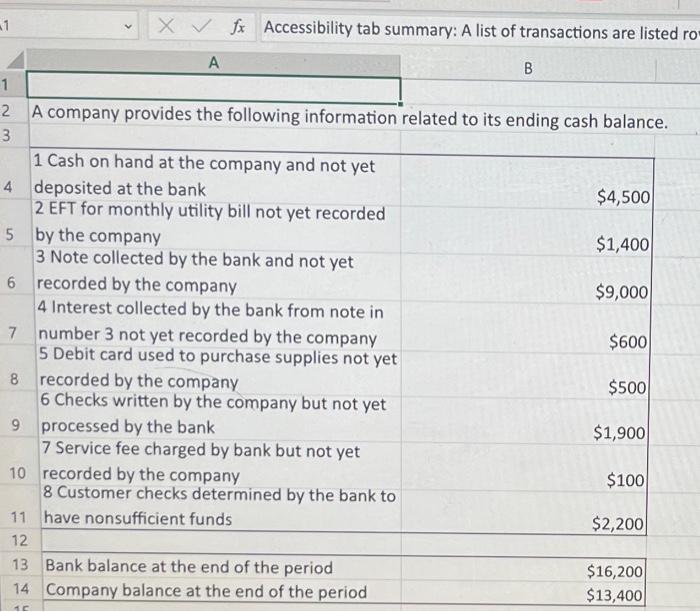

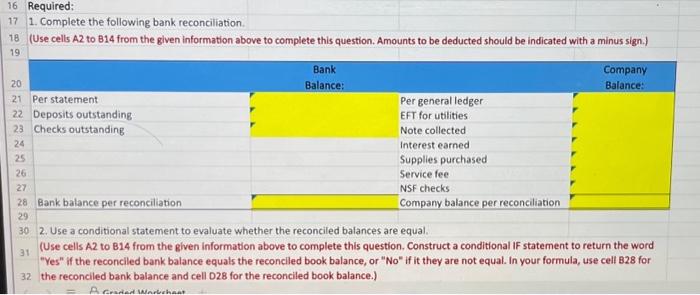

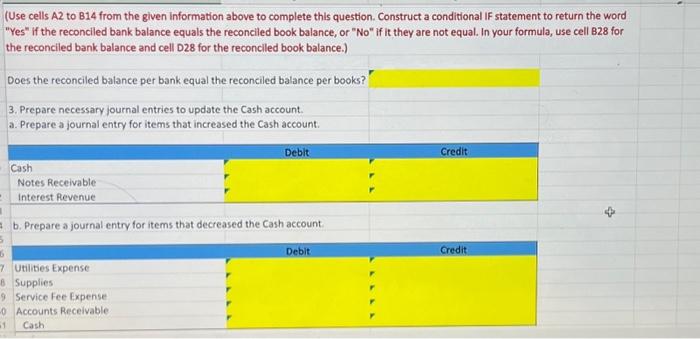

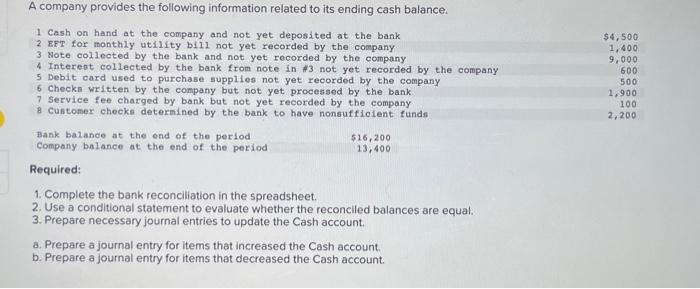

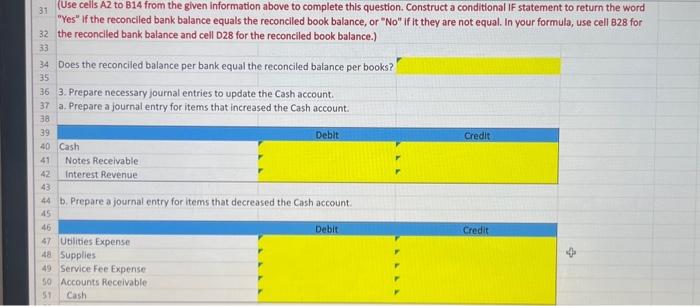

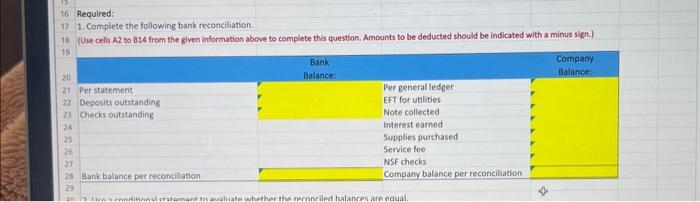

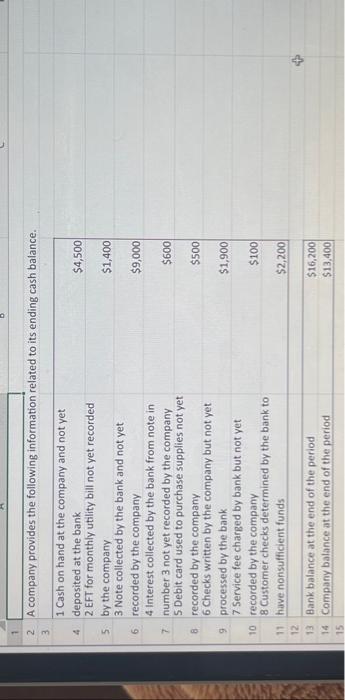

Accessibility tab summary: A list of transactions are listed ro 1. Complete the following bank reconciliation. (Use cells A2 to B14 from the given information above to complete this question. Amounts to be deducted should be indicated with a minus sign.) 30. 2. Use a conditional statement to evaluate whether the reconciled balances are equal. (Use cells A2 to B14 from the given information above to complete this question. Construct a conditional If statement to return the word 31. "Yes" if the reconciled bank balance equals the reconclled book balance, or "No" if it they are not equal. In your formula, use cell B28 for 32. the reconciled bank balance and cell D28 for the reconciled book balance.) (Use cells A2 to B14 from the given information above to complete this question. Construct a conditional IF statement to return the word "Yes" if the reconciled bank balance equals the reconciled book balance, or "No" if it they are not equal. In your formula, use cell B28 for the reconciled bank balance and cell D 28 for the reconciled book balance.) Does the reconciled balance per bank equal the reconciled balance per books? r 3. Prepare necessary journal entries to update the Cash account. a. Prepare a journal entry for items that increased the Cash account. b. Prepare a journal entry for items that decreased the Cash account Required: 1. Complete the bank reconciliation in the spreadsheet. 2. Use a conditional statement to evaluate whether the reconciled balances are equal. 