Answered step by step

Verified Expert Solution

Question

1 Approved Answer

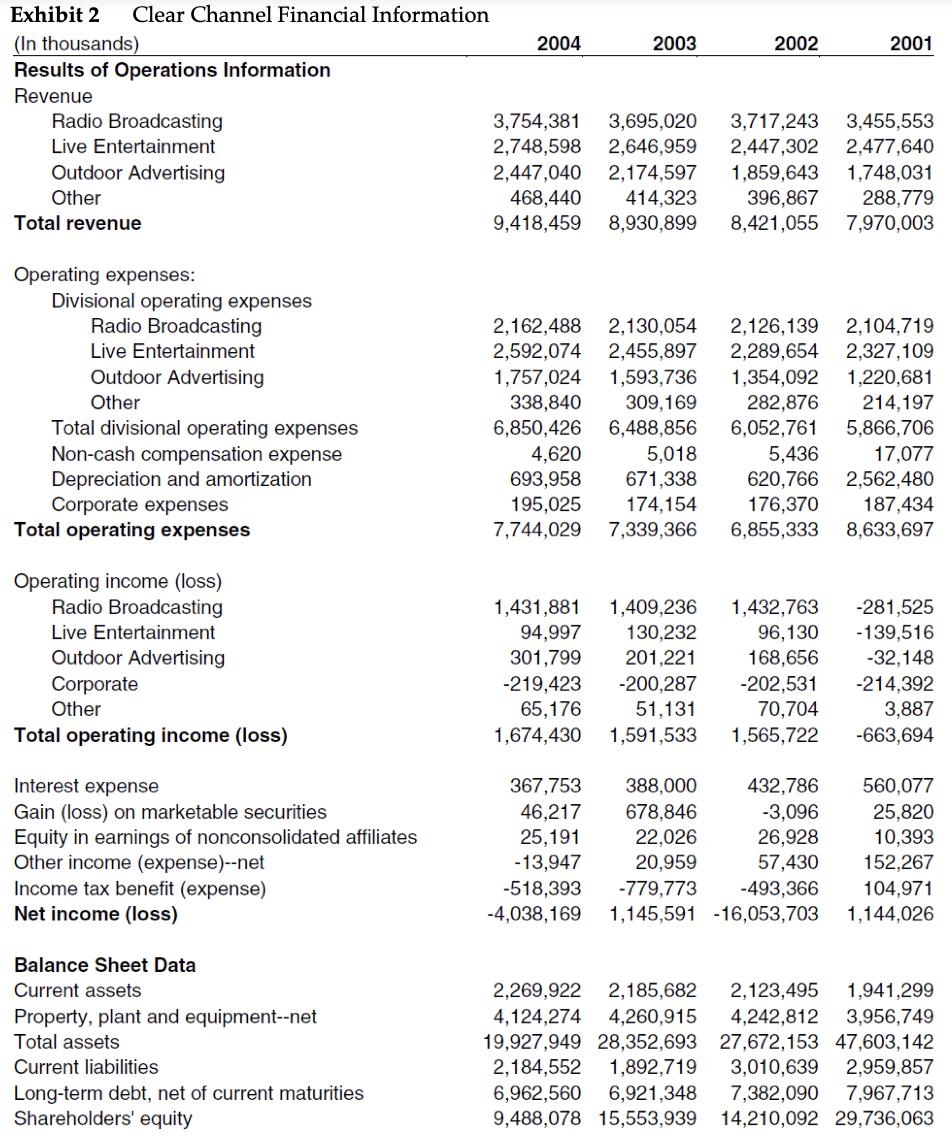

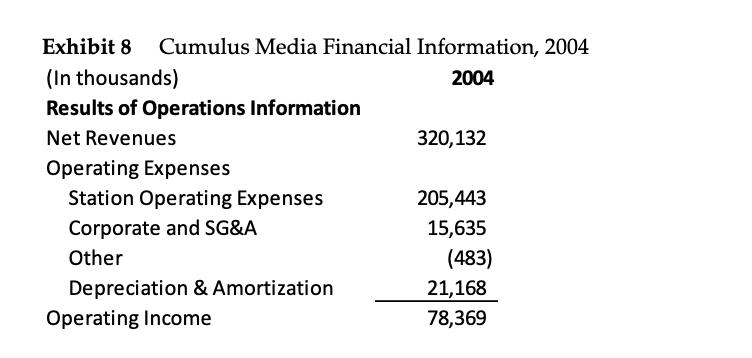

According to Exhibits 2 and 8 operating expenses as a percentage of sales are 205/320 = 64% for Cumulus and 2162/3754 = 57.6% for CCs

According to Exhibits 2 and 8 operating expenses as a percentage of sales are 205/320 = 64% for Cumulus and 2162/3754 = 57.6% for CC’s radio business in 2004. Quantify the difference per equivalent unit for the two firms.

Exhibit 2 Clear Channel Financial Information (In thousands) Results of Operations Information Revenue Radio Broadcasting Live Entertainment Outdoor Advertising Other Total revenue Operating expenses: Divisional operating expenses Radio Broadcasting Live Entertainment Outdoor Advertising Other Total divisional operating expenses Non-cash compensation expense Depreciation and amortization Corporate expenses Total operating expenses Operating income (loss) Radio Broadcasting Live Entertainment Outdoor Advertising Corporate Other Total operating income (loss) Interest expense Gain (loss) on marketable securities Equity in earnings of nonconsolidated affiliates Other income (expense)--net Income tax benefit (expense) Net income (loss) Balance Sheet Data Current assets Property, plant and equipment--net Total assets Current liabilities Long-term debt, net of current maturities Shareholders' equity 2004 2003 2002 3,754,381 3,695,020 3,717,243 3,455,553 2,748,598 2,646,959 2,447,302 2,477,640 2,447,040 2,174,597 1,859,643 1,748,031 468,440 414,323 396,867 288,779 9,418,459 8,930,899 8,421,055 7,970,003 2,104,719 2,162,488 2,130,054 2,126,139 2,592,074 2,455,897 2,289,654 2,327,109 1,757,024 1,593,736 1,354,092 1,220,681 214,197 338,840 309,169 282,876 6,850,426 6,488,856 6,052,761 5,866,706 5,018 5,436 17,077 4,620 693,958 671,338 620,766 2,562,480 195,025 174,154 176,370 187,434 7,744,029 7,339,366 6,855,333 8,633,697 1,431,881 1,409,236 1,432,763 94,997 130,232 301,799 201,221 -219,423 -200,287 65,176 51,131 1,674,430 1,591,533 2001 96,130 168,656 -202,531 70,704 1,565,722 -281,525 -139,516 -32,148 -214,392 3,887 -663,694 367,753 388,000 432,786 560,077 46,217 678,846 -3,096 25,820 25,191 22,026 26,928 10,393 -13,947 20,959 57,430 152,267 -518,393 -779,773 -493,366 104,971 -4,038,169 1,145,591 -16,053,703 1,144,026 2,269,922 2,185,682 2,123,495 1,941,299 4,124,274 4,260,915 4,242,812 3,956,749 19,927,949 28,352,693 27,672,153 47,603,142 2,184,552 1,892,719 3,010,639 2,959,857 6,962,560 6,921,348 7,382,090 7,967,713 9,488,078 15,553,939 14,210,092 29,736,063

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started