Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Calculating predetermined factory overhead rates and recording journal entries Curtain Company produces a line of products that require a significant amount of factory

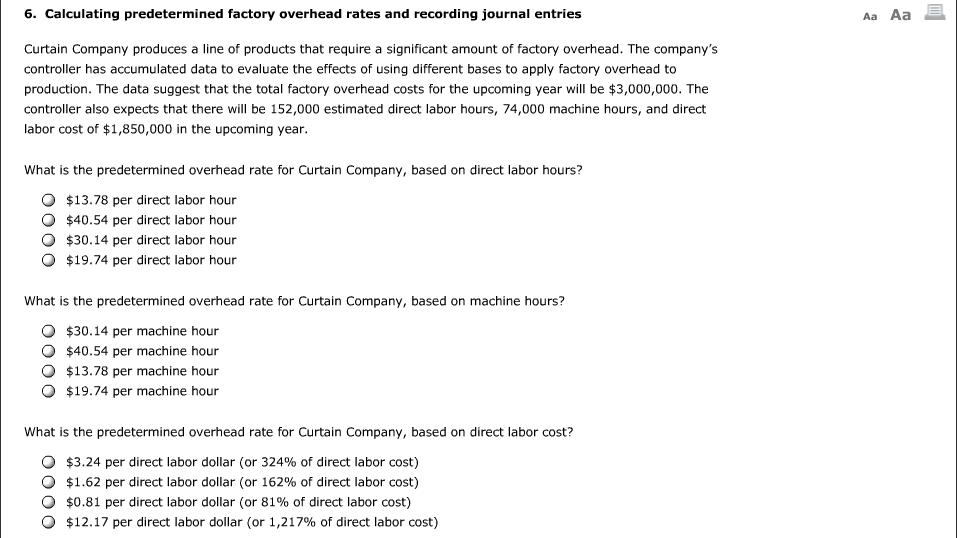

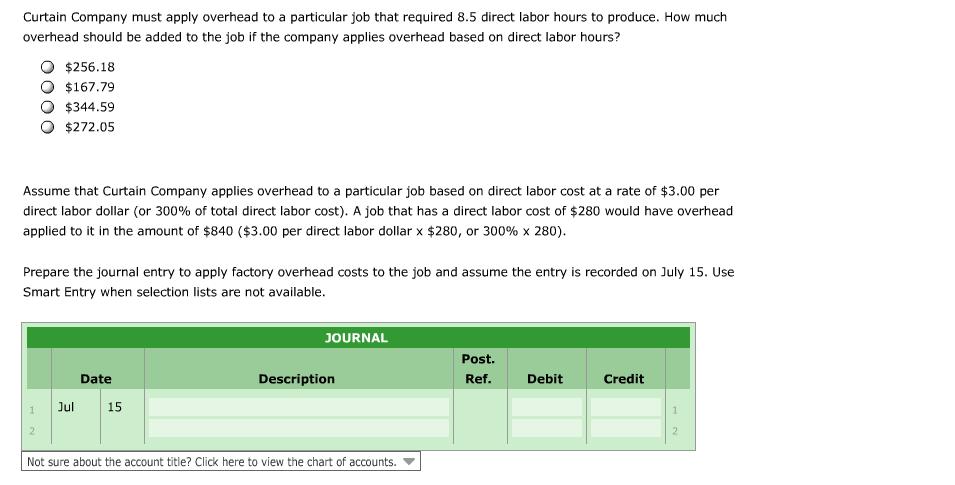

6. Calculating predetermined factory overhead rates and recording journal entries Curtain Company produces a line of products that require a significant amount of factory overhead. The company's controller has accumulated data to evaluate the effects of using different bases to apply factory overhead to production. The data suggest that the total factory overhead costs for the upcoming year will be $3,000,000. The controller also expects that there will be 152,000 estimated direct labor hours, 74,000 machine hours, and direct labor cost of $1,850,000 in the upcoming year. What is the predetermined overhead rate for Curtain Company, based on direct labor hours? $13.78 per direct labor hour $40.54 per direct labor hour $30.14 per direct labor hour $19.74 per direct labor hour What is the predetermined overhead rate for Curtain Company, based on machine hours? $30.14 per machine hour $40.54 per machine hour $13.78 per machine hour $19.74 per machine hour What is the predetermined overhead rate for Curtain Company, based on direct labor cost? $3.24 per direct labor dollar (or 324% of direct labor cost) $1.62 per direct labor dollar (or 162% of direct labor cost) $0.81 per direct labor dollar (or 81% of direct labor cost) $12.17 per direct labor dollar (or 1,217% of direct labor cost) Aa Aa Curtain Company must apply overhead to a particular job that required 8.5 direct labor hours to produce. How much overhead should be added to the job if the company applies overhead based on direct labor hours? $256.18 $167.79 $344.59 $272.05 Assume that Curtain Company applies overhead to a particular job based on direct labor cost at a rate of $3.00 per direct labor dollar (or 300% of total direct labor cost). A job that has a direct labor cost of $280 would have overhead applied to it in the amount of $840 ($3.00 per direct labor dollar x $280, or 300% x 280). Prepare the journal entry to apply factory overhead costs to the job and assume the entry is recorded on July 15. Use Smart Entry when selection lists are not available. 2 Jul Date 15 JOURNAL Description Not sure about the account title? Click here to view the chart of accounts. Post. Ref. Debit Credit 1 2

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

A 3000000 152000 1974 per direct labor hour B 3000000 1850000 16...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started