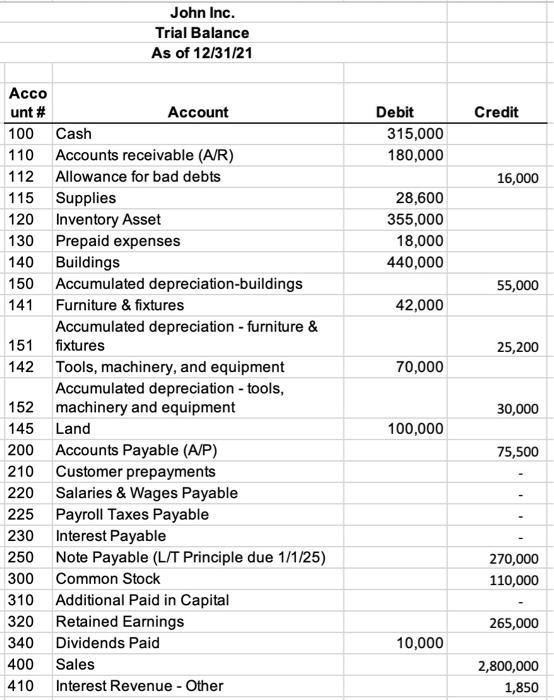

Acco unt # 140 150 141 100 Cash 110 Accounts receivable (A/R) 112 Allowance for bad debts 115 Supplies 120 Inventory Asset 130 151

