balance Sheet for the month of January. Finally. complete the closing entries for the month. Page 4 Account Name Chart of Accounts Account number 1110 1120 1210 1211 1240 1250 1260 1310 1410 1705 1707 1708 1710 1711 1712 1713 2110 2111 2112 2113 2114 2115 2116 Cash Petty Cash Accounts Receivable Allowance for Doubtful Accounts Supplies Prepaid Insurance Prepaid Rent Inventory Equity Investments Land Buildings Accumulated Depreciation - Buildings Office Equipment Accumulated Depreciation - Office Equipment Computer Equipment Accumulated Depreciation - Computer Equipment Accounts Payable FIT Payable FICA Payable SIT Payable FUTA Payable SUTA Payable Health Insurance Payable Dividends Payable Unearned Rent Warranties Payable Interest Payable Notes Payable Mortgage Payable Common Stock Paid-in Capital in excess of par - Common Preferred Stock Paid-in Capital in excess of par - Preferred Treasury Stock Retained Earnings Sales Sales Discount Rent Revenue 2117 2118 2119 2120 2125 2130 3100 3120 3200 3210 3230 3300 4100 4110 4200 4210 4300 5100 5103 5105 5107 5110 5115 5117 5120 5121 5122 5123 5124 5130 5140 5150 5160 5170 5180 5182 5185 5900 Dividend Revenue Loss on Disposal Cost of Goods Sold Freight Expense Salary Expense Payroll Tax Expense Rent Expense Organizational Expense Advertising Expense Insurance Expense Utilities Expense Telephone Expense Charitable Expense Entertainment Expense Interest Expense Supplies Expense Depreciation Expense - Office Equipment Depreciation Expense - Computer Equipment Depreciation Expense - Buildings Bad Debt Expense Cash Over/Short Warranty Expense Miscellaneous Expense ACC-227 ABC Company Project General Journal Entry Problems The ABC Company was organized on December 13, 2019 by Arnold Jones, Investor. James Smith, President and Roger Travis, Controller and Treasurer. For the month of December, the company had the following balances after completing a few transactions on December 31, 2019 after the closing process: Cash - $200,000, Inventory - $50,000, Common Stock, $90,000 (representing 90,000 shares), and Retained Earnings of $160,000. These are the beginning balances in those accounts. The ABC Company uses the perpetual inventory system. Purchase are recorded net (discounts deducted when inventory is purchased) and sales are recorded gross (discounts are recorded when payment is received within the discount period) During the month of January, the following transactions occurred. January 1 Issued 90,000 shares of $1 par, common stock at in exchange for $120,000 cash. Jones, Smith, and Travis each received 30,000 shares. January 1 Borrowed $75,000 from Virginia Bank and Trust by signing a promissory note due in 3 years. Interest of 6% will be paid at the end of the year on December 31. The principal will be paid when the note matures. January 1 Purchased insurance policy with cash for a 9-month period of time for $3,600. January 1 Rented office space in a downtown building for 24,000 cash for an entire year. January 1 Smith and Travis are paid monthly on this date. Smith received $9,000 per month. His federal income tax withholding is 741.00. Travis has 596.00 withheld for federal income tax. Both men have 7.65% withheld for FICA. 5% State Income Tax. ABC Company must match their FICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. Remember FUTA is paid on the first 7,000 of wages and SUTA on the first 16,950. January 2 The Law Firm of Barrow and Jarrett performed $10,000 of legal services for the ABC Company. The firm agreed to accept 2,000 shares of common stock as payment for their services. January 3 Purchased office equipment for $12,000 and a computer system for $4,500 on account from Office Depot. Depreciation will be adjusted at the end of the month. January 3 Issued 1,200 shares of 2% preferred stock at $10 Par Value in exchange for $15,000 cash. Jones, Smith, and Travis each received 400 share of this issue of preferred stock. January 4 Purchased land for $25,000 and a building on the land for $96,000 for cash. January 4 Signed a $25,000 mortgage to purchase a small lot, beside the building and land previously purchased, at 4.5% for a 10 year period with payments due at the end of every month. The monthly payment to be made at the end of the month is $259.10 per month including interest amounting to $93.75. Page 1 ACC-227 ABC Company Project January 5 Purchased merchandise inventory for $55,000 on account from The Pegram Corporation. The Pegram Corporation gave the ABC Company payment terms of 3/10, net 45. January 6 Purchased $4,000 of stock with cash in Jones Incorporated, a competitor, as a short term available for sale investment amounting to less than 20% ownership of the competitor's company. January 8 Purchased office equipment for $120 on account. Depreciation amounts to $12 per year. January 9 Sold merchandise on account to John Roberts and Associates for $80,000. The merchandise originally was purchased at a cost of $35,000. ABC Company gave John Roberts terms of 2/10, net 30. The shipping terms were FOB Destination Point. The ABC Company uses the perpetual inventory system. January 9 Established a petty cash fund of $200.00. January 10 The appropriate party paid the freight costs of $800 in cash for the purchase of the 9th January 11 Hired a receptionist, Cynthia Jones, for $18 per hour. She receives overtime at time and a half for all hours over 40. She is paid weekly and has federal income tax withheld at 7.5% of her gross income. She pays 5% state tax. In addition, she has $15 per pay period withheld for health insurance. January 12 Purchased $800 worth of supplies on account with Office Depot January 13 Purchased advertising for cash with the local newspaper for $400. January 15 Received $2,400 cash in advance for the rental of a portion of the building to the XYZ Company for a 2-month period. January 15 James declared a $8,000 dividend of common shareholders of record on January 25. The dividend is payable on January 30. January 16 Received payment for the balance due from John Roberts and Associates. January 17 Sold merchandise on account to Smith and Associates for $70,000. The merchandise originally was purchased at a cost of $32,000. ABC Company gave Smith and Associates terms of 2/10, net 30. The shipping terms were FOB Shipping Point. The ABC Company uses the perpetual inventory system. January 17 Paid Miss Jones for 42 hours of work. She has 7.65% withheld for FICA and federal income tax withheld at 7.5% of her gross income ABC Company must match her FICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. Page 2 ACC-227 ABC Company Project January 18 The appropriate party paid the freight costs of $800 in cash for the purchase of the 17th. January 19 Purchased $20,000 of merchandise inventory from The Purdue Corporation on account. Terms given to the ABC Company by Purdue were 1/10, net 60. January 22 Paid the Pegram Corporation $50,000 on the account that resulted from the purchase of January 5. January 24 Paid Miss Jones for 45 hours of work. She has 7.65% withheld for FICA and 7.5% withheld for federal income tax. ABC Company must match her TICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. January 27 Paid utilities expense of $780 in cash. January 28 Paid phone expense of $135 in cash January 29 Paid Purdue Corporation in full. January 30 Received $25,000 from Smith and Associates on their account. January 30 Paid dividends declared to common stockholders. January 30 Paid dividend to preferred stockholders. January 30 Paid $800 on account with Office Depot for the supplies purchased on January 12. January 31 Office Equipment purchased on January 8 was destroyed and thrown into the trash bin. Company suffers a loss on the disposal of this equipment. (Note: remember to update depreciation before disposal of office equipment) January 31 Received $150 as a cash dividend from Jones Incorporated. January 31 Replenished petty cash fund. The fund had entertainment expenses paid on January 4 of $44.75, charitable contributions paid on January 14 of $27.00, and $20.50 of miscellaneous expenses paid within the month. The petty cash custodian's petty cash box had $7.00 in it January 31 Purchased 100 shares of Treasury stock for $5 per share. January 31 Paid Miss Jones for 40 hours of work. She has 7.65% withheld for FICA and 7.5% withheld for federal income tax. ABC Company must match her FICA withholdings as a payroll tax expense. The company also must pay .6% for FUTA and 5.2% for SUTA. January 31 Paid payroll taxes. Checks for FIT and FICA, FUTA, SIT and SUTA: 3 separate payments (3 separate journal entries). Page 3 ACC-227 ABC Company Project January 31 The mortgage payment was made on a timely basis today. January 31 Before starting the adjusting process, Roger completed an unadjusted trial balance. January 31 The following adjusting entries were made on this date: Supplies on hand were $400 Insurance was adjusted for a one month period. Prepaid rent was adjusted for a one month period Depreciation for building was $180 monthly Depreciation for office equipment was $1,200 annually. Adjust for the month. Depreciation for computer was $900 annually. Adjust for one month. Unearned rent was adjusted for 2 weeks of earned rent revenue. Bad Debt Estimates were calculated as 1.5% of the credit sales as of the balance in accounts receivable on January 31. Interest Expense was accrued for the note from Virginia Bank and Trust. Estimated warranty liabilities amounted to $1,000. Instructions Complete the general entries and adjusting entries to record these transactions in good form, including dates and posting to the general ledger. Then, complete the unadjusted trial balance and unadjusted trial balance. After completing the adjusted trial balance, complete the Multi-step Income Statement, Statement of Retained Earnings and Classified Balance Sheet for the month of January. Finally. complete the closing entries for the month. Page 4 Account Name Chart of Accounts Account number 1110 1120 1210 1211 1240 1250 1260 1310 1410 1705 1707 1708 1710 1711 1712 1713 2110 2111 2112 2113 2114 2115 2116 Cash Petty Cash Accounts Receivable Allowance for Doubtful Accounts Supplies Prepaid Insurance Prepaid Rent Inventory Equity Investments Land Buildings Accumulated Depreciation - Buildings Office Equipment Accumulated Depreciation - Office Equipment Computer Equipment Accumulated Depreciation - Computer Equipment Accounts Payable FIT Payable FICA Payable SIT Payable FUTA Payable SUTA Payable Health Insurance Payable Dividends Payable Unearned Rent Warranties Payable Interest Payable Notes Payable Mortgage Payable Common Stock Paid-in Capital in excess of par - Common Preferred Stock Paid-in Capital in excess of par - Preferred Treasury Stock Retained Earnings Sales Sales Discount Rent Revenue 2117 2118 2119 2120 2125 2130 3100 3120 3200 3210 3230 3300 4100 4110 4200 4210 4300 5100 5103 5105 5107 5110 5115 5117 5120 5121 5122 5123 5124 5130 5140 5150 5160 5170 5180 5182 5185 5900 Dividend Revenue Loss on Disposal Cost of Goods Sold Freight Expense Salary Expense Payroll Tax Expense Rent Expense Organizational Expense Advertising Expense Insurance Expense Utilities Expense Telephone Expense Charitable Expense Entertainment Expense Interest Expense Supplies Expense Depreciation Expense - Office Equipment Depreciation Expense - Computer Equipment Depreciation Expense - Buildings Bad Debt Expense Cash Over/Short Warranty Expense Miscellaneous Expense