Question

A security analyst has advised you that the stock of ABC Company is going to rise from $22.00 to $25.00 per share over the

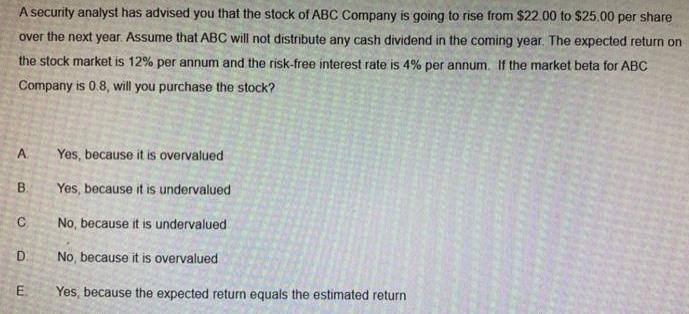

A security analyst has advised you that the stock of ABC Company is going to rise from $22.00 to $25.00 per share over the next year. Assume that ABC will not distribute any cash dividend in the coming year. The expected return on the stock market is 12% per annum and the risk-free interest rate is 4% per annum. If the market beta for ABC Company is 0.8, will you purchase the stock? A B C D ui Yes, because it is overvalued Yes, because it is undervalued No, because it is undervalued No, because it is overvalued Yes, because the expected return equals the estimated return

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Yes because it is undervalued Expected return Stock price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Discovering Advanced Algebra An Investigative Approach

Authors: Jerald Murdock, Ellen Kamischke, Eric Kamischke

1st edition

1559539844, 978-1604400069, 1604400064, 978-1559539845

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App