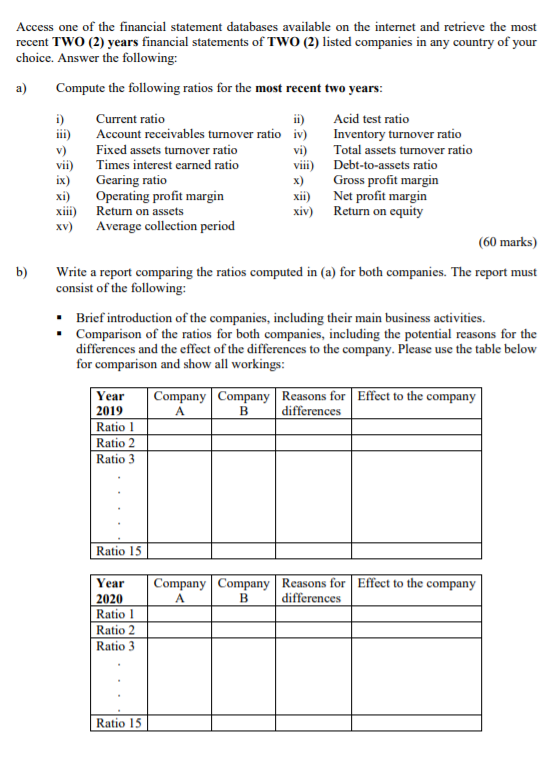

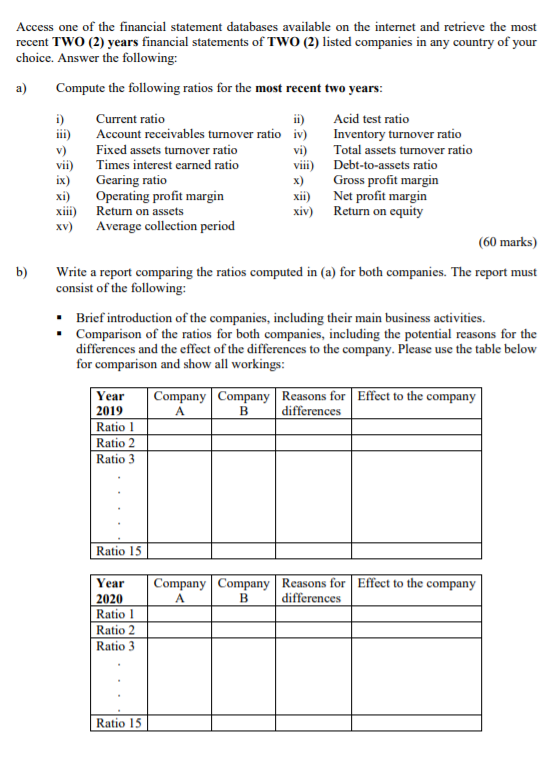

Access one of the financial statement databases available on the internet and retrieve the most recent TWO (2) years financial statements of TWO (2) listed companies in any country of your choice. Answer the following: a) Compute the following ratios for the most recent two years: i) Current ratio ii) Acid test ratio iii) Account receivables turnover ratio iv) Inventory turnover ratio v) Fixed assets turnover ratio vi) Total assets turnover ratio vii) Times interest earned ratio viii) Debt-to-assets ratio ix) Gearing ratio x) Gross profit margin xi) Operating profit margin xii) Net profit margin xiii) Return on assets xiv) Return on equity xV) Average collection period (60 marks) b) Write a report comparing the ratios computed in (a) for both companies. The report must consist of the following: Brief introduction of the companies, including their main business activities. Comparison of the ratios for both companies, including the potential reasons for the differences and the effect of the differences to the company. Please use the table below for comparison and show all workings: Company Company Reasons for Effect to the company differences B Year 2019 Ratio 1 Ratio 2 Ratio 3 Ratio 15 Company Company Reasons for Effect to the company A differences B Year 2020 Ratio 1 Ratio 2 Ratio 3 Ratio 15 Access one of the financial statement databases available on the internet and retrieve the most recent TWO (2) years financial statements of TWO (2) listed companies in any country of your choice. Answer the following: a) Compute the following ratios for the most recent two years: i) Current ratio ii) Acid test ratio iii) Account receivables turnover ratio iv) Inventory turnover ratio v) Fixed assets turnover ratio vi) Total assets turnover ratio vii) Times interest earned ratio viii) Debt-to-assets ratio ix) Gearing ratio x) Gross profit margin xi) Operating profit margin xii) Net profit margin xiii) Return on assets xiv) Return on equity xV) Average collection period (60 marks) b) Write a report comparing the ratios computed in (a) for both companies. The report must consist of the following: Brief introduction of the companies, including their main business activities. Comparison of the ratios for both companies, including the potential reasons for the differences and the effect of the differences to the company. Please use the table below for comparison and show all workings: Company Company Reasons for Effect to the company differences B Year 2019 Ratio 1 Ratio 2 Ratio 3 Ratio 15 Company Company Reasons for Effect to the company A differences B Year 2020 Ratio 1 Ratio 2 Ratio 3 Ratio 15