Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accelerated Return Notes provide payoffs at maturity that depend on the value of an under- lying stock and the notional N. Assume the stock

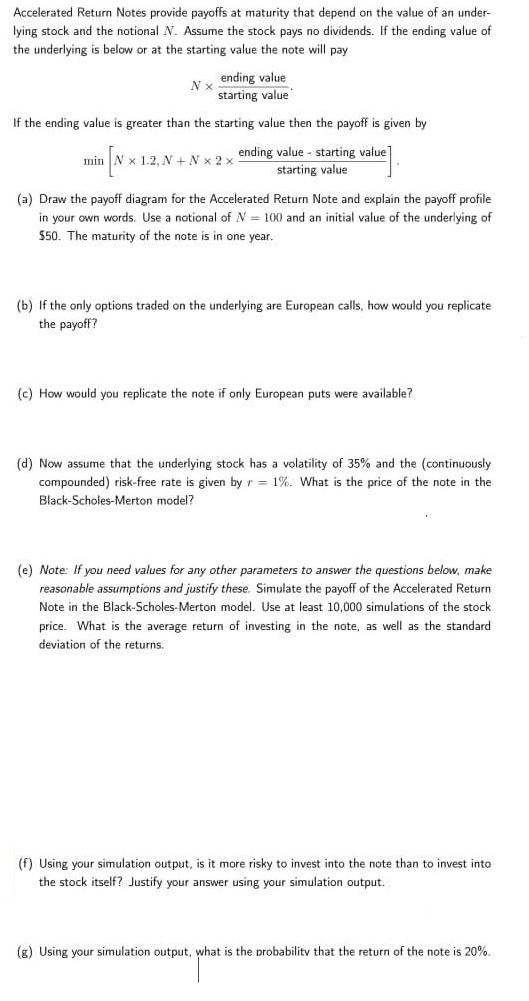

Accelerated Return Notes provide payoffs at maturity that depend on the value of an under- lying stock and the notional N. Assume the stock pays no dividends. If the ending value of the underlying is below or at the starting value the note will pay Nx ending value starting value If the ending value is greater than the starting value then the payoff is given by ending value starting value] starting value min x 1.2, N + N x 2 x (a) Draw the payoff diagram for the Accelerated Return Note and explain the payoff profile in your own words. Use a notional of N=100 and an initial value of the underlying of $50. The maturity of the note is in one year. (b) If the only options traded on the underlying are European calls, how would you replicate the payoff? (c) How would you replicate the note if only European puts were available? (d) Now assume that the underlying stock has a volatility of 35% the (continuously compounded) risk-free rate is given by r = 1%. What is the price of the note in the Black-Scholes-Merton model? (e) Note: If you need values for any other parameters to answer the questions below, make reasonable assumptions and justify these. Simulate the payoff of the Accelerated Return Note in the Black-Scholes-Merton model. Use at least 10,000 simulations of the stock price. What is the average return of investing in the note, as well as the standard deviation of the returns. (f) Using your simulation output, is it more risky to invest into the note than to invest into the stock itself? Justify your answer using your simulation output. (g) Using your simulation output, what is the probability that the return of the note is 20%.

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a Payoff diagram for the Accelerated Return Note The payoff diagram for the Accelerated Return Note is shown below The payoff profile is as follows If the ending value of the underlying stock is below ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started