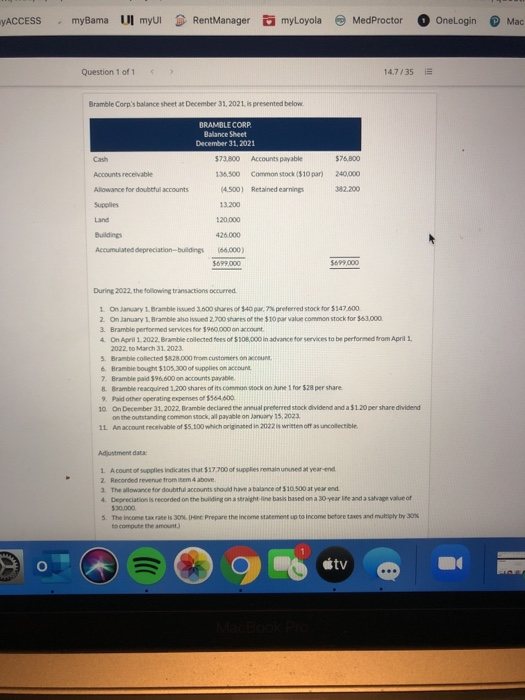

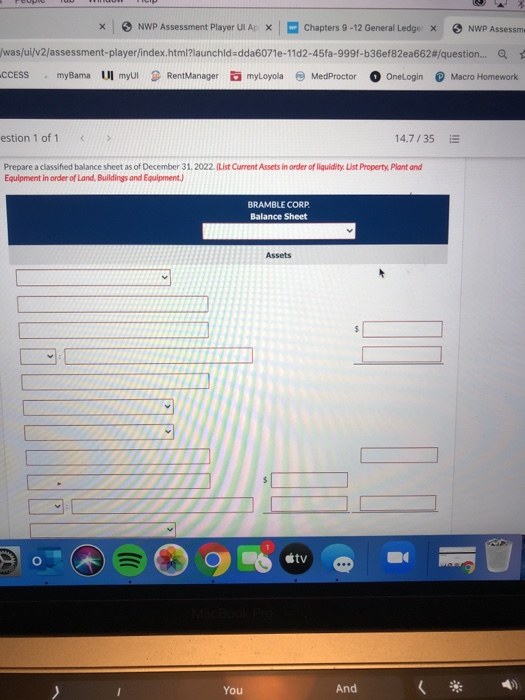

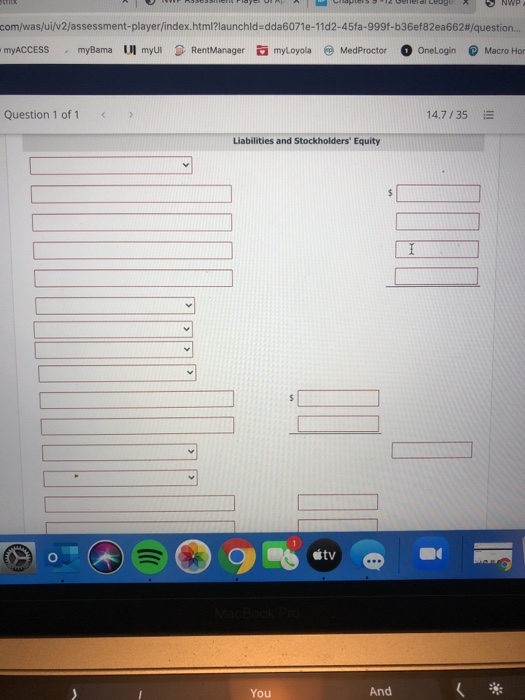

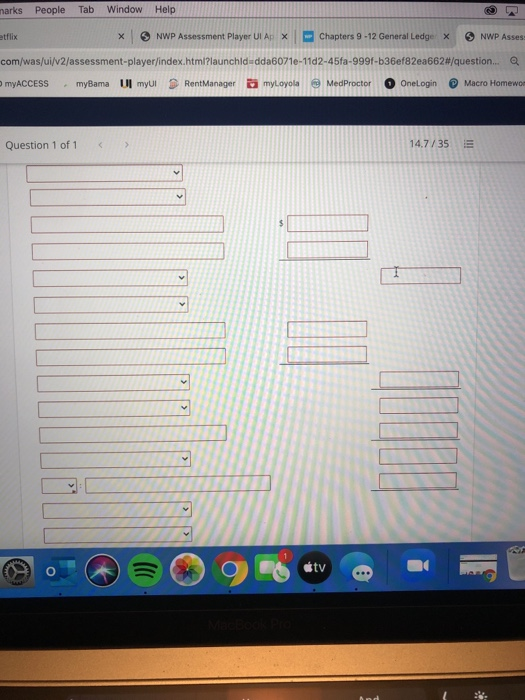

ACCESS myBama U myl RentManager myLoyola MedProctor OneLogin Question 1 of 1 14.7/35 Bramble Corp's balance sheet at December 31, 2021. is presented below BRAMBLE CORP Balance Sheet December 31, 2021 Cash $73.800 Accounts payable $76,800 Accounts receivable 136.500 Common stock ($10 par) 240,000 Allowance for doubtful accounts 14.500) Retained earnings 382,200 13.200 Land 120.000 Buildings 426.000 Accumulated depreciation-buildings (66.000) $699.000 5699.000 Suples During 2022, the following transactions occurred 1. On January 1, Brambled 2.600 shares of $40 par 7% preferred stock for $347.000 2. On January 1, Bramble howed 2.700 shares of the $10 par value common stock for $63.000 3. Bramble performed services for $900.000 on count 4. On April 1, 2022. Bramble collected fees of S108,000 in advance for services to be performed from April 1, 2022. to March 31, 2023 5. Bramble collected $828.000 from customers on Xcount 6. Bramble bought $105,300 of polies on n. 7. Bramble paid $96.600 on accounts payable B. Bramble reacquired 1.200 shares of its common stock onane 1 for $20 per share 9. Paid other operating expenses of 5564600 10. On December 31, 2022, Bramble declared the preferred stock dividend and a $1.20 per share dividend on the outstanding common stock, all payable onary 15, 2023 11 An account receivable of 55.100 which originated in 2022 is written off as uncollectible Adjustment data 1. A count of supplies indicates that $17.700 of supplies remained a year-end 2. Recorded revenue from item 4 above 3. The allowance for doubthul accounts should have a balance of $10.500 at year end 4. Depreciation is recorded on the building on a sight-line basis based on a 30 year it anda salvage value of 530.000 5. The income tax rates. Prepare the income statement to come before and multiply by 30% to compute the amount lll tv ... > NWP Assessment Player Ul Ap X Chapters 9-12 General Ledge x NWP Assessme /was/ui/v2/assessment-player/index.html?launchid=dda6071e-11d2-45fa-999f-b36ef82ea662#/question... a CCESS myBama | myUI RentManager myLoyola MedProctor OneLogin Macro Homework estion 1 of 1 NWP Assessment Player Ul Ap X Chapters 9-12 General Ledge x NWP Assessme /was/ui/v2/assessment-player/index.html?launchid=dda6071e-11d2-45fa-999f-b36ef82ea662#/question... a CCESS myBama | myUI RentManager myLoyola MedProctor OneLogin Macro Homework estion 1 of 1