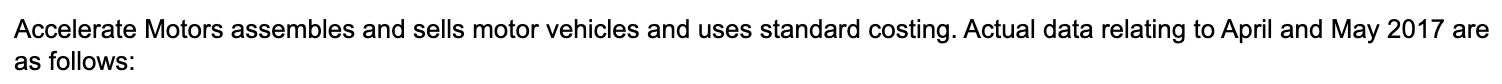

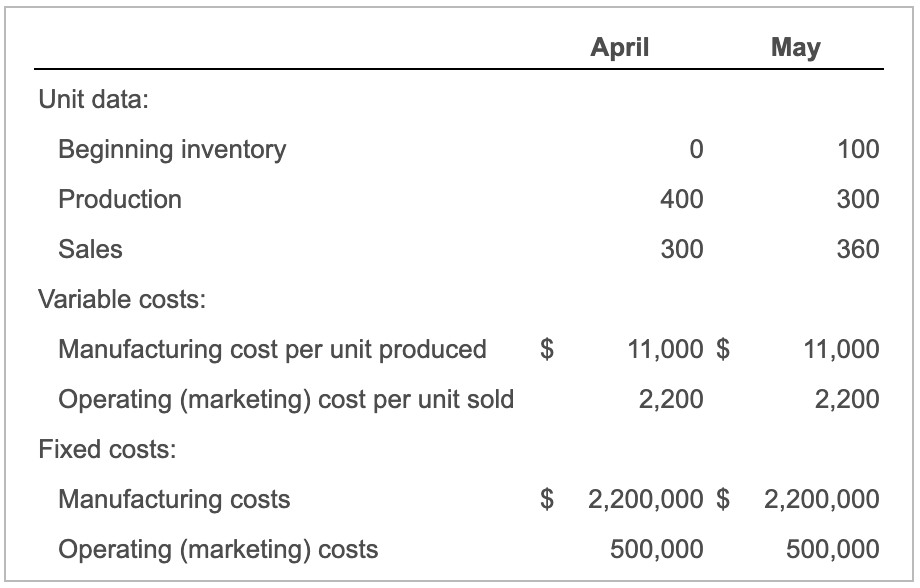

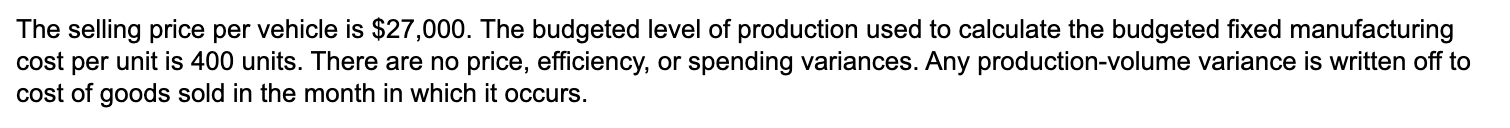

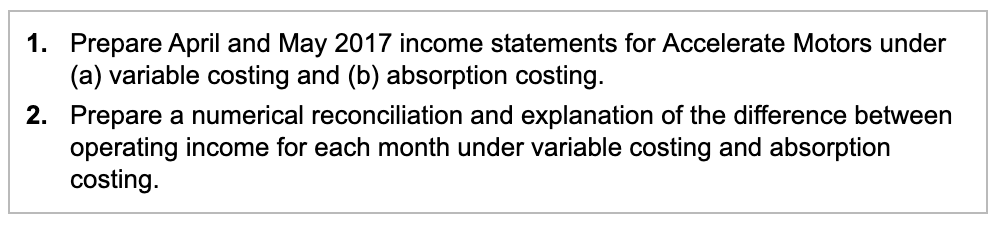

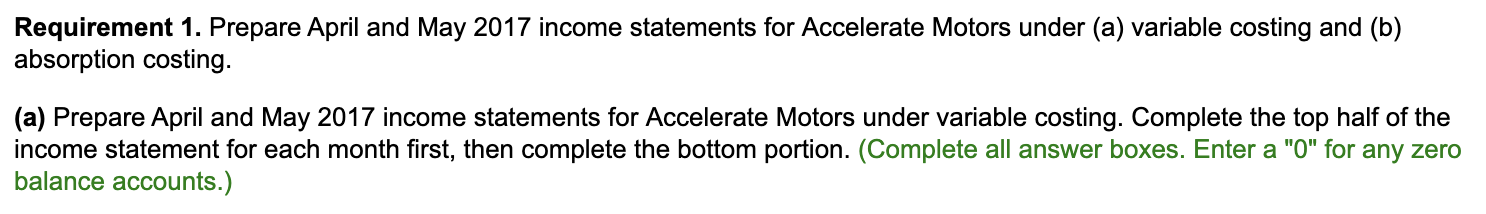

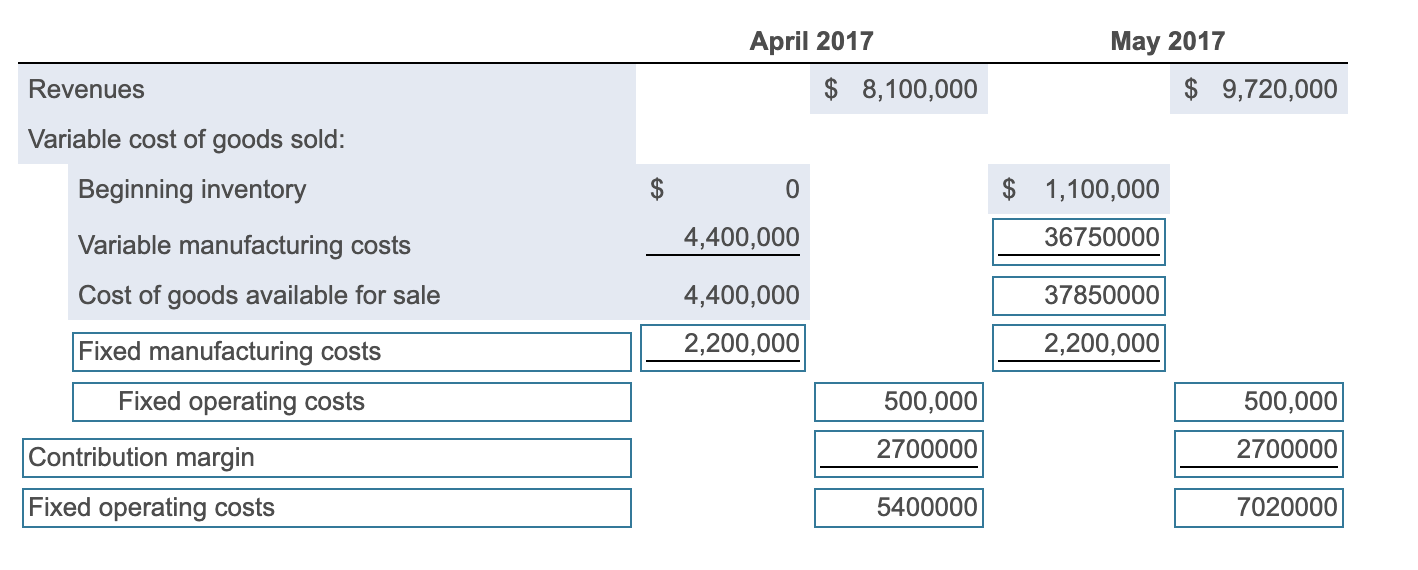

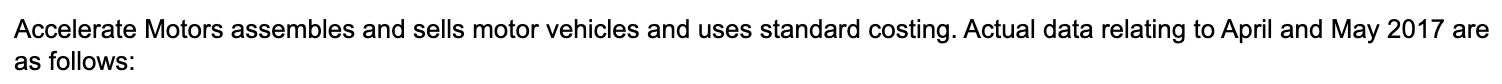

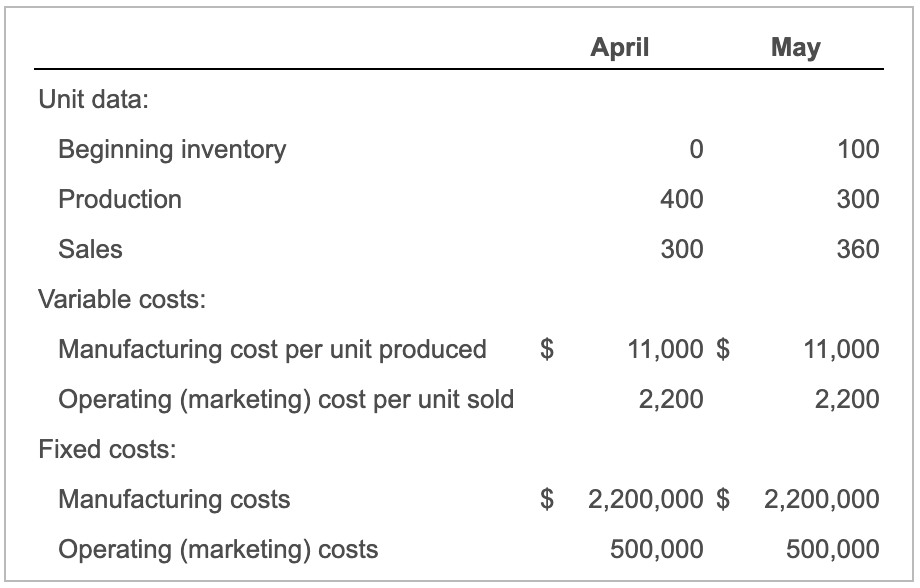

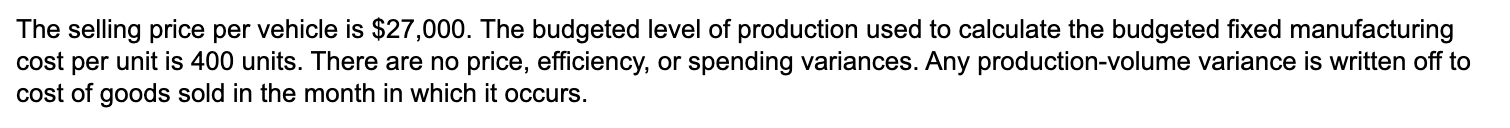

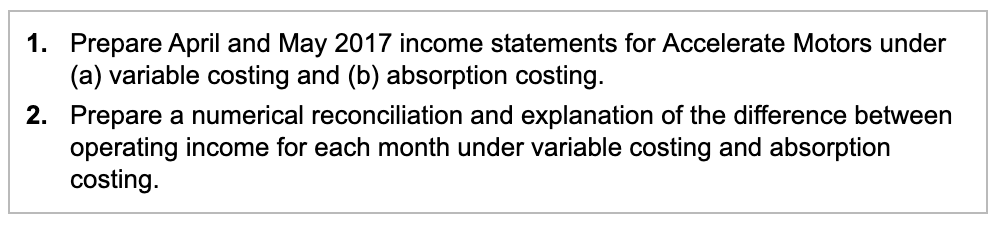

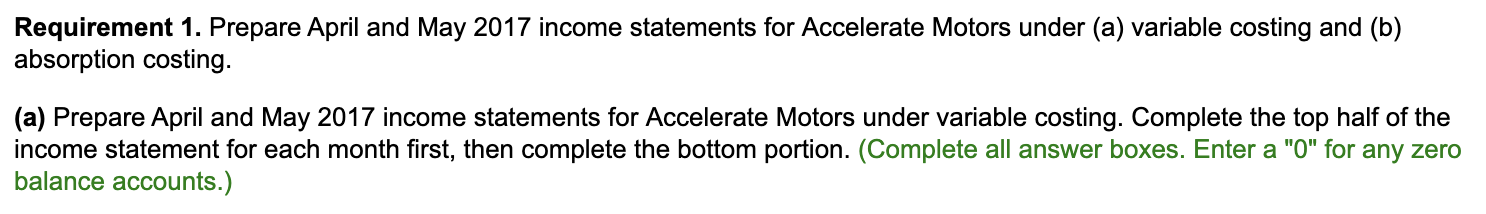

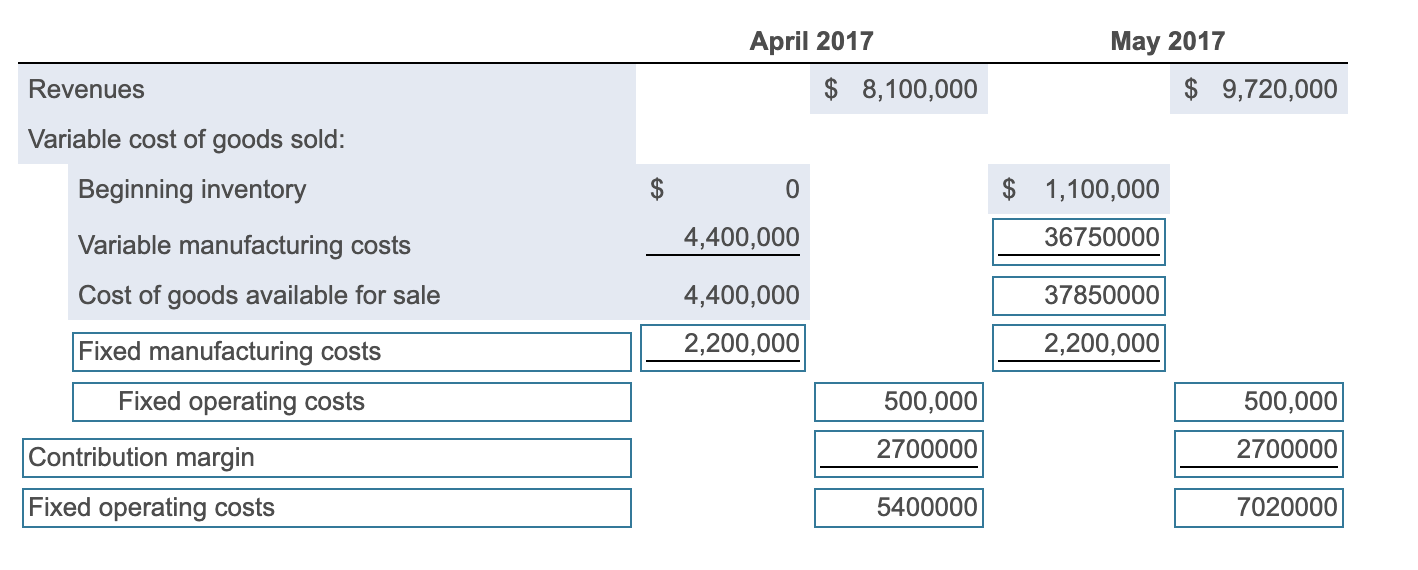

Accelerate Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2017 are as follows: April May Unit data: Beginning inventory Production 0 100 400 300 Sales 300 360 Variable costs: $ 11,000 $ 11,000 Manufacturing cost per unit produced Operating (marketing) cost per unit sold 2,200 2,200 Fixed costs: Manufacturing costs Operating (marketing) costs $ 2,200,000 $ 2,200,000 500,000 500,000 The selling price per vehicle is $27,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 400 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. 1. Prepare April and May 2017 income statements for Accelerate Motors under (a) variable costing and (b) absorption costing. 2. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing. Requirement 1. Prepare April and May 2017 income statements for Accelerate Motors under (a) variable costing and (b) absorption costing. (a) Prepare April and May 2017 income statements for Accelerate Motors under variable costing. Complete the top half of the income statement for each month first, then complete the bottom portion. (Complete all answer boxes. Enter a "0" for any zero balance accounts.) May 2017 April 2017 $ 8,100,000 Revenues $ 9,720,000 Variable cost of goods sold: Beginning inventory 0 1,100,000 4,400,000 36750000 37850000 Variable manufacturing costs Cost of goods available for sale Fixed manufacturing costs Fixed operating costs 4,400,000 2,200,000 2,200,000 500,000 500,000 Contribution margin 2700000 2700000 Fixed operating costs 5400000 7020000 Accelerate Motors accombles and cells motor vehicles and use as fo el of sper BAdjustment for production-volume variance The : Allocated fixed manufacturing costs cost Beginning inventory cost Contribution margin Rear Cost of goods available for sale Deduct ending inventory balai Fixed manufacturing costs Fixed operating costs Rev Gross margin Vari Operating income Revenues Variable cost of goods sold Variable manufacturing costs Variable operating costs $ Accelerate Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2017 are as follows: April May Unit data: Beginning inventory Production 0 100 400 300 Sales 300 360 Variable costs: $ 11,000 $ 11,000 Manufacturing cost per unit produced Operating (marketing) cost per unit sold 2,200 2,200 Fixed costs: Manufacturing costs Operating (marketing) costs $ 2,200,000 $ 2,200,000 500,000 500,000 The selling price per vehicle is $27,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 400 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. 1. Prepare April and May 2017 income statements for Accelerate Motors under (a) variable costing and (b) absorption costing. 2. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing. Requirement 1. Prepare April and May 2017 income statements for Accelerate Motors under (a) variable costing and (b) absorption costing. (a) Prepare April and May 2017 income statements for Accelerate Motors under variable costing. Complete the top half of the income statement for each month first, then complete the bottom portion. (Complete all answer boxes. Enter a "0" for any zero balance accounts.) May 2017 April 2017 $ 8,100,000 Revenues $ 9,720,000 Variable cost of goods sold: Beginning inventory 0 1,100,000 4,400,000 36750000 37850000 Variable manufacturing costs Cost of goods available for sale Fixed manufacturing costs Fixed operating costs 4,400,000 2,200,000 2,200,000 500,000 500,000 Contribution margin 2700000 2700000 Fixed operating costs 5400000 7020000 Accelerate Motors accombles and cells motor vehicles and use as fo el of sper BAdjustment for production-volume variance The : Allocated fixed manufacturing costs cost Beginning inventory cost Contribution margin Rear Cost of goods available for sale Deduct ending inventory balai Fixed manufacturing costs Fixed operating costs Rev Gross margin Vari Operating income Revenues Variable cost of goods sold Variable manufacturing costs Variable operating costs $