3. Prepare necessary journal entries to update the Cash account. a. Prepare a journal entry for items that increased the Cash account. b. Prepare a journal entry for items that decreased the Cash account. (Use ceils A2 to B14 from the given information above to complete this question. Construct a conditional IF statement to return the word the reconclied bank balance and cell D28 for the reconciled book balance.) Does the reconciled balance per bank equal the reconciled balance per books? 3. Prepare necessary journal entries to update the Cash account. a. Prepare a journal entry for items that increased the Cash account. b. Prepare a journal entry for items that decreased the Cash account. Required: 1. Complete the following bank reconcliation. (Use celis A2 to B24 from the given information above to complete this question. Amounts to be deducted should be indicated with a minus sign.) 1 2 A company provides the following information related to its ending cash balance. 3 1 Cash on hand at the company and not yet 4 deposited at the bank 2 EFT for monthly utility bill not yet recorded 5. by the company 3 Note collected by the bank and not yet 6 recorded by the company 4 Interest collected by the bank from note in 7 number 3 not yet recorded by the company 5 Debit card used to purchase supplies not yet 8 recorded by the company 6 Checks written by the company but not yet 9 processed by the bank 7 service fee charged by bank but not yet 10 recorded by the company 8 Customer checks determined by the bank to have nonsufficient funds $4,500 $1,400 $9,000 12. 13 Bank balance at the end of the period 14 Company balance at the end of the period $600 15 $500 $1,900 $100 $2,200 $16,200 $13,400