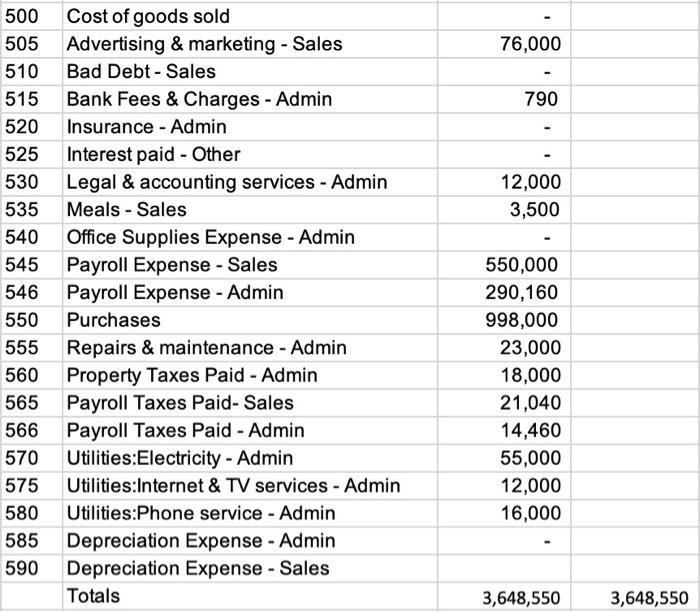

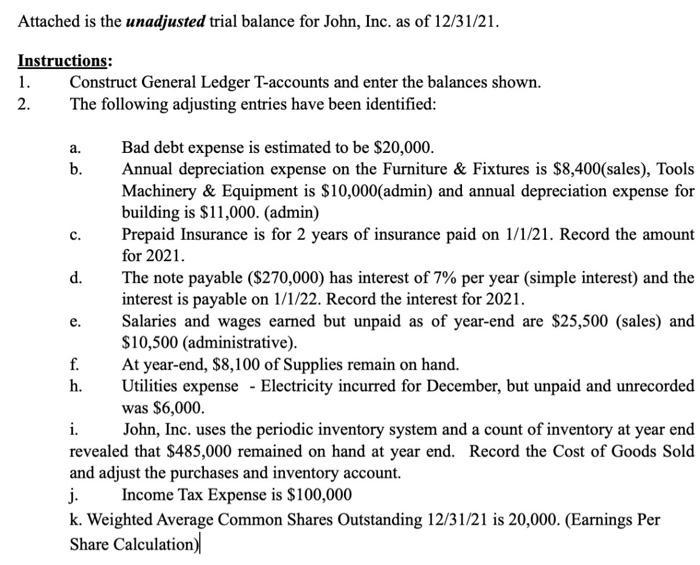

Acco unt # 140 150 141 100 Cash 110 Accounts receivable (A/R) 112 Allowance for bad debts 115 Supplies 120 Inventory Asset 130 151 142 John Inc. Trial Balance As of 12/31/21 Account Prepaid expenses Buildings Accumulated depreciation-buildings Furniture & fixtures Accumulated depreciation - furniture & 152 145 Land fixtures Tools, machinery, and equipment Accumulated depreciation - tools, machinery and equipment 200 Accounts Payable (A/P) 210 Customer prepayments 220 Salaries & Wages Payable 225 230 250 300 310 320 Retained Earnings 340 Dividends Paid 400 Sales 410 Interest Revenue - Other Payroll Taxes Payable Interest Payable Note Payable (L/T Principle due 1/1/25) Common Stock Additional Paid in Capital Debit 315,000 180,000 28,600 355,000 18,000 440,000 42,000 70,000 100,000 10,000 Credit 16,000 55,000 25,200 30,000 75,500 270,000 110,000 265,000 2,800,000 1,850 Cost of goods sold Advertising & marketing - Sales Bad Debt - Sales 500 505 510 515 520 525 530 535 540 Office Supplies Expense - Admin 545 Payroll Expense - Sales 546 Payroll Expense - Admin 550 Purchases 555 Repairs & maintenance - Admin 560 Property Taxes Paid - Admin 565 Payroll Taxes Paid- Sales 566 Payroll Taxes Paid - Admin 570 Utilities:Electricity - Admin 575 580 585 590 Bank Fees & Charges - Admin Insurance - Admin Interest paid - Other Legal & accounting services - Admin Meals - Sales Utilities: Internet & TV services - Admin Utilities:Phone service - Admin Depreciation Expense - Admin Depreciation Expense - Sales Totals 76,000 - 790 12,000 3,500 550,000 290,160 998,000 23,000 18,000 21,040 14,460 55,000 12,000 16,000 - 3,648,550 3,648,550 Attached is the unadjusted trial balance for John, Inc. as of 12/31/21. Instructions: 1. 2. Construct General Ledger T-accounts and enter the balances shown. The following adjusting entries have been identified: a. Bad debt expense is estimated to be $20,000. b. Annual depreciation expense on the Furniture & Fixtures is $8,400(sales), Tools Machinery & Equipment is $10,000(admin) and annual depreciation expense for building is $11,000. (admin) Prepaid Insurance is for 2 years of insurance paid on 1/1/21. Record the amount for 2021. The note payable ($270,000) has interest of 7% per year (simple interest) and the interest is payable on 1/1/22. Record the interest for 2021. C. d. e. Salaries and wages earned but unpaid as of year-end are $25,500 (sales) and $10,500 (administrative). f. h. At year-end, $8,100 of Supplies remain on hand. Utilities expense - Electricity incurred for December, but unpaid and unrecorded was $6,000. i. John, Inc. uses the periodic inventory system and a count of inventory at year end revealed that $485,000 remained on hand at year end. Record the Cost of Goods Sold and adjust the purchases and inventory account. j. Income Tax Expense is $100,000 k. Weighted Average Common Shares Outstanding 12/31/21 is 20,000. (Earnings Per Share Calculation) Prepare the adjusting journal entries (include explanations). Post the entries to the appropriate general ledger T-accounts (construct additional T- accounts as necessary). T- Accounts can be done written. Keep your T- Accounts running as you would posting to the general ledger and submit them after closing entries have been made. 3. 4. 5. 6. 7. 8. Prepare an adjusted trial balance. Prepare a classified balance sheet, a statement of retained earnings and a multi-step income statement in good form. Prepare closing journal entries and post to the T-accounts. Prepare a post-closing trial balance. You should use Excel or a similar spreadsheet program to prepare your work. (your T- accounts can be prepared by hand and postings can be by hand) (Submit adjusting journal entries, adjusted trial balance, classified balance sheet, multistep income statement, statement of retained earnings, closing journal entries, post closing trial balance and your final T-accounts after posting closing entries) - Label and put in order when submitting.

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Construct General Ledger Taccounts and enter the balances shown Lets create the General Ledger Taccounts with the balances provided in the unadjusted trial balance Assets 1 Cash 315000 2 Accoun...